New Mexico State Tax Withholding Form 2024 – There are a variety of reasons why a person may decide to submit an application for withholding. Withholding exemptions, documentation requirements and the amount of allowances for withholding requested are all factors. Whatever the reason one chooses to submit a form, there are a few things to keep in mind.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR at least once per year. It is possible to submit an exemption form for withholding, when you meet the conditions. The exclusions are that you can access on this page.

For submitting Form 1040-NR attach Form 1042-S. The document is required to declare the federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. It is essential to fill in the correct information when filling out the form. You may have to treat a single individual if you do not provide the correct information.

Nonresident aliens pay 30 percent withholding tax. If your tax burden is less than 30 percent of your withholding, you may be eligible to receive an exemption from withholding. There are a variety of exclusions. Some of these exclusions are only for spouses or dependents like children.

You may be entitled to refunds if you have violated the rules of chapter 4. Refunds can be made in accordance with Sections 471 to 474. Refunds are given by the agent who withholds tax. This is the person responsible for withholding the tax at the source.

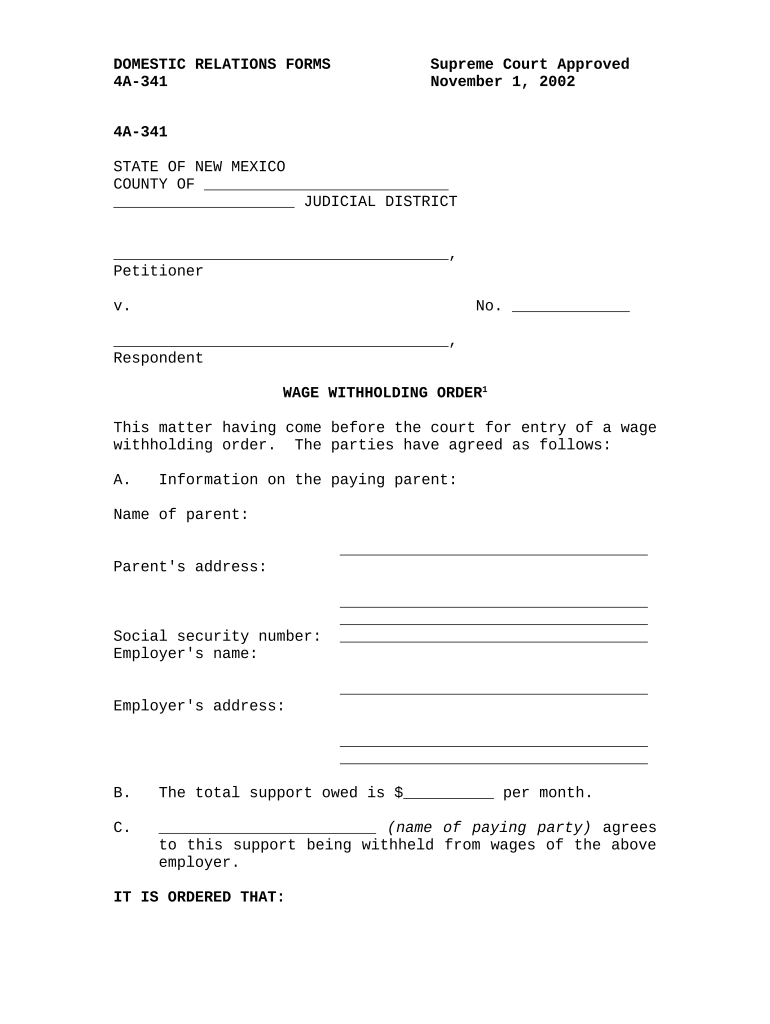

Relational status

A valid marital status and withholding forms will ease the work of you and your spouse. In addition, the amount of money that you can deposit in the bank will pleasantly surprise you. The problem is picking the right bank among the numerous possibilities. There are certain things you should avoid doing. Unwise decisions could lead to costly negative consequences. However, if the instructions are followed and you pay attention, you should not have any problems. If you’re lucky, you might even meet new friends while traveling. Today is the anniversary day of your wedding. I’m hoping that you can utilize it in order to find the sought-after diamond. To do this properly, you’ll require guidance of a certified Tax Expert. The small amount is well enough for a life-long wealth. You can get a lot of information on the internet. TaxSlayer is a trusted tax preparation company.

The number of withholding allowances claimed

It is essential to state the amount of withholding allowances which you would like to claim on the W-4 form. This is critical because your pay will be affected by the amount of tax that you pay.

Many factors influence the amount you qualify for allowances. The amount you earn can impact how many allowances are offered to you. If you make a lot of income, you may be eligible for a larger allowance.

A tax deduction that is suitable for you can allow you to avoid tax bills. If you file your annual income tax returns and you are entitled to a refund. It is essential to pick the right method.

