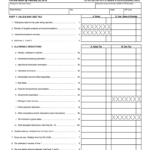

Michigan Sales Use Withholding Tax Form – There stand a digit of reasons for a person to decide to fill out a tax form. This includes the documentation requirements, withholding exclusions as well as the withholding allowances. No matter what the reason is for the filing of an application, there are certain things to keep in mind.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR once every year. If you fulfill the minimum requirements, you could be eligible to submit an exemption form from withholding. The exclusions are accessible to you on this page.

When submitting Form1040-NR, Attach Form 1042S. The form outlines the withholdings that are made by the agency. Complete the form in a timely manner. You may have to treat a single individual if you do not provide this information.

The non-resident alien withholding rate is 30%. A nonresident alien may be qualified for exemption. This happens the case if your tax burden less than 30%. There are many exemptions. Some of them are for spouses, dependents, or children.

Generally, withholding under Chapter 4 allows you to claim the right to a refund. Refunds are allowed according to Sections 1471-1474. These refunds must be made by the agents who withhold taxes that is, the person who withholds taxes at the source.

relationship status

You and your spouse’s work will be made easy with a valid marriage status withholding form. The bank may be surprised by the amount of money that you have to deposit. It is difficult to decide which one of the options you’ll choose. There are certain aspects you should avoid. Making the wrong choice could cost you dearly. If you follow the guidelines and adhere to them, there won’t be any issues. If you’re lucky enough you’ll make new friends while traveling. Today is the day you celebrate your wedding. I’m hoping you’ll be able to apply it against them to secure the sought-after diamond. If you want to do this properly, you’ll require guidance of a certified Tax Expert. It’s worthwhile to accumulate wealth over the course of your life. It is a good thing that you can access plenty of information on the internet. TaxSlayer and other reputable tax preparation firms are a few of the best.

There are numerous withholding allowances that are being requested

When submitting Form W-4, you should specify the number of withholding allowances you want to claim. This is important since the amount of tax withdrawn from your pay will be affected by how you withhold.

There are many variables that influence the allowance amount that you can apply for. If you’re married, you could be qualified for an exemption for head of household. The amount you’re eligible to claim will depend on your income. You may be eligible for more allowances if earn a significant amount of money.

Tax deductions that are suitable for you can help you avoid large tax bills. You may even get an income tax refund when you file the annual tax return. It is essential to choose the right approach.

Do your research as you would with any financial option. Calculators can aid you in determining the amount of withholding allowances are required to be claimed. You can also speak to an expert.

filing specifications

Employers must report any withholding tax that is being paid by employees. The IRS will accept documents to pay certain taxes. You might also need additional documents, such as an withholding tax reconciliation or a quarterly tax return. Here’s some information about the different tax forms, and the time when they should be submitted.

In order to be eligible for reimbursement of tax withholding on salary, bonus, commissions or other income earned by your employees it is possible to file a tax return for withholding. If you also pay your employees on time, you might be eligible for reimbursement for any taxes not withheld. It is important to remember that some of these taxes might be county taxes. Furthermore, there are special tax withholding procedures that can be implemented in specific circumstances.

Electronic filing of withholding forms is required according to IRS regulations. The Federal Employer Identification Number must be listed when you submit your tax return for national revenue. If you don’t, you risk facing consequences.

