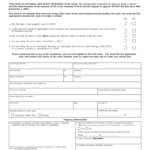

Maryland Withholding Form 2024 – There are a variety of reasons why someone might choose to fill out a tax form. These factors include the requirements for documentation, exemptions to withholding, as well as the amount of required withholding allowances. However, if one chooses to submit the form there are some points to be aware of.

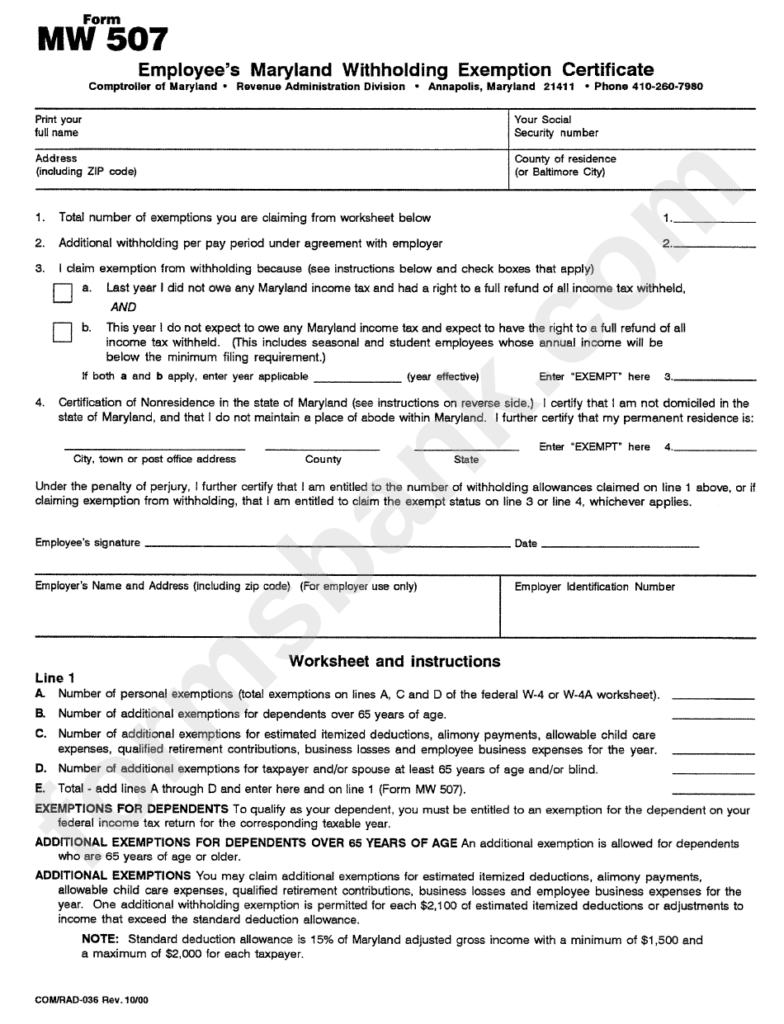

Withholding exemptions

Non-resident aliens are required to submit Form 1040-NR at a minimum once a year. You may be eligible to submit an exemption form for withholding, in the event that you meet all criteria. This page will provide all exclusions.

If you are submitting Form1040-NR to the IRS, include Form 1042S. This document is required to report the federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. Please ensure you are entering the right information when filling in this form. One person may be treated if the information is not supplied.

The tax withholding rate for non-resident aliens is 30%. Nonresident aliens could be qualified for exemption. This is when your tax burden is less than 30 percent. There are numerous exemptions. Some of these exclusions are only applicable to spouses and dependents such as children.

In general, refunds are offered for the chapter 4 withholding. As per Sections 1471 to 1474, refunds can be made. These refunds are made by the withholding agent (the person who is responsible for withholding tax at the source).

Status of the relationship

The work of your spouse and you can be made easier by the proper marriage status withholding form. You’ll be amazed at the amount you can deposit at the bank. The problem is picking the right bank out of the many choices. You should be careful when you make a decision. Unwise decisions could lead to costly consequences. If you stick to the directions and watch out for any potential pitfalls, you won’t have problems. If you’re lucky enough, you could even meet new friends while traveling. Today is your anniversary. I’m hoping you’ll use it against them in order to get the elusive diamond. It is best to seek the advice of a certified tax expert to ensure you’re doing it right. The accumulation of wealth over time is more than the modest payment. There are a myriad of online resources that can provide you with details. TaxSlayer and other trusted tax preparation firms are some of the best.

The number of withholding allowances claimed

In submitting Form W-4 you should specify the number of withholding allowances you wish to claim. This is crucial since the tax amount taken from your paychecks will depend on how you withhold.

You may be eligible to claim an exemption for the head of your household when you’re married. The amount you earn will also impact how much allowances you’re eligible to claim. If you earn a high amount you may be eligible to receive a higher allowance.

A tax deduction that is appropriate for you could help you avoid large tax payments. If you file your annual income tax return, you could even receive a refund. But, you should be careful about how you approach the tax return.

