Mn Tax Withholding Form – Most people may find themselves perplexed when it concerns filling in the Withholding Form, a important file that determines how much government revenue tax is subtracted from your incomes. Recognizing this form is essential, as it can significantly influence your net income in addition to your overall tax liability at year-end. By precisely finishing your withholding, you can avoid owing a large amount when taxes are due or paying way too much throughout the year, which could be much better utilized in your spending plan. Let’s walk you via every little thing you require to know about this crucial form. Mn Tax Withholding Form.

Types of Withholding Forms

Before you explore tax withholding, it is necessary to understand the different kinds of withholding forms you’ll come across. Each form serves a unique purpose, and recognizing which one applies to your situation can conserve you effort and time. Right here’s a quick introduction of the most common types:

- Federal Withholding Forms

- State Withholding Forms

- Other Relevant Forms

- Employer-Specific Forms

- Extra Withholding Options

This understanding will certainly aid you navigate your tax duties extra effectively.

| Type | Description |

|---|---|

| Federal Withholding Forms | Forms required by the IRS to deduct federal taxes from your paycheck. |

| State Withholding Forms | Forms necessary for your state tax obligations. |

| Other Relevant Forms | Additional forms related to specific withholdings, such as local taxes. |

| Employer-Specific Forms | Forms that vary depending on your employer’s requirements. |

| Additional Withholding Options | Choices you can make regarding extra deductions from your paycheck. |

Federal Withholding Forms

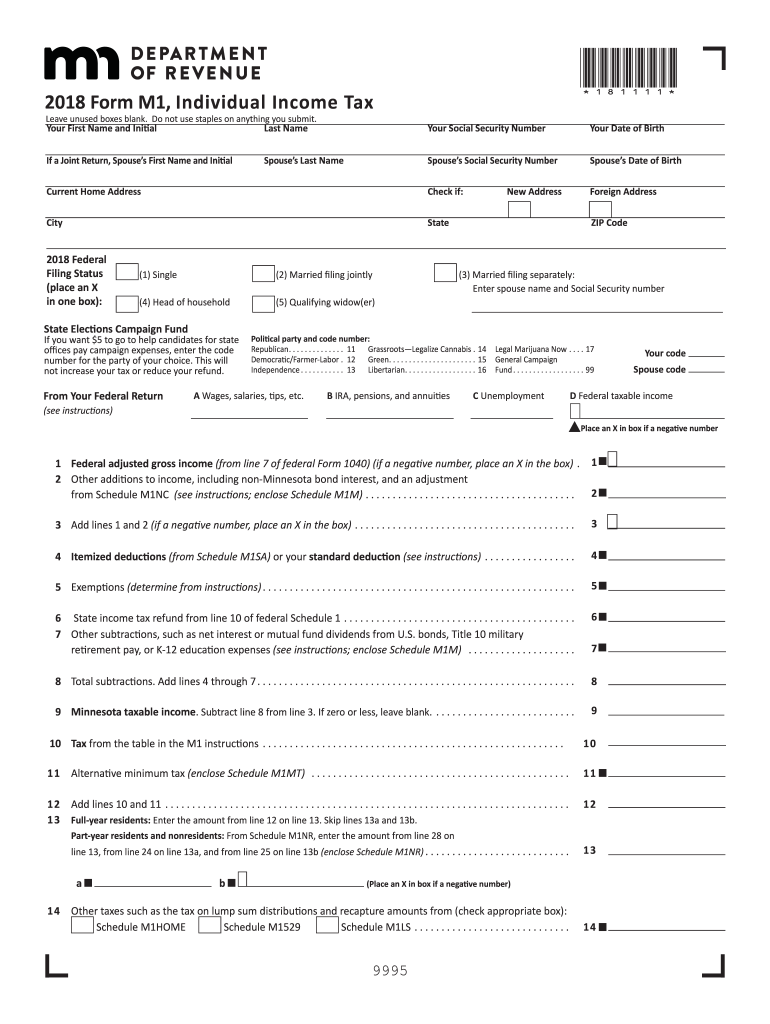

Forms for government withholding are primarily made to notify your employer just how much federal income tax to keep from your income. The most usual form is the W-4, which you submit upon beginning a job or when your monetary situation adjustments. It’s crucial to finish this form precisely to avoid under-withholding or over-withholding taxes.

