Non Resident Withholding Tax Form – There are many explanations why somebody could decide to complete a withholding form. Withholding exemptions, documentation requirements as well as the quantity of allowances for withholding demanded are all elements. Whatever the reason behind a person to file a document, there are certain things that you need to remember.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR once a year. If the requirements are met, you may be eligible to apply for an exemption from withholding. The exclusions you can find on this page are yours.

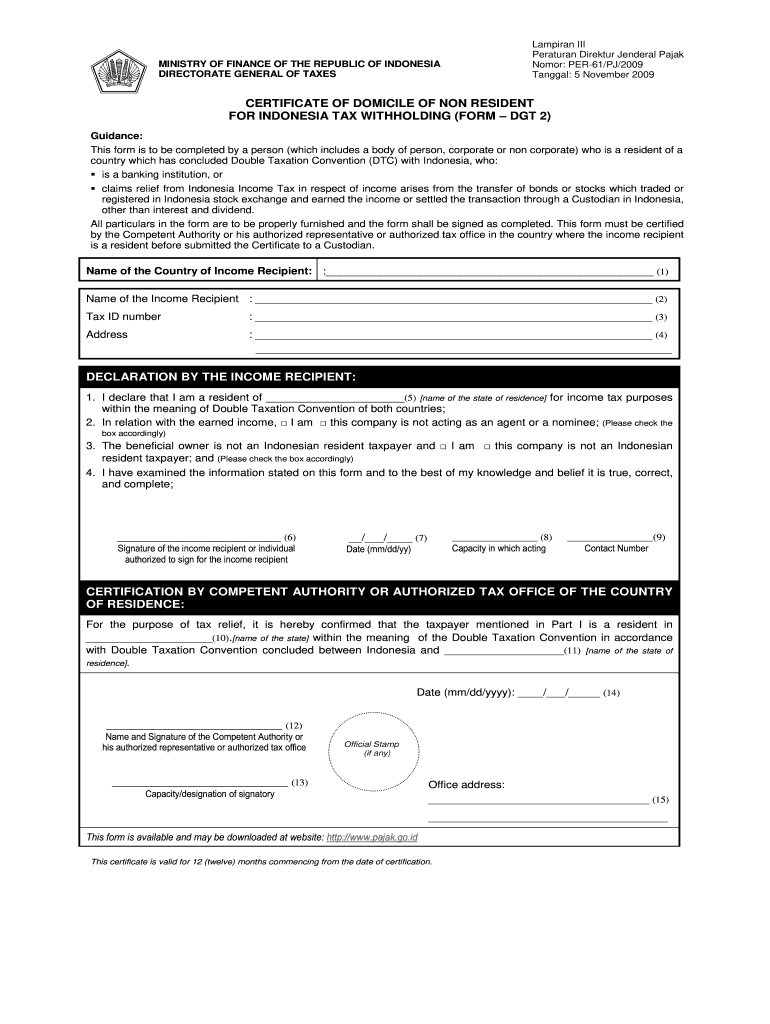

The first step for filling out Form 1040-NR is attaching the Form 1042 S. For federal income tax reporting purposes, this form details the withholding process of the agency responsible for withholding. Be sure to enter the correct information as you fill in the form. There is a possibility for a person to be treated if the information is not given.

The tax withholding rate for non-resident aliens is 30 percent. It is possible to be exempted from withholding tax if your tax burden exceeds 30 percent. There are many exemptions available. Certain exclusions are only available to spouses or dependents like children.

In general, chapter 4 withholding allows you to receive an amount of money. In accordance with Section 1471 through 1474, refunds are granted. The refunds are given by the withholding agent (the person who is responsible for withholding tax at the source).

Status of the relationship

The correct marital status as well as withholding form will simplify your work and that of your spouse. You’ll be amazed at the amount you can deposit to the bank. The challenge is in deciding which one of the many options to choose. Certain aspects should be avoided. The wrong decision can cost you dearly. If you stick to the instructions and be alert for any potential pitfalls and pitfalls, you’ll be fine. You might make some new friends if you are fortunate. Today is your anniversary. I’m hoping you’ll be able to utilize it to secure the elusive diamond. To do it right, you will need the assistance of a certified accountant. The tiny amount is worth it for a lifetime of wealth. Online information is easily accessible. TaxSlayer as well as other reliable tax preparation firms are a few of the most reliable.

