North Carolina State Withholding Form Nc-4 – There are many reasons why someone might choose to complete a withholding form. These factors include the requirements for documentation, exemptions from withholding and the amount of withholding allowances. There are some important things to keep in mind regardless of why that a person has to fill out a form.

Exemptions from withholding

Non-resident aliens must submit Form 1040–NR every calendar year. If you meet the requirements, you may be able to claim exemptions from the form for withholding. This page will list all exemptions.

Attaching Form 1042-S is the first step to file Form 1040-NR. The form contains information on the withholding that is performed by the agency responsible for withholding for federal income tax reporting purposes. Complete the form in a timely manner. It is possible for a person to be treated differently if the correct information is not provided.

Non-resident aliens are subject to 30 percent withholding. A nonresident alien may be qualified for an exemption. This is when your tax burden is lower than 30 percent. There are many exclusions. Some of them apply to spouses or dependents, like children.

Generally, withholding under Chapter 4 gives you the right to an amount of money back. Refunds are permitted under Sections 1471-1474. Refunds are to be given by the agents who withhold taxes who is the person who is responsible for withholding taxes at source.

Relational status

The correct marital status as well as withholding form will simplify the job of both you and your spouse. You’ll be amazed at the amount you can deposit at the bank. Knowing which of the several possibilities you’re most likely to choose is the challenge. There are certain actions you shouldn’t do. False decisions can lead to costly consequences. However, if you adhere to the guidelines and be alert for any potential pitfalls, you won’t have problems. If you’re fortunate you may even meet some new friends when you travel. Today is your birthday. I’m hoping you can use it against them to find that perfect wedding ring. If you want to get it right you’ll need the help of a certified accountant. A little amount can make a lifetime of wealth. Online information is easy to find. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

There are many withholding allowances being requested

On the W-4 form you fill out, you need to specify how many withholding allowances are you seeking. This is essential because the tax amount withdrawn from your pay will depend on how much you withhold.

The amount of allowances you are entitled to will be determined by the various aspects. For instance, if you are married, you could be eligible for an exemption for the head of household or for the household. Additionally, you can claim additional allowances, based on how much you earn. You can apply for a greater allowance if you make a lot of money.

A tax deduction appropriate for you could help you avoid large tax bills. It is possible to receive the amount you owe if you submit your annual income tax return. But be sure to choose the right method.

Similar to any financial decision, you should conduct your homework. Calculators are useful for determining how many withholding allowances need to be claimed. You can also speak to a specialist.

Formulating specifications

If you’re an employer, you have to pay and report withholding tax from your employees. In the case of a small amount of the taxes, you are able to provide documentation to the IRS. Other documents you might need to submit include a withholding tax reconciliation, quarterly tax returns, and an annual tax return. Here is more information on the different types of withholding tax and the deadlines to file them.

You might have to file tax returns for withholding to claim the earnings you earn from your employees, like bonuses and commissions or salaries. In addition, if you pay your employees in time, you may be eligible for reimbursement of taxes that were withheld. It is important to remember that certain taxes might be county taxes. There are special tax withholding strategies that could be suitable in certain situations.

The IRS regulations require that you electronically file withholding documents. Your Federal Employer Identification Number needs to be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.

