North Carolina State Withholding Quarterly Form 2024 – There are a variety of reasons why a person could choose to submit an application for withholding. These include documentation requirements, withholding exclusions and withholding allowances. It is important to be aware of these aspects regardless of why you choose to submit a request form.

Exemptions from withholding

Non-resident aliens have to submit Form 1040-NR at a minimum once per year. It is possible to submit an exemption form for withholding tax when you meet the conditions. This page lists all exclusions.

The first step for submitting Form 1040 – NR is to attach the Form 1042 S. This form is a record of the withholdings that are made by the agency. Fill out the form correctly. If this information is not supplied, one person may be diagnosed with a medical condition.

The 30% non-resident alien tax withholding rate is 30 percent. The tax burden of your business must not exceed 30% to be eligible for exemption from withholding. There are many exclusions. Some of them are for spouses and dependents such as children.

You are entitled to a refund if you violate the terms of chapter 4. In accordance with Section 1471 through 1474, refunds are given. These refunds must be made by the withholding agents who is the person who collects taxes at source.

Status of relationships

A valid marital status and withholding forms can simplify the job of both you and your spouse. You’ll be amazed at the amount you can deposit to the bank. It is difficult to decide what option you will choose. There are some things you must be aware of. Making the wrong decision will result in a significant cost. But if you follow it and pay attention to the instructions, you won’t encounter any issues. You might make some new acquaintances if you’re lucky. Today is the day you celebrate your marriage. I’m hoping you’ll be able to utilize it against them to find that elusive wedding ring. It will be a complicated task that requires the expertise of an accountant. This tiny amount is worth the lifetime of wealth. There are a myriad of online resources that provide details. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

The number of withholding allowances that were made

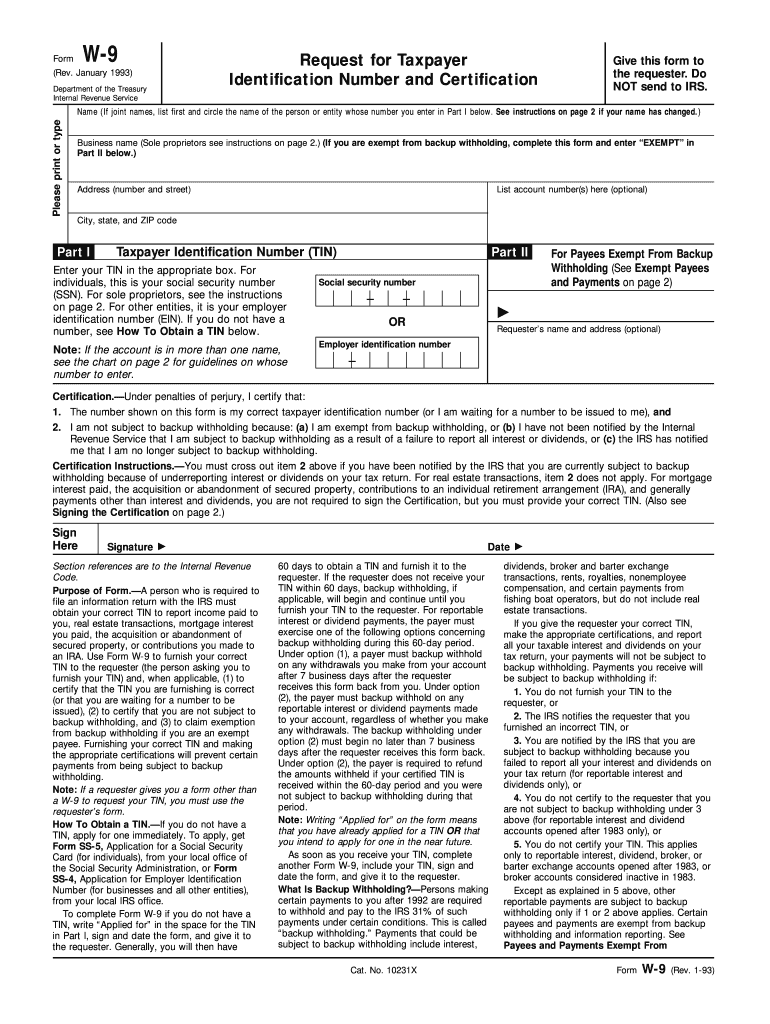

You need to indicate how many withholding allowances you wish to claim on the Form W-4 you submit. This is essential since the withholdings can have an effect on the amount of tax that is taken from your pay checks.

