Michigan Withholding Forms 2024 – There are many reasons an individual might decide to fill out forms withholding. This includes the need for documentation, exemptions from withholding and also the amount of required withholding allowances. It is important to be aware of these factors regardless of the reason you decide to fill out a form.

Withholding exemptions

Nonresident aliens are required to submit Form 1040-NR at least once per year. If the requirements meet, you may be eligible to apply for an exemption from withholding. This page lists all exclusions.

To submit Form 1040-NR, the first step is to attach Form 1042S. The form contains information on the withholding done by the agency responsible for withholding for federal tax reporting for tax reporting purposes. Complete the form in a timely manner. If the correct information isn’t given, a person could be taken into custody.

The 30% tax withholding rate for non-resident aliens is 30 percent. The tax burden of your business must not exceed 30% to be eligible for exemption from withholding. There are many exemptions available. Some are specifically for spouses, and dependents, such as children.

In general, the chapter 4 withholding gives you the right to an amount of money. Refunds may be granted under Sections 1400 to 1474. The refunds are given by the agent who withholds tax (the person who withholds tax at source).

Relationship status

A marital withholding form is a good way to simplify your life and aid your spouse. It will also surprise you how much you can put in the bank. The challenge is in deciding which one of the many options to pick. Be cautious about when you make a decision. False decisions can lead to costly results. If you adhere to the directions and adhere to them, there won’t be any problems. If you’re lucky you could even meet acquaintances on your travels. Today marks the anniversary of your wedding. I’m hoping you’re capable of using this to get that wedding ring you’ve been looking for. In order to complete the job correctly it is necessary to obtain the assistance of a tax professional who is certified. It’s worth it to build wealth over a lifetime. There is a wealth of details online. TaxSlayer is a trusted tax preparation firm.

