Ohio Tax Withholding Form 2024 – There are numerous reasons an individual could submit an application for withholding. The reasons include the need for documentation as well as exemptions from withholding, as well as the amount of withholding allowances. There are a few important things to keep in mind regardless of the reason that a person has to fill out a form.

Withholding exemptions

Non-resident aliens must complete Form 1040-NR once a year. If you meet the criteria, you may be qualified for exemption from withholding. This page lists the exclusions.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The document is required to record the federal income tax. It outlines the withholding of the withholding agent. Please ensure you are entering the correct information when filling in this form. One person may be treated differently if this information is not supplied.

The rate of withholding for non-resident aliens is 30%. If your tax burden is less than 30 percent of your withholding, you may qualify to be exempt from withholding. There are many exemptions offered. Some are only for spouses and dependents such as children.

Generallyspeaking, withholding in Chapter 4 gives you the right to the right to a refund. Refunds are permitted under Sections 1471-1474. Refunds are provided by the withholding agent. This is the person who is responsible for withholding tax at the point of origin.

relational status

A valid marital status withholding can make it simpler for both you and your spouse to accomplish your job. You’ll be amazed by the amount that you can deposit at the bank. Knowing which of the many possibilities you’re most likely to choose is the challenge. There are certain aspects to avoid. There are a lot of costs when you make a bad choice. If you adhere to the rules and pay attention to the instructions, you won’t have any issues. If you’re fortunate you could even meet a few new pals while traveling. Today is the anniversary day of your wedding. I’m hoping you’ll be able to utilize it to secure that elusive diamond. You’ll need the help of a certified tax expert to finish it properly. The small amount of money you pay is enough to last the life of your wealth. You can find plenty of information on the internet. TaxSlayer is a trusted tax preparation company is one of the most useful.

The number of withholding allowances claimed

The W-4 form must be filled out with the number of withholding allowances that you would like to be able to claim. This is crucial since the tax withheld will affect how much is taken from your paycheck.

You may be able to apply for an exemption on behalf of your spouse in the event that you are married. Additionally, you can claim additional allowances, based on how much you earn. You may be eligible for more allowances if have a large amount of income.

Making the right choice of tax deductions can save you from a large tax payment. The possibility of a refund is possible if you submit your income tax return for the current year. Be cautious about how you approach this.

Research like you would with any other financial decision. Calculators are useful for determining how many allowances for withholding need to be made. A specialist may be an alternative.