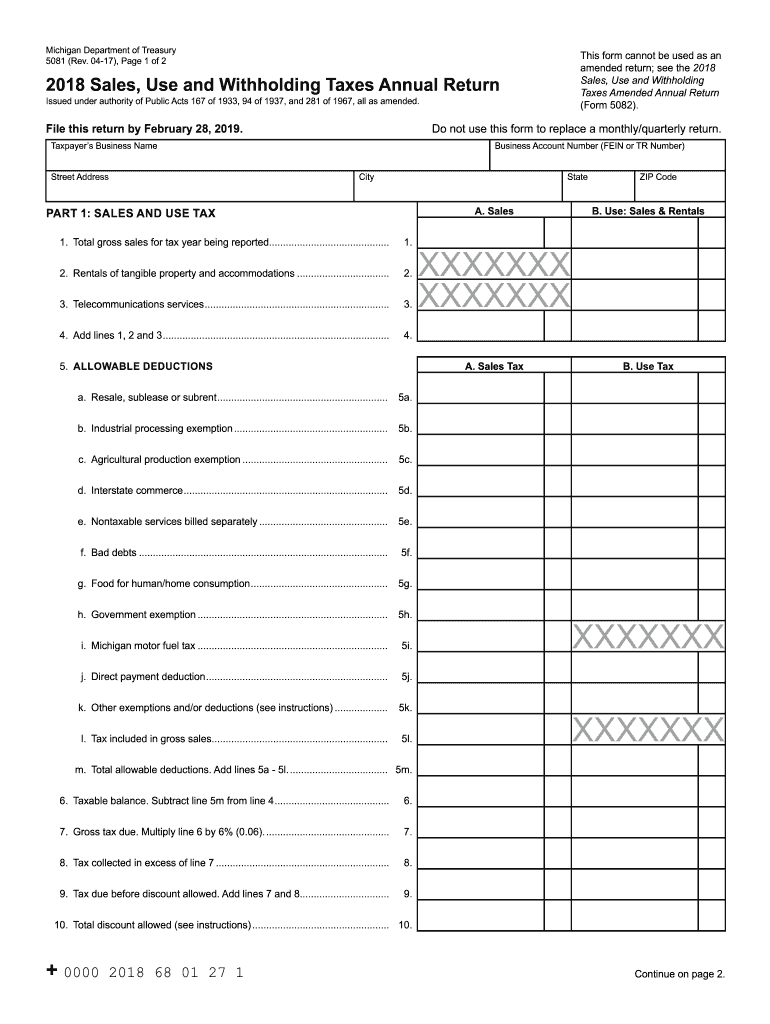

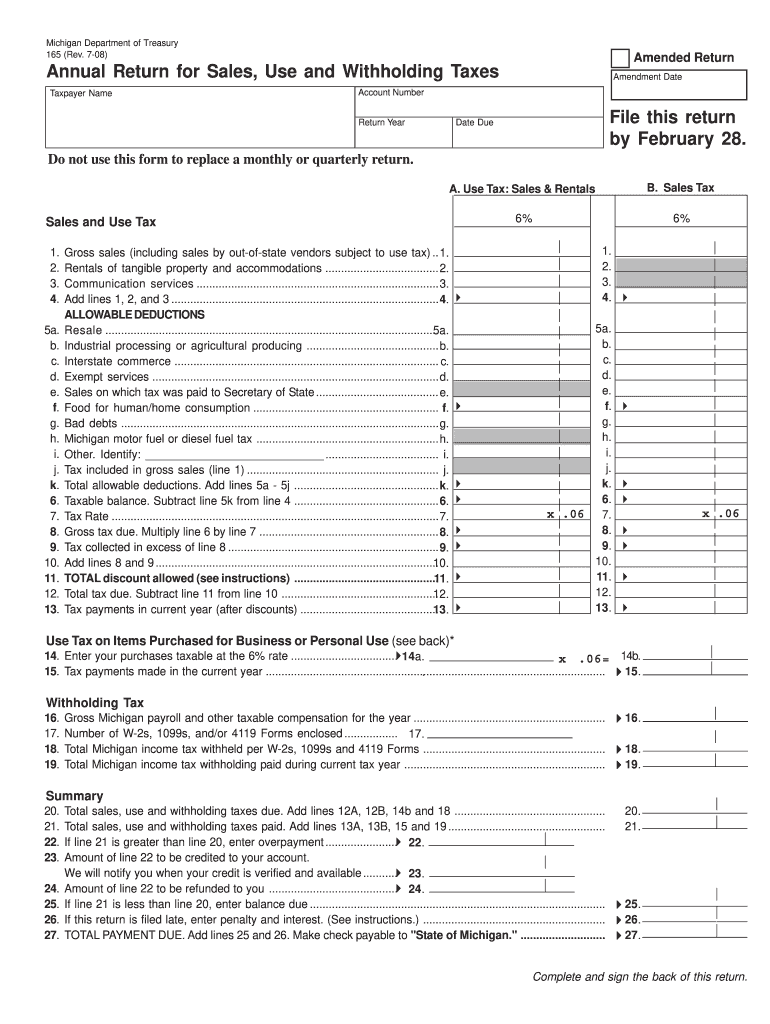

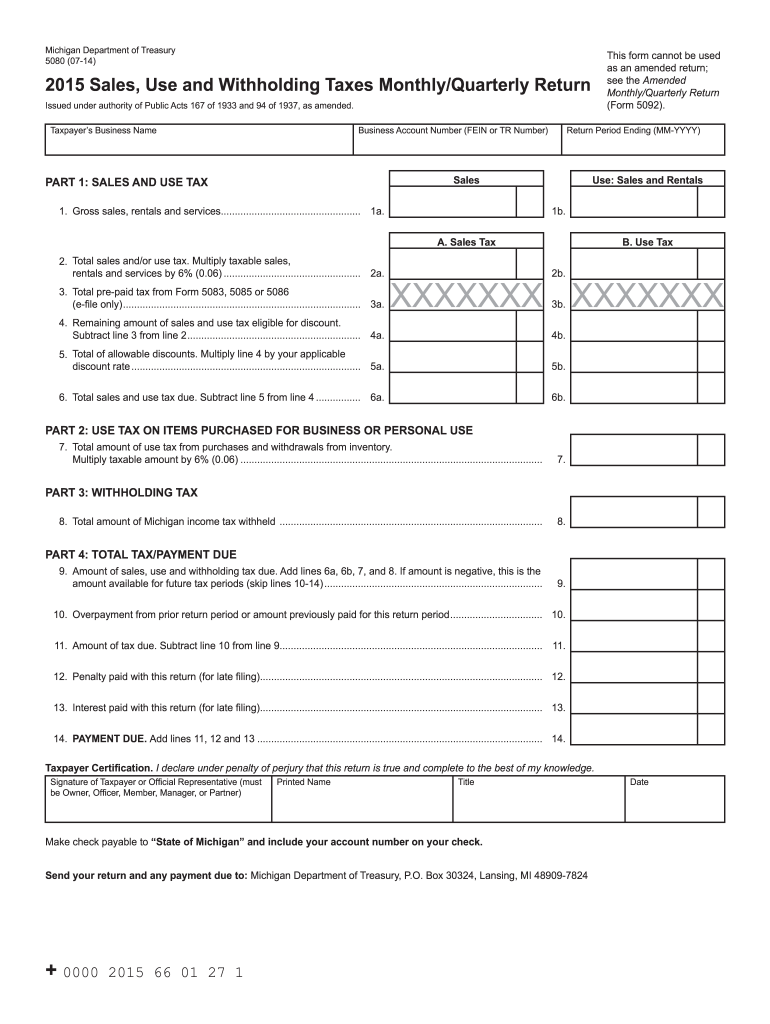

Gallery of Michigan Sales Use Withholding Tax Form

Michigan Sales Use And Withholding Tax Forms And Instructions 2022