The amount of withholding allowances claimed

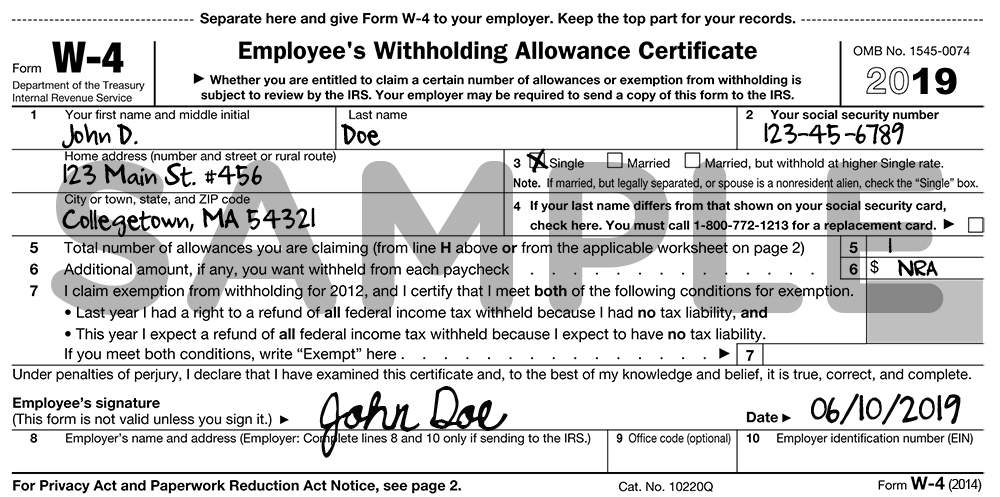

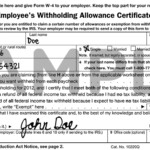

In submitting Form W-4 you must specify how many withholding allowances you want to claim. This is important since your wages could be affected by the amount of tax that you pay.

The amount of allowances you are entitled to will be determined by a variety of factors. For example when you’re married, you might be eligible for a head or household exemption. The amount you can claim will depend on the income you earn. You can apply for more allowances if earn a significant amount of money.

The proper amount of tax deductions will save you from a large tax cost. Even better, you might even get a refund if your tax return for income is completed. Be sure to select your method carefully.

Similar to any financial decision, you should conduct your homework. Calculators can help determine the amount of withholding that should be demanded. You may also talk to an expert.

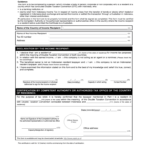

Sending specifications

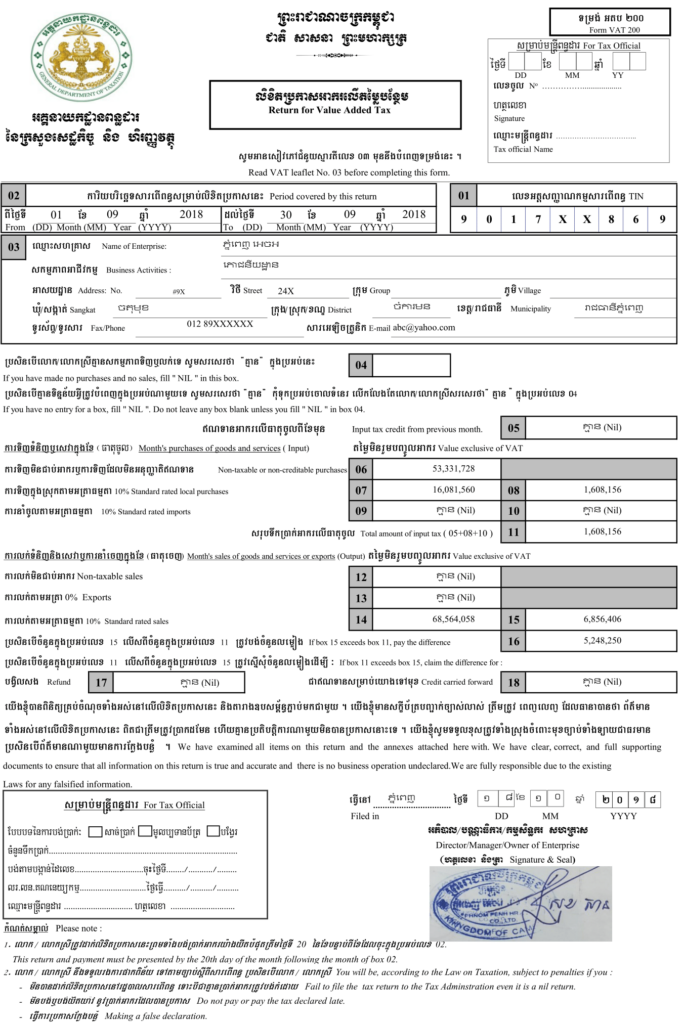

If you’re an employer, you are required to pay and report withholding tax from your employees. For some taxes you can submit paperwork to IRS. A withholding tax reconciliation, a quarterly tax return, as well as an annual tax return are all examples of other paperwork you may be required to submit. Here’s some information about the various tax forms and when they must be submitted.

Withholding tax returns may be required for income like bonuses, salary, commissions and other income. You may also be eligible to receive reimbursement of taxes withheld if you’re employees were paid on time. Be aware that some of these taxes may be county taxes. In addition, there are specific withholding practices that can be applied under particular circumstances.

You are required to electronically submit withholding forms in accordance with IRS regulations. The Federal Employer Identification number must be included when you submit your national tax return. If you don’t, you risk facing consequences.