Michigan Sales Use And Withholding Tax Form 2024 – There are a variety of reasons why a person could choose to submit an application for withholding. Withholding exemptions, documentation requirements and the amount of allowances for withholding demanded are all elements. No matter the motive someone has to fill out the Form There are a few things to remember.

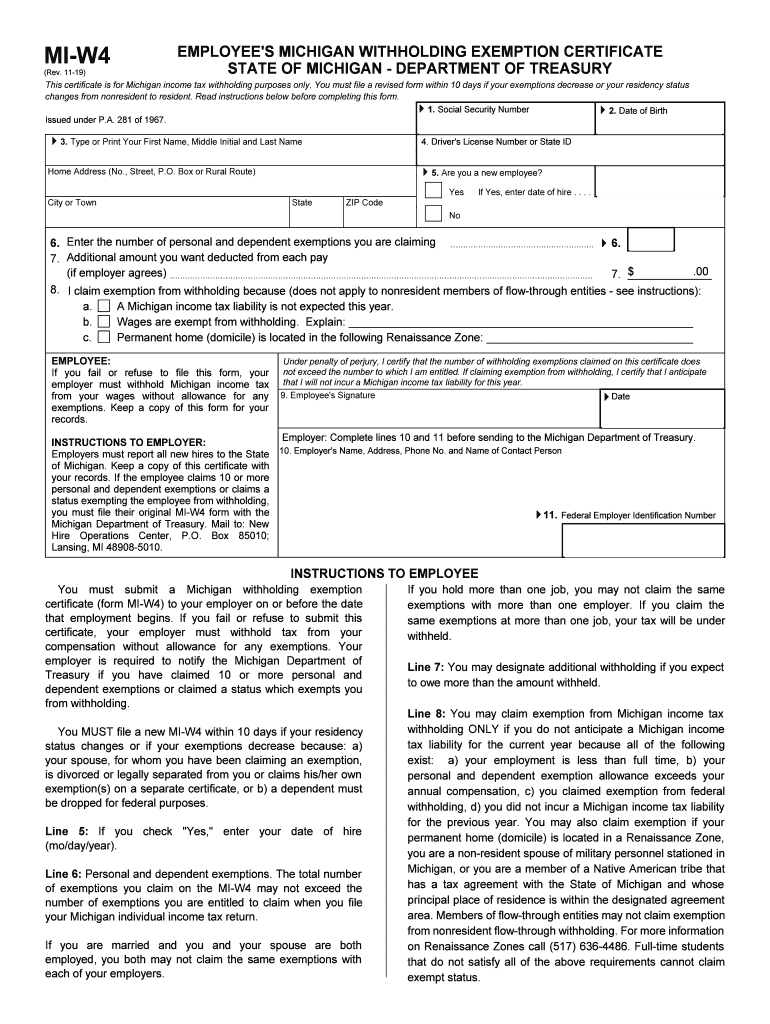

Withholding exemptions

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If your requirements are met, you may be eligible to apply for an exemption from withholding. The exclusions you can find here are yours.

For Form 1040-NR submission The first step is to attach Form 1042S. To report federal income tax reasons, this form provides the withholdings made by the withholding agency. It is important to enter exact information when you fill out the form. A person could be treated if this information is not provided.

The 30% non-resident alien tax withholding rate is 30 percent. Nonresident aliens could be qualified for an exemption. This applies the case if your tax burden lower than 30 percent. There are numerous exemptions. Some are for spouses and dependents, such as children.

In general, the withholding section of chapter 4 entitles you to an amount of money. Refunds are granted in accordance with Sections 1401, 1474, and 1475. The refunds are made by the withholding agents, which is the person who is responsible for withholding taxes at the source.