Submission of specifications

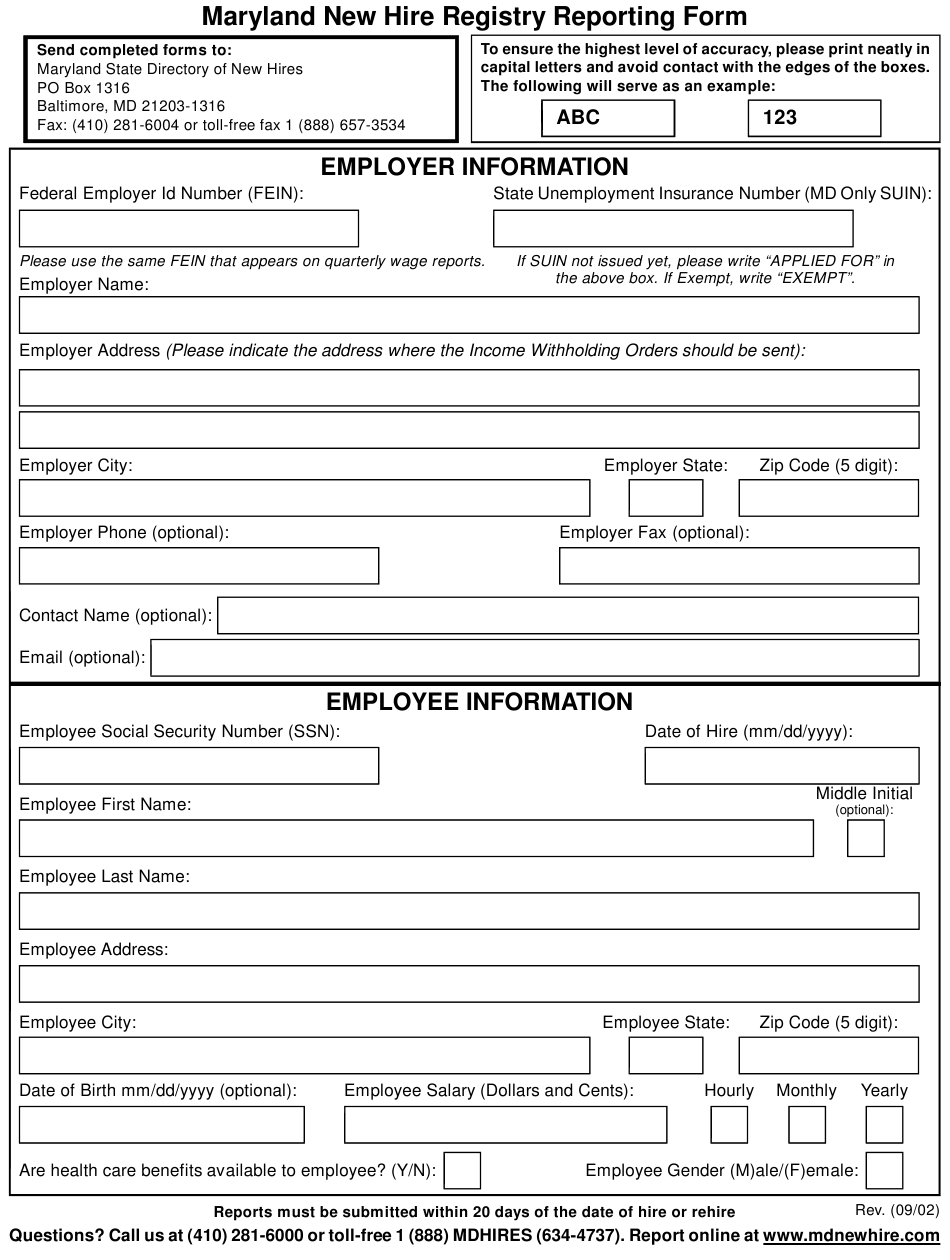

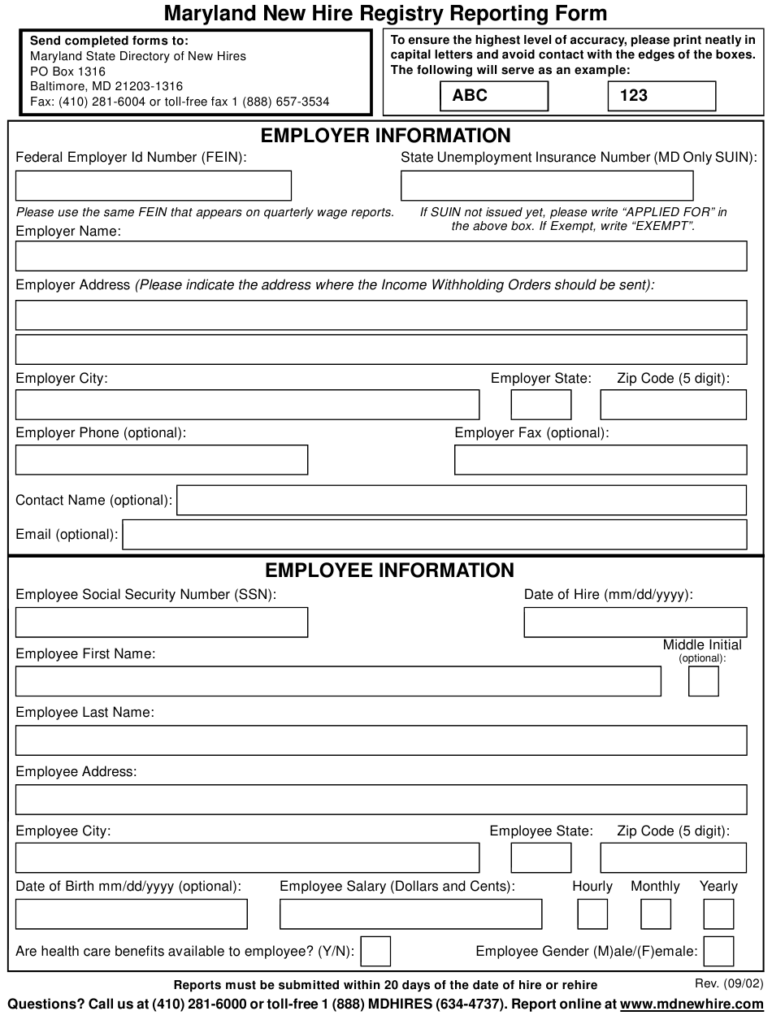

Employers are required to report the company who withholds taxes from employees. Certain of these taxes may be submitted to the IRS by submitting paperwork. A tax return that is annually filed, quarterly tax returns or tax withholding reconciliations are just a few kinds of documentation you may require. Here are some specifics about the various types of tax withholding forms along with the filing deadlines.

It is possible that you will need to file withholding tax returns to claim the earnings you earn from your employees, including bonuses or commissions. You may also have to file for salary. Additionally, if you pay your employees on time it could be possible to qualify to be reimbursed for any taxes taken out of your paycheck. It is crucial to remember that there are a variety of taxes that are local taxes. Furthermore, there are special methods of withholding that are applied under particular situations.

In accordance with IRS regulations the IRS regulations, electronic filings of tax withholding forms are required. When filing your tax returns for the national income tax, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.