New York State Tax Form Withholding – There are many reasons someone may decide to submit a withholding application. Documentation requirements, withholding exemptions as well as the quantity of allowances for withholding requested are all factors. Whatever the reason behind an individual to file documents there are certain aspects to keep in mind.

Exemptions from withholding

Nonresident aliens are required once a year to submit Form1040-NR. If you meet these requirements, you could be eligible to receive exemptions from the form for withholding. The exclusions are available on this page.

Attaching Form 1042-S is the first step to file Form 1040-NR. The form provides information about the withholding done by the tax agency that handles withholding to report federal income tax for tax reporting purposes. It is essential to fill in the correct information when filling out the form. You could be required to treat a single person if you don’t provide the correct information.

Non-resident aliens have to pay 30 percent withholding. Non-resident aliens may be qualified for an exemption. This is the case if your tax burden less than 30%. There are a variety of exclusions. Some are specifically designed for spouses, whereas others are intended for use by dependents, such as children.

In general, the withholding section of chapter 4 gives you the right to an amount of money. In accordance with Section 1471 through 1474, refunds are given. The person who is the withholding agent, or the individual who is responsible for withholding the tax at source, is responsible for making these refunds.

relationship status

An official marriage status withholding form can help your spouse and you both to make the most of your time. The bank could be shocked by the amount of money that you deposit. The challenge is in deciding what option to choose. There are some things you must avoid. False decisions can lead to costly results. If you follow the directions and adhere to them, there won’t be any problems. If you’re lucky you’ll make new acquaintances while traveling. Today is your anniversary. I’m hoping that you can use it against them to get that elusive engagement ring. To do it right, you will need the assistance of a certified accountant. The accumulation of wealth over time is more than the small amount. Fortunately, you can find a ton of information online. TaxSlayer and other reputable tax preparation firms are a few of the best.

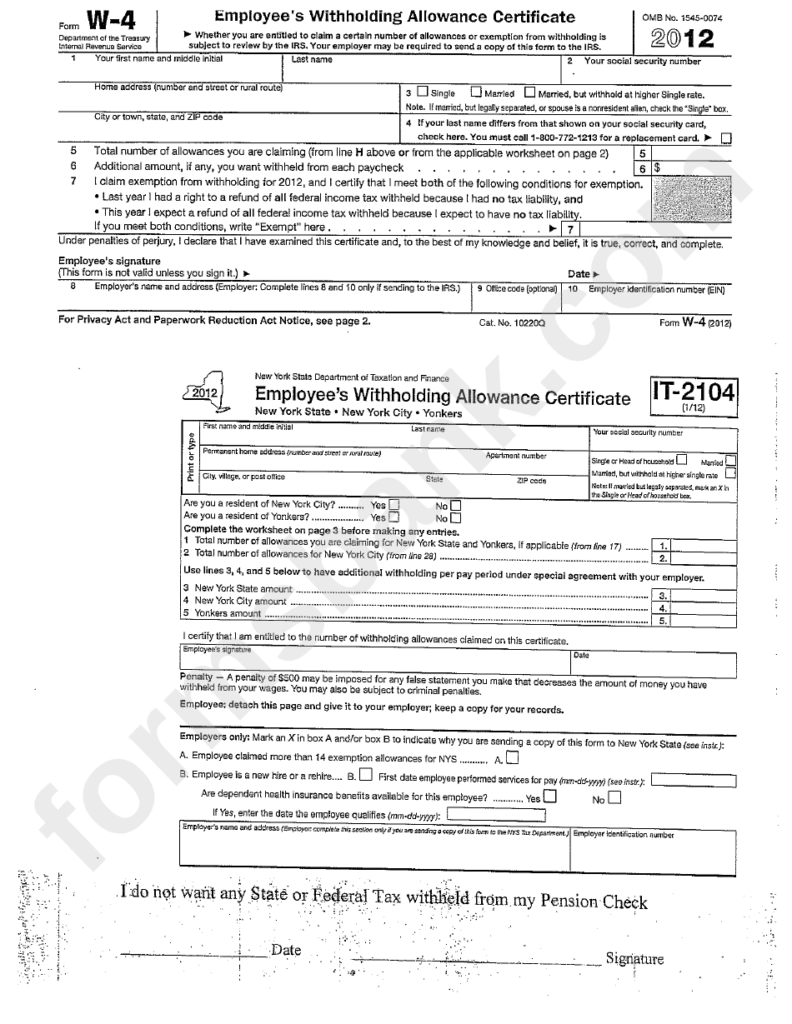

Amount of withholding allowances claimed

It is important to specify the amount of withholding allowances you would like to claim on the form W-4. This is important because the tax withheld will affect the amount of tax taken from your paycheck.

