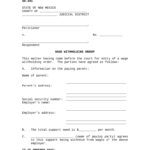

New Mexico Withholding Tax Form 2024 – There are a variety of reasons someone might choose to fill out a withholding form. Documentation requirements, withholding exemptions and the amount of withholding allowances requested are all factors. Whatever the reason behind the filing of documents it is important to remember certain points that you need to remember.

Exemptions from withholding

Non-resident aliens must submit Form 1040–NR at least once per calendar year. If you satisfy these requirements, you may be able to claim exemptions from the withholding forms. This page you will discover the exemptions that you can avail.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The document is required to report federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. When filling out the form, ensure that you have provided the accurate details. If the information you provide is not supplied, one person may be treated.

The tax withholding rate for non-resident aliens is 30 percent. Tax burdens must not exceed 30% in order to be exempt from withholding. There are many exemptions. Some of them are intended for spouses, whereas others are designed for use by dependents like children.

The majority of the time, a refund is available for chapter 4 withholding. Refunds can be made in accordance with Sections 1400 through 1474. The agent who withholds the tax, or the person who collects the tax at source, is the one responsible for distributing these refunds.

Status of relationships

A form for a marital withholding is a good way to simplify your life and help your spouse. You’ll also be surprised by how much money you could put in the bank. The challenge is in deciding which one of the many options to pick. There are certain aspects to avoid. Making the wrong choice could cost you dearly. If you stick to it and pay attention to directions, you shouldn’t have any issues. It is possible to make new friends if you are lucky. After all, today marks the anniversary of your wedding. I’m sure you’ll use it against them to locate that perfect engagement ring. To do it right you’ll require the aid of a qualified accountant. It’s worth it to build wealth over the course of a lifetime. Information on the internet is readily available. TaxSlayer is one of the most trusted and reputable tax preparation firms.

