Nebraska Quarterly Withholding Form – There are numerous reasons that a person might decide to file a withholding application. This includes documentation requirements as well as exemptions from withholding, as well as the amount of requested withholding allowances. Whatever the reason behind a person to file documents there are certain aspects to keep in mind.

Withholding exemptions

Nonresident aliens are required at least once a year to submit Form1040-NR. However, if your requirements are met, you could be eligible to request an exemption from withholding. This page will provide all exclusions.

For submitting Form 1040-NR include Form 1042-S. For federal income tax reporting reasons, this form outlines the withholding process of the withholding agency. Be sure to enter the right information when filling out this form. If the information you provide is not provided, one individual could be taken into custody.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. An exemption from withholding may be available if you have a tax burden that is lower than 30 percent. There are a variety of exclusions. Certain are only for spouses and dependents, such as children.

In general, withholding under Chapter 4 entitles you for an amount of money back. Refunds can be granted in accordance with Sections 471 to 474. The person who is the withholding agent or the person who is responsible for withholding the tax at source, is the one responsible for distributing these refunds.

relational status

Your and your spouse’s job will be made easy with a valid marital status withholding form. The bank could be shocked by the amount of money you’ve deposited. The challenge is choosing the right option from the multitude of possibilities. There are some things you shouldn’t do. A bad decision could cause you to pay a steep price. If you stick to the directions and adhere to them, there won’t be any problems. If you’re lucky you could even meet acquaintances while traveling. Today is your birthday. I’m sure you’ll be able to use this against them in order to acquire that wedding ring you’ve been looking for. It will be a complicated task that requires the expertise of an expert in taxation. A lifetime of wealth is worth the modest payment. There are a myriad of websites that offer details. TaxSlayer is a trusted tax preparation company, is one of the most useful.

The number of withholding allowances that were requested

It is crucial to indicate the amount of the withholding allowance you wish to claim on the form W-4. This is important because it affects how much tax you receive from your pay checks.

There are a variety of factors that influence the amount of allowances you can claim. If you’re married you may be qualified for an exemption for head of household. Your income will affect the amount of allowances you are entitled to. You may be eligible for a greater allowance if you make a lot of money.

Choosing the proper amount of tax deductions can allow you to avoid a significant tax payment. If you submit your annual income tax returns, you may even be entitled to a refund. Be sure to select the right method.

Like any financial decision, you should do your homework. Calculators can be used to figure out how many allowances for withholding need to be claimed. A specialist could be a good option.

