Md Employee Tax Withholding Form – There stand a digit of reasons for a person to decide to complete a withholding form. This includes the need for documentation, exemptions to withholding and also the amount of required withholding allowances. You must be aware of these aspects regardless of your reason for choosing to file a request form.

Exemptions from withholding

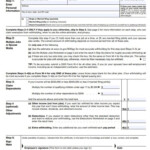

Nonresident aliens are required once each year to fill out Form1040-NR. If you satisfy the requirements, you may be qualified for exemption from withholding. The exemptions listed here are yours.

When you submit Form1040-NR, attach Form 1042S. The form contains information on the withholding process carried out by the tax agency that handles withholding for federal tax reporting for tax reporting purposes. When filling out the form, ensure that you have provided the accurate details. It is possible that you will have to treat a single individual if you do not provide this information.

The non-resident alien withholding tax is 30 percent. Exemption from withholding could be available if you have the tax burden lower than 30 percent. There are many exemptions available. Some are specifically for spouses, and dependents, like children.

Generally, you are entitled to a reimbursement in accordance with chapter 4. Refunds can be claimed under Sections 1401, 1474, and 1475. The refunds are given by the tax agent (the person who withholds tax at the source).

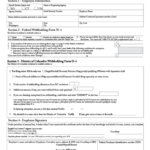

Relational status

A valid marital status withholding can make it simpler for you and your spouse to accomplish your job. The bank might be shocked by the amount of money that you deposit. Knowing which of the many possibilities you’re most likely to pick is the tough part. There are certain actions you should avoid doing. It will be costly to make a wrong decision. But if you follow it and pay attention to instructions, you won’t run into any problems. If you’re lucky, you could make new acquaintances on your trip. Today marks the anniversary of your marriage. I’m hoping you’ll utilize it to secure the sought-after diamond. If you want to get it right you’ll need the assistance of a certified accountant. The accumulation of wealth over time is more than that modest payment. You can find tons of details online. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

