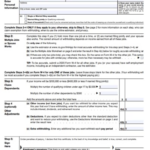

New York Withholding Form 2401 – There are a variety of reasons why a person could choose to submit an application for withholding. This includes documentation requirements including withholding exemptions and the amount of withholding allowances. It is important to be aware of these things regardless of your reason for choosing to fill out a form.

Withholding exemptions

Non-resident aliens must submit Form 1040–NR once a calendar year. However, if your requirements are met, you could be eligible for an exemption from withholding. The exemptions listed on this page are yours.

When submitting Form1040-NR, Attach Form 1042S. The form provides information about the withholding process carried out by the agency responsible for withholding to report federal income tax for tax reporting purposes. It is essential to fill in the correct information when filling out the form. This information might not be provided and could result in one individual being treated differently.

The tax withholding rate for non-resident aliens is 30 percent. Exemption from withholding could be possible if you’ve got a an income tax burden of less than 30%. There are a variety of exemptions that are available. Certain of them are designed for spouses, while others are meant to be used by dependents such as children.

In general, the withholding section of chapter 4 allows you to receive the possibility of a refund. Refunds can be made under Sections 471 through 474. The withholding agent, or the person who collects the tax at source is responsible for the refunds.

Relational status

A proper marital status withholding will make it easier for both you and your spouse to accomplish your job. The bank may be surprised by the amount of money that you deposit. The problem is deciding which one of the many options to select. Undoubtedly, there are some that you shouldn’t do. False decisions can lead to expensive results. It’s not a problem when you adhere to the instructions and be attentive. If you’re lucky, you might even make a few new pals while traveling. Today marks the anniversary. I’m hoping that they will turn it against you to help you get that elusive engagement ring. For a successful completion of the task you must obtain the assistance from a qualified tax professional. This small payment is well worth the lifetime of wealth. It is a good thing that you can access plenty of information on the internet. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