The amount of allowances you are entitled to will be determined by various factors. For instance If you’re married, you could be eligible for a head or household exemption. Your income will affect the amount of allowances you are eligible for. If you earn a substantial amount of income, you may be eligible for a larger allowance.

It is possible to reduce the amount of your tax bill by choosing the right amount of tax deductions. If you file the annual tax return for income, you may even be entitled to a refund. However, you must choose your approach wisely.

Conduct your own research, just as you would with any financial decision. Calculators can be utilized to figure out how many withholding allowances are required to be claimed. A specialist might be a viable option.

Formulating specifications

Withholding taxes on your employees must be collected and reported if you are an employer. The IRS may accept forms for certain taxes. A withholding tax reconciliation and a quarterly tax return, or the annual tax return are some examples of other paperwork you may be required to submit. Below are information on the various tax forms for withholding and the deadlines for each.

To be qualified for reimbursement of withholding tax on the compensation, bonuses, salary or other revenue that your employees receive it is possible to file a tax return for withholding. If you pay your employees on time, then you may be eligible for reimbursement of any withheld taxes. It is crucial to remember that some of these taxes are local taxes. Furthermore, there are special tax withholding procedures that can be used in certain situations.

The IRS regulations require you to electronically file withholding documents. When you submit your tax return for national revenue make sure you provide the Federal Employer Identification number. If you don’t, you risk facing consequences.

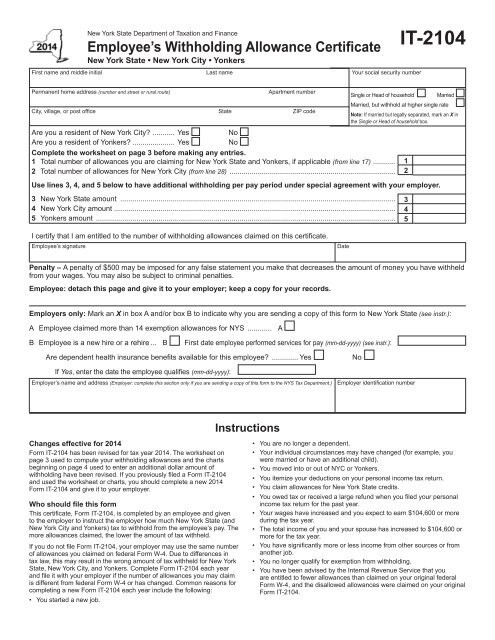

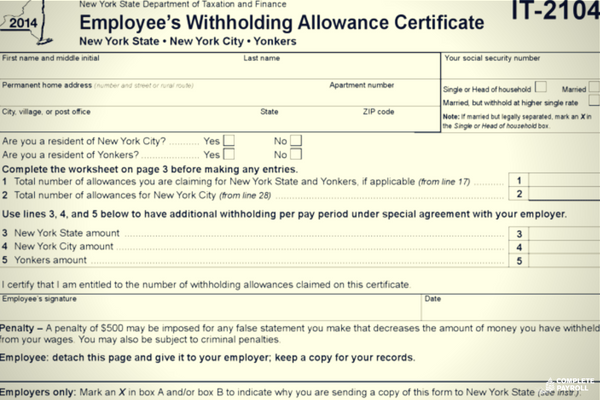

Gallery of New York State Tax Form Withholding

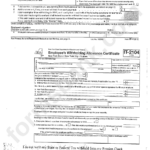

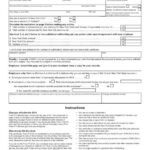

Form IT 2104 New York State Tax Withholding South Colonie