Oregon Tax Withholding Form – There are a variety of reasons why a person might decide to file a withholding application. These factors include the documents required, the exclusion of withholding as well as the withholding allowances. No matter why a person chooses to file an application it is important to remember a few aspects to consider.

Withholding exemptions

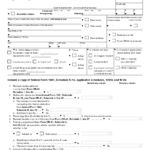

Non-resident aliens must submit Form 1040–NR every calendar year. You may be eligible to apply for an exemption for withholding tax in the event that you meet all conditions. The exclusions you can find here are yours.

For submitting Form 1040-NR attach Form 1042-S. This form details the withholdings that the agency makes. Make sure you fill out the form correctly. There is a possibility for one individual to be treated in a manner that is not correct if the correct information is not provided.

The tax withholding rate for non-resident aliens is 30%. Non-resident aliens may be eligible for an exemption. This applies the case if your tax burden lower than 30%. There are many exclusions. Certain exclusions are only applicable to spouses and dependents, such as children.

Generally, you are entitled to a reimbursement under chapter 4. Refunds are granted according to Sections 1401, 1474 and 1475. Refunds are given to the tax agent withholding that is the person who collects taxes from the source.

Relational status

An official marital status form withholding forms will assist both of you get the most out of your time. You’ll be surprised by how much you can transfer to the bank. The difficulty lies in choosing the right option from the multitude of choices. You should be careful with what you choose to do. Making the wrong choice could cost you a lot. It’s not a problem if you just follow the directions and pay attention. If you’re lucky enough to meet some new acquaintances while driving. Today marks the day you celebrate your marriage. I’m hoping you’ll be able to apply it against them in order to find the sought-after diamond. You’ll want the assistance from a certified tax expert to ensure you’re doing it right. The tiny amount is worthwhile for the life-long wealth. Information on the internet is readily available. TaxSlayer is among the most trusted and respected tax preparation firms.

There are a lot of withholding allowances being claimed

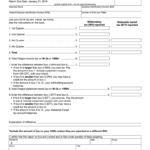

The form W-4 should be completed with the amount of withholding allowances you want to claim. This is vital because it affects how much tax you will receive from your pay checks.

A number of factors can influence the amount you qualify for allowances. Your income level can also determine the amount of allowances offered to you. You may be eligible for a greater allowance if you earn a significant amount of money.

Selecting the appropriate amount of tax deductions could save you from a large tax payment. Even better, you might be eligible for a refund when your tax return for income has been completed. However, you must choose your strategy carefully.

It is essential to do your homework the same way you would with any financial decision. Calculators are readily available to assist you in determining how much withholding allowances are required to be claimed. Another option is to talk to a professional.

