Pennsylvania State Tax Withholding Form 2024 – There are many reasons someone may choose to fill out forms for withholding. This includes the need for documentation, exemptions to withholding and also the amount of required withholding allowances. No matter the reason someone chooses to file a Form there are some points to be aware of.

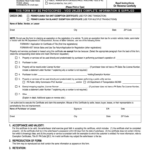

Exemptions from withholding

Non-resident aliens are required to file Form 1040-NR at least once per year. If the requirements are met, you could be eligible to apply for an exemption from withholding. There are exemptions accessible to you on this page.

When submitting Form1040-NR, Attach Form 1042S. This document is required to declare federal income tax. It provides the details of the withholding by the withholding agent. Make sure that you fill in the correct information when you fill in the form. If the information you provide is not provided, one individual could be taken into custody.

The rate of withholding for non-resident aliens is 30 percent. Nonresident aliens could be qualified for an exemption. This happens the case if your tax burden less than 30 percent. There are numerous exemptions. Some of them apply to spouses and dependents, such as children.

Generally, you are eligible for a reimbursement under chapter 4. As per Sections 1471 to 1474, refunds are granted. These refunds are made by the agent who withholds tax (the person who withholds tax at the source).

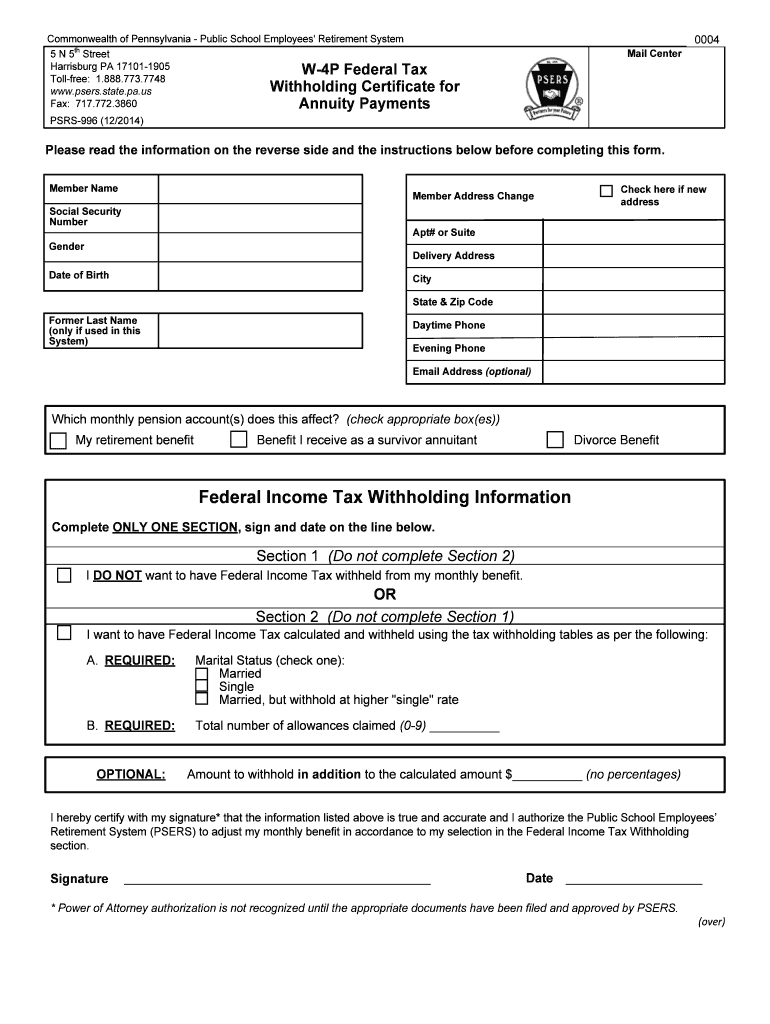

Relationship status

A form for a marital withholding is a good way to make your life easier and help your spouse. In addition, the amount of money you may deposit at the bank can be awestruck. It can be difficult to choose what option you’ll choose. You must be cautious in with what you choose to do. A bad decision could cost you dearly. If you stick to the instructions and be alert for any potential pitfalls, you won’t have problems. If you’re lucky, you may even make new acquaintances while you travel. Today is your anniversary. I’m sure you’ll be in a position to leverage this against them in order to acquire that wedding ring you’ve been looking for. To do this properly, you’ll require the guidance of a qualified Tax Expert. The accumulation of wealth over time is more than the modest payment. There are a myriad of websites that offer details. TaxSlayer is a trusted tax preparation company.

