North Dakota State Tax Withholding Form 2024 – There are a variety of reasons someone might choose to complete a form for withholding form. This includes documentation requirements as well as exemptions from withholding, as well as the amount of withholding allowances. You must be aware of these things regardless of why you choose to submit a request form.

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once every year. If the requirements are met, you could be eligible for an exemption from withholding. On this page, you’ll discover the exemptions that you can avail.

To file Form 1040-NR the first step is to attach Form 1042S. This form is a record of the withholdings that are made by the agency. Be sure to enter the right information when filling in this form. A person could be treated differently if this information is not entered.

The 30% non-resident alien tax withholding rate is 30. The tax burden of your business must not exceed 30% in order to be eligible for exemption from withholding. There are a variety of exemptions. Some are only for spouses, dependents, or children.

You can claim a refund if you violate the terms of chapter 4. Refunds can be claimed under sections 1401, 1474 and 1475. The refunds are made by the withholding agents that is, the person who withholds taxes at source.

Relational status

Your and your spouse’s job will be made easy by the proper marriage-related status withholding document. You’ll be surprised by the amount of money you can deposit to the bank. It isn’t easy to determine which of the many options you’ll choose. You should be careful with what you choose to do. Making the wrong choice could cost you a lot. If the rules are adhered to and you are attentive to the rules, you shouldn’t have any problems. If you’re lucky enough, you might find some new friends while driving. Today marks the anniversary. I hope you will use it against them to search for that one-of-a-kind wedding ring. If you want to do this properly, you’ll require advice of a qualified Tax Expert. A modest amount of money can make a lifetime of wealth. Information on the internet is easily accessible. TaxSlayer is a reputable tax preparation firm.

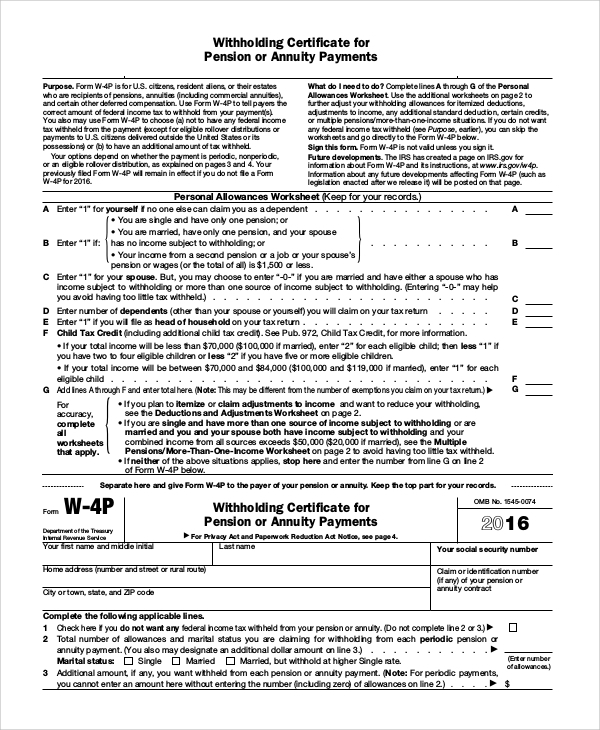

Number of withholding allowances requested

On the W-4 form you file, you should declare how many withholding allowances are you seeking. This is crucial since the tax withheld can affect the amount of tax taken from your paychecks.

A variety of factors influence the amount of allowances requested.If you’re married for instance, you could be eligible to claim an exemption for head of household. The amount you are eligible for will be contingent on your income. If you have a high income, you may be eligible for an increased allowance.

It is possible to reduce the amount of your tax bill by choosing the right amount of tax deductions. You could actually receive a refund if you file your annual tax return. But it is important to choose the right approach.

As with any financial decision it is crucial to do your homework. Calculators can be used for determining the amount of withholding allowances that are required to be requested. Alternative options include speaking with a specialist.