The number of withholding allowances that were made

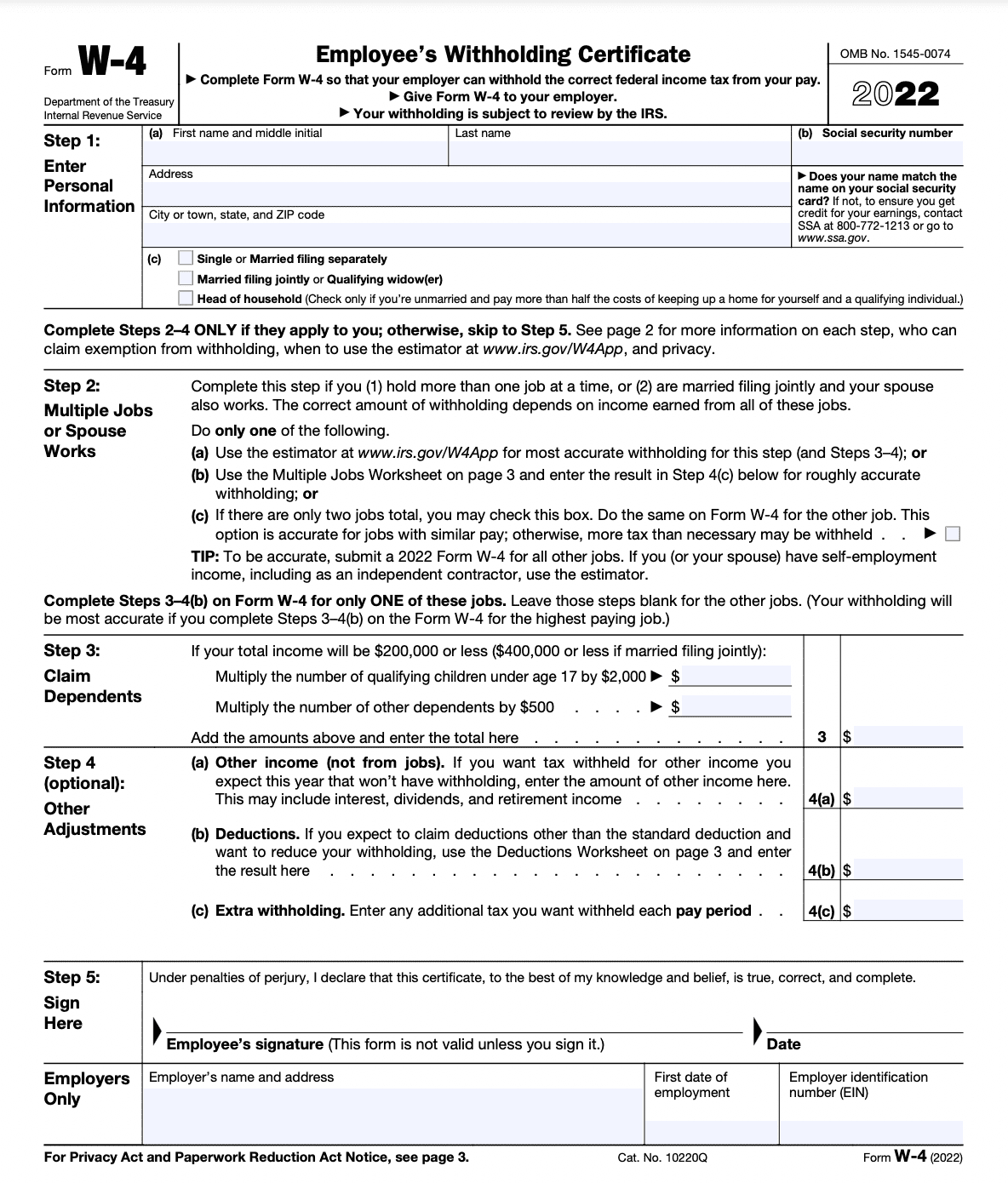

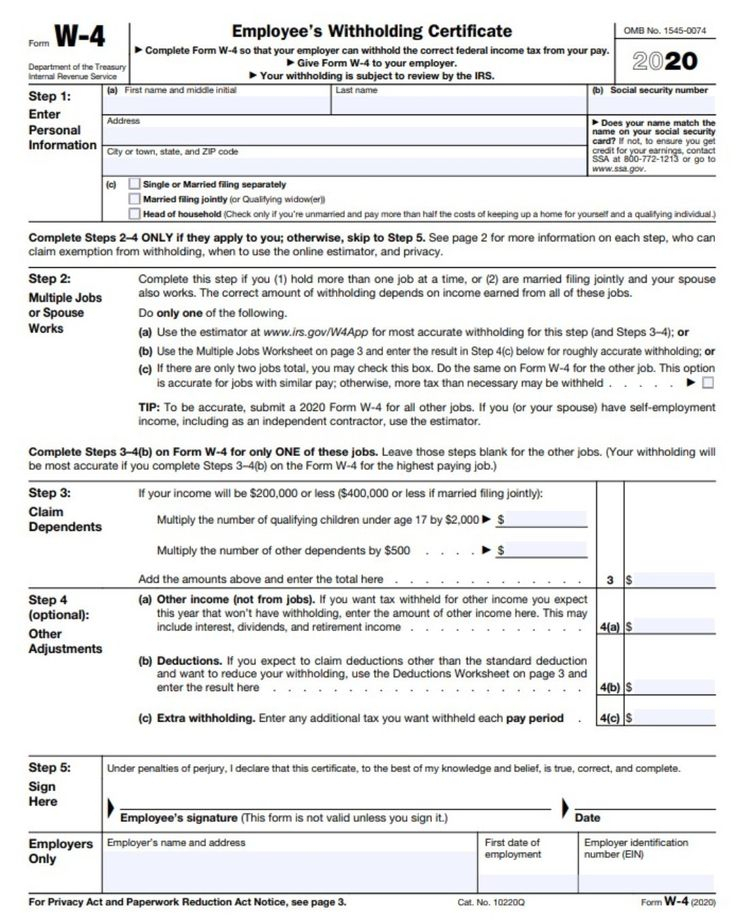

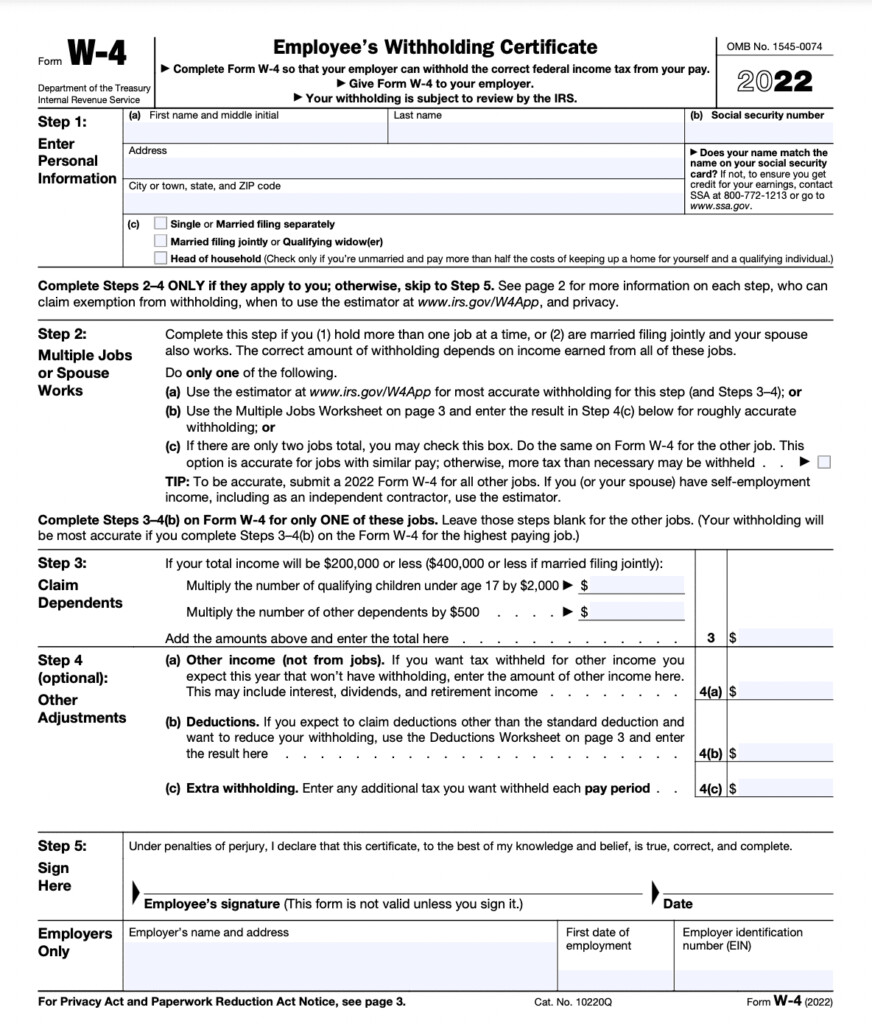

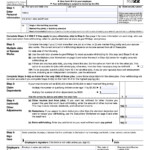

When you fill out Form W-4, you must specify how many withholding allowances you wish to claim. This is important since the amount of tax you are able to deduct from your pay will be affected by the much you withhold.

A number of factors can affect the amount you are eligible for allowances. Your income level can also affect the number of allowances available to you. You may be eligible for more allowances if have a large amount of income.

It is possible to reduce the amount of your tax bill by choosing the correct amount of tax deductions. In addition, you could even receive a tax refund if your tax return for income is completed. It is essential to choose the right approach.

Research as you would in any other financial decision. Calculators can help determine the amount of withholding that should be claimed. Another option is to talk to a professional.

