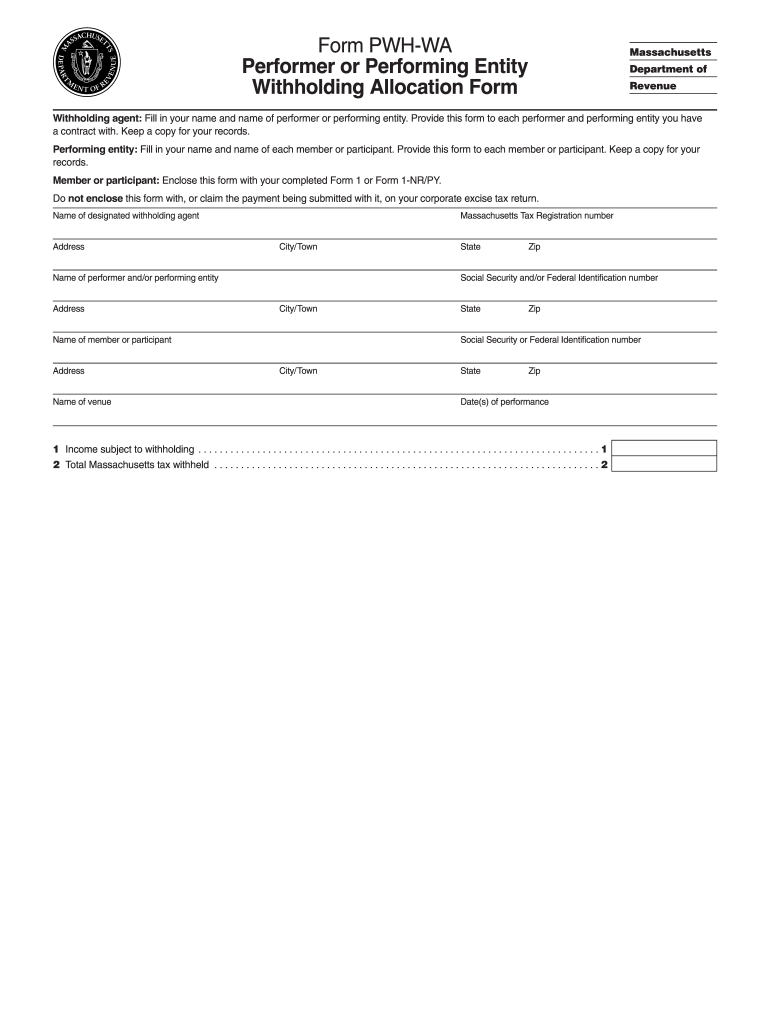

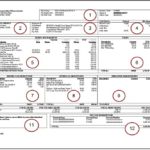

Mass.gov Massachusetts Withholding Tax Form – There are many reasons one might decide to fill out a withholding form. The reasons include the need for documentation including withholding exemptions and the amount of withholding allowances. Whatever the reason a person chooses to file a form there are some points to be aware of.

Withholding exemptions

Non-resident aliens are required to file Form 1040–NR once a calendar year. If your requirements meet, you may be eligible for an exemption from withholding. On this page, you’ll find the exclusions for you to choose from.

To submit Form 1040-NR, attach Form 1042-S. This form is a record of the withholdings made by the agency. Make sure you enter the right information when you fill out the form. A person could be treated if the information is not provided.

The 30% non-resident alien tax withholding rate is 30 percent. Your tax burden must not exceed 30% in order to be eligible for exemption from withholding. There are a variety of exemptions. Some are for spouses or dependents, for example, children.

You may be entitled to a refund if you violate the terms of chapter 4. As per Sections 1471 to 1474, refunds are granted. The refunds are given by the tax agent (the person who is responsible for withholding tax at the source).

Status of relationships

The marital withholding form is a good way to simplify your life and help your spouse. The bank might be shocked by the amount of money that you have to deposit. It isn’t easy to determine which of the many options you will choose. Certain things are best avoided. False decisions can lead to expensive negative consequences. If you stick to the guidelines and follow them, there shouldn’t be any issues. If you’re lucky, you could be able to make new friends during your trip. Today is the anniversary day of your wedding. I’m sure you’ll be capable of using this to get that elusive wedding ring. For a successful approach you’ll need the help of a certified accountant. This tiny amount is worth the lifetime of wealth. There is a wealth of information online. TaxSlayer is a reputable tax preparation firm.

The amount of withholding allowances that are claimed

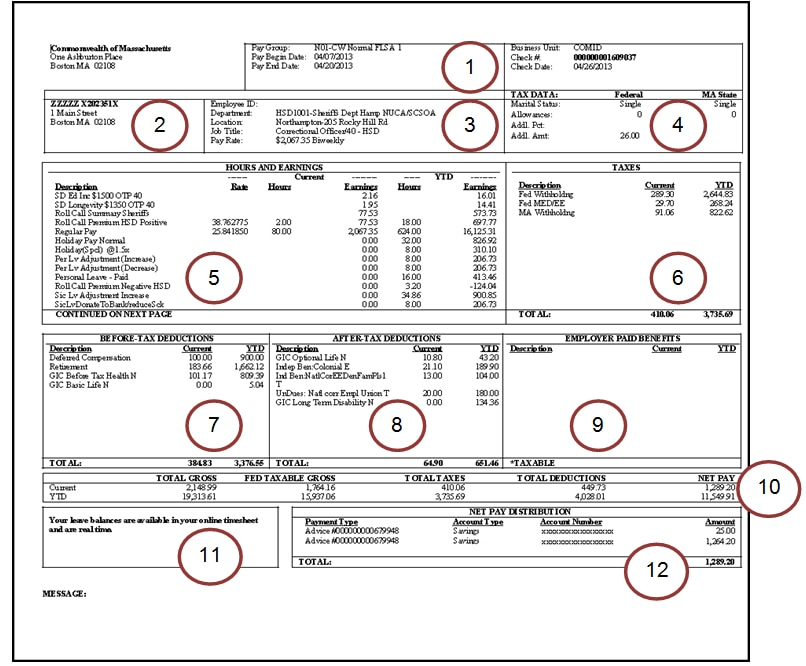

It is important to specify the amount of the withholding allowance you wish to claim on the W-4 form. This is critical since your wages could depend on the tax amount you have to pay.

The amount of allowances that you are entitled to will be determined by the various aspects. For example If you’re married, you could be qualified for an exemption for your household or head. The amount you earn will also impact the amount of allowances you’re qualified to receive. If you have high income it could be possible to receive a higher allowance.

Selecting the appropriate amount of tax deductions can help you avoid a hefty tax payment. In fact, if you file your annual income tax return, you might even get a refund. Be cautious regarding how you go about this.

You must do your homework the same way you would with any financial choice. To determine the amount of tax withholding allowances to be claimed, you can make use of calculators. Another option is to talk to a professional.

Sending specifications

Employers are required to report any withholding taxes that are being taken from employees. You may submit documentation to the IRS to collect a portion of these taxes. There are other forms you might need for example, a quarterly tax return or withholding reconciliation. Here are some details about the various types of tax withholding forms along with the filing deadlines.

The bonuses, salary commissions, other earnings you earn from your employees could necessitate you to file withholding tax returns. It is also possible to be reimbursed for taxes withheld if your employees received their wages in time. It is important to keep in mind that not all of these taxes are local taxes. In certain situations the rules for withholding can be different.

As per IRS regulations Electronic filing of forms for withholding are required. The Federal Employer identification number should be listed when you point your national tax return. If you don’t, you risk facing consequences.