The amount of withholding allowances claimed

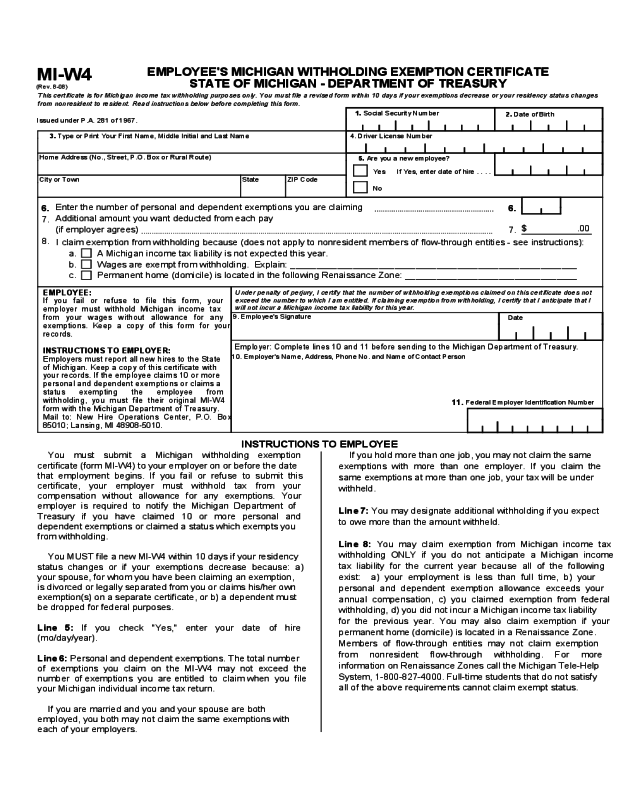

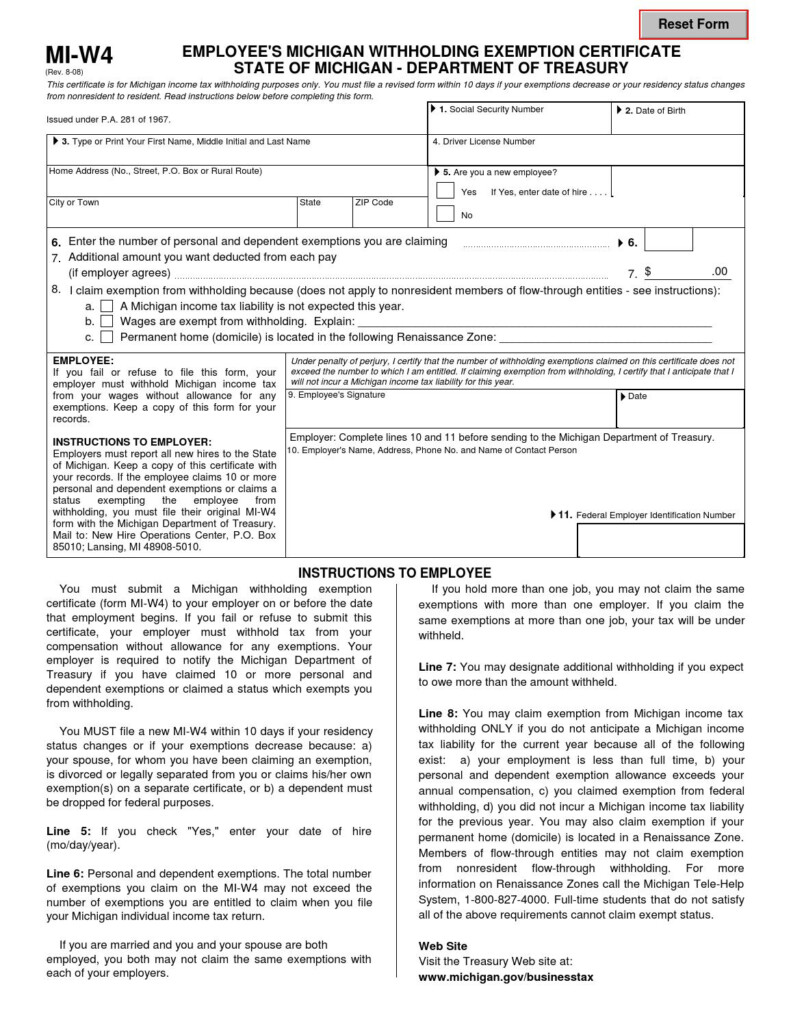

You must specify how many withholding allowances you wish to be able to claim on the Form W-4 you submit. This is important because the withholdings will have an effect on the amount of tax is taken out of your paycheck.

Many factors affect the amount of allowances requested.If you’re married for instance, you could be able to apply for an exemption for the head of household. The amount you’re eligible to claim will depend on the income you earn. If you earn a substantial amount of money, you might be eligible for a larger allowance.

Choosing the proper amount of tax deductions can help you avoid a hefty tax bill. Refunds could be feasible if you submit your tax return on income for the year. However, it is crucial to pick the right method.

In any financial decision, it is important to conduct your own research. Calculators can be utilized to figure out how many withholding allowances are required to be claimed. Alternate options include speaking to a specialist.

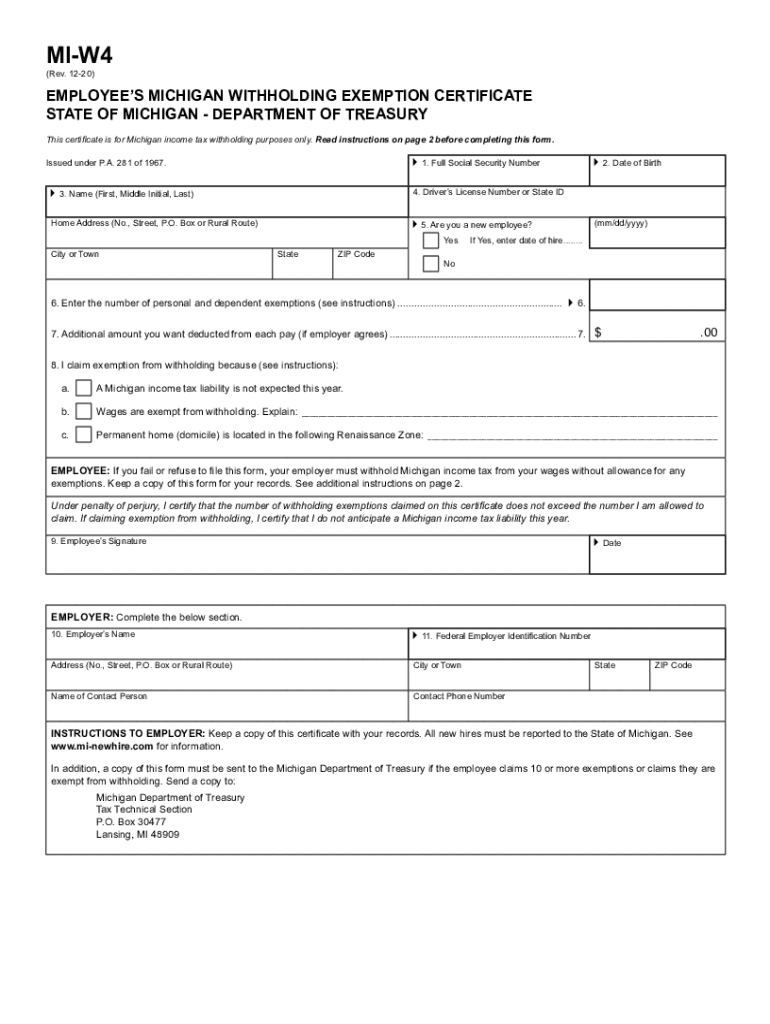

Specifications to be filed

Employers should report the employer who withholds tax from their employees. The IRS may accept forms for some of these taxes. You might also need additional documentation such as a withholding tax reconciliation or a quarterly tax return. Here are some information about the various types of tax withholding forms along with the filing deadlines.

The compensation, bonuses commissions, other earnings you earn from your employees may require you to file tax returns withholding. You could also be eligible to receive reimbursement for tax withholding if your employees were paid in time. Be aware that these taxes could be considered to be local taxes. There are also unique withholding rules that can be used in specific situations.

You have to submit electronically withholding forms according to IRS regulations. The Federal Employer Identification number must be included when you submit to your tax return for the nation. If you don’t, you risk facing consequences.