Ms Withholding Form – There are many reasons that one could fill out an application for withholding. The requirements for documentation, exemptions from withholding and the amount of the allowance requested are all factors. No matter the reasons someone is deciding to file an Application there are some aspects to keep in mind.

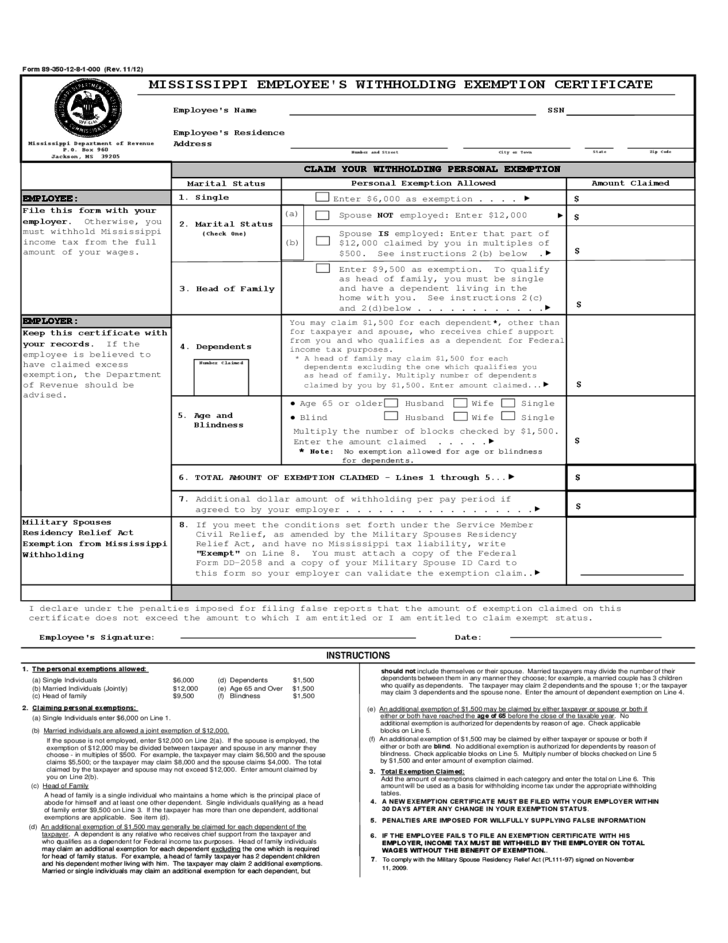

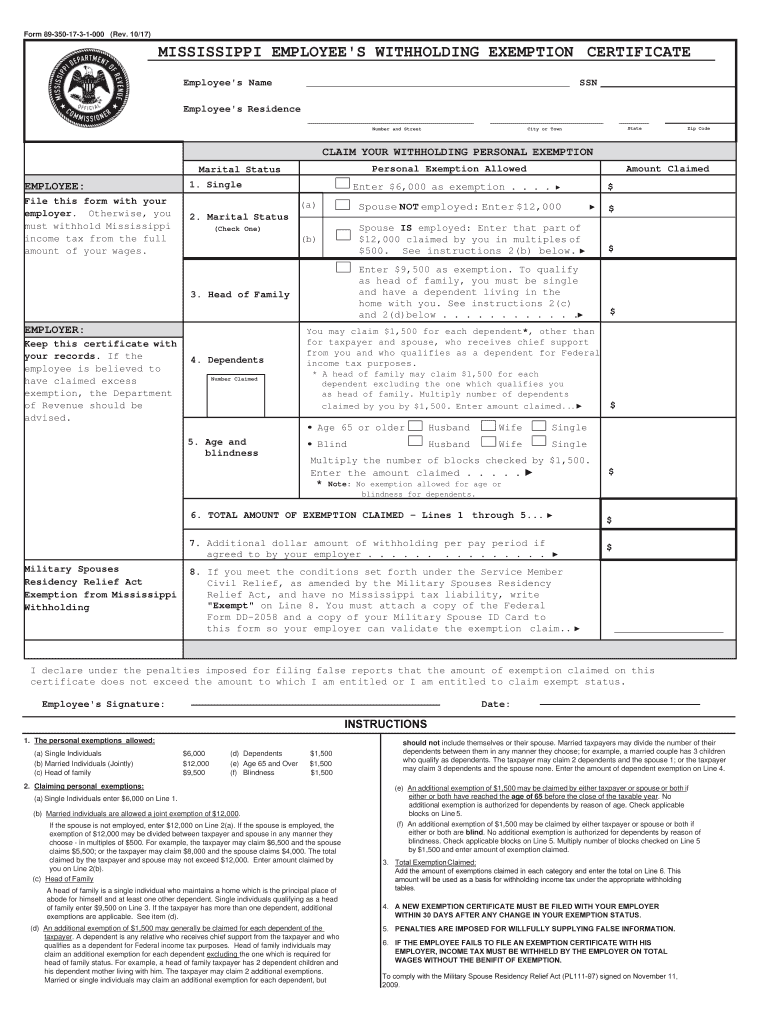

Exemptions from withholding

Non-resident aliens are required to file Form 1040–NR at least once per calendar year. If you fulfill the minimum requirements, you could be able to submit an exemption form from withholding. The exemptions you will find here are yours.