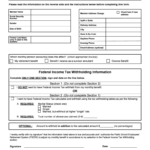

The amount of withholding allowances that were claimed

In submitting Form W-4 you should specify the number of withholdings allowances you would like to claim. This is vital since it will affect how much tax you receive from your wages.

The amount of allowances you are entitled to will be determined by the various aspects. For example when you’re married, you could be entitled to a head or household exemption. Your income can affect the number of allowances accessible to you. If you have high income you may be eligible to receive a higher allowance.

The proper amount of tax deductions will help you avoid a significant tax bill. If you submit the annual tax return for income, you may even be qualified for a tax refund. It is important to be cautious regarding how you go about this.

Do your research, like you would with any financial decision. Calculators can assist you in determining how many withholding amounts should be claimed. In addition contact a specialist.

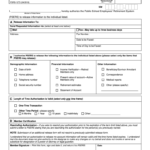

Formulating specifications

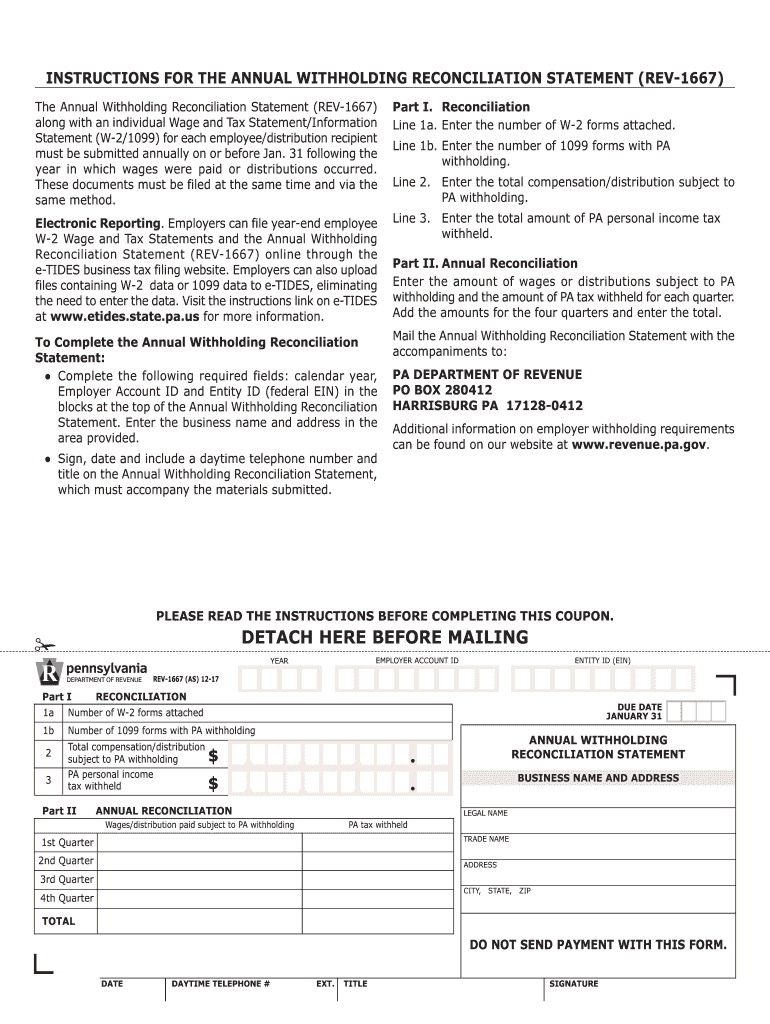

