New Jersey Withholding Form – There are a variety of reasons why one could fill out the form to request withholding. These factors include documentation requirements and withholding exemptions. It is important to be aware of these aspects regardless of your reason for choosing to fill out a form.

Exemptions from withholding

Nonresident aliens are required once each year to fill out Form1040-NR. If you satisfy these requirements, you may be eligible to receive an exemption from the withholding forms. On this page, you will discover the exemptions that you can avail.

The first step to submit Form 1040 – NR is to attach Form 1042 S. The document lists the amount withheld by the withholding agencies for federal income tax reporting for tax reporting purposes. It is essential to fill in the correct information when filling out the form. You could be required to treat a single person for not providing the correct information.

Non-resident aliens are subject to a 30% withholding tax. An exemption from withholding may be possible if you’ve got a an income tax burden of less than 30%. There are several different exclusions offered. Some of them are intended to be used by spouses, while some are meant for use by dependents, such as children.

In general, chapter 4 withholding entitles you to a refund. Refunds can be granted under Sections 471 through 474. The person who is the withholding agent, or the individual who is responsible for withholding the tax at source, is responsible for the refunds.

Relational status

Your and your spouse’s job is made simpler by the proper marriage status withholding form. You will be pleasantly surprised by the amount of money you can transfer to the bank. It can be difficult to choose which of the many options you’ll pick. There are some things you must avoid. It can be costly to make the wrong decision. But if you adhere to the guidelines and watch out for any pitfalls You won’t face any issues. If you’re fortunate, you might even make some new friends on your travels. Today is the anniversary. I’m hoping you’ll be able to apply it against them in order to get that elusive diamond. It’s a complex job that requires the knowledge of a tax professional. A small amount of money can make a lifetime of wealth. You can find tons of details online. TaxSlayer is a trusted tax preparation company.

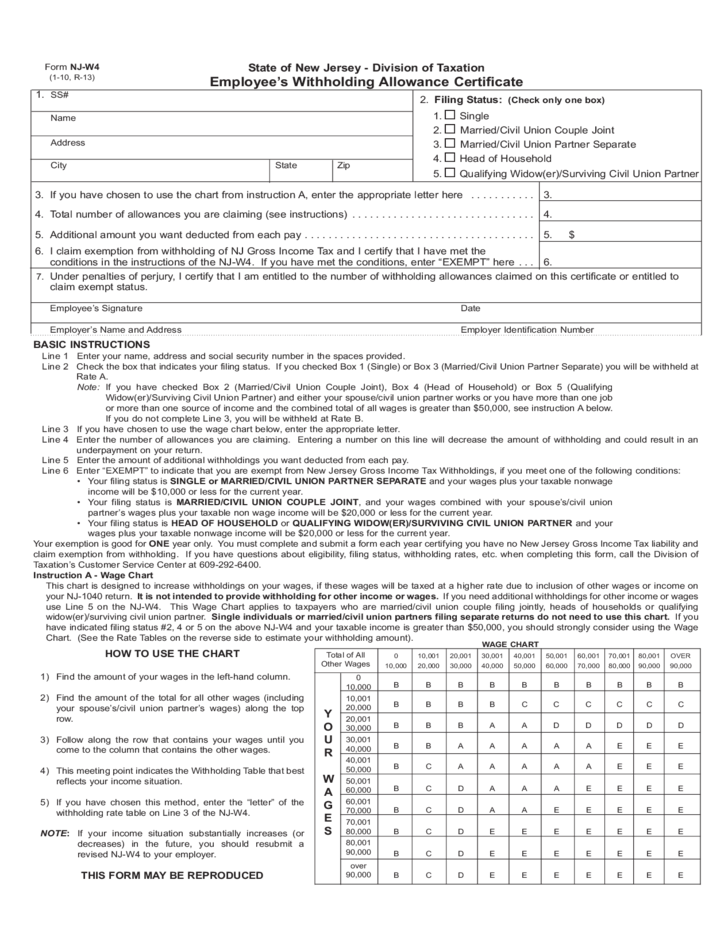

Amount of withholding allowances claimed

On the Form W-4 that you submit, you must declare how many withholding allowances are you seeking. This is crucial since the withholdings will have an impact on how much tax is taken out of your paychecks.

A variety of factors influence the amount of allowances requested.If you’re married, as an example, you may be eligible to claim a head of household exemption. Your income level can also affect the number of allowances accessible to you. If you have a higher income it could be possible to receive higher amounts.

A proper amount of tax deductions will save you from a large tax bill. Even better, you might even get a refund if your annual income tax return has been completed. Be sure to select your method carefully.

Just like with any financial decision, it is important to do your homework. Calculators are a great tool to figure out how many withholding allowances are required to be claimed. Alternative options include speaking with an expert.

Filing specifications

Withholding taxes on your employees must be collected and reported in the event that you are an employer. Some of these taxes may be reported to the IRS by submitting forms. There are other forms you might need for example, a quarterly tax return or withholding reconciliation. Here’s some details on the various withholding tax form categories and the deadlines for filing them.

It is possible that you will need to file tax returns withholding for the income you receive from your employees, including bonuses, commissions, or salary. You could also be eligible to receive reimbursement of taxes withheld if you’re employees received their wages on time. It is important to keep in mind that some of these taxes are local taxes. In certain situations there are rules regarding withholding that can be different.

According to IRS regulations the IRS regulations, electronic filing of forms for withholding are required. Your Federal Employer Identification Number needs to be listed when you submit your tax return for national revenue. If you don’t, you risk facing consequences.