Michigan Withholding Tax Form Schedule W – There are many reasons one might choose to fill out withholding forms. This includes the documents required, the exclusion of withholding, and the requested withholding allowances. There are some things you should remember, regardless of the reason that a person has to fill out an application.

Exemptions from withholding

Nonresident aliens are required once every year to file Form1040-NR. However, if you satisfy the requirements, you might be eligible to submit an exemption from withholding form. The following page lists all exclusions.

The first step in filling out Form 1040-NR is attaching Form 1042 S. For federal income tax reporting reasons, this form outlines the withholding process of the tax agency that handles withholding. Be sure to enter the correct information when you complete the form. You could be required to treat a specific person for not providing the correct information.

The 30% non-resident alien tax withholding tax rate is 30. If the tax you pay is lower than 30 percent of your withholding, you may be eligible to be exempt from withholding. There are a variety of exemptions offered. Some of these exclusions are only for spouses or dependents like children.

Generally, a refund is accessible for Chapter 4 withholding. As per Sections 1471 to 1474, refunds are given. Refunds are provided by the tax agent. The withholding agent is the person responsible for withholding the tax at the point of origin.

Status of the relationship

A valid marital status withholding can make it simpler for both you and your spouse to do your work. You’ll also be surprised by how much you can deposit at the bank. The trick is to decide what option to select. Certain, there are items you must avoid. Making the wrong choice could cost you dearly. If you follow the guidelines and follow them, there shouldn’t be any problems. If you’re lucky enough, you might find some new acquaintances on the road. Today is the anniversary. I’m sure you’ll be in a position to leverage this against them to obtain that wedding ring you’ve been looking for. If you want to get it right you’ll require the assistance of a certified accountant. This tiny amount is enough to last the life of your wealth. There are a myriad of online resources that can provide you with information. TaxSlayer is a trusted tax preparation company is one of the most useful.

The amount of withholding allowances claimed

It is important to specify the amount of withholding allowances you wish to claim on the form W-4. This is essential because the amount of tax withdrawn from your paycheck will be affected by how you withhold.

The amount of allowances that you get will be contingent on a variety of factors. For example If you’re married, you could be qualified for an exemption for the head of household or for the household. Additionally, you can claim additional allowances depending on how much you earn. An additional allowance could be granted if you make lots of money.

Selecting the appropriate amount of tax deductions could save you from a large tax payment. In addition, you could be eligible for a refund when your tax return for income has been completed. But you need to pick your strategy carefully.

You must do your homework, just like you would with any financial option. Calculators can assist you in determining how many withholding amounts should be claimed. Alternative options include speaking with an expert.

Specifications for filing

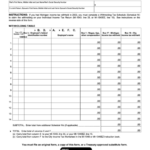

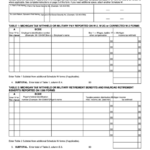

Employers must inform the IRS of any withholding tax that is being collected from employees. The IRS may accept forms for some of these taxes. A tax reconciliation for withholding and the quarterly tax return as well as the annual tax return are examples of additional paperwork you might need to submit. Here’s a brief overview of the different tax forms and when they must be filed.

Tax returns withholding may be required for certain incomes such as bonuses, salary, commissions and other income. In addition, if you pay your employees in time, you may be eligible for reimbursement of taxes that were withheld. It is important to note that certain taxes are also county taxes should be taken into consideration. There are also unique withholding strategies that are applicable in certain circumstances.

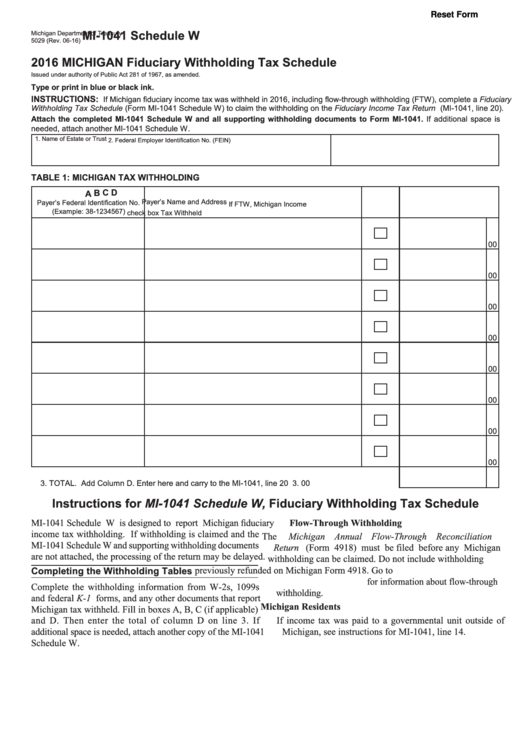

In accordance with IRS regulations, electronic filing of forms for withholding are required. It is mandatory to include your Federal Employer ID Number when you submit to your tax return for national income. If you don’t, you risk facing consequences.