State Withholding Forms

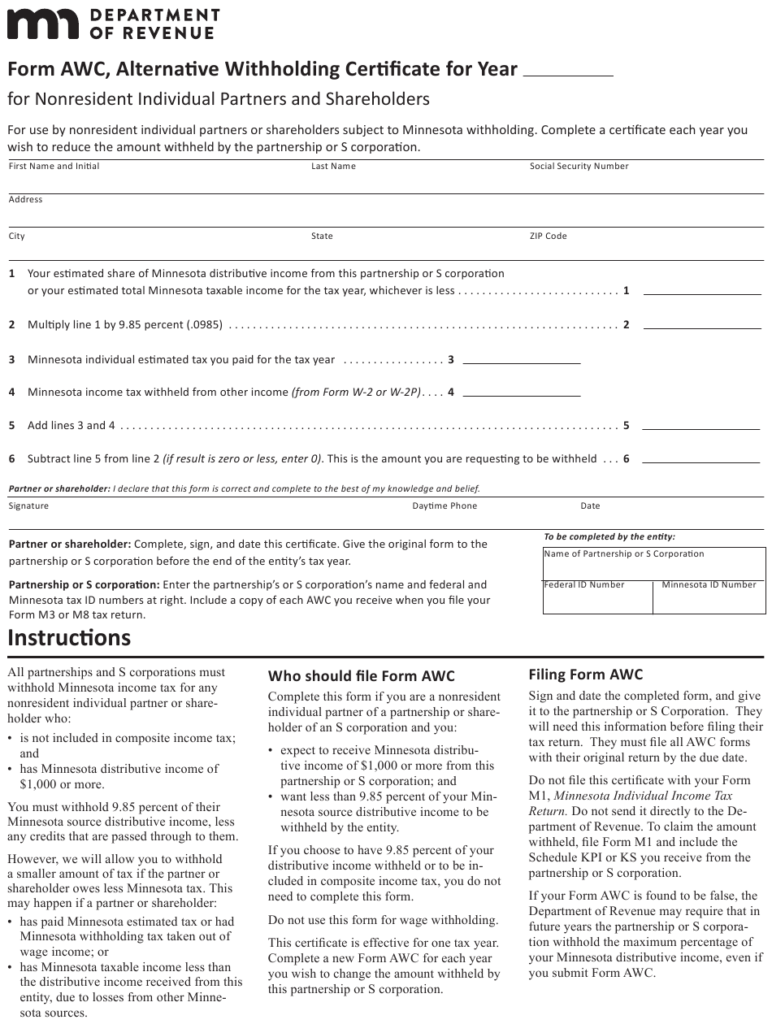

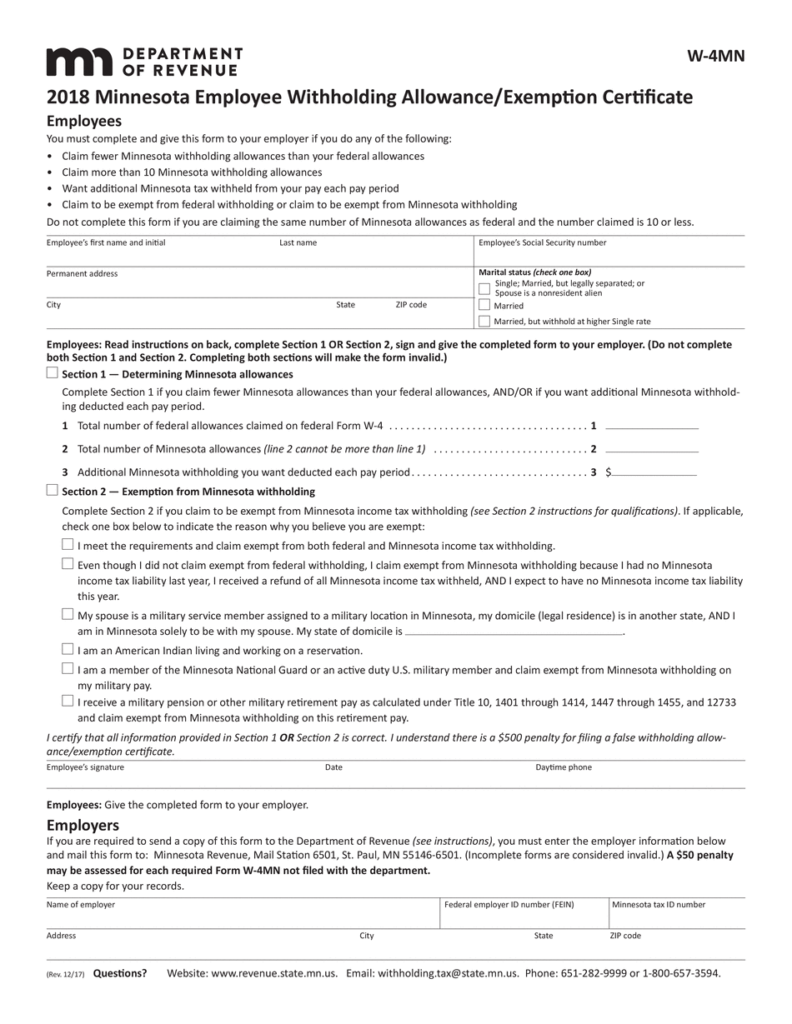

For state tax obligations, each state has its own set of withholding forms, often modeled after the government W-4. These forms specify the quantity of state tax to hold back from your paycheck. If you operate in numerous states or relocate states throughout the year, you require to readjust your withholdings accordingly to make sure conformity.

Plus, understanding your state’s details withholding needs can significantly influence your take-home income. Variants in state tax rates and deductions might need you to send the ideal forms to stay clear of charges. Falling short to do so can lead to unexpected tax responsibilities when you submit your annual returns.

Various Other Pertinent Forms

One of the often-overlooked facets of tax withholding is the existence of other appropriate forms that can affect your financial resources. These might consist of forms for neighborhood taxes or unique exceptions, as well as those for sure benefits. Each of these forms can play a crucial role in properly reflecting your tax situation.

With a detailed understanding of withholding forms, you can take control of your tax circumstance and guarantee that you are certified with your government and state obligations. This important knowledge will not just aid you stay clear of prospective fines yet also enhance your economic planning throughout the year.

Tips for Completing Withholding Forms

If you’re looking to ensure the precision of your tax withholding, there are numerous pointers you can adhere to when finishing your withholding forms. Here are some vital methods to remember:

- Understand Your Tax Scenario to make educated choices.

- Double-Check Info for mistakes or mistakes.

- Seek Expert Assist if you doubt concerning your forms.

Viewing the value of these steps can dramatically impact your tax obligations.

