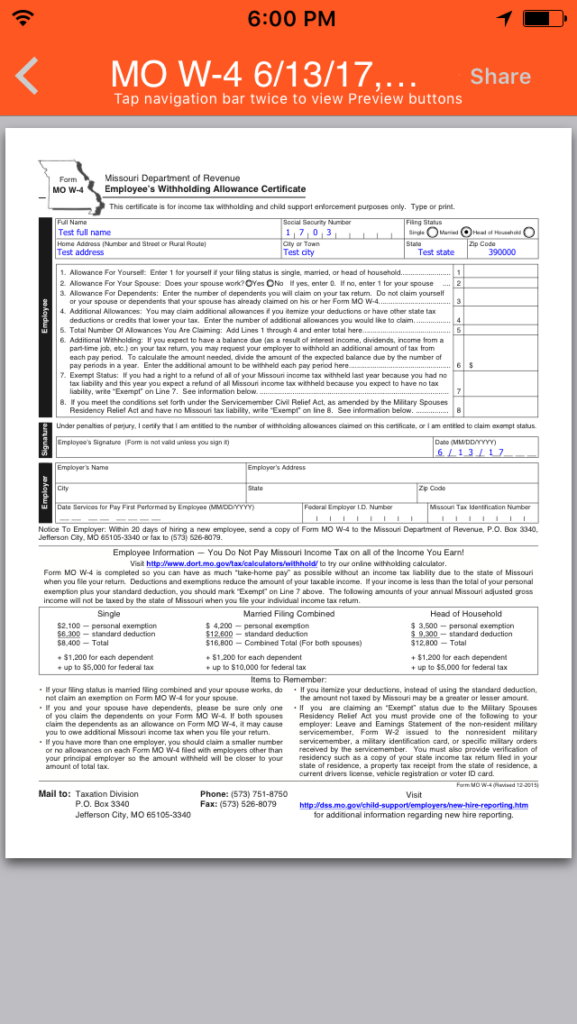

Missouri Withholding Form 2024 – There are numerous reasons that a person could choose to submit a withholding application. The requirements for documentation, exemptions from withholding and the amount of allowances for withholding requested are all factors. Whatever the reason a person chooses to file the form there are some points to be aware of.

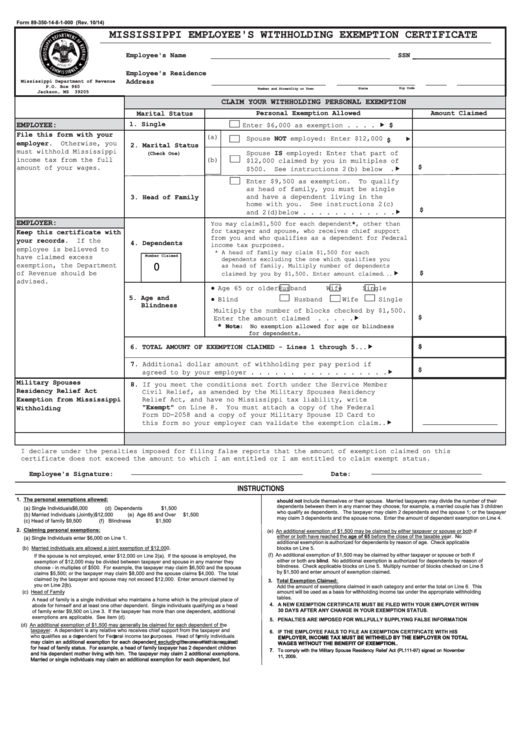

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once every year. If you meet the requirements, you could be eligible to receive exemptions from the withholding form. This page lists all exemptions.

The application of Form 1042-S to Form 1042-S is a first step to file Form 1040-NR. To report federal income tax reasons, this form provides the withholdings made by the agency responsible for withholding. Make sure you enter the correct information when filling in this form. There is a possibility for one individual to be treated in a manner that is not correct if the information is not given.

Nonresident aliens pay the option of paying a 30% tax on withholding. Exemption from withholding could be possible if you’ve got a an income tax burden of less than 30%. There are many exemptions. Some are for spouses or dependents like children.