Attaching Form 1042-S is the first step to submit Form 1040-NR. This document is required to report federal income tax. It provides the details of the withholding of the withholding agent. When you fill out the form, make sure you fill in the accurate information. It is possible that you will have to treat one person for not providing this information.

Non-resident aliens have to pay 30 percent withholding. Your tax burden should not exceed 30% in order to be eligible for exemption from withholding. There are many different exemptions. Some are for spouses and dependents, such as children.

You are entitled to refunds if you have violated the provisions of chapter 4. In accordance with Section 1471 through 1474, refunds are given. The refunds are made by the agents who withhold taxes, which is the person who is responsible for withholding taxes at the source.

Relational status

An official marriage status withholding forms will assist you and your spouse get the most out of your time. Additionally, the quantity of money you can put at the bank can surprise you. It can be difficult to determine which one of the options most appealing. There are certain things that you should not do. A bad decision could cause you to pay a steep price. If you stick to the directions and watch out to any possible pitfalls and pitfalls, you’ll be fine. If you’re lucky, you could be able to make new friends during your trip. Today is your birthday. I’m hoping that they will turn it against you in order to assist you in getting that elusive engagement ring. You’ll need the help from a certified tax expert to ensure you’re doing it right. It’s worthwhile to create wealth over the course of your life. Fortunately, you can find many sources of information online. TaxSlayer is one of the most trusted and reputable tax preparation companies.

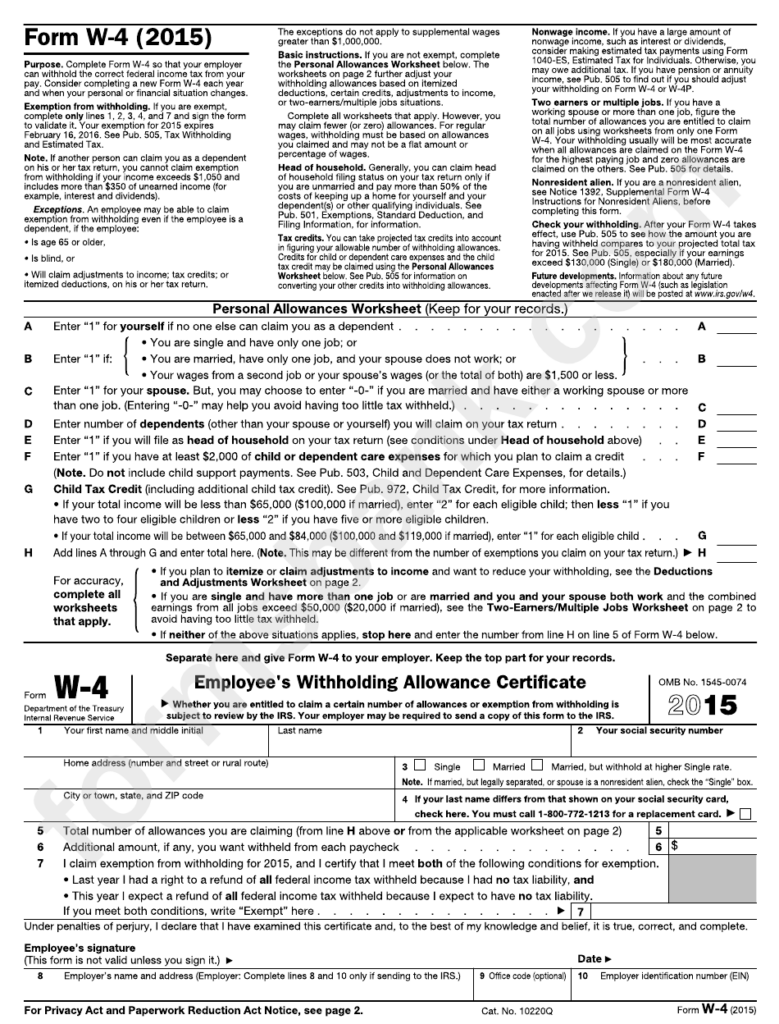

There are numerous withholding allowances that are being requested

In submitting Form W-4 you need to specify how many withholding allowances you want to claim. This is crucial as your paychecks may be affected by the amount of tax that you pay.

You could be eligible to request an exemption for your head of household in the event that you are married. Additionally, you can claim additional allowances depending on how much you earn. A higher allowance may be granted if you make an excessive amount.

A tax deduction that is appropriate for you could aid you in avoiding large tax obligations. You may even get a refund if you file the annual tax return. However, be cautious about your approach.

In any financial decision, you must be aware of the facts. Calculators can assist you in determining how many withholding amounts should be demanded. An alternative is to speak to a professional.

Filing specifications

If you’re an employer, you must pay and report withholding tax from your employees. You may submit documentation to the IRS to collect a portion of these taxes. An annual tax return, quarterly tax returns or withholding tax reconciliation are all examples of paperwork you might require. Here are some details regarding the various forms of tax forms for withholding along with the deadlines for filing.

In order to be eligible to receive reimbursement for withholding taxes on the compensation, bonuses, salary or any other earnings received from your employees You may be required to submit a tax return withholding. It is also possible to be reimbursed of taxes withheld if you’re employees received their wages in time. It is important to remember that certain taxes may be county taxes. There are special methods of withholding that are suitable in certain circumstances.

Electronic filing of withholding forms is required according to IRS regulations. Your Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.