New Hire Withholding Form – There are a variety of reasons why someone could complete the form to request withholding. This includes the need for documentation, exemptions to withholding, as well as the amount of the required withholding allowances. There are certain important things to keep in mind regardless of why a person files the form.

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR at a minimum every year. If you meet these requirements, you could be eligible for an exemption from the withholding form. The exemptions listed here are yours.

The first step to submitting Form 1040 – NR is attaching Form 1042 S. This form lists the amount withheld by the tax authorities to report federal income tax to be used for reporting purposes. When filling out the form ensure that you have provided the accurate details. You could be required to treat a specific person for not providing this information.

Non-resident aliens are subjected to 30 percent withholding. A nonresident alien may be qualified for exemption. This is when your tax burden is less than 30%. There are many exemptions. Some of these exclusions are only available to spouses or dependents, such as children.

You are entitled to refunds if you have violated the terms of chapter 4. Refunds can be granted according to Sections 471 through 474. These refunds are provided by the withholding agent (the person who is responsible for withholding tax at the source).

Relational status

The marital withholding form is a good way to make your life easier and help your spouse. It will also surprise you how much you can deposit at the bank. The challenge is in deciding which of the numerous options to choose. You should be careful what you do. It’s costly to make the wrong choice. If the rules are followed and you pay attention you shouldn’t face any problems. If you’re lucky enough, you could even meet new friends while traveling. Today is the day you celebrate your marriage. I’m hoping you’ll be able to utilize it in order to find the sought-after diamond. It’s a complex job that requires the knowledge of an expert in taxation. The small amount of money you pay is enough to last the life of your wealth. You can find tons of details online. TaxSlayer is a well-known tax preparation firm is among the most useful.

The amount of withholding allowances that are claimed

It is crucial to indicate the amount of withholding allowances which you wish to claim on the form W-4. This is crucial since the withholdings can have an effect on the amount of tax is deducted from your paychecks.

The amount of allowances that you are entitled to will be determined by the various aspects. For example when you’re married, you may be entitled to an exemption for your household or head. The amount you earn will affect the amount of allowances you are eligible for. You can apply for more allowances if make a lot of money.

The proper amount of tax deductions will aid you in avoiding a substantial tax cost. Refunds could be possible if you file your tax return on income for the year. However, you must choose your approach carefully.

Research as you would in any other financial decision. Calculators are readily available to aid you in determining the amount of withholding allowances are required to be claimed. You can also speak to an expert.

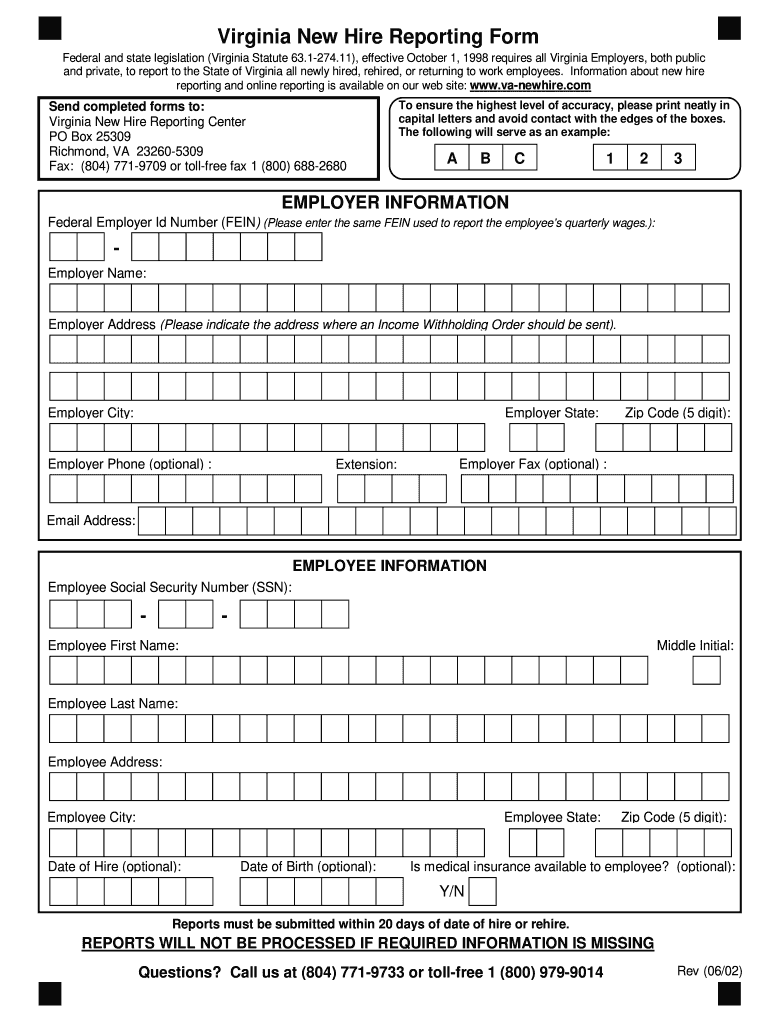

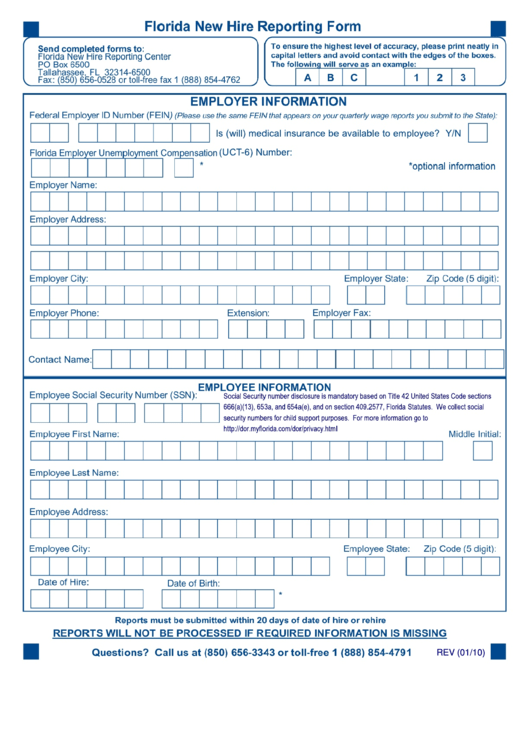

Sending specifications

Employers must inform the IRS of any withholding taxes being paid by employees. For certain taxes, you may submit paperwork to the IRS. There are other forms you might need for example, the quarterly tax return or withholding reconciliation. Here are the details on different withholding tax forms and the deadlines for each.

Tax returns withholding may be required for income like bonuses, salary or commissions as well as other earnings. If you make sure that your employees are paid on time, you could be eligible for reimbursement of any withheld taxes. Be aware that these taxes may also be considered local taxes. There are certain tax withholding strategies that could be suitable in certain circumstances.

According to IRS rules, you have to electronically submit forms for withholding. It is mandatory to include your Federal Employer ID Number when you file to your tax return for national income. If you don’t, you risk facing consequences.