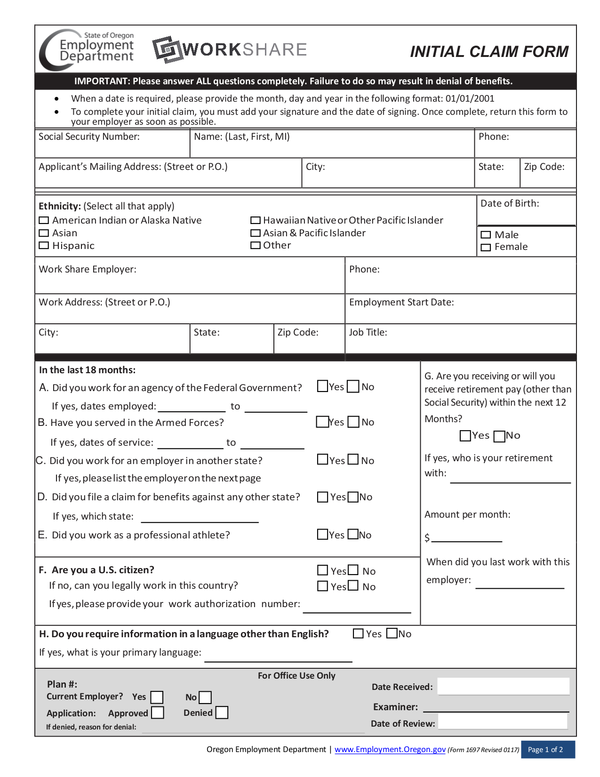

Oregon State Income Tax Withholding Form – There are a variety of reasons an individual might decide to fill out withholding forms. These include documentation requirements, withholding exclusions and withholding allowances. It is important to be aware of these factors regardless of why you choose to submit a request form.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. If you satisfy these requirements, you could be eligible for exemptions from the form for withholding. This page lists all exclusions.

When submitting Form1040-NR, Attach Form 1042S. The document is required to declare the federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. When filling out the form, ensure that you provide the exact details. There is a possibility for one individual to be treated in a manner that is not correct if the correct information is not provided.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. You could be eligible to be exempted from withholding if the tax burden is greater than 30 percent. There are a variety of exemptions offered. Some of these exclusions are only for spouses or dependents like children.

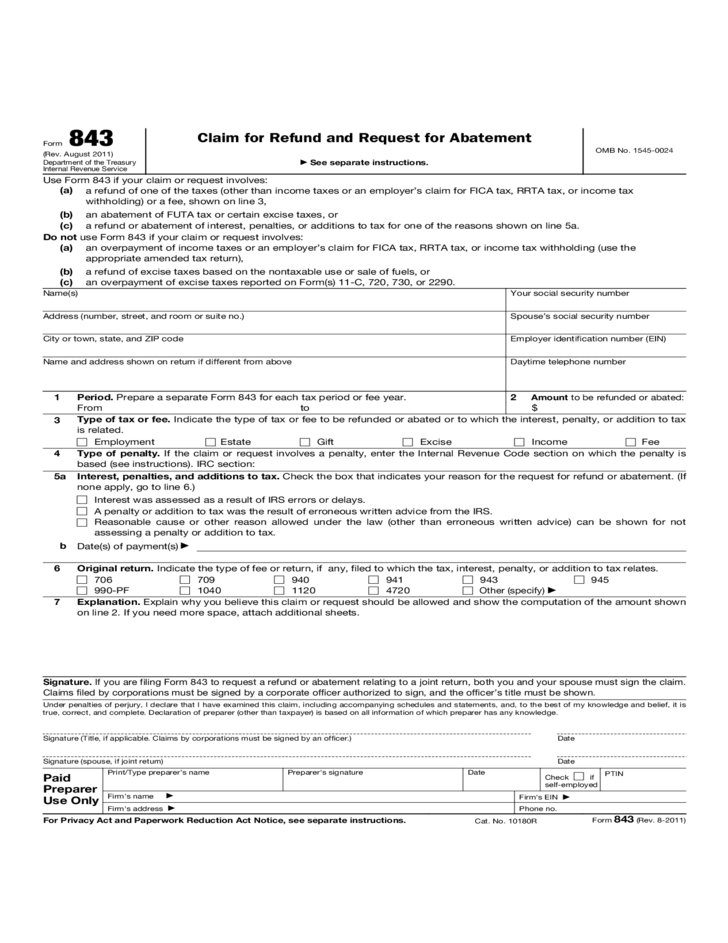

You may be entitled to refunds if you have violated the terms of chapter 4. Refunds can be claimed in accordance with sections 1401, 1474 and 1475. The agent who withholds the tax, or the individual who withholds the tax at source is the one responsible for distributing these refunds.

