Mississippi State Tax Withholding Form – There are many reasons that an individual could submit a form for withholding. This includes documentation requirements and withholding exemptions. You must be aware of these factors regardless of the reason you decide to fill out a form.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR at least once each year. If you fulfill the minimum requirements, you could be eligible to submit an exemption from withholding form. The following page lists all exemptions.

When submitting Form1040-NR, Attach Form 1042S. This form lists the amount withheld by the withholding agencies for federal tax reporting purposes. Be sure to enter the correct information when filling out this form. If this information is not provided, one individual could be taken into custody.

The tax withholding rate for non-resident aliens is 30%. Your tax burden should not exceed 30% in order to be exempt from withholding. There are a variety of exclusions. Some of them are intended to be used by spouses, while some are meant for use by dependents like children.

The majority of the time, a refund is available for chapter 4 withholding. Refunds may be granted under Sections 1400 to 1474. Refunds are to be given by the agents who withhold taxes who is the person who collects taxes at the source.

Relational status

A valid marital status withholding will make it easier for both of you to accomplish your job. You’ll be surprised by the amount of money you can put in the bank. It isn’t easy to decide which of the many options is the most attractive. There are certain things that you should not do. Making the wrong choice could result in a costly loss. If you stick to the directions and keep your eyes open for any pitfalls, you won’t have problems. If you’re lucky you might be able to make new friends during your trip. Today is the anniversary. I’m hoping you’ll use it against them in order to find the sought-after diamond. For this to be done correctly, you’ll need the guidance of a qualified Tax Expert. The tiny amount is worthwhile for the lifetime of wealth. There is a wealth of details online. TaxSlayer, a reputable tax preparation company is one of the most helpful.

number of claimed withholding allowances

In submitting Form W-4 you must specify how many withholdings allowances you would like to claim. This is crucial because your pay will depend on the tax amount you have to pay.

There are a variety of factors that can influence the amount you qualify for allowances. Your income level also affects how much allowances you’re entitled to. A higher allowance may be granted if you make lots of money.

The right amount of tax deductions will save you from a large tax charge. You may even get an income tax refund when you file the annual tax return. You need to be careful about how you approach this.

In every financial decision, you should conduct your own research. Calculators can be used to determine how many withholding allowances you should claim. A better option is to consult with a professional.