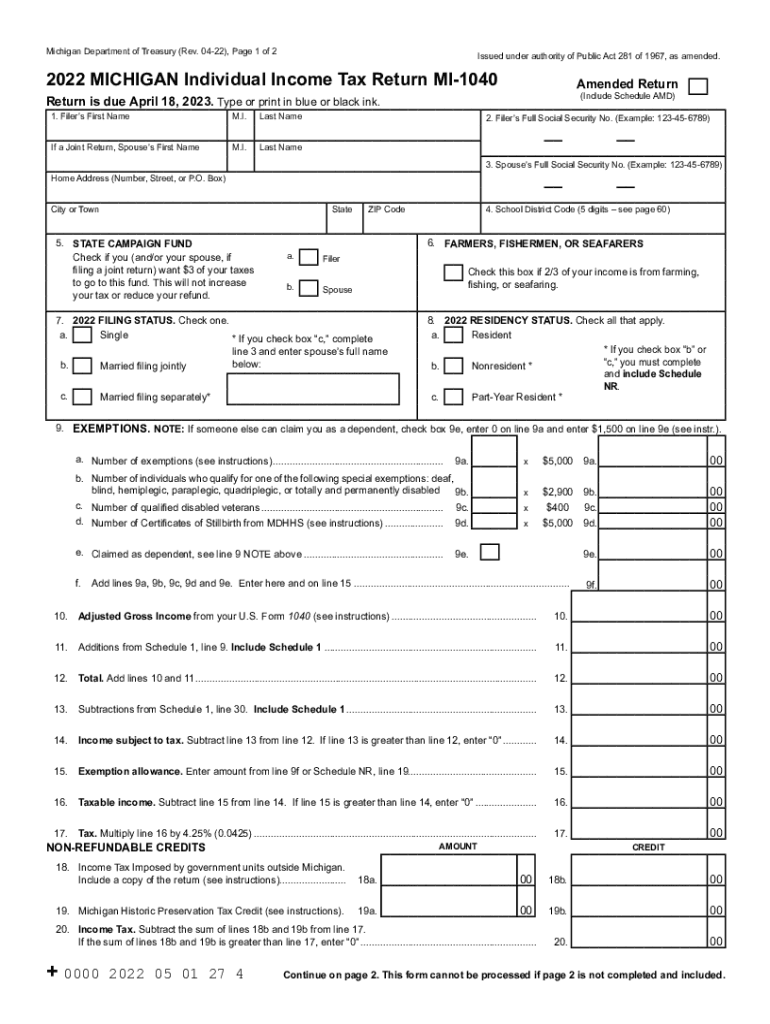

Relational status

You and your spouse’s work can be made easier by the proper marriage status withholding form. Additionally, the quantity of money that you can deposit at the bank can delight you. It isn’t easy to determine which one of the many options is the most appealing. Certain, there are that you shouldn’t do. The wrong decision can cause you to pay a steep price. If the rules are adhered to and you are attentive, you should not have any problems. If you’re lucky, you might be able to make new friends as traveling. In the end, today is the anniversary of your wedding. I’m hoping you’ll be able to utilize it in order to find that elusive diamond. For a successful completion of the task it is necessary to seek the assistance of a tax professional who is certified. It’s worthwhile to accumulate wealth over the course of a lifetime. Information on the internet is easily accessible. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

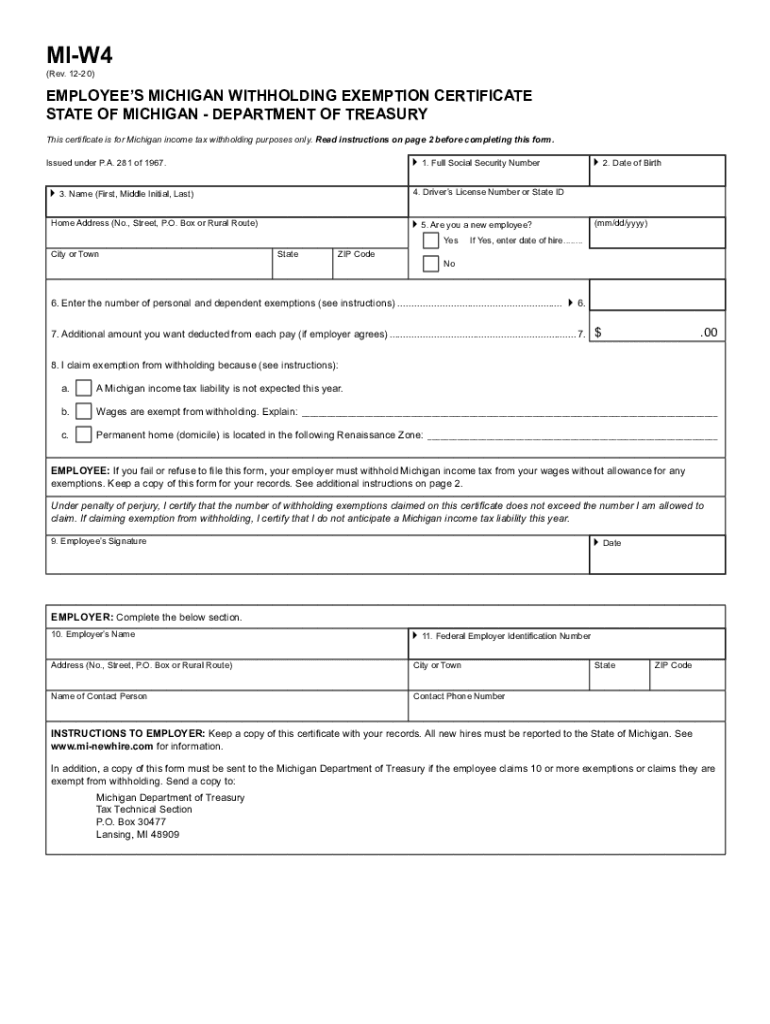

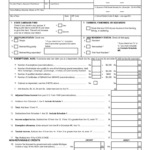

The amount of withholding allowances claimed

It is important to specify the amount of withholding allowances you would like to claim on the W-4 form. This is critical because your pay will be affected by the amount of tax you have to pay.

The amount of allowances that you receive will depend on a variety of factors. For example when you’re married, you might be eligible for an exemption for the head of household or for the household. The amount you earn can impact how many allowances are accessible to you. A higher allowance may be granted if you make lots of money.

A tax deduction appropriate for you could aid you in avoiding large tax bills. A refund could be feasible if you submit your tax return on income for the current year. But be sure to choose the right method.

Like any financial decision, you should do your homework. To figure out the amount of tax withholding allowances to be claimed, make use of calculators. A professional may be an alternative.

Filing requirements

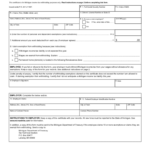

Employers must report the employer who withholds taxes from their employees. For certain taxes you can submit paperwork to IRS. A tax return that is annually filed and quarterly tax returns, or tax withholding reconciliations are just a few examples of paperwork you might require. Here is some information on the various withholding tax form categories as well as the deadlines for the submission of these forms.

To be eligible to receive reimbursement for tax withholding on salary, bonus, commissions or other revenue earned by your employees You may be required to file a tax return for withholding. It is also possible to be reimbursed for taxes withheld if your employees received their wages promptly. Noting that certain of these taxes are taxation by county is vital. There are also unique withholding procedures that can be used in specific situations.

According to IRS regulations the IRS regulations, electronic filing of forms for withholding are required. If you are submitting your tax return for national revenue, please include your Federal Employer Identification number. If you don’t, you risk facing consequences.