You may be entitled to a refund if you violate the provisions of chapter 4. Refunds are allowed according to Sections 1471-1474. Refunds are provided by the withholding agent. This is the individual responsible for withholding the tax at the point of origin.

Relational status

A form for a marital withholding is an excellent way to simplify your life and assist your spouse. You’ll also be surprised by with the amount of money you can put in the bank. It isn’t easy to decide which of many choices is most appealing. There are certain things you should be aware of. You will pay a lot when you make a bad decision. If you follow the guidelines and adhere to them, there won’t be any problems. If you’re lucky you’ll make new acquaintances on the road. Today is your anniversary. I’m hoping you can leverage it to secure that dream engagement ring. It is best to seek the advice of a certified tax expert to complete it correctly. It’s worth it to build wealth over the course of a lifetime. You can find plenty of information online. Tax preparation firms that are reputable, such as TaxSlayer are one of the most useful.

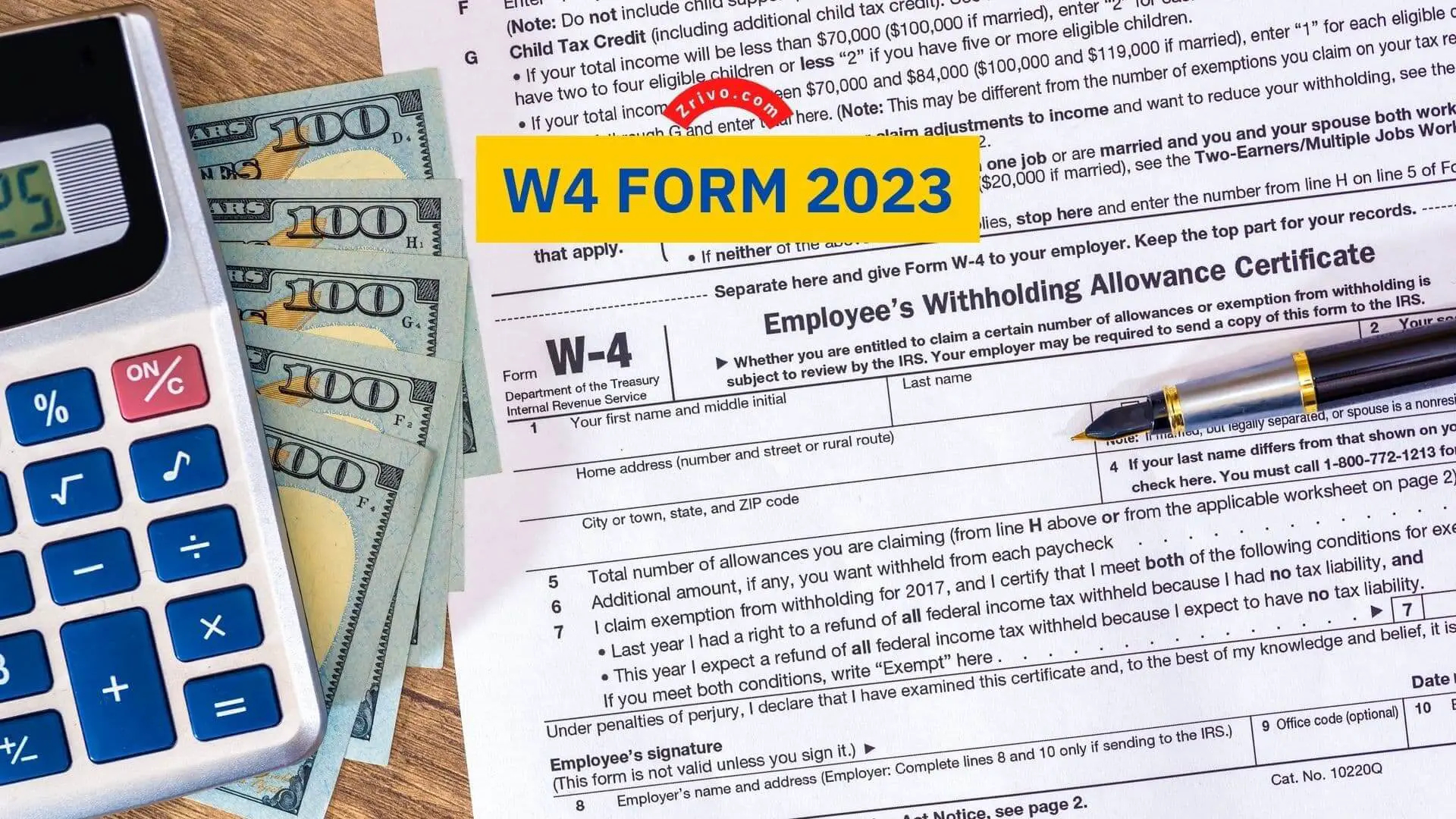

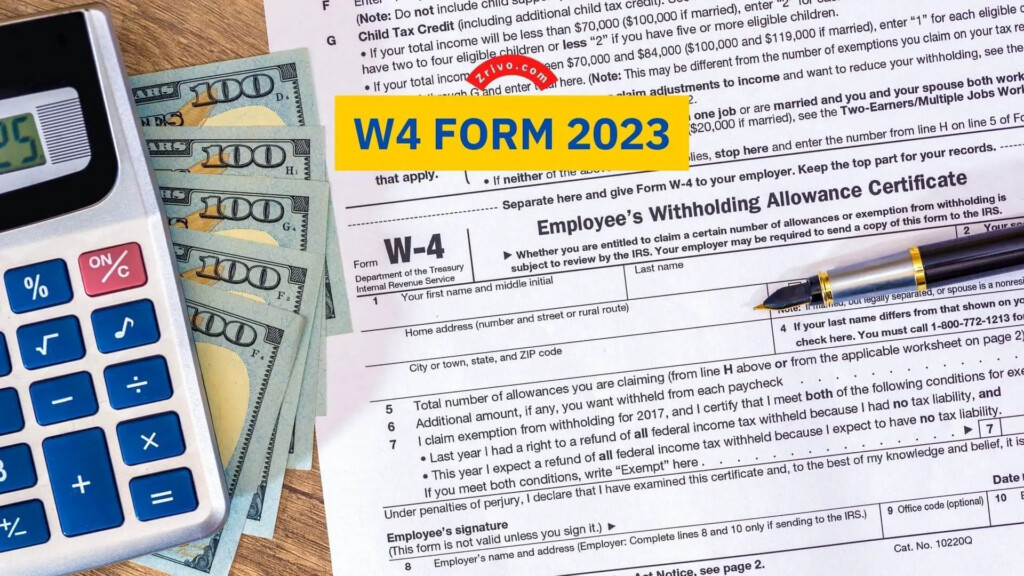

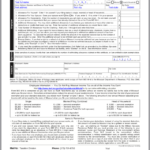

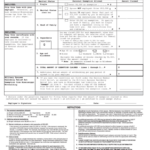

The amount of withholding allowances requested

You need to indicate how many withholding allowances you want to be able to claim on the W-4 that you file. This is important because the tax withheld will affect the amount taken out of your pay check.

There are a variety of factors which affect the allowance amount you are able to request. If you’re married, you might be qualified for an exemption for head of household. Additionally, you can claim additional allowances depending on how much you earn. If you earn a substantial income, you can request an increase in your allowance.

You may be able to avoid paying a large tax bill by deciding on the appropriate amount of tax deductions. If you submit your annual tax returns and you are eligible for a refund. However, you must choose the right method.

Like any financial decision, you must conduct your own research. Calculators can be utilized to determine how many withholding allowances are required to be claimed. An alternative is to speak with a professional.

Filing requirements

If you are an employer, you have to be able to collect and report withholding taxes from your employees. Certain of these taxes may be submitted to the IRS by submitting forms. There are additional forms you might need for example, a quarterly tax return or withholding reconciliation. Here is some information on the different tax forms for withholding categories as well as the deadlines for filling them out.

To be qualified for reimbursement of withholding tax on the salary, bonus, commissions or other revenue earned by your employees, you may need to file a tax return for withholding. If you also pay your employees on-time you may be eligible to receive reimbursement for taxes withheld. Noting that certain of these taxes could be considered to be taxation by county is crucial. Furthermore, there are special methods of withholding that are used in certain circumstances.

You must electronically submit withholding forms according to IRS regulations. When filing your tax returns for the national income tax ensure that you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.