Nc Tax Withholding Form Nra – There are many reasons that one could fill out the form to request withholding. This is due to the requirement for documentation, withholding exemptions and the amount of withholding allowances. It doesn’t matter what reasons someone is deciding to file a Form There are a few aspects to keep in mind.

Withholding exemptions

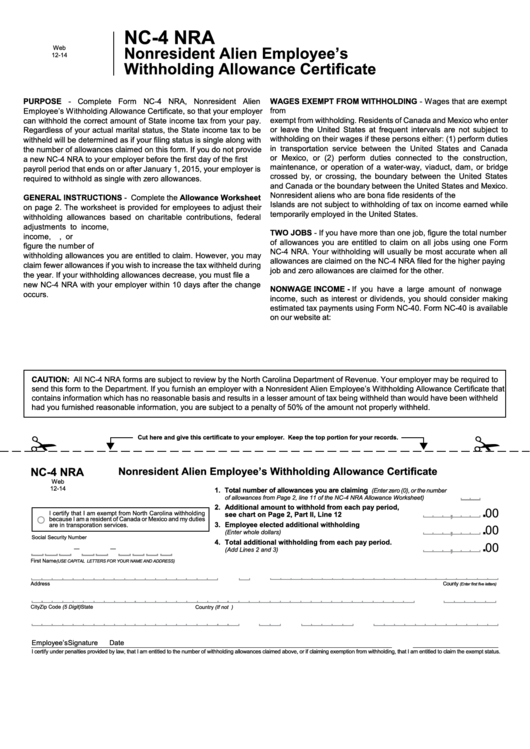

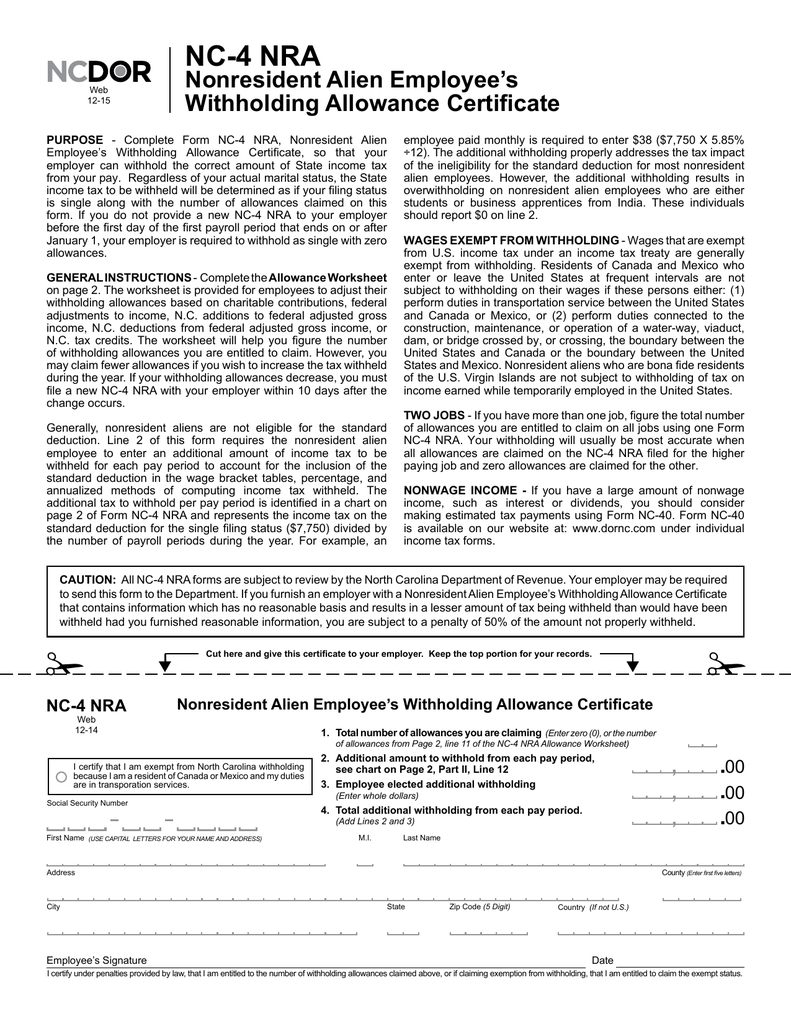

Nonresident aliens are required at least once a year to submit Form1040-NR. If the requirements are met, you may be eligible to request an exemption from withholding. This page will list all exemptions.

The first step for filling out Form 1040-NR is attaching Form 1042 S. To report federal income tax reasons, this form provides the withholding process of the agency responsible for withholding. When you fill out the form, make sure you fill in the accurate details. If the correct information isn’t supplied, one person may be diagnosed with a medical condition.

Nonresident aliens pay 30 percent withholding tax. If the tax you pay is less than 30% of your withholding, you may qualify to receive an exemption from withholding. There are many different exemptions. Certain exclusions are only applicable to spouses and dependents such as children.

