Nj Income Tax Withholding Form – There are numerous reasons someone could complete an application for withholding. These factors include the document requirements, exclusions from withholding as well as the withholding allowances. No matter the reason for an individual to file an application it is important to remember certain points you must keep in mind.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR once a calendar year. However, if your requirements are met, you may be eligible to apply for an exemption from withholding. This page lists all exclusions.

To submit Form 1040-NR, the first step is attaching Form 1042S. The form contains information on the withholding that is performed by the agency responsible for withholding for federal tax reporting to be used for reporting purposes. It is important to enter the correct information when filling out the form. If this information is not given, a person could be taken into custody.

Nonresident aliens have the option of paying a 30% tax on withholding. If the tax you pay is less than 30 percent of your withholding you may qualify to be exempt from withholding. There are a variety of exclusions. Certain of them are designed for spouses, whereas others are meant for use by dependents, such as children.

Generally, you are entitled to a reimbursement under chapter 4. Refunds may be granted according to Sections 1400 through 1474. Refunds will be made to the withholding agent that is the person who collects the tax at the source.

Relational status

The marital withholding form can simplify your life and assist your spouse. The bank may be surprised by the amount of money that you deposit. It isn’t easy to determine which one of the many options is most attractive. Undoubtedly, there are some items you must avoid. It can be costly to make a wrong decision. If you adhere to the guidelines and follow them, there shouldn’t be any problems. If you’re lucky you might meet some new friends on your trip. Today is the anniversary date of your wedding. I’m sure you’ll be in a position to leverage this to get the elusive wedding ring. To do this properly, you’ll require the guidance of a qualified Tax Expert. It’s worthwhile to create wealth over a lifetime. Information on the internet is easily accessible. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