Gallery of North Carolina State Withholding Form Nc-4

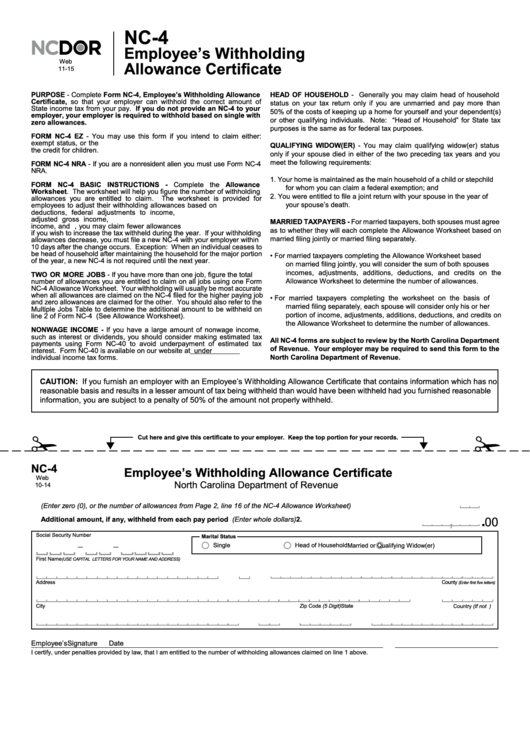

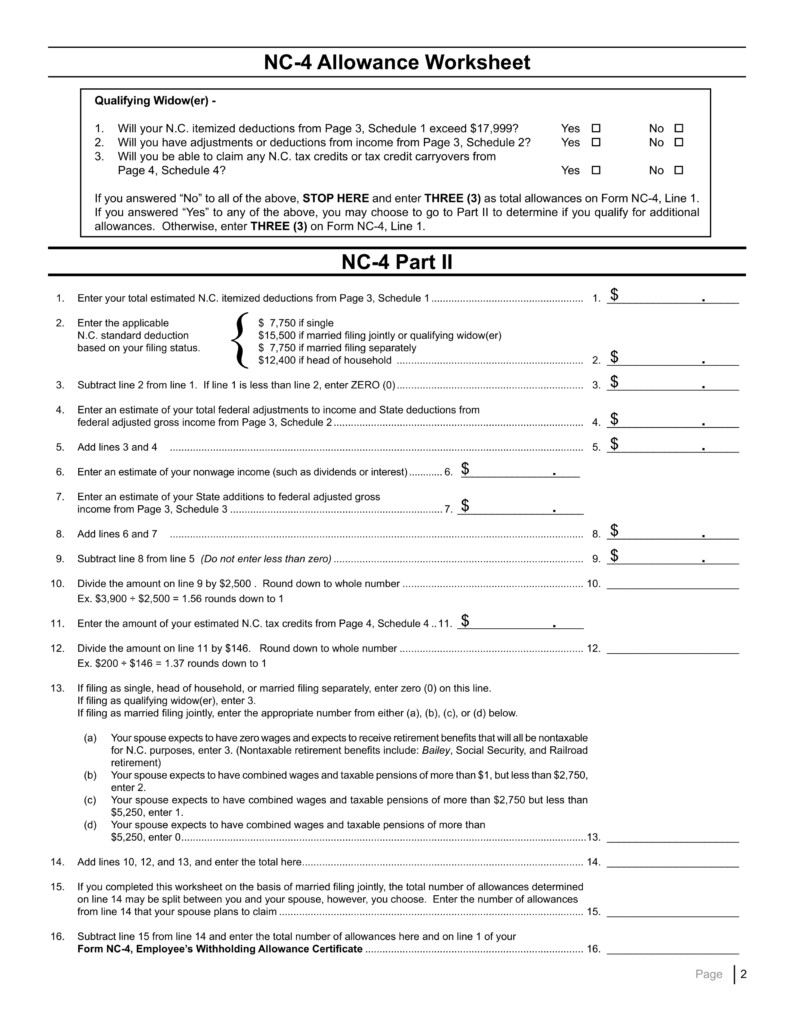

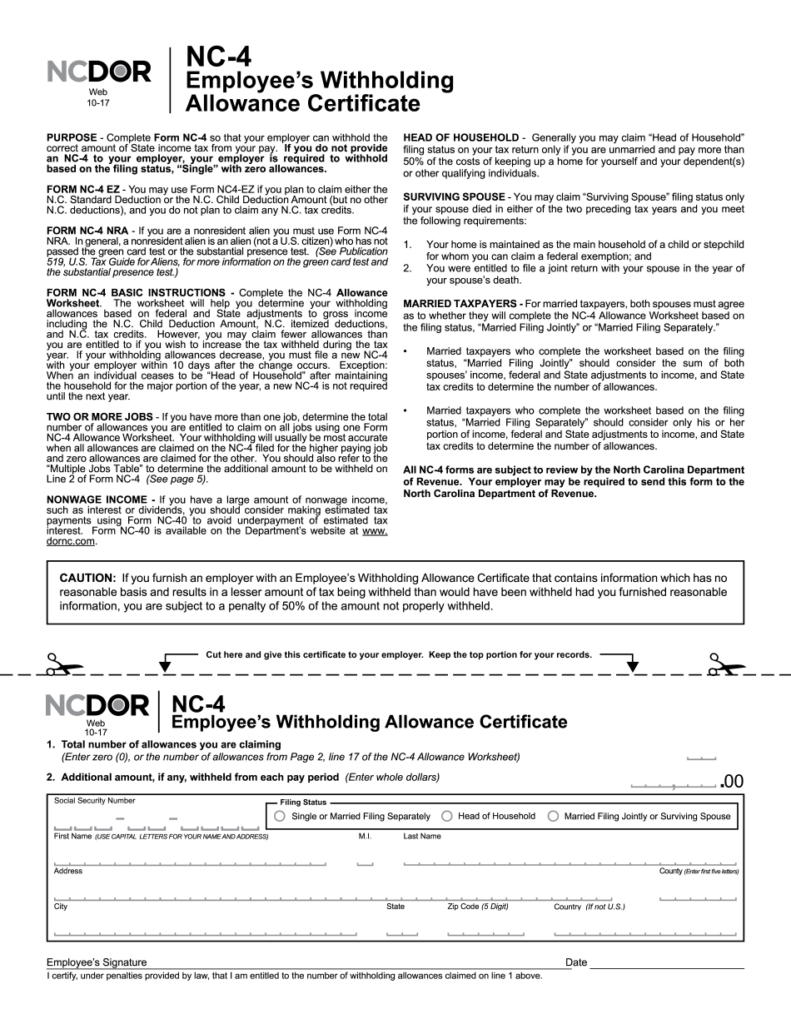

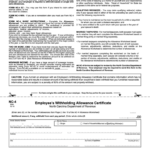

Form Nc 4 Employee S Withholding Allowance Certificate Nc 4p