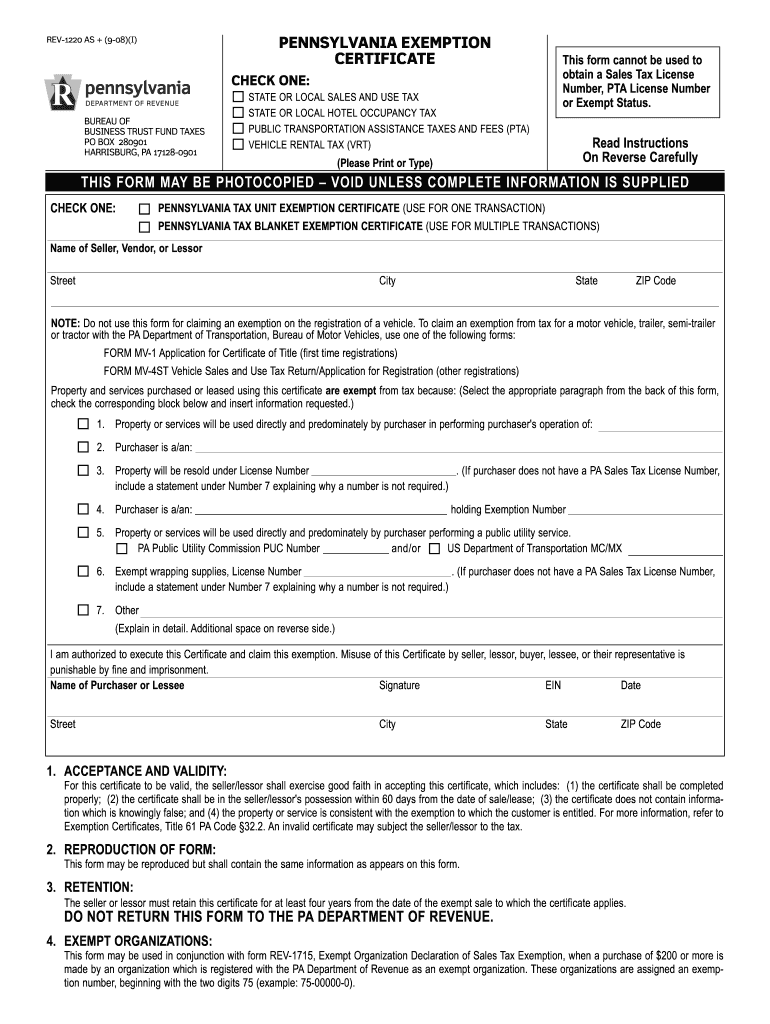

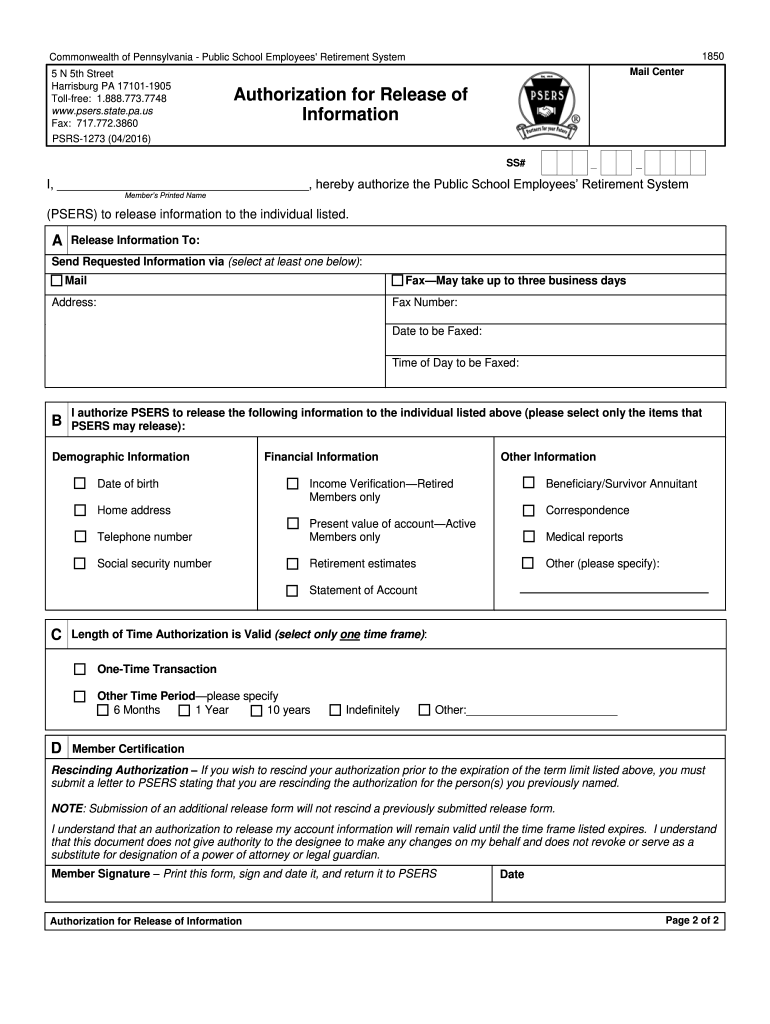

If you’re an employer, you must pay and report withholding tax on your employees. You can submit paperwork to the IRS for some of these taxes. Other documents you might be required to file include an withholding tax reconciliation, quarterly tax returns, as well as the annual tax return. Here’s some information about the various withholding tax form categories, as well as the deadlines to the submission of these forms.

Withholding tax returns may be required for certain incomes like bonuses, salary and commissions, as well as other income. Additionally, if employees are paid in time, you could be eligible for reimbursement of withheld taxes. It is important to remember that some of these taxes may be county taxes. There are also unique withholding techniques that can be used under certain conditions.

In accordance with IRS regulations, you are required to electronically submit forms for withholding. If you are filing your tax returns for national revenue make sure you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.