Missouri Withholding Reconciliation Form – There are numerous reasons that a person could choose to submit a withholding application. This includes documentation requirements and exemptions from withholding. There are a few things you should remember regardless of the reason the person fills out the form.

Exemptions from withholding

Nonresident aliens are required at least once a year to submit Form1040-NR. If you fulfill the minimum requirements, you could be eligible to submit an exemption from the withholding form. The exemptions listed on this page are yours.

The first step in submitting Form 1040 – NR is attaching Form 1042 S. The form contains information on the withholding done by the tax agency that handles withholding for federal income tax reporting for tax reporting purposes. It is important to enter correct information when you complete the form. If the correct information isn’t supplied, one person may be diagnosed with a medical condition.

The withholding rate for nonresident aliens is 30%. Nonresident aliens could be qualified for an exemption. This applies if your tax burden is lower than 30%. There are many exemptions. Some of them are intended for spouses, while others are intended for use by dependents like children.

Generally, you are eligible to receive a refund under chapter 4. Refunds are allowed according to Sections 1471-1474. The refunds are made by the tax agent. The withholding agent is the person who is responsible for withholding tax at the source.

Relationship status

An official marital status form withholding forms will assist both of you make the most of your time. The bank could be shocked by the amount that you have to deposit. It isn’t easy to decide which of many choices is most appealing. Certain aspects should be avoided. The wrong decision can cost you dearly. If you adhere to the directions and follow them, there shouldn’t be any issues. If you’re lucky you might be able to make new friends during your journey. Today is the anniversary of your wedding. I’m sure you’ll be able to use it against them to find that perfect wedding ring. You’ll want the assistance of a certified tax expert to complete it correctly. A little amount can create a lifetime of wealth. Online information is easily accessible. TaxSlayer, a reputable tax preparation firm is among the most helpful.

number of claimed withholding allowances

It is important to specify the number of withholding allowances to claim on the Form W-4 that you file. This is important because it affects the amount of tax you get from your pay checks.

A number of factors can affect the amount you are eligible for allowances. The amount you earn can determine the amount of allowances accessible to you. A larger allowance might be granted if you make an excessive amount.

You may be able to reduce the amount of your tax bill by deciding on the appropriate amount of tax deductions. In addition, you could even get a refund if your annual income tax return is filed. But you need to pick your strategy carefully.

Like any financial decision you make it is crucial to research the subject thoroughly. Calculators can be used to determine how many withholding allowances are required to be claimed. As an alternative, you may speak with an expert.

Formulating specifications

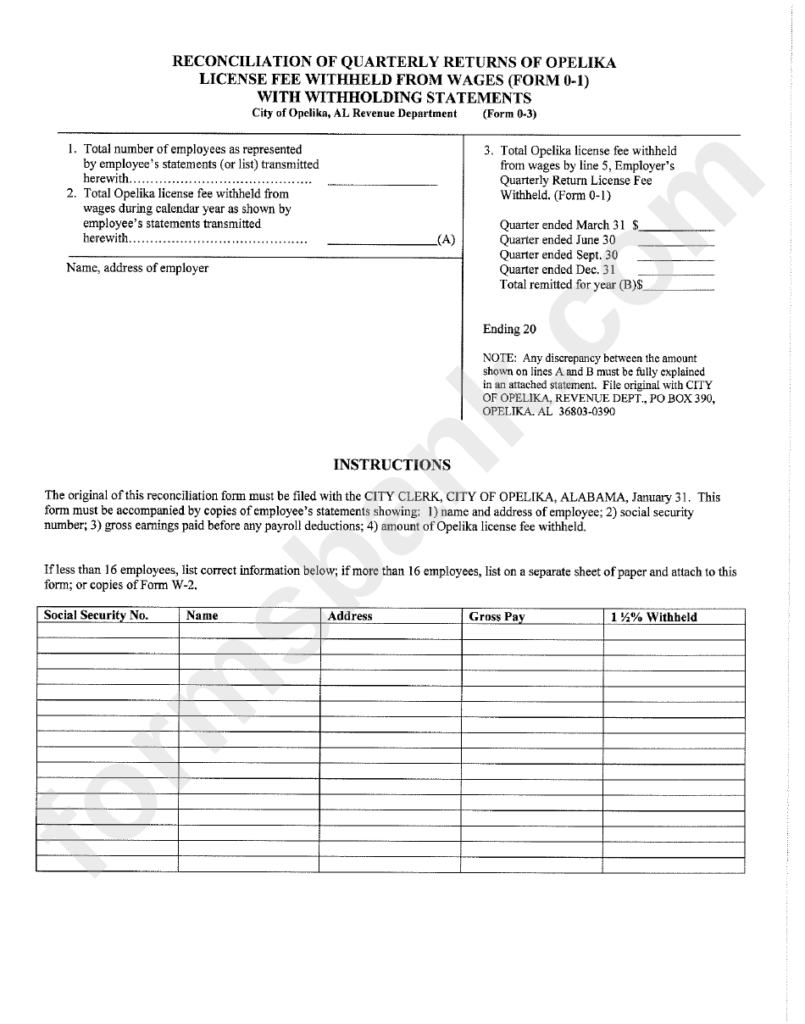

Employers are required to collect withholding taxes from their employees and then report the tax. If you are unable to collect the taxes, you are able to send paperwork to IRS. A withholding tax reconciliation or a quarterly tax return, as well as the annual tax return are examples of other paperwork you may be required to submit. Here’s some details on the various withholding tax form categories, as well as the deadlines to filing them.

To be eligible for reimbursement of withholding taxes on the pay, bonuses, commissions or any other earnings earned by your employees You may be required to submit a tax return withholding. If employees are paid on time, you may be eligible for the tax deductions you withheld. Remember that these taxes may be considered to be local taxes. There are certain methods of withholding that are applicable in specific situations.

In accordance with IRS regulations, you are required to electronically submit withholding forms. Your Federal Employer Identification Number needs to be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.