Status of relationships

An official marital status form withholding forms will assist you and your spouse make the most of your time. Furthermore, the amount of money that you can deposit at the bank can be awestruck. The problem is picking the right bank from the multitude of possibilities. Undoubtedly, there are some items you must avoid. Making the wrong decision will result in a significant cost. There’s no problem when you follow the directions and pay attention. If you’re lucky, you might even make acquaintances while traveling. Today is your birthday. I hope you will utilize it against them to locate that perfect ring. It will be a complicated job that requires the knowledge of an expert in taxation. It’s worth it to build wealth over a lifetime. It is a good thing that you can access plenty of information on the internet. TaxSlayer is one of the most trusted and respected tax preparation companies.

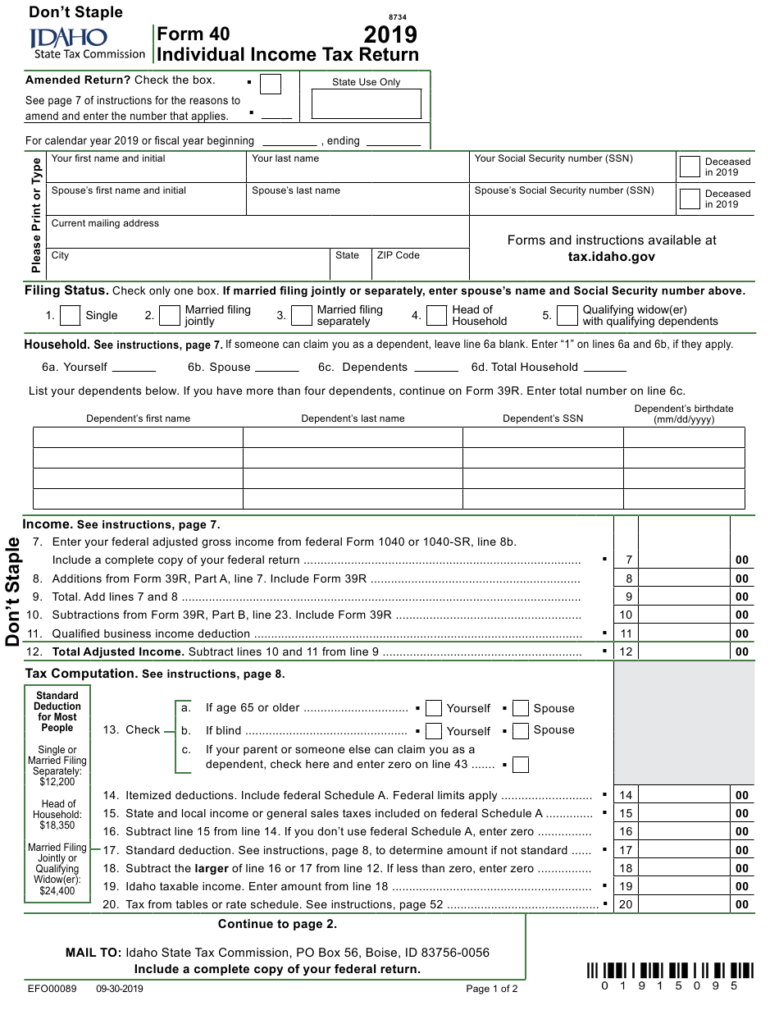

Amount of withholding allowances claimed

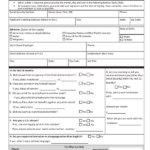

The W-4 form must be filled in with the amount of withholding allowances you would like to be able to claim. This is essential as the tax withheld will impact the amount taken out of your paycheck.

You could be eligible to apply for an exemption on behalf of your spouse when you’re married. Your income will determine how many allowances you can receive. An additional allowance could be granted if you make a lot.

You may be able to avoid paying a large tax bill by deciding on the appropriate amount of tax deductions. Refunds could be feasible if you submit your tax return on income for the previous year. But it is important to choose the right approach.

As with any financial decision you make it is essential to research the subject thoroughly. Calculators can help you determine how much withholding allowances you can claim. In addition, you may speak with an expert.

Filing specifications

Employers should report the employer who withholds tax from their employees. A few of these taxes can be submitted to the IRS by submitting forms. A tax return for the year and quarterly tax returns, or tax withholding reconciliations are just a few types of documents you could need. Here is more information on the different types of withholding tax and the deadlines for filing them.

Your employees may require the submission of withholding tax returns in order to receive their wages, bonuses and commissions. If you make sure that your employees are paid on time, you could be eligible for reimbursement of any withheld taxes. The fact that certain taxes are county taxes should be taken into consideration. There are also unique withholding procedures that can be utilized in certain situations.

Electronic submission of withholding forms is mandatory according to IRS regulations. If you are filing your tax returns for the national income tax ensure that you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.