Comprehending Your Tax Circumstance

Forms are not one-size-fits-all. You require to review your tax circumstance to establish what withholding quantity will match your details requirements. Factors such as earnings level, marital status, and dependents all play a essential function in how much tax you ought to withhold. Knowing these aspects will certainly aid you fill out the suitable forms precisely.

Double-Checking Details

Also little mistakes can result in significant tax issues. When you complete your withholding forms, it’s critical to carefully assess all details you’ve gone into. Make sure that your Social Security number, address, and other individual information are appropriate. A minor mistake can cause hold-ups and potential fines.

Your diligence in double-checking can save you from future frustrations. Pay specific focus to access associated with your filing standing and the variety of allocations you assert, as these can heavily affect your tax concern. Fixing an mistake after submission can be a hassle, so it’s better to invest the time in advance to validate everything is precise.

Looking For Professional Help

Assistance is important if you’re feeling unsure about just how to finish your withholding forms. Consulting with a tax professional can give you with tailored recommendations and assistance navigate the ins and outs of tax regulations that refer to your personal circumstance.

One more advantage of seeking professional aid is their know-how can assist you in taking full advantage of deductions and debts, eventually decreasing your total tax obligation. They can also help in making sure that you are withholding the ideal quantity, preventing overpayment or underpayment, both of which can have serious economic effects. Involving with a professional might feel like an included expense, however the long-lasting cost savings can be significant.