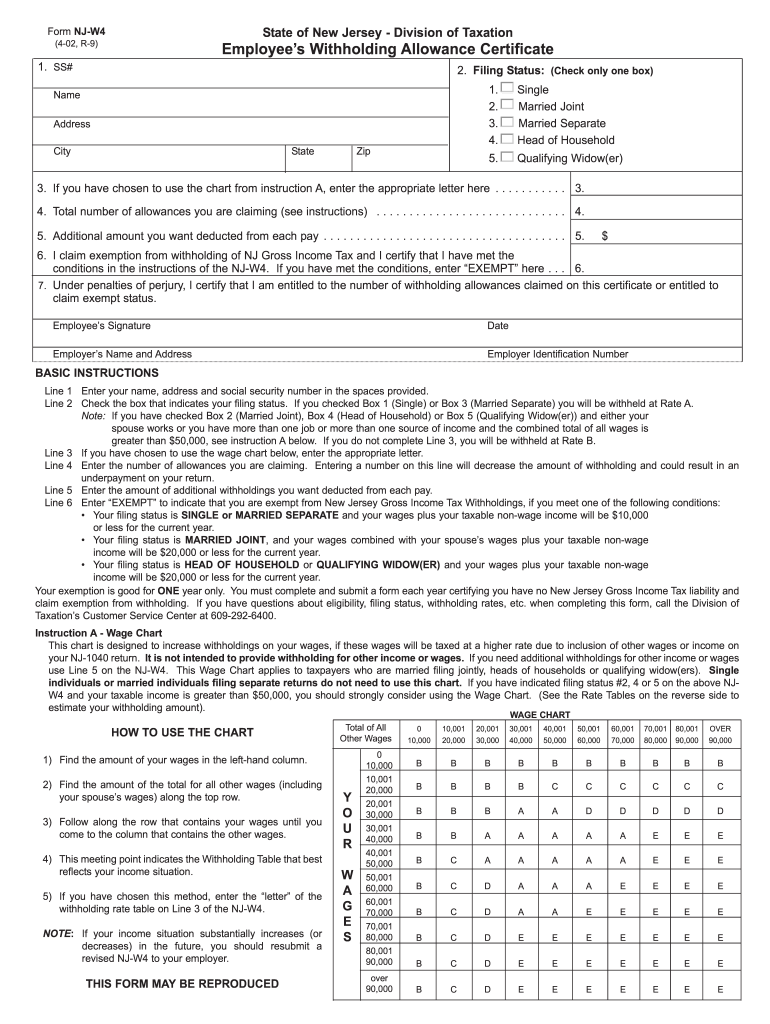

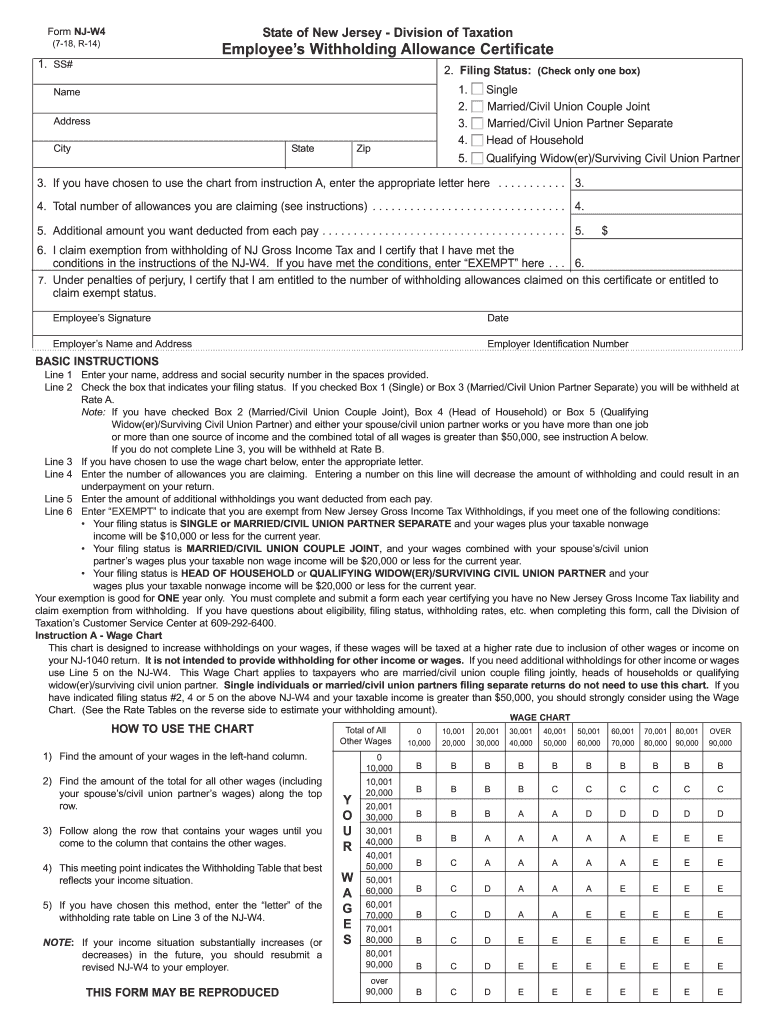

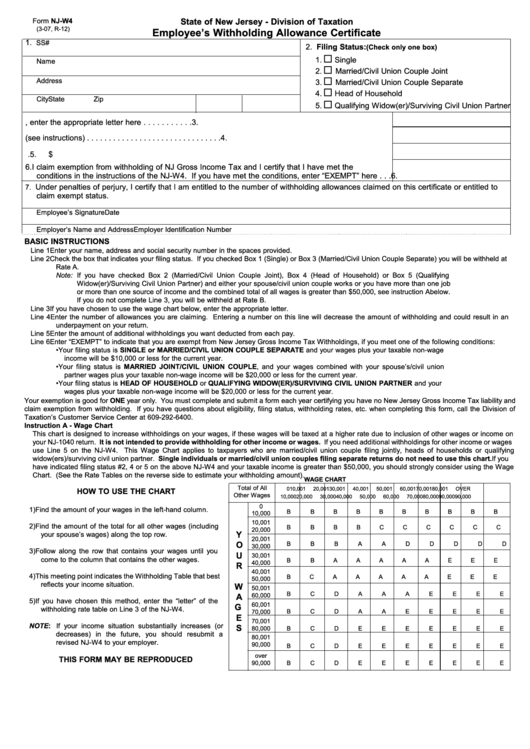

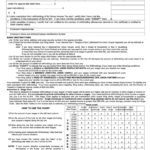

The amount of withholding allowances that are claimed

When filling out the form W-4 you fill out, you need to declare the amount of withholding allowances you requesting. This is crucial since the amount of tax you are able to deduct from your paycheck will be affected by the much you withhold.

The amount of allowances you receive will depend on various factors. For instance when you’re married, you could be eligible for a head or household exemption. You may also be eligible for higher allowances based on the amount you earn. If you have a higher income, you might be eligible to receive more allowances.

A tax deduction appropriate for you could allow you to avoid tax payments. In fact, if you submit your annual income tax return, you might even receive a refund. It is essential to choose the right approach.

Similar to any financial decision, you must do your research. Calculators are useful to figure out how many allowances for withholding need to be claimed. You can also speak to a specialist.

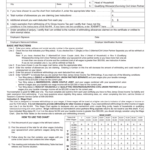

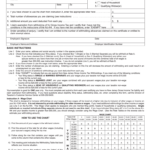

Submitting specifications

Employers should report the employer who withholds tax from employees. For certain taxes you can submit paperwork to the IRS. There may be additional documentation , like an withholding tax reconciliation or a quarterly tax return. Here’s some information about the different tax forms, and the time when they should be filed.

It is possible that you will need to file tax returns withholding in order to report the income you get from your employees, such as bonuses and commissions or salaries. Additionally, if you paid your employees in time, you may be eligible to receive reimbursement for taxes that were withheld. It is crucial to remember that there are a variety of taxes that are local taxes. In certain circumstances, withholding rules can also be unique.

The IRS regulations require that you electronically submit withholding documents. The Federal Employer Identification Number should be listed on to your national tax return. If you don’t, you risk facing consequences.