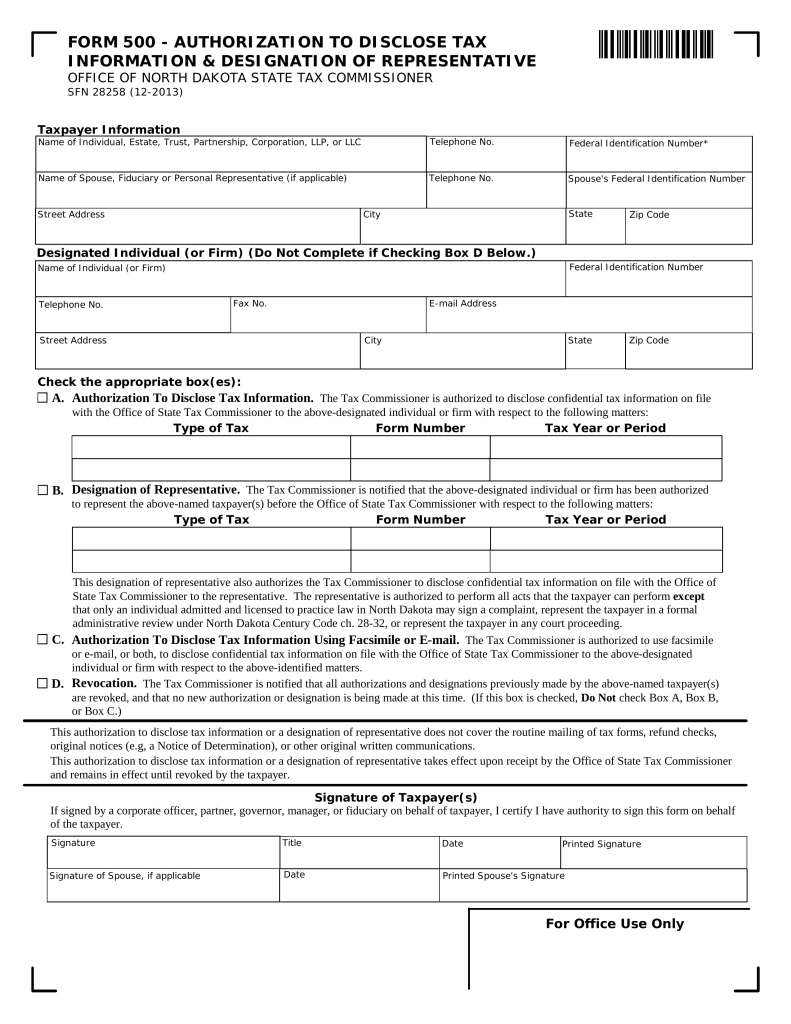

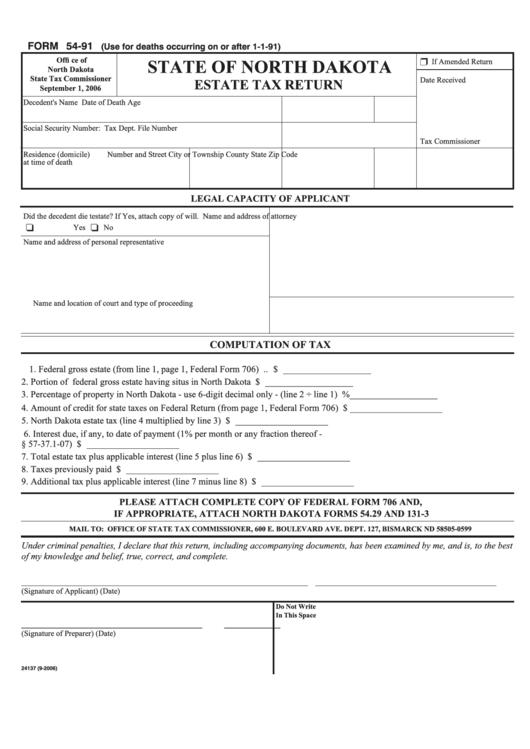

Specifications that must be filed

Withholding taxes from your employees have to be collected and reported if you’re an employer. The IRS can accept paperwork for some of these taxes. You might also need additional documents, such as an withholding tax reconciliation or a quarterly tax return. Here’s some information about the different tax forms for withholding categories and the deadlines for filing them.

It is possible that you will need to file tax returns withholding in order to report the income you get from your employees, like bonuses and commissions or salaries. If you make sure that your employees are paid on time, you may be eligible to receive the refund of taxes that you withheld. Be aware that some of these taxes may be county taxes. There are also specific withholding techniques that can be used in certain circumstances.

You must electronically submit withholding forms according to IRS regulations. When you file your national revenue tax returns, be sure to include your Federal Employee Identification Number. If you don’t, you risk facing consequences.