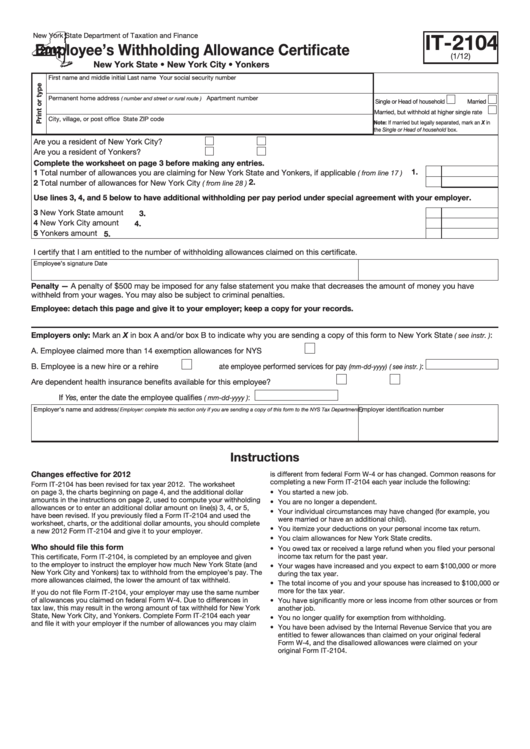

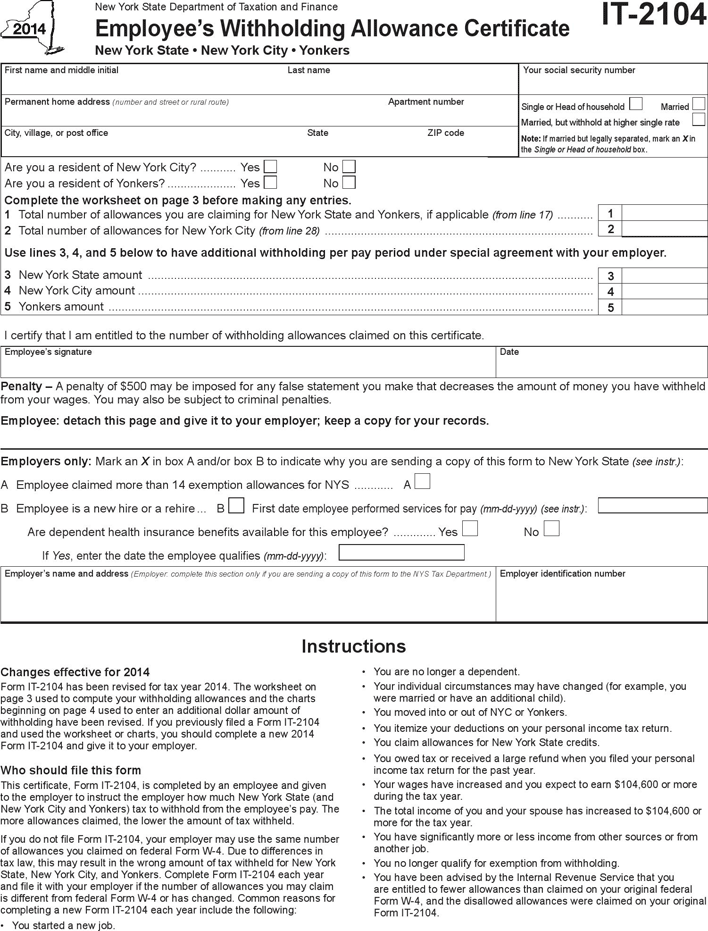

Nys Withholding Form It 2104 – There stand a digit of reasons why someone might choose to fill out a tax form. These factors include the documentation requirements, withholding exclusions, and the requested withholding allowances. No matter the reason for a person to file a document it is important to remember certain points to keep in mind.

