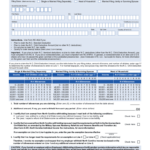

North Carolina Withholding Form Nc 4 – There are many reasons why an individual might want to fill out a withholding form. The reasons include the need for documentation as well as exemptions from withholding, as well as the quantity of requested withholding allowances. It is important to be aware of these aspects regardless of the reason you decide to file a request form.

Withholding exemptions

Non-resident aliens are required to submit Form 1040-NR at least once per year. You could be eligible to file an exemption form for withholding tax when you meet the requirements. This page you will see the exemptions that are that you can avail.

To complete Form 1040-NR, add Form 1042-S. For federal income tax reporting purposes, this form outlines the withholding made by the withholding agency. Make sure you enter the correct information as you fill in the form. This information might not be provided and could result in one individual being treated.

Non-resident aliens are subject to the 30% tax withholding rate. A nonresident alien may be eligible for an exemption. This is when your tax burden is less than 30%. There are many exemptions. Some are for spouses and dependents, such as children.

You may be entitled to refunds if you have violated the terms of chapter 4. Refunds are available under Sections 1401, 1474 and 1475. The refunds are made to the tax agent withholding the person who withholds the tax from the source.

Status of relationships

You and your spouse’s work will be made easy with a valid marriage-related status withholding document. You’ll be surprised by the amount of money you can put in the bank. Knowing which of the many possibilities you’re likely pick is the tough part. Undoubtedly, there are some that you shouldn’t do. Making the wrong choice could result in a costly loss. If you adhere to the rules and pay attention to instructions, you won’t encounter any issues. If you’re fortunate, you might even make a few new pals on your travels. Today is the anniversary day of your wedding. I’m hoping you can use it against them to get that elusive engagement ring. For a successful completion of the task it is necessary to seek the assistance of a tax professional who is certified. A modest amount of money could create a lifetime’s worth of wealth. Information on the internet is easy to find. TaxSlayer is a well-known tax preparation company is one of the most helpful.

There are a lot of withholding allowances being claimed

The W-4 form must be filled in with the amount of withholding allowances that you would like to take advantage of. This is essential as the tax withheld will impact the amount taken out of your paychecks.

Many factors affect the amount you are eligible for allowances. The amount you’re eligible to claim will depend on your income. If you make a lot of money, you might get a bigger allowance.

A tax deduction that is suitable for you can help you avoid large tax bills. In addition, you could even receive a tax refund if your annual income tax return is filed. Be sure to select your method carefully.

Just like with any financial decision it is essential to do your homework. Calculators can assist you in determining the number of withholdings that need to be demanded. An alternative is to speak to a professional.

Specifications for filing

If you’re an employer, you have to collect and report withholding taxes on your employees. A few of these taxes may be submitted to the IRS by submitting forms. There are other forms you might need for example, the quarterly tax return or withholding reconciliation. Below are details on the different types of withholding taxes and the deadlines to file them.

To be eligible to receive reimbursement for withholding taxes on the salary, bonus, commissions or any other earnings earned by your employees it is possible to submit withholding tax return. If you pay your employees on time, then you may be eligible to receive reimbursement of any withheld taxes. Be aware that certain taxes could be considered to be taxation by county is crucial. There are also specific withholding strategies that can be used in certain circumstances.

Electronic submission of forms for withholding is required under IRS regulations. You must provide your Federal Employer Identification Number when you submit at your income tax return from the national tax system. If you don’t, you risk facing consequences.