Michigan Tax Withholding Form 2024 – There are numerous reasons an individual could submit an application for withholding. This is due to the requirement for documentation, exemptions to withholding, as well as the amount of required withholding allowances. You must be aware of these aspects regardless of your reason for choosing to fill out a form.

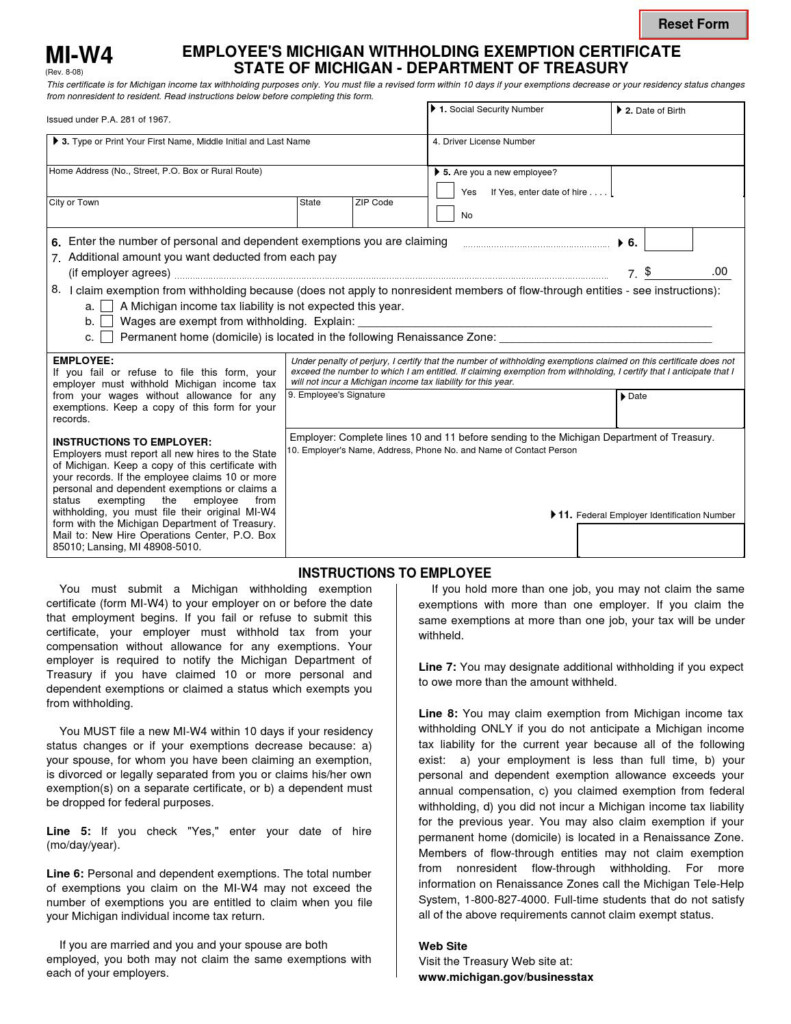

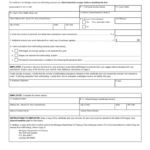

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR at a minimum once per year. You could be eligible to submit an exemption form for withholding, if you meet all the criteria. The exemptions listed on this page are yours.

To file Form 1040-NR, the first step is to attach Form 1042S. For federal income tax reporting purposes, this form details the withholding made by the tax agency that handles withholding. Make sure you enter the correct information when filling out this form. There is a possibility for one person to be treated if the information isn’t provided.

Nonresident aliens have 30 percent withholding tax. You may be eligible to get an exemption from withholding tax if your tax burden is greater than 30 percent. There are many exemptions. Some of them apply to spouses and dependents, such as children.

Generallyspeaking, withholding in Chapter 4 gives you the right to an amount of money back. Refunds can be granted under Sections 471 through 474. Refunds are provided by the tax agent. The withholding agent is the individual responsible for withholding the tax at the point of origin.

Relational status

An official marriage status withholding forms will assist both of you to make the most of your time. In addition, the amount of money you can put at the bank could be awestruck. It isn’t easy to determine which one of the options you will choose. There are certain things that you shouldn’t do. It’s costly to make a wrong decision. If you stick to it and follow the instructions, you won’t encounter any issues. If you’re lucky enough, you might find some new acquaintances traveling. Today is the anniversary date of your wedding. I’m hoping you can use it against them to secure that dream engagement ring. To do it right you’ll need the help of a certified accountant. A little amount could create a lifetime’s worth of wealth. There are numerous websites that offer details. TaxSlayer is a trusted tax preparation business, is one of the most helpful.

There are many withholding allowances that are being made available

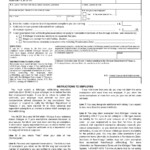

You need to indicate how many withholding allowances you want to be able to claim on the form W-4 that you file. This is important because it affects how much tax you receive from your paychecks.

You could be eligible to claim an exemption for your spouse in the event that you are married. The amount of allowances you can claim will depend on your income. If you have a higher income it could be possible to receive more allowances.

A tax deduction appropriate for you could allow you to avoid tax obligations. In reality, if you complete your yearly income tax return, you could even be eligible for a tax refund. But you need to pick the right method.

Like every financial decision, you should do your research. To determine the amount of withholding allowances to be claimed, you can use calculators. In addition contact an expert.

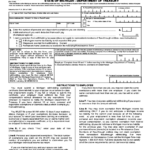

Submitting specifications

Employers are required to report the company who withholds taxes from their employees. In the case of a small amount of the taxes, you are able to send paperwork to IRS. An annual tax return, quarterly tax returns or tax withholding reconciliations are just a few types of documents you could require. Here are some information on the different types of tax withholding forms and the deadlines for filing.

It is possible that you will need to file withholding tax returns for the income you receive from your employees, like bonuses, commissions, or salary. If you pay your employees on time, then you may be eligible to receive the reimbursement of taxes withheld. It is important to note that there are a variety of taxes that are local taxes. In addition, there are specific withholding practices that can be used in certain conditions.

According to IRS rules, you have to electronically submit withholding forms. The Federal Employer Identification number must be included when you submit at your national tax return. If you don’t, you risk facing consequences.