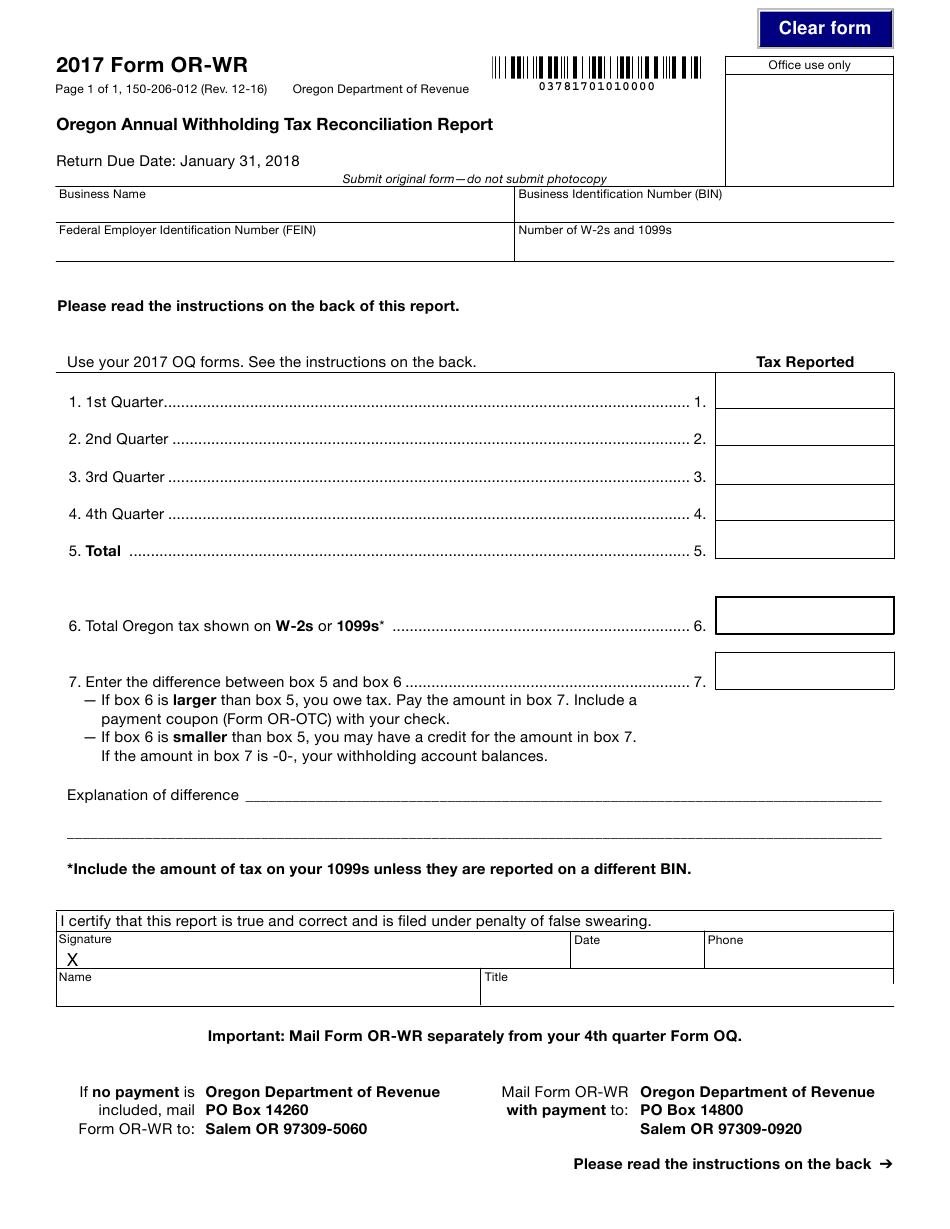

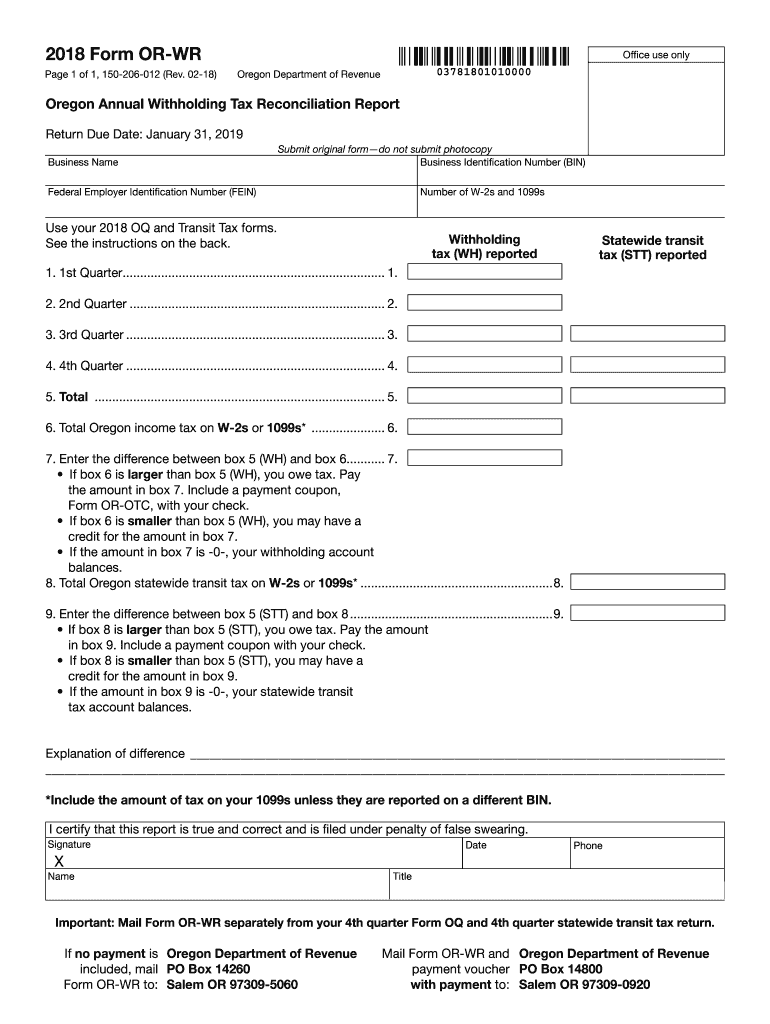

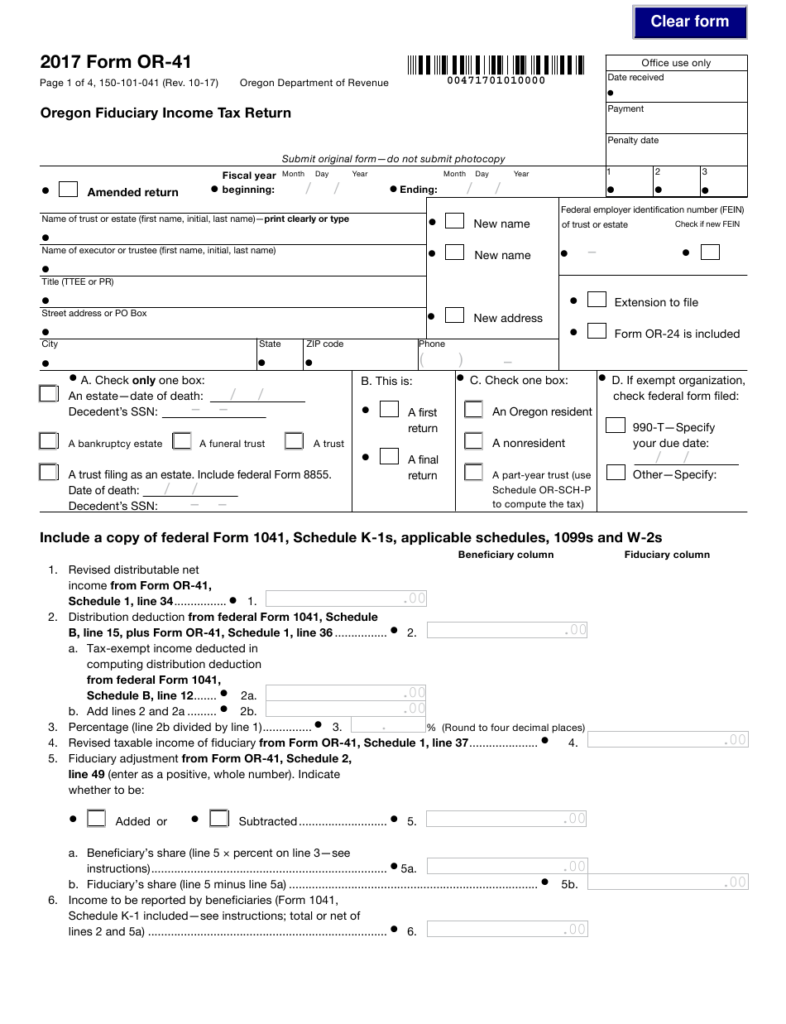

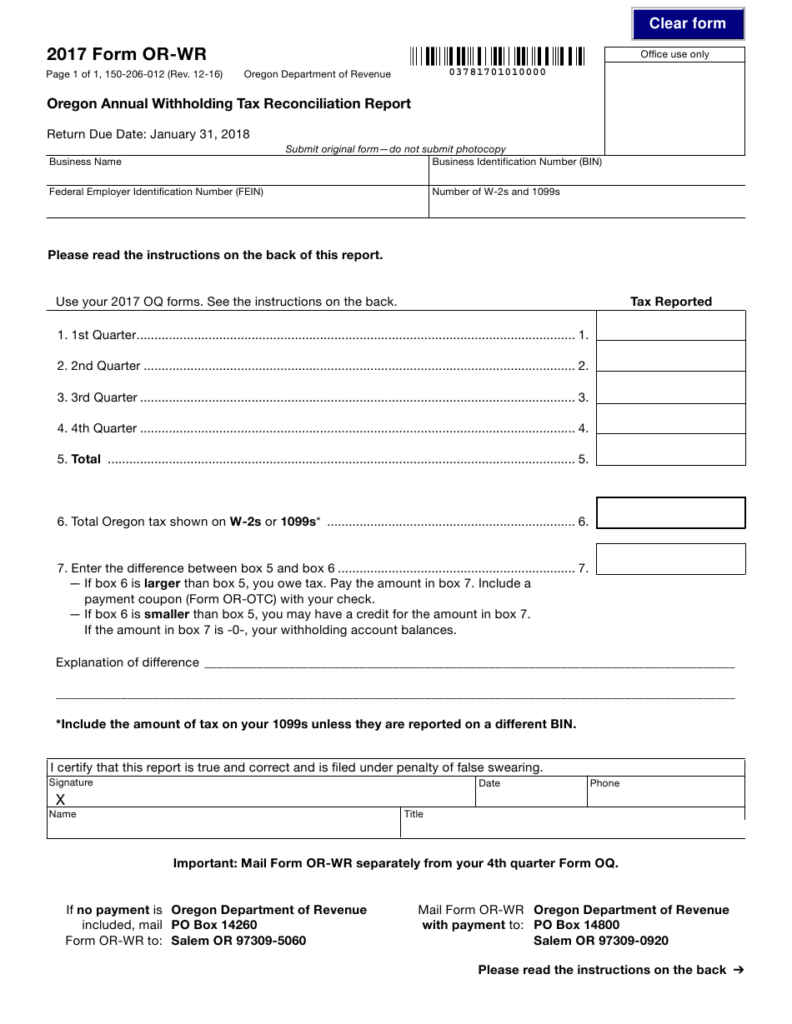

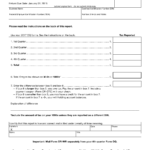

Formulating specifications

Employers must pay withholding taxes to their employees and then report it. If you are taxed on a specific amount you can submit paperwork to IRS. A tax reconciliation for withholding, an annual tax return for quarterly filing, or an annual tax return are some examples of other paperwork you may be required to submit. Here are some information about the various types of withholding tax forms along with the deadlines for filing.

You might have to file withholding tax returns for the income you receive from your employees, like bonuses, commissions, or salary. Also, if employees are paid punctually, you might be eligible for the tax deductions you withheld. Noting that certain of these taxes may be taxation by county is vital. There are also special withholding methods which can be utilized in specific situations.

The IRS regulations require that you electronically submit your withholding documentation. The Federal Employer Identification Number needs to be listed on your tax return for national revenue. If you don’t, you risk facing consequences.