Ohio State Withholding Form 2024 – There are numerous reasons one could fill out an application for withholding. This includes the documents required, the exclusion of withholding as well as the withholding allowances. However, if a person chooses to file a form there are some points to be aware of.

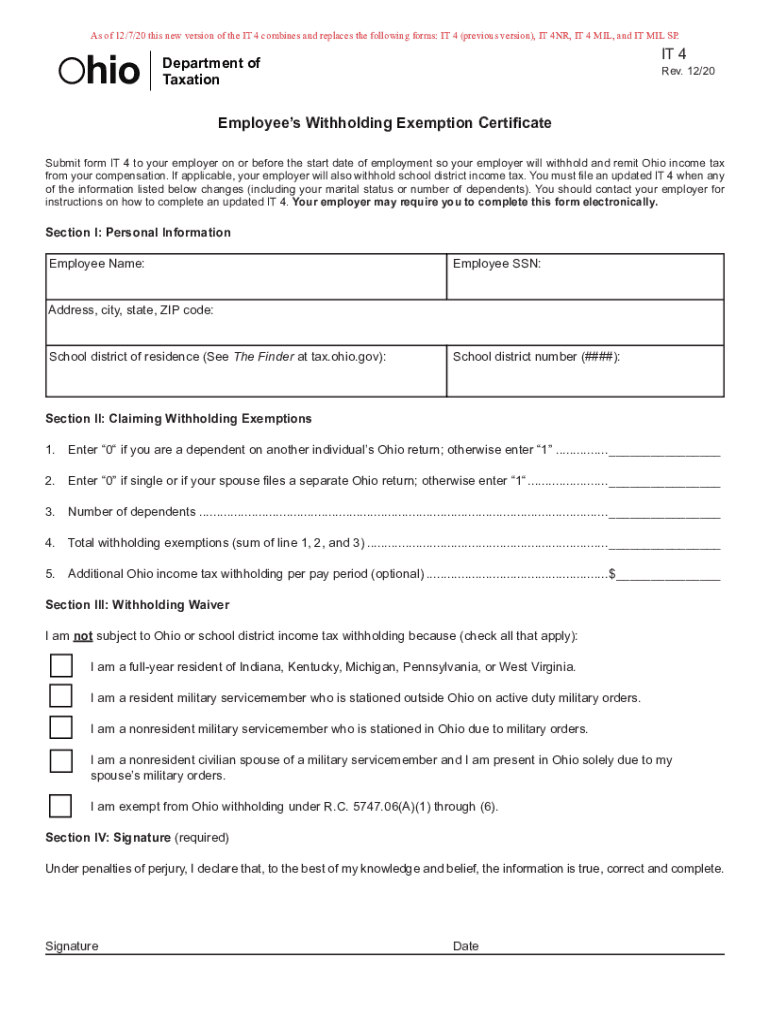

Exemptions from withholding

Nonresident aliens are required at least once every year to file Form1040-NR. You may be eligible to submit an exemption form for withholding, when you meet the criteria. The exemptions you will find on this page are yours.

For submitting Form 1040-NR add Form 1042-S. This form lists the amount that is withheld by the withholding agencies for federal income tax reporting purposes. When you fill out the form, ensure that you have provided the correct details. This information may not be disclosed and result in one person being treated differently.

The tax withholding rate for non-resident aliens is 30 percent. An exemption from withholding may be available if you have an income tax burden of lower than 30%. There are numerous exemptions. Some of them are only applicable to spouses and dependents such as children.

In general, you’re eligible to receive a refund in accordance with chapter 4. Refunds are available in accordance with Sections 1401, 1474, and 1475. The refunds are made by the agent who withholds tax. This is the individual who is responsible for withholding tax at the point of origin.

Status of relationships

An official marriage status withholding form will help both of you get the most out of your time. It will also surprise you with the amount of money you can make a deposit to the bank. The challenge is selecting the best option out of the many possibilities. Certain aspects should be avoided. Making the wrong choice could cause you to pay a steep price. However, if you adhere to the directions and keep your eyes open for any potential pitfalls, you won’t have problems. It is possible to make new acquaintances if you’re lucky. Today is the anniversary day of your wedding. I’m hoping you’ll be able to utilize it against them to search for that one-of-a-kind wedding ring. It’s a difficult job that requires the experience of an expert in taxation. The small amount of money you pay is enough to last the life of your wealth. You can find tons of information on the internet. TaxSlayer is among the most trusted and respected tax preparation firms.

In the amount of withholding allowances that are claimed

On the Form W-4 that you submit, you must specify the amount of withholding allowances you asking for. This is crucial since the withholdings can have an effect on the amount of tax that is taken from your paychecks.

There are a variety of factors that affect the amount of allowances requested.If you’re married, as an example, you may be able to apply for an exemption for head of household. Your income can impact how many allowances are available to you. If you have high income you may be eligible to receive more allowances.

It could save you thousands of dollars by choosing the correct amount of tax deductions. If you file the annual tax return for income and you are entitled to a refund. However, be cautious about your approach.

It is essential to do your homework the same way you would for any financial choice. Calculators will help you determine the amount of withholding that should be requested. Alternate options include speaking to an expert.

Specifications for filing

Employers are required to report the company who withholds taxes from employees. Some of these taxes may be reported to the IRS through the submission of paperwork. There are other forms you could require, such as an annual tax return, or a withholding reconciliation. Here’s some details on the different forms of withholding tax categories as well as the deadlines for filling them out.

Employees may need you to submit withholding taxes returns in order to receive their bonuses, salary and commissions. Additionally, if you pay your employees on-time you may be eligible to receive reimbursement for taxes taken out of your paycheck. It is important to note that some of these taxes are local taxes. There are also special withholding strategies that can be used in certain circumstances.

You have to submit electronically tax withholding forms as per IRS regulations. The Federal Employer Identification Number should be listed when you submit to your national tax return. If you don’t, you risk facing consequences.