Step-by-Step Overview to Submitting Withholding Forms

Unlike many other forms, submitting a withholding form precisely is vital for ensuring the right amount of tax obligations is held back from your paycheck. A mistake in this process might result in underpayment or overpayment of taxes, resulting in undesirable shocks come tax season. Here’s a simple step-by-step overview to assist you browse this essential task.

Steps to Fill In Withholding Forms

- Step 1: Gather Essential InformationCollect personal information such as your name, Social Security number, and declaring status.

- Action 2: Picking the Right FormDetermine which form you require based upon your employment situation and choices.

- Action 3: Finishing the Form AccuratelyFill in all relevant areas, guaranteeing that details is right and total.

- Tip 4: Submitting the FormAfter conclusion, send the form to your employer or the relevant tax authority.

Collect Necessary Details

There’s no need to hurry into filling out your withholding forms without the appropriate information. Before you start, collect all essential personal information, including your full name, Social Security number, address, and employment information. This information is important to make certain that your form is filled in appropriately and reflects your monetary circumstance properly.

Picking the Right Form

Guide your choice by recognizing the various kinds of withholding forms available, such as the W-4 for employees or the W-4P for pensioners. Your selection will depend upon your work kind and personal monetary scenario, consisting of factors like extra earnings and exceptions you might receive.

The appropriate form can dramatically impact your tax withholding amounts, so take your time to select carefully. If you are freelance or have multiple income sources, take into consideration seeking advice from a tax expert to determine which forms finest suit your requirements to prevent any type of possible tax liabilities.

Completing the Form Precisely

Now that you have all your details and have actually chosen the appropriate form, it’s time to load it out. Meticulously go into all required details, such as filing condition and exceptions. Any type of errors could result in inaccurate tax withholding, which could impact your monetary health throughout the year.

A comprehensive evaluation is very important before completing your form. Consider verifying all access for typographical errors or omissions. Bear in mind, each item of info, from your marriage status to your variety of dependents, plays a vital role in identifying how much tax is held back.

Submitting the Form

Little points can make a huge difference when it pertains to tax forms. When you’ve finished your withholding form, see to it to submit it to your company without delay. This guarantees that the proper withholding starts asap to stay clear of any kind of problems with your income.

Needed actions involve either handing your form straight to your HR division or submitting it digitally, depending upon your office’s policy. Make sure to maintain a duplicate for your records, and if you do not see adjustments in your incomes soon after submitting, follow up with your employer to ensure every little thing is on track.

Variables to Consider When Selecting Withholding Quantities

Currently, when it involves choosing your withholding amounts, there are numerous vital aspects to think about. Recognizing these can considerably affect your economic health and wellness throughout the tax year and beyond:

- Your personal monetary scenarios

- Adjustments in work status

- Prepared for tax credit scores and reductions

Personal Financial Situations

You need to review your individual economic circumstance extensively before deciding on your withholding amounts. Consider your existing revenue, expenditures, and any dependents you may have. This examination permits you to assess how much tax is reasonable to keep to prevent underpayment penalties or obtaining a big reimbursement.

Modifications in Work Status

Among one of the most significant adjustments that can influence your withholding amounts is your work standing. Whether you are starting a brand-new task, changing positions, or shedding a task entirely can have a direct effect on your income and, subsequently, your tax situation.

A change in work condition might imply a brand-new salary, adjustments in benefits, or added earnings sources, such as part-time job. As a result, you need to readjust your withholding to line up with your existing financial image. Ensure to re-evaluate your withholding if you find yourself in a new work with various pay structures, or if you take on freelance job that can complicate your tax scenario.

Anticipated Tax Credit Histories and Reductions

Amounts you expect to declare in tax credit histories and deductions can additionally affect your withholding choices. If you expect obtaining considerable credit scores, readjusting your withholding downwards might be practical.

Aspects such as changes in your life situations like marital relationship, having kids, or getting a home typically include potential tax credit scores or reductions. Maximizing these can result in considerable financial savings. Consequently, it is necessary to examine exactly how these aspects engage with your overall tax approach, as they might decrease your taxable income, further notifying your withholding amount. This deliberate monitoring of your tax obligations can aid you remain financially stable throughout the year.

