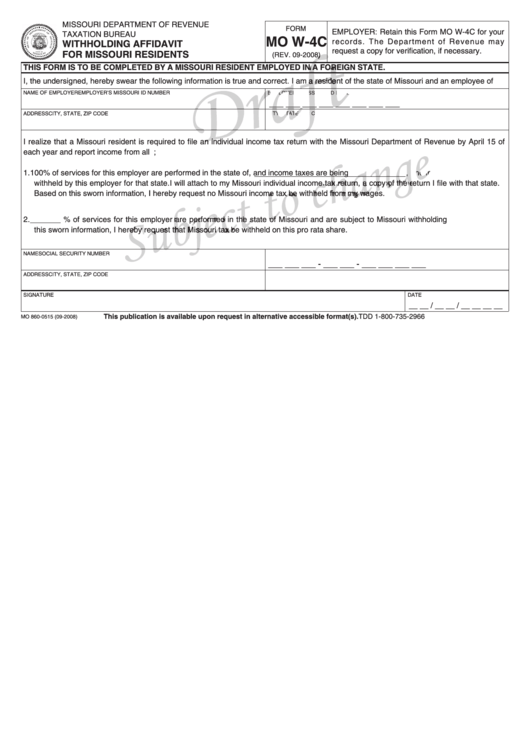

Missouri Quarterly Withholding Form – There are a variety of reasons for a person to decide to fill out a tax form. The requirements for documentation, exemptions from withholding as well as the quantity of the allowance required are just a few of the factors. Whatever the reason behind the filing of an application, there are certain things you must keep in mind.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. If you satisfy these requirements, you could be eligible for exemptions from the withholding form. The exclusions are accessible to you on this page.

The first step for submit Form 1040 – NR is attaching the Form 1042 S. For federal income tax reporting reasons, this form details the withholding made by the withholding agency. It is essential to fill in the correct information when filling out the form. One individual may be treated if the information is not entered.

The tax withholding rate for non-resident aliens is 30%. A tax exemption may be available if you have a tax burden that is less than 30 percent. There are many exemptions. Some of these exclusions are only available to spouses or dependents like children.

In general, the chapter 4 withholding gives you the right to the possibility of a refund. Refunds are available in accordance with sections 1401, 1474, and 1475. These refunds must be made by the agents who withhold taxes that is, the person who is responsible for withholding taxes at the source.

Status of relationships

A valid marital status withholding can help you and your spouse to complete your tasks. In addition, the amount of money you can put at the bank can be awestruck. The difficulty lies in picking the right bank from the multitude of choices. Undoubtedly, there are some that you shouldn’t do. There are a lot of costs if you make a wrong decision. If the rules are adhered to and you are attentive you shouldn’t face any issues. If you’re lucky you’ll make new acquaintances on the road. Today is the anniversary. I’m hoping that you can leverage it to secure that dream ring. It’s a difficult job that requires the experience of an expert in taxation. A small amount of money can create a lifetime of wealth. There is a wealth of information on the internet. TaxSlayer is a trusted tax preparation firm is one of the most helpful.