Exemptions from withholding

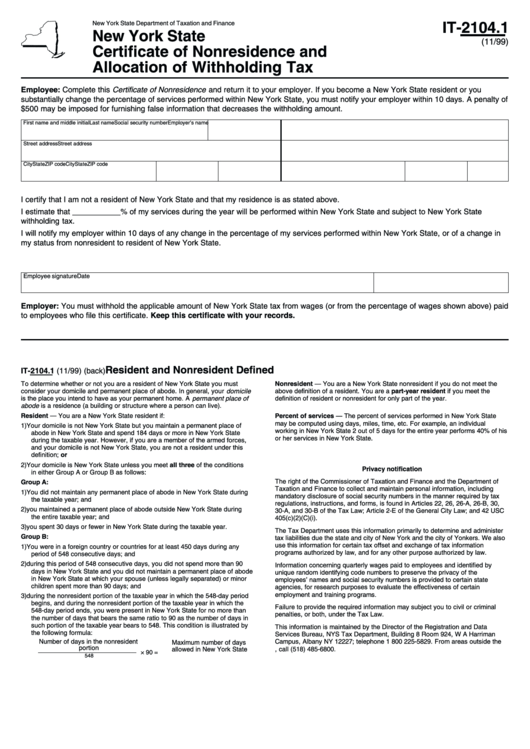

Non-resident aliens are required to submit Form 1040-NR at least once per year. If you meet the requirements, you may be eligible for an exemption from the withholding form. On this page, you will find the exclusions that you can avail.

To submit Form 1040-NR, include Form 1042-S. This form lists the amount that is withheld by the tax withholding authorities for federal income tax reporting to be used for reporting purposes. When filling out the form ensure that you have provided the accurate details. There is a possibility for a person to be treated differently if the correct information is not provided.

The rate of withholding for non-resident aliens is 30 percent. It is possible to be exempted from withholding if your tax burden exceeds 30%. There are many exemptions. Some are only for spouses and dependents such as children.

In general, you’re eligible for a reimbursement under chapter 4. Refunds can be claimed under Sections 1401, 1474, and 1475. Refunds are to be given by the withholding agents who is the person who withholds taxes at the source.

Relational status

The work of your spouse and you can be made easier with a valid marital status withholding form. You’ll be amazed at the amount that you can deposit at the bank. It can be difficult to decide which of the options the most appealing. There are some things you should avoid doing. False decisions can lead to costly negative consequences. If the rules are adhered to and you are attentive, you should not have any issues. If you’re lucky, you could be able to make new friends during your journey. Today is the anniversary. I’m hoping you can use it against them to get that elusive wedding ring. To do it right you’ll require the aid of a qualified accountant. The accumulation of wealth over time is more than that small amount. Information on the internet is easily accessible. TaxSlayer is among the most trusted and reputable tax preparation companies.

There are a lot of withholding allowances that are being made available

When filling out the form W-4 you fill out, you need to indicate how many withholding allowances are you seeking. This is important because the withholdings will impact on how much tax is taken from your paychecks.

You could be eligible to claim an exemption for the head of your household when you’re married. Your income level will also determine how many allowances you are eligible for. If you earn a higher income, you could be eligible to request a higher allowance.

A tax deduction appropriate for you could help you avoid large tax bills. If you file your annual tax returns, you may even be eligible for a refund. It is essential to pick the right method.

Like any financial decision you make it is essential to do your homework. Calculators can be utilized to figure out how many withholding allowances you should claim. A better option is to consult with a professional.

Submission of specifications

Employers must report the employer who withholds taxes from their employees. It is possible to submit documents to the IRS for a few of these taxes. Other documents you might need to submit include an withholding tax reconciliation as well as quarterly tax returns and the annual tax return. Below are details on the different forms of withholding tax and the deadlines to file them.

In order to be eligible to receive reimbursement for tax withholding on compensation, bonuses, salary or other income received from your employees You may be required to submit withholding tax return. If your employees receive their wages on time, you may be eligible to get the tax deductions you withheld. It is important to keep in mind that there are a variety of taxes that are local taxes. There are also special withholding strategies which can be utilized under certain conditions.

In accordance with IRS regulations, electronic filings of tax withholding forms are required. Your Federal Employer Identification Number must be included when you point to your national tax return. If you don’t, you risk facing consequences.