Like any financial decision, you must conduct your own research. Calculators can be utilized to determine how many withholding allowances are required to be claimed. You may also talk to an expert.

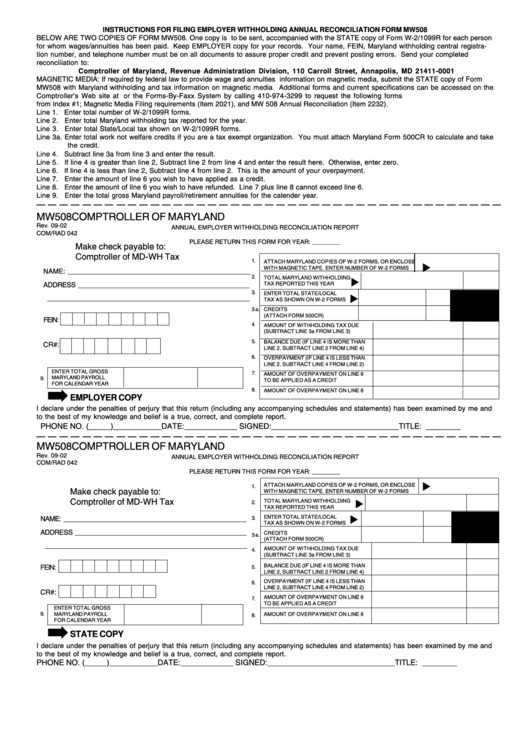

Specifications for filing

Employers must inform the IRS of any withholding taxes being paid by employees. If you are taxed on a specific amount you can submit paperwork to IRS. Additional paperwork that you may need to submit include the reconciliation of your withholding tax and quarterly tax returns and the annual tax return. Below are details about the different withholding tax forms and their deadlines.

You may have to file tax returns withholding for the income you receive from your employees, including bonuses and commissions or salaries. If you make sure that your employees are paid on time, you may be eligible for the refund of taxes that you withheld. Remember that these taxes could be considered as taxation by the county. There are specific tax withholding strategies that could be appropriate in particular circumstances.

The IRS regulations require you to electronically file withholding documents. When you file your national revenue tax return make sure you include the Federal Employer Identification number. If you don’t, you risk facing consequences.

Gallery of Maryland Withholding Form 2024

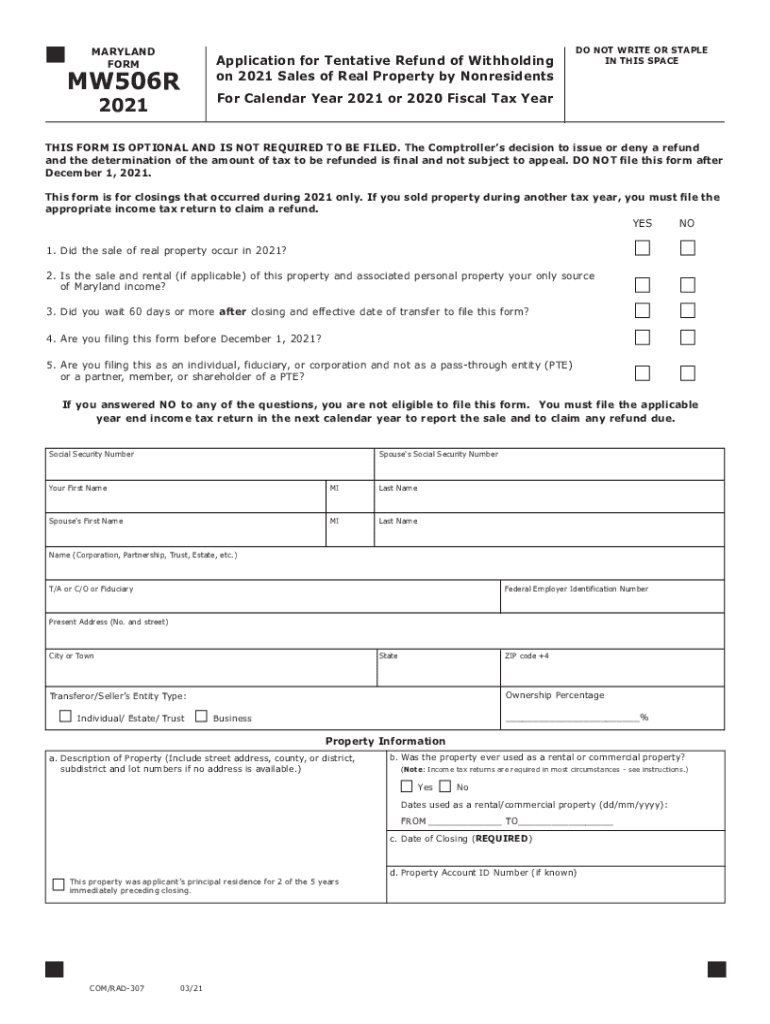

Maryland Withholding Form 2021 2022 W4 Form