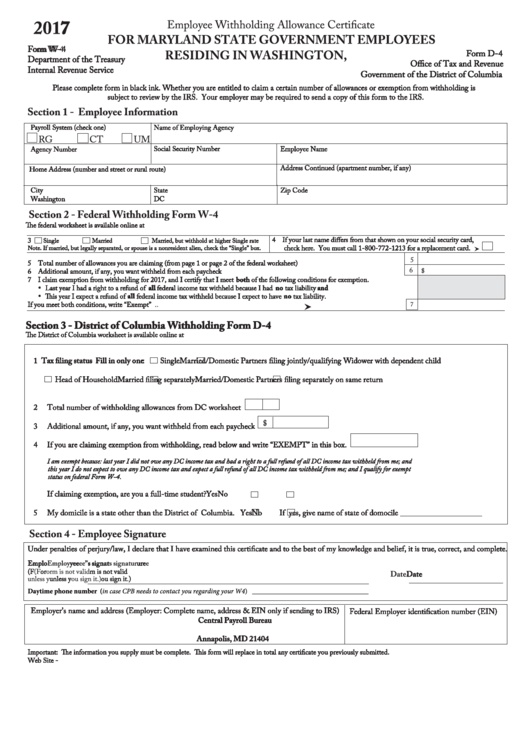

Sending specifications

Employers are required to collect withholding taxes from their employees and report the tax. You can submit paperwork to the IRS for a few of these taxation. A tax return for the year, quarterly tax returns or withholding tax reconciliation are all examples of paperwork you might need. Here are some information regarding the various forms of tax withholding forms as well as the deadlines for filing.

Your employees might require you to file withholding tax returns in order to receive their salary, bonuses and commissions. You could also be eligible to get reimbursements for tax withholding if your employees were paid in time. The fact that some of these taxes are county taxes ought to also be noted. Additionally, you can find specific withholding methods that are utilized in certain circumstances.

Electronic submission of forms for withholding is mandatory according to IRS regulations. When you file your tax returns for the national income tax, be sure to provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.