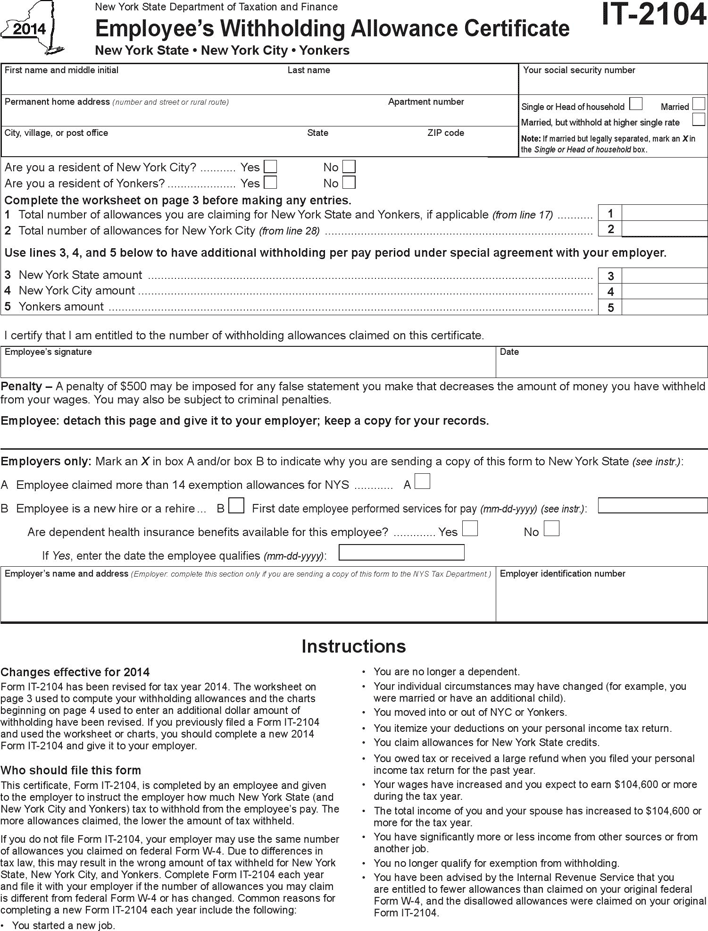

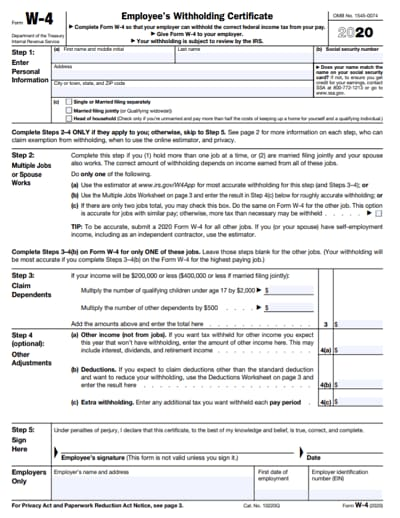

Number of withholding allowances claimed

On the Form W-4 that you fill out, you need to indicate the amount of withholding allowances you seeking. This is essential since the withholdings will effect on the amount of tax that is deducted from your paycheck.

Many factors affect the amount you are eligible for allowances. The amount you earn can impact how many allowances are available to you. If you have high income it could be possible to receive a higher allowance.

The proper amount of tax deductions can help you avoid a significant tax charge. The possibility of a refund is possible if you submit your income tax return for the current year. But , you have to choose your strategy carefully.

As with any financial decision it is crucial to conduct your research. Calculators can be used for determining how many withholding allowances need to be requested. Other options include talking to a specialist.

Formulating specifications

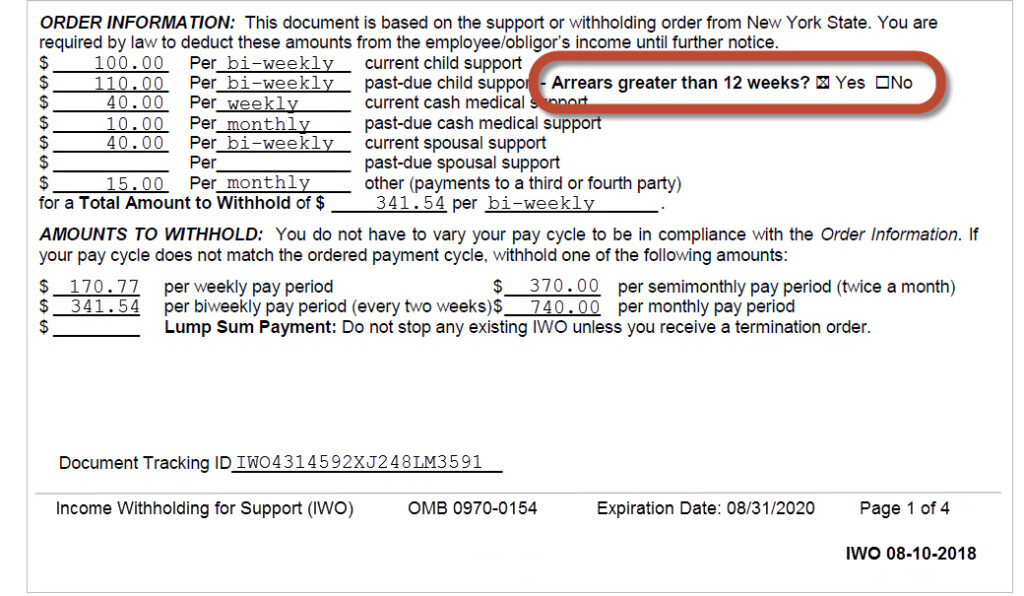

Employers must inform the IRS of any withholding taxes that are being paid by employees. For a limited number of these taxes, you can send paperwork to IRS. A reconciliation of withholding tax, the quarterly tax return or the annual tax return are some examples of additional documents you could need to submit. Here are some information about the various types of withholding tax forms as well as the filing deadlines.

Tax withholding returns can be required for income such as salary, bonuses or commissions as well as other earnings. If you also pay your employees on time it could be possible to qualify for reimbursement for any taxes taken out of your paycheck. It is crucial to remember that not all of these taxes are local taxes. In certain situations there are rules regarding withholding that can be different.

According to IRS rules, you have to electronically submit withholding forms. Your Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.