Ny Tax Withholding Form – There stand a digit of explanations why somebody could decide to complete a withholding form. Documentation requirements, withholding exemptions as well as the quantity of allowances for withholding requested are all factors. Whatever the reason the person decides to fill out the form, there are a few things to keep in mind.

Withholding exemptions

Non-resident aliens must submit Form 1040–NR at least once per calendar year. It is possible to submit an exemption form from withholding when you meet the criteria. This page you’ll discover the exemptions that you can avail.

If you are submitting Form1040-NR to the IRS, include Form 1042S. This form provides details about the withholding done by the tax agency that handles withholding for federal tax reporting to be used for reporting purposes. Make sure that you fill in the right information when you complete the form. It is possible for a person to be treated if the information is not given.

Nonresident aliens have a 30% withholding tax. You may be eligible to receive an exemption from withholding if the tax burden is higher than 30 percent. There are many exclusions. Some are specifically for spouses, and dependents, like children.

In general, you’re eligible to receive a refund in accordance with chapter 4. According to Sections 1471 through 1474, refunds are granted. These refunds are provided by the agent who withholds tax (the person who withholds tax at source).

Relational status

The correct marital status as well as withholding forms will ease the job of both you and your spouse. Additionally, the quantity of money that you can deposit in the bank will pleasantly delight you. Knowing which of the several possibilities you’re most likely to pick is the tough part. Be cautious about with what you choose to do. Making a mistake can have costly results. If you adhere to the rules and follow the directions, you shouldn’t run into any problems. If you’re lucky enough to meet some new friends while on the road. After all, today marks the anniversary of your wedding. I’m hoping you can make use of it to secure that dream engagement ring. To do this properly, you’ll require the guidance of a qualified Tax Expert. It’s worthwhile to accumulate wealth over the course of a lifetime. There is a wealth of information on the internet. Reputable tax preparation firms like TaxSlayer are among the most helpful.

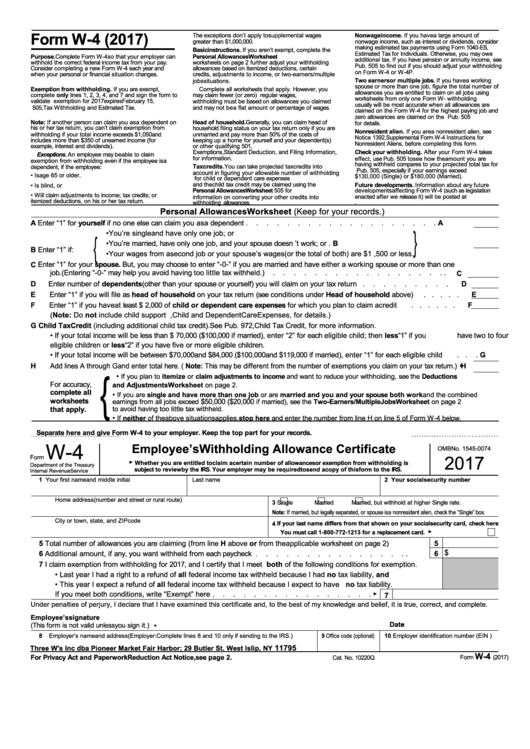

Number of claimed withholding allowances

It is important to specify the number of withholding allowances you want to claim on the form W-4 you submit. This is important because the tax withheld can affect how much is taken from your pay check.

There are a variety of factors that affect the amount of allowances requested.If you’re married, as an example, you might be eligible for an exemption for the head of household. You can also claim more allowances depending on how much you earn. If you earn a high amount it could be possible to receive more allowances.

Choosing the proper amount of tax deductions might allow you to avoid a significant tax payment. If you file your annual tax returns You could be entitled to a refund. Be cautious when it comes to preparing this.

In every financial decision, you should be aware of the facts. To figure out the amount of withholding allowances to be claimed, use calculators. A better option is to consult with a specialist.

Formulating specifications

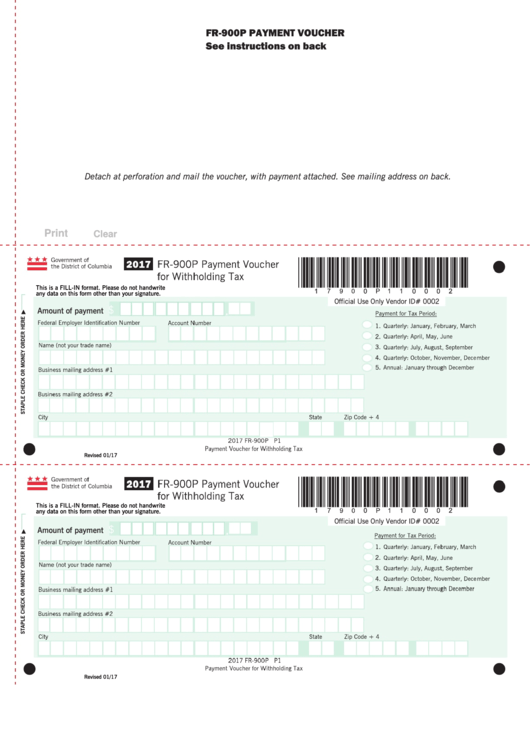

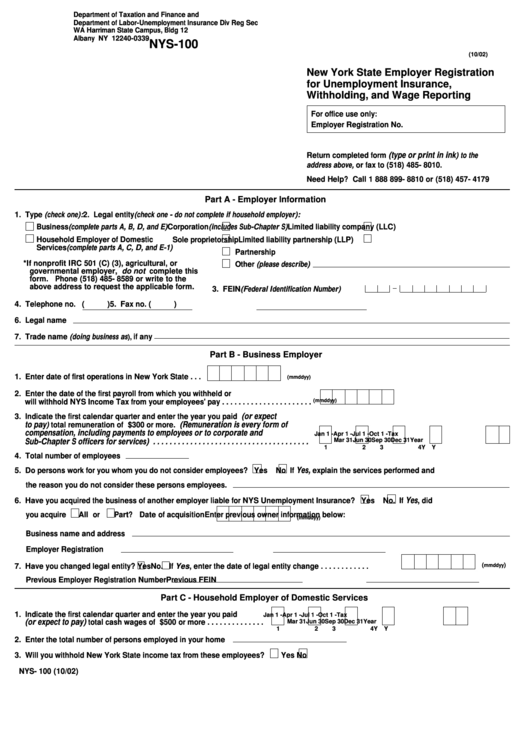

Withholding tax from your employees must be collected and reported if you are an employer. A few of these taxes may be submitted to the IRS by submitting forms. A reconciliation of withholding tax, an annual tax return for quarterly filing, or the annual tax return are examples of other paperwork you may be required to submit. Here are some information regarding the various forms of tax forms for withholding along with the deadlines for filing.

To be qualified for reimbursement of tax withholding on pay, bonuses, commissions or other revenue that your employees receive You may be required to file a tax return for withholding. In addition, if you pay your employees on-time you may be eligible to be reimbursed for any taxes that were taken out of your paycheck. It is important to note that not all of these taxes are local taxes. There are also special withholding strategies that are applicable in specific situations.

You must electronically submit withholding forms in accordance with IRS regulations. The Federal Employer Identification Number should be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.