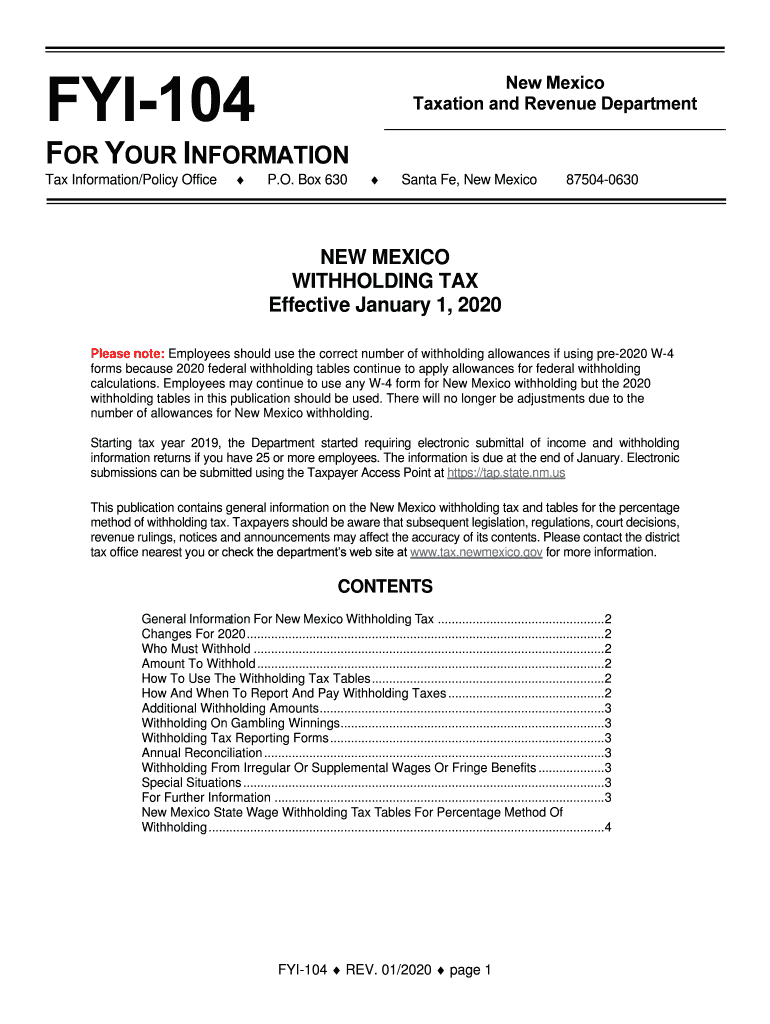

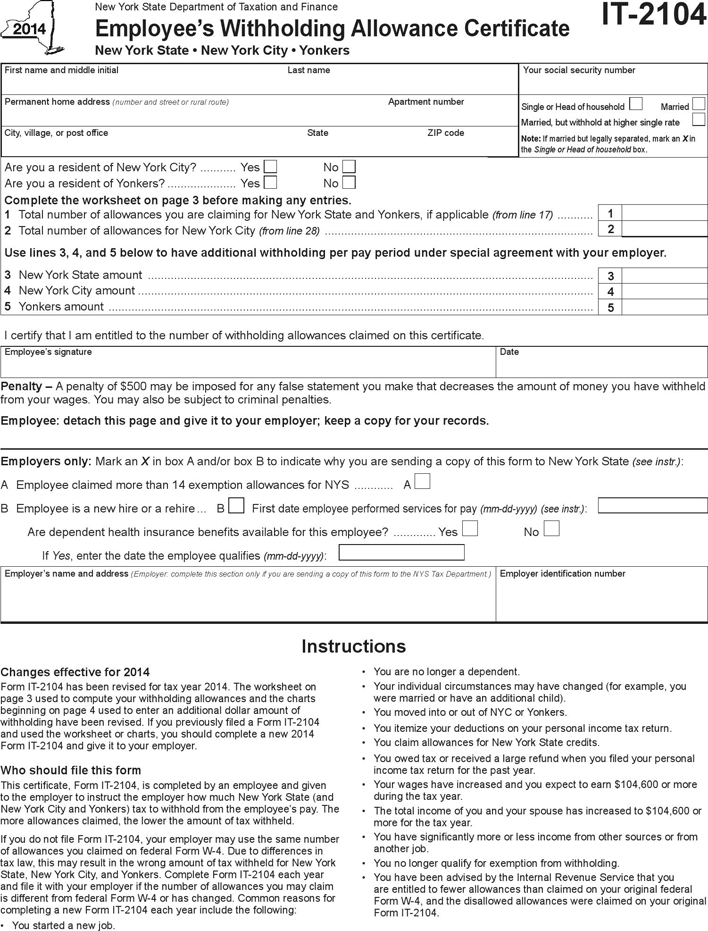

In the amount of withholding allowances that are claimed

The W-4 form must be filled out with the number of withholding allowances that you would like to be able to claim. This is important because your pay will be affected by the amount of tax that you pay.

There are a variety of factors that can affect the amount you are eligible for allowances. Your income can determine the amount of allowances available to you. If you make a lot of money, you might be eligible for a larger allowance.

You could save thousands of dollars by choosing the correct amount of tax deductions. In fact, if you file your annual income tax return, you might even receive a refund. It is important to be cautious regarding how you go about this.

As with any financial decision, it is important that you should do your homework. Calculators will help you determine how many withholding amounts should be demanded. An alternative is to speak to a professional.

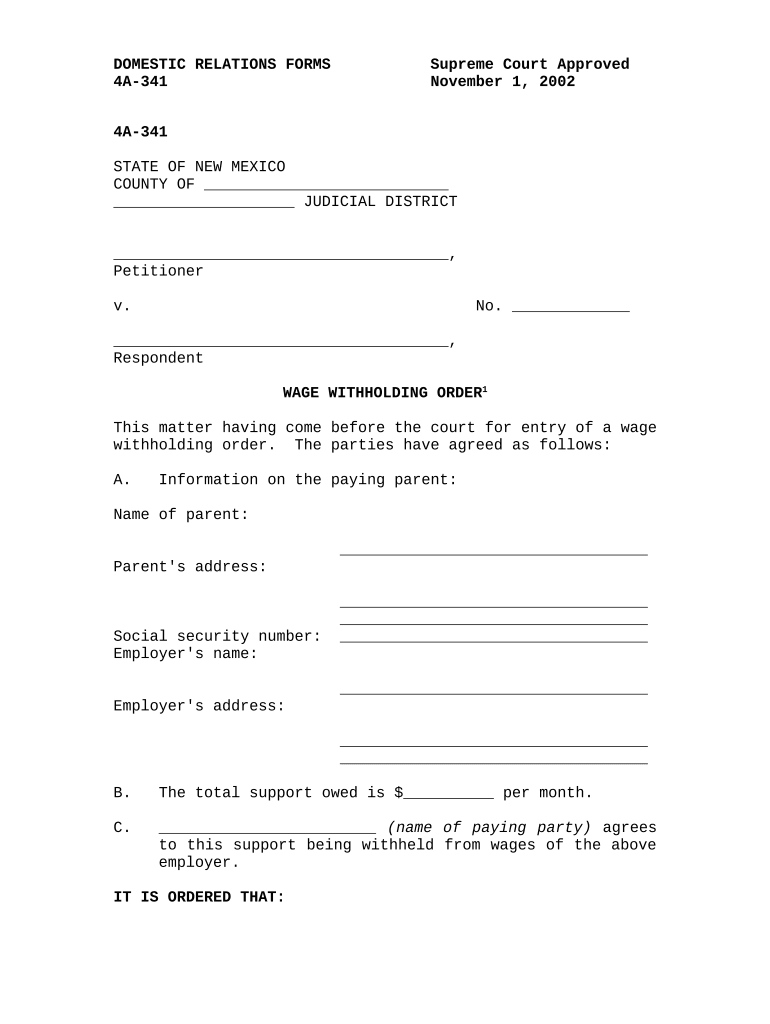

Specifications for filing

Employers are required to report the company who withholds tax from employees. For a limited number of the taxes, you are able to send paperwork to IRS. A tax return that is annually filed, quarterly tax returns or the reconciliation of withholding tax are all examples of paperwork you might require. Here’s some information about the different forms of withholding tax categories and the deadlines for filling them out.

Withholding tax returns may be required to prove income such as salary, bonuses and commissions, as well as other income. It is also possible to get reimbursements for tax withholding if your employees were paid on time. It is important to note that some of these taxes may be taxation by county is important. Additionally, there are unique withholding practices that can be implemented in specific circumstances.

You must electronically submit withholding forms according to IRS regulations. The Federal Employer Identification Number should be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.