Do your research, like you would with any other financial decision. Calculators are useful to figure out the amount of withholding allowances that need to be made. It is also possible to speak with a specialist.

Formulating specifications

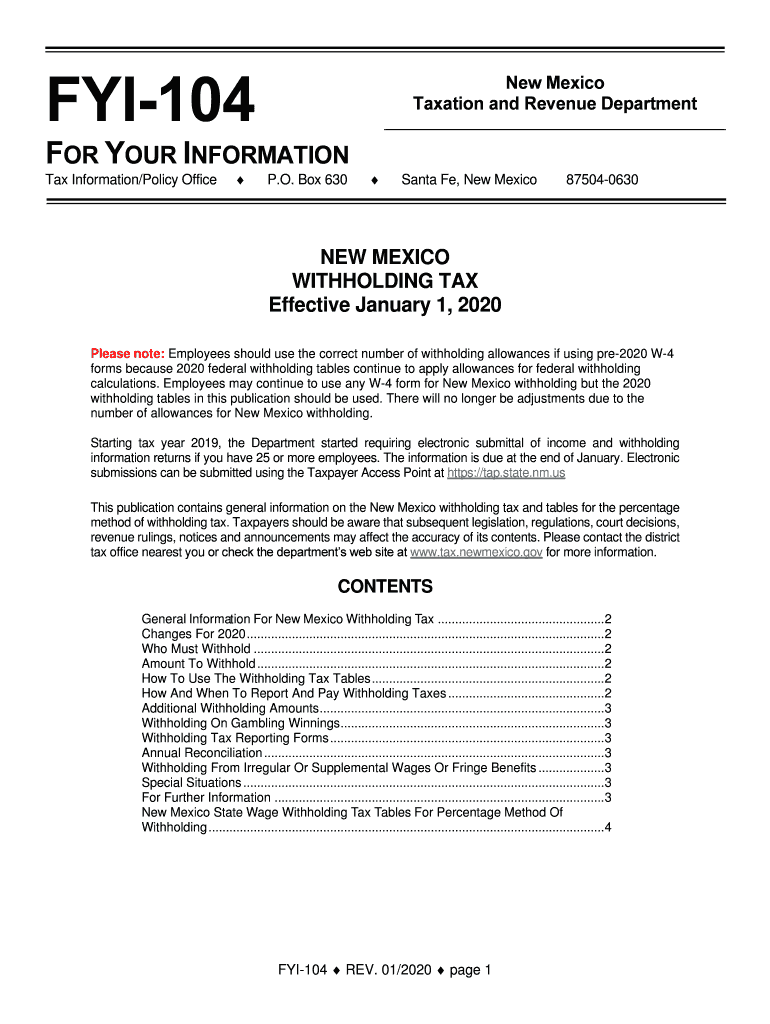

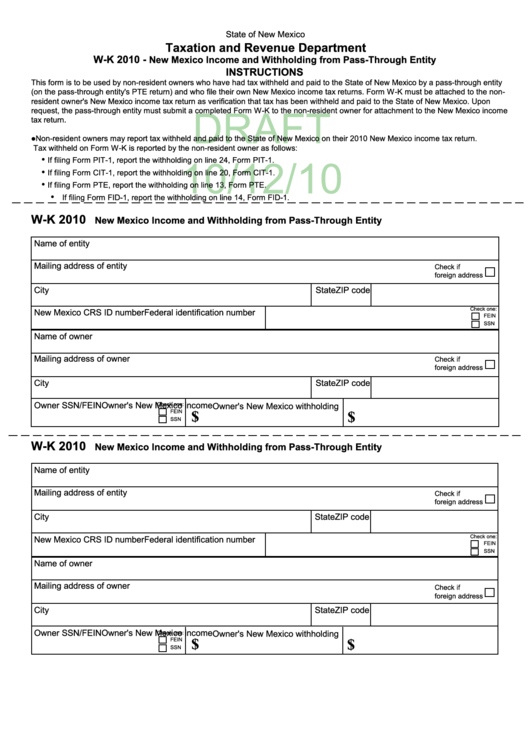

Employers are required to report any withholding taxes being taken from employees. Some of these taxes can be reported to the IRS through the submission of paperwork. There are other forms you might need for example, the quarterly tax return or withholding reconciliation. Here’s some information about the different tax forms, and when they need to be filed.

The compensation, bonuses, commissions, and other earnings you earn from employees might require you to file tax returns withholding. If you paid your employees on time, you could be eligible for reimbursement of taxes that were withheld. The fact that some of these taxes are also county taxes ought to be considered. Additionally, you can find specific withholding procedures that can be used in specific circumstances.

According to IRS regulations the IRS regulations, electronic filing of forms for withholding are required. It is mandatory to provide your Federal Employer ID Number when you point your national income tax return. If you don’t, you risk facing consequences.