Many factors determine the amount that you can claim for allowances. Your income also determines how much allowances you’re eligible to claim. You could be eligible to claim more allowances if have a large amount of income.

The proper amount of tax deductions will help you avoid a significant tax charge. If you file the annual tax return for income You could be qualified for a tax refund. It is important to be cautious when it comes to preparing this.

As with any financial decision, it is important to conduct your own research. Calculators can be used to determine how many withholding allowances are required to be claimed. If you prefer contact a specialist.

filing specifications

If you are an employer, you have to be able to collect and report withholding taxes from your employees. Certain of these taxes can be reported to the IRS by submitting forms. A tax return that is annually filed and quarterly tax returns as well as the reconciliation of withholding tax are all kinds of documentation you may need. Here’s some details on the different tax forms for withholding categories, as well as the deadlines to the submission of these forms.

Tax returns withholding may be required for income such as bonuses, salary or commissions as well as other earnings. It is also possible to get reimbursements for tax withholding if your employees received their wages on time. You should also remember that some of these taxes could be considered to be local taxes. In certain circumstances, withholding rules can also be different.

As per IRS regulations Electronic submissions of withholding forms are required. Your Federal Employer Identification Number needs to be included when you point your national revenue tax return. If you don’t, you risk facing consequences.

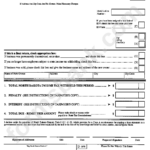

Gallery of North Carolina State Withholding Quarterly Form 2024

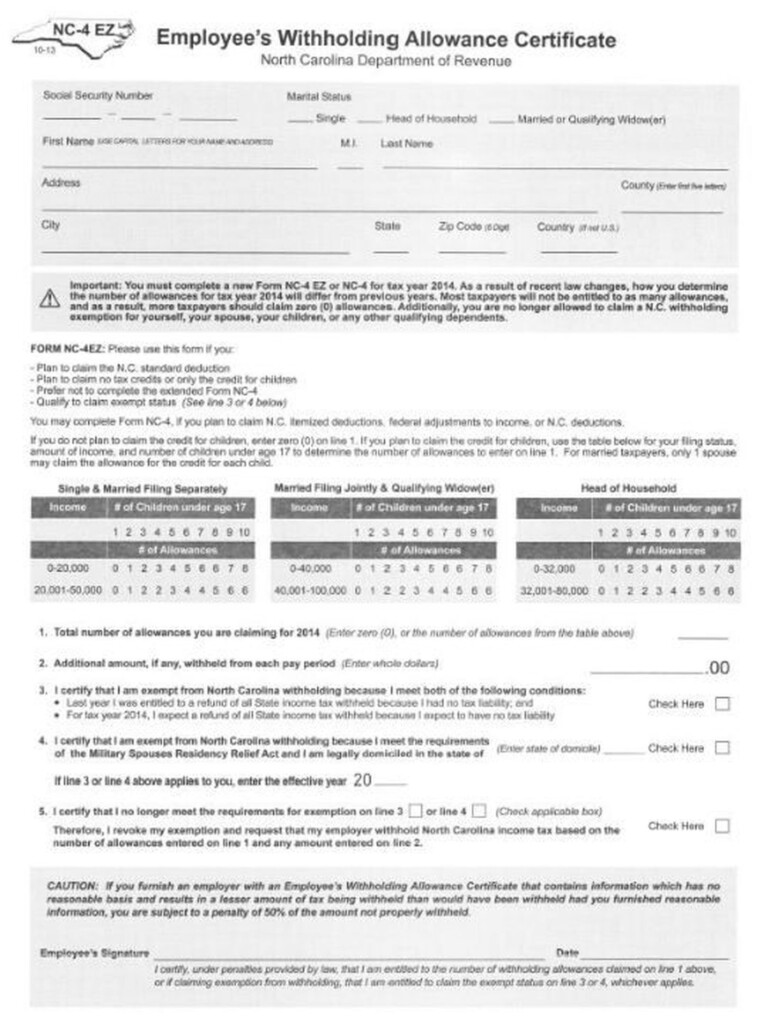

North Carolina State Withholding Form Nc 4 Ez WithholdingForm