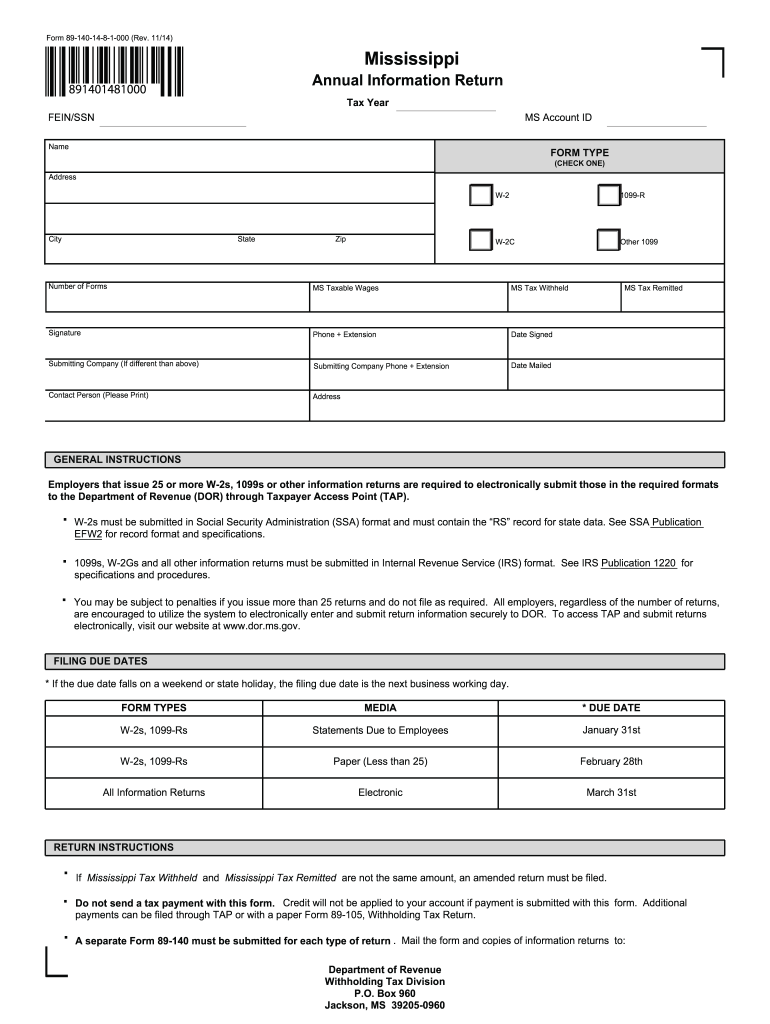

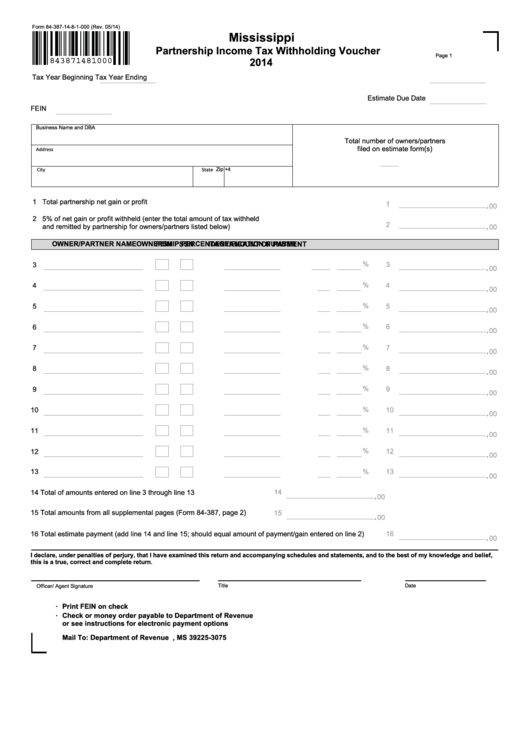

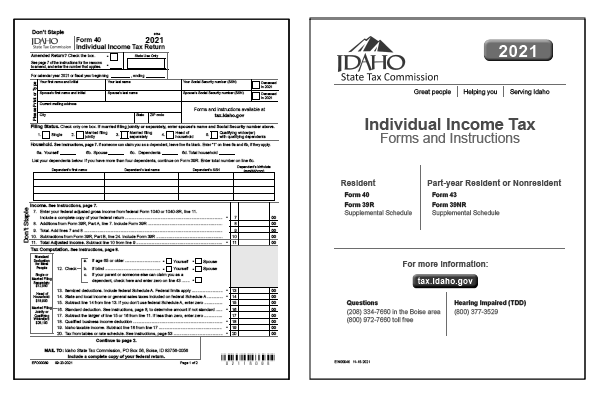

Formulating specifications

Employers must inform the IRS of any withholding tax that is being taken from employees. The IRS will accept documents for some of these taxes. A reconciliation of withholding tax, the quarterly tax return or an annual tax return are some examples of additional paperwork you might be required to submit. Here are some information on the different types of withholding tax forms and the filing deadlines.

The salary, bonuses, commissions, and other income that you receive from your employees may require you to submit tax returns withholding. If you make sure that your employees are paid on time, you could be eligible for the reimbursement of taxes withheld. It is important to note that some of these taxes may be county taxes, is also vital. In some situations there are rules regarding withholding that can be unique.

You must electronically submit withholding forms in accordance with IRS regulations. When you file your national tax return, please provide your Federal Employer Identification number. If you don’t, you risk facing consequences.

Gallery of Mississippi State Tax Withholding Form

Mississippi State Withholding Form 2021 2022 W4 Form