Generally, withholding under Chapter 4 allows you to claim the right to a refund. Refunds can be made under Sections 1400 to 1474. The refunds are made by the tax withholding agents who is the person who withholds taxes at source.

Relational status

The work of your spouse and you can be made easier by the proper marriage status withholding form. You’ll be amazed by the amount you can deposit to the bank. The difficulty lies in picking the right bank among the numerous possibilities. Certain issues should be avoided. It’s costly to make a wrong decision. You won’t have any issues when you adhere to the instructions and be attentive. If you’re fortunate you may even meet some new friends when you travel. Today marks the anniversary of your wedding. I’m hoping that you can utilize it in order to get the elusive diamond. To complete the task correctly, you will need to obtain the assistance from a qualified tax professional. It’s worthwhile to accumulate wealth over the course of your life. Information on the internet is easily accessible. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

the number of claims for withholding allowances

The form W-4 should be filled out with the number of withholding allowances you wish to be able to claim. This is essential because the tax amount taken from your paycheck will be affected by the much you withhold.

You may be eligible to apply for an exemption on behalf of your head of household in the event that you are married. The amount you earn can affect the number of allowances accessible to you. If you have a higher income, you might be eligible to receive higher amounts.

Choosing the proper amount of tax deductions might help you avoid a hefty tax bill. Refunds could be feasible if you submit your tax return on income for the year. However, you must choose the right method.

Like any other financial decision, you should do your homework. Calculators can be utilized to determine the amount of withholding allowances that must be made. It is also possible to speak with a specialist.

Specifications that must be filed

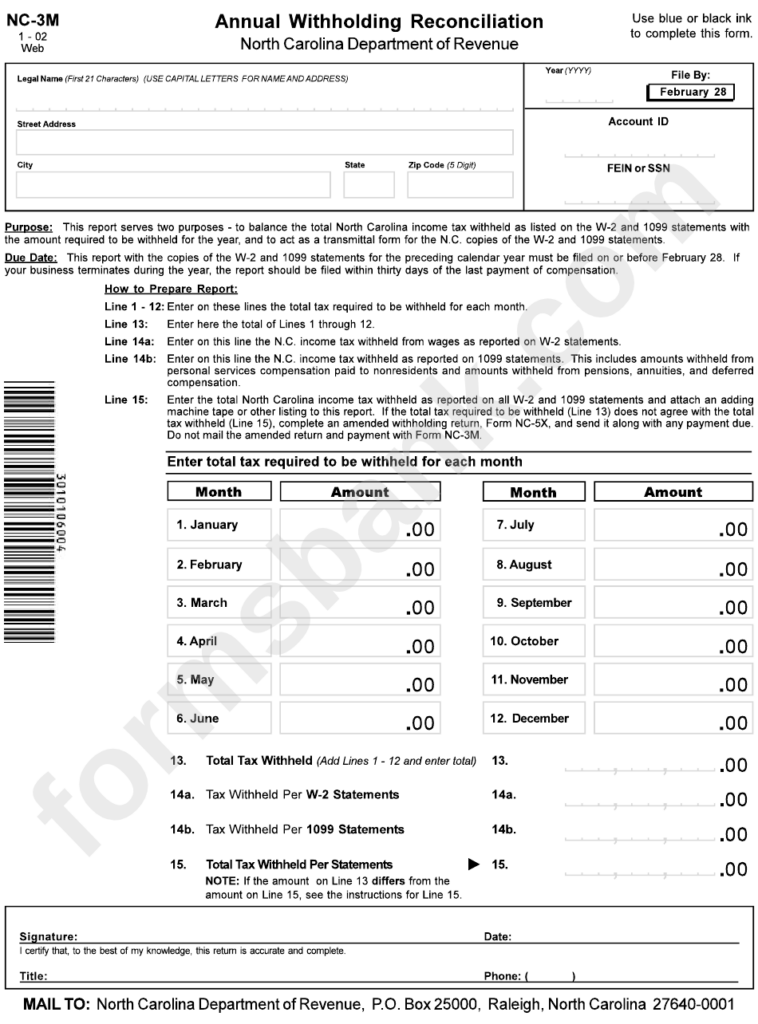

Withholding taxes on employees need to be collected and reported if you’re an employer. Some of these taxes can be filed with the IRS by submitting paperwork. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few examples of paperwork you might need. Here’s some details about the different tax forms and the time when they should be submitted.

Tax withholding returns can be required to prove income such as salary, bonuses or commissions as well as other earnings. If you also pay your employees on time, you might be eligible for reimbursement for any taxes withheld. It is important to note that some of these taxes could be considered to be taxes imposed by the county, is vital. In certain circumstances, withholding rules can also be unique.

Electronic submission of withholding forms is required under IRS regulations. The Federal Employer Identification Number needs to be listed when you submit to your national tax return. If you don’t, you risk facing consequences.