Submitting specifications

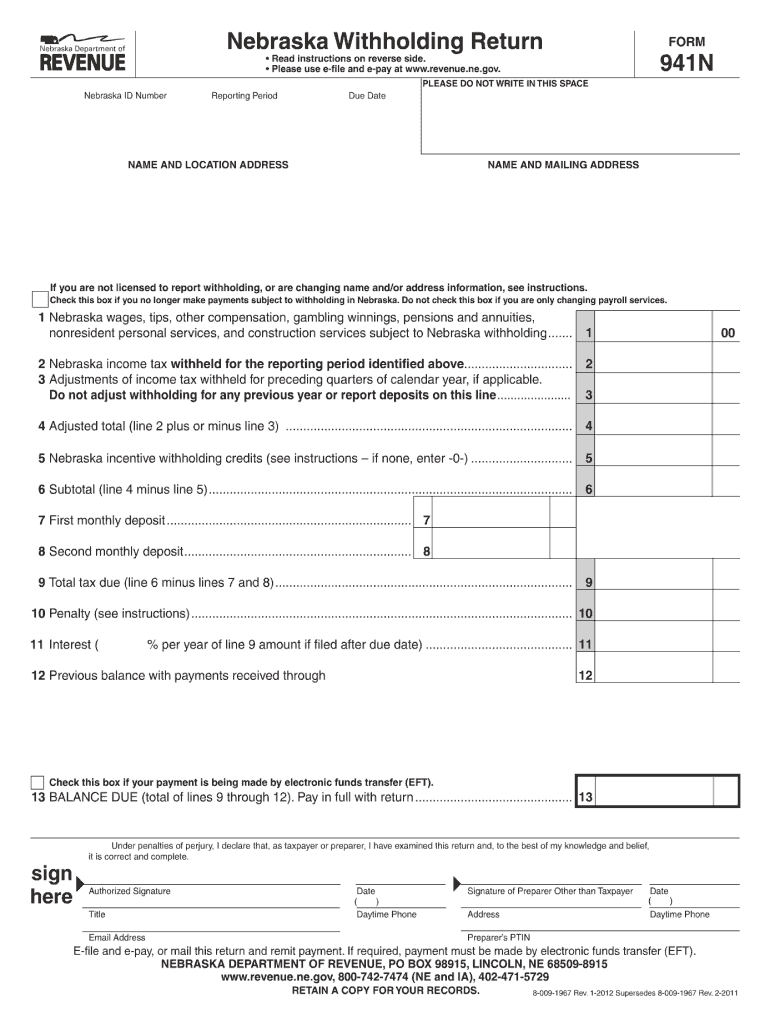

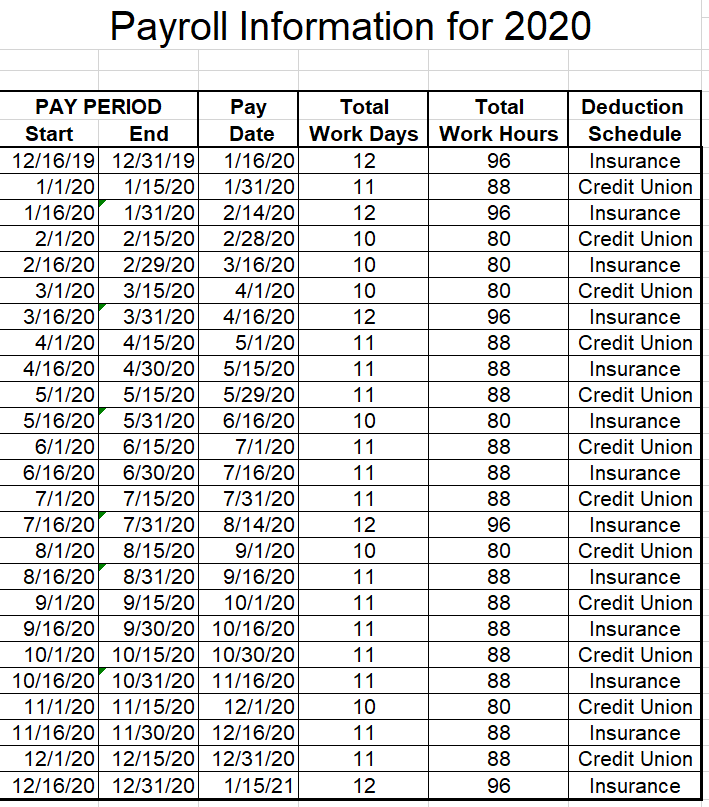

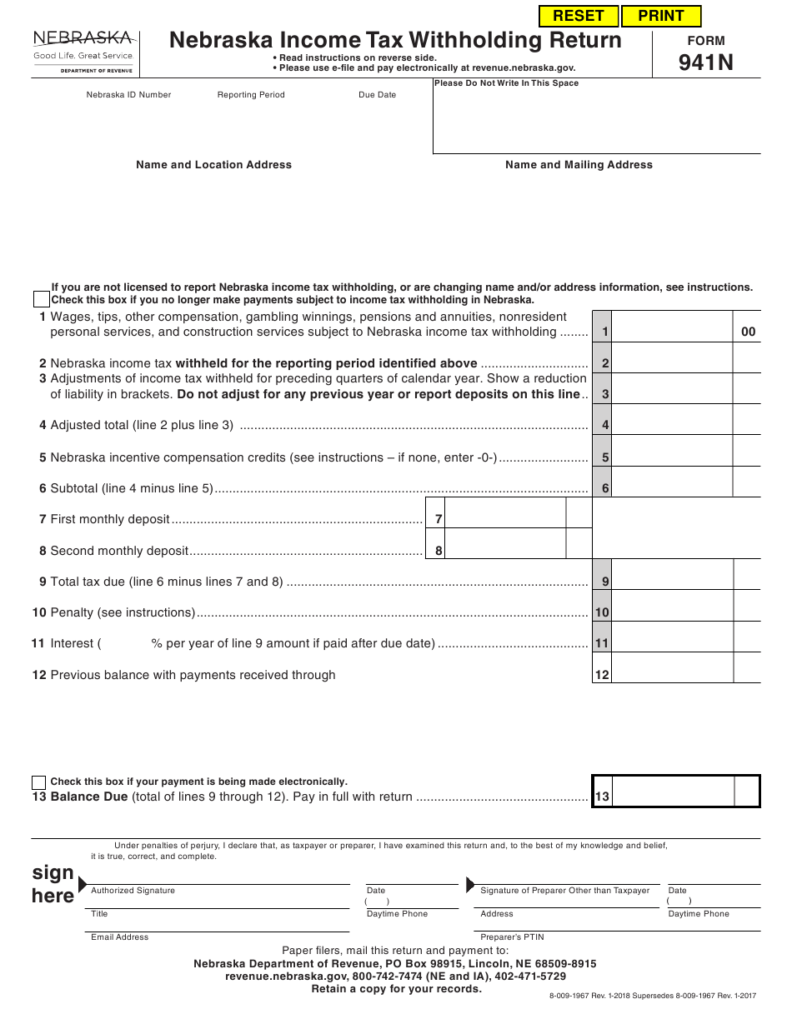

If you are an employer, you have to collect and report withholding taxes from your employees. For certain taxes you can submit paperwork to the IRS. You may also need additional forms that you might need for example, a quarterly tax return or withholding reconciliation. Here is more information on the different forms of withholding taxes and the deadlines to file them.

Tax withholding returns can be required to prove income such as salary, bonuses and commissions, as well as other income. If you pay your employees on time, you could be eligible for reimbursement of any withheld taxes. It is important to keep in mind that not all of these taxes are local taxes. Additionally, you can find specific withholding procedures that can be applied in particular situations.

The IRS regulations require that you electronically submit your withholding documentation. When you file your tax return for national revenue be sure to provide your Federal Employer Identification number. If you don’t, you risk facing consequences.

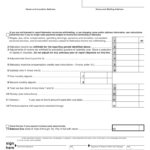

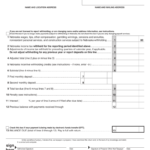

Gallery of Nebraska Quarterly Withholding Form

Nebraska Withholding Tax Registration Federal Withholding Tables 2021