Benefits and drawbacks of Various Withholding Strategies

Keep in mind that withholding strategies can significantly impact your financial scenario. Comprehending the pros and cons of each approach is vital for making educated choices regarding your tax commitments. Below is a break down of the benefits and downsides of both higher and reduced withholding strategies.

| Pros | Cons |

|---|---|

| Less risk of owing taxes at year-end | Less take-home pay throughout the year |

| Potential for a tax refund | Opportunity cost of not investing extra funds |

| Simplifies budgeting for your taxes | May result in an overpayment of taxes |

| Easier to save for large expenses | Could affect your cash flow |

| More manageable tax payments | Less flexibility in financial planning |

| Psychological comfort of having taxes pre-paid | May require adjustment of withholding if income changes |

| Fewer surprises at tax time | Potential to miss out on investment opportunities |

| Can help avoid underpayment penalties | May lead to lower immediate disposable income |

| More straightforward tax process | Less control over your money during the year |

Pros of Higher Withholding

On a higher withholding approach, you can enjoy the advantage of decreasing the danger of owing taxes at year-end. This strategy allows you to receive a potential tax reimbursement, offering a monetary cushion that can be beneficial in times of demand.

Cons of Higher Withholding

Greater withholding means you will have less net earnings throughout the year. This might restrict your ability to allot funds for daily costs and various other financial objectives.

It’s important to recognize that this constraint can result in cash flow issues, making it tougher to benefit from opportunities like investments or larger purchases. As a result, while you reduce the danger of tax bills, you may produce challenges somewhere else in your budgeting process.

Pros of Lower Withholding

Withholding much less from your income can boost your prompt capital, permitting you to spend or assign funds to various other priorities in your life. This method can give higher adaptability for managing your finances over the year.

A reduced withholding rate can equip you to enhance your investment potential and emergency financial savings, which can improve your long-lasting monetary health. Nevertheless, be cautious, as this method requires regimented budgeting to stay clear of overspending and tax liabilities later.

Disadvantages of Lower Withholding

Any type of approach that involves reduced withholding provides the danger of owing tax obligations at year-end. This can lead to sudden financial problems if you haven’t effectively prepared for your tax commitments.

Withholding less might cause unforeseen capital issues if your tax situation moves unexpectedly. Consequently, it’s essential to track your funds very closely and reevaluate your withholding at the very least every year to guarantee you’re planned for your tax obligations.

Summarizing

To finish up, comprehending the objective and relevance of the Withholding Form is important for managing your tax obligations efficiently. By properly completing this form, you can guarantee that the proper quantity of tax is kept from your revenue, which can assist avoid unanticipated tax bills or reimbursements at the end of the year. Constantly review your withholding status, especially after significant life adjustments, to maintain your monetary situation in check and prevent any type of shocks come tax period.

FAQ

- Q: What is a Withholding Form?

- A: A withholding form is a file made use of by employers to determine how much government income tax to withhold from an worker’s paycheck. One of the most common withholding form is the IRS Form W-4, which staff members submit when they start a brand-new work or when they require to adjust their withholding status. The details offered on this form, including declaring status and the variety of allowances declared, helps the employer determine the ideal total up to hold back for tax purposes.

- Q: How do I recognize if I require to send a brand-new Withholding Form?

- A: You ought to consider submitting a new withholding form if you experience changes in your economic situation that might affect your tax responsibility. This can include modifications like marital relationship, divorce, the birth of a child, or changes in your earnings. It’s likewise a good idea to upgrade your withholding if you find that you owe a considerable quantity throughout tax period or if you obtain a big tax reimbursement, as this shows that your withholding could be adjusted to better fit your tax circumstance for the list below year.

- Q: What occurs if I do not send a Withholding Form?

- A: If you do not submit a withholding form to your employer, they will fail to the IRS specifications for withholding. Usually, this suggests that the employer will withhold taxes as if you are a solitary filer with zero allowances. This might lead to greater tax obligations being taken from your income than necessary, bring about a smaller sized net income and possibly a larger reimbursement, but you may lose out on having more cash in your pocket throughout the year. It’s normally best to submit your withholding form to show your details economic scenario.

Gallery of Mn Tax Withholding Form

Tax File Declaration Form 2024 Nanci Valeria

Georgia Tax Withholding Form G 4 WithholdingForm

Mn Withholding Form 2024 Wynn Amelina