The number of withholding allowances claimed

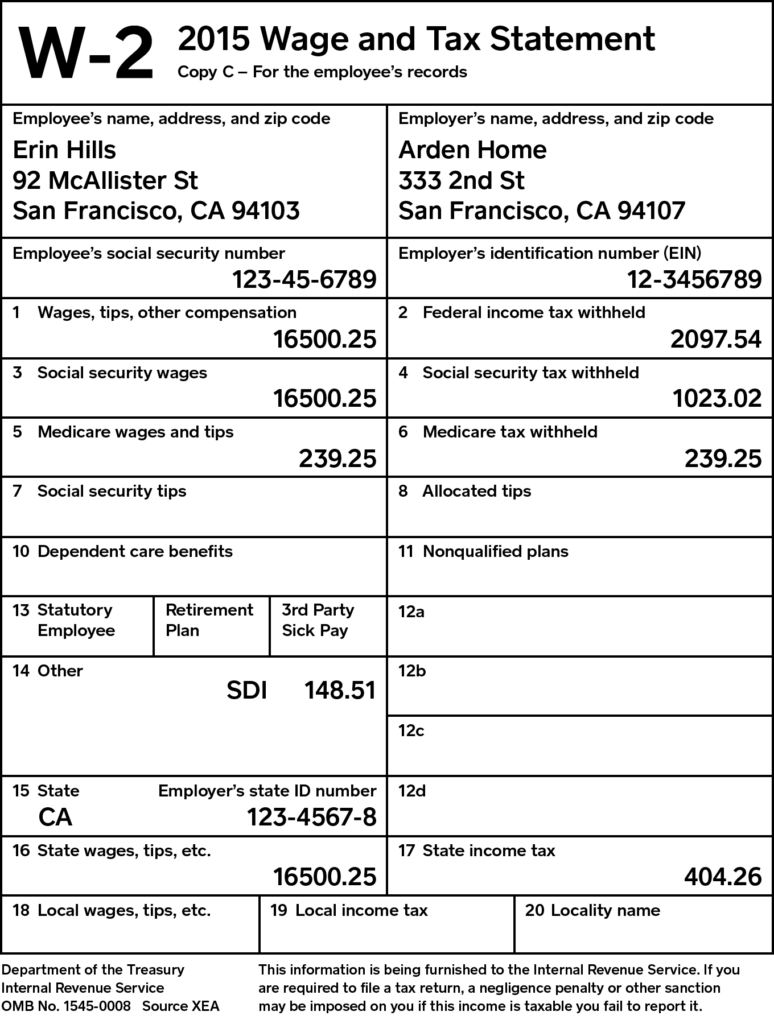

When filling out the form W-4 you fill out, you need to specify how many withholding allowances are you asking for. This is vital since it will affect the amount of tax you get from your pay checks.

There are many variables that affect the amount of allowances that you can claim. If you’re married you may be eligible for a head-of-household exemption. Your income will influence how many allowances your are eligible for. You can apply for more allowances if earn a significant amount of money.

The right amount of tax deductions could aid you in avoiding a substantial tax bill. If you file the annual tax return for income You could be eligible for a refund. However, it is crucial to choose the right approach.

Do your research the same way you would with any other financial decision. Calculators are useful to determine how many allowances for withholding are required to be made. If you prefer contact a specialist.

Specifications for filing

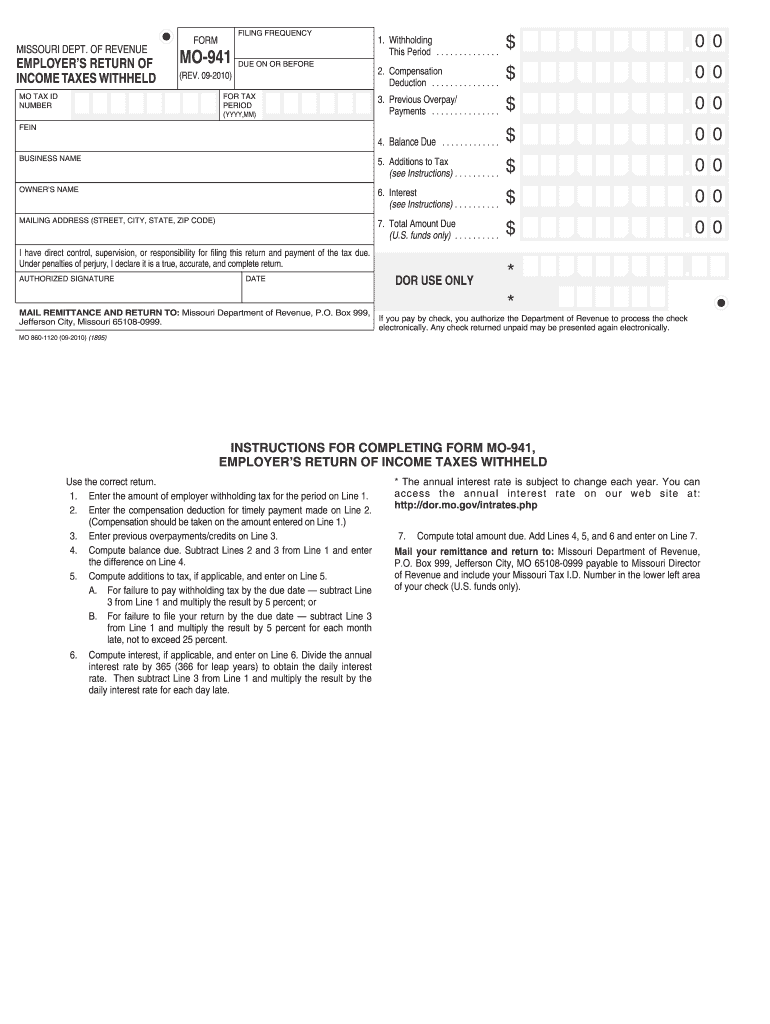

Employers are required to report any withholding tax that is being collected from employees. Certain of these taxes may be submitted to the IRS through the submission of paperwork. There are other forms you might need like a quarterly tax return or withholding reconciliation. Here is some information on the various withholding tax form categories and the deadlines for filling them out.

The salary, bonuses commissions, bonuses, and other income that you receive from your employees may require you to file withholding tax returns. If you pay your employees on time, you may be eligible to receive reimbursement of any withheld taxes. The fact that certain taxes are county taxes must be taken into consideration. In addition, there are specific methods of withholding that are applied under particular conditions.

Electronic filing of withholding forms is mandatory according to IRS regulations. When you file your tax return for national revenue make sure you include the Federal Employer Identification number. If you don’t, you risk facing consequences.