Maryland Tax Withholding Form – There are many reasons one might choose to fill out forms for withholding. This is due to the requirement for documentation, exemptions to withholding, as well as the amount of the required withholding allowances. You must be aware of these factors regardless of the reason you decide to submit a request form.

Withholding exemptions

Non-resident aliens must submit Form 1040–NR every calendar year. If you meet these conditions, you could be eligible to receive exemptions from the form for withholding. This page lists all exemptions.

The first step in submitting Form 1040 – NR is attaching Form 1042 S. The document is required to record federal income tax. It details the withholding of the withholding agent. Make sure you enter the right information when filling in this form. If this information is not supplied, one person may be taken into custody.

The tax withholding rate for non-resident aliens is 30 percent. You could be eligible to be exempted from withholding if the tax burden exceeds 30%. There are numerous exemptions. Certain exclusions are only available to spouses or dependents, such as children.

Generally, a refund is offered for the chapter 4 withholding. Refunds can be made under Sections 1400 to 1474. The refunds are given by the withholding agent (the person who collects tax at the source).

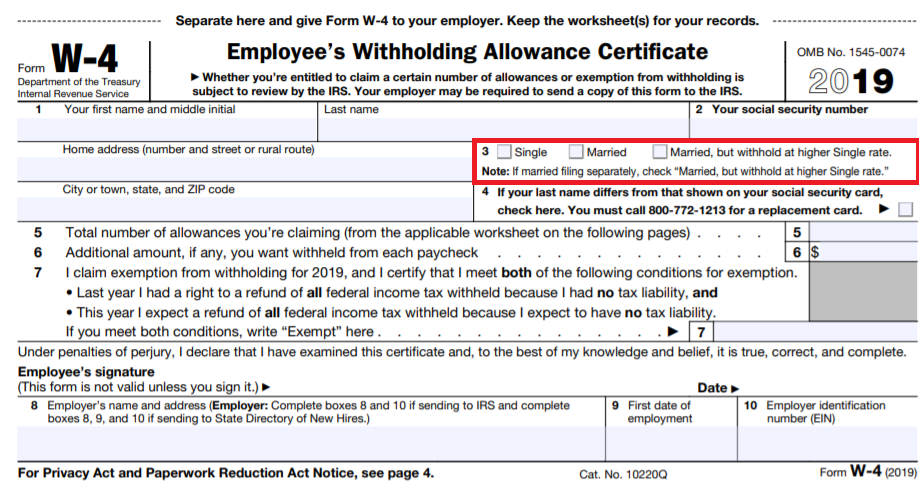

relationship status

An appropriate marital status that is withheld will make it easier for both of you to accomplish your job. The bank might be shocked by the amount that you have to deposit. Knowing which of the several possibilities you’re likely choose is the challenge. There are some things you shouldn’t do. The wrong decision can cost you dearly. However, if the instructions are adhered to and you are attentive you shouldn’t face any problems. If you’re lucky enough, you could even make new acquaintances while you travel. In the end, today is the date of your wedding anniversary. I’m hoping that you can leverage it to secure that dream wedding ring. If you want to get it right you’ll require the help of a certified accountant. It’s worthwhile to create wealth over a lifetime. You can find plenty of information on the internet. TaxSlayer and other reputable tax preparation firms are some of the top.

Amount of withholding allowances claimed

When filling out the form W-4 you file, you should indicate how many withholding allowances are you asking for. This is crucial since the amount of tax withdrawn from your paycheck will be affected by how you withhold.

You may be eligible to claim an exemption for your head of household in the event that you are married. Your income also determines the amount of allowances you’re eligible to claim. If you have a high income, you could be eligible to request an increase in your allowance.

You could save thousands of dollars by choosing the correct amount of tax deductions. If you submit your annual income tax return, you may even receive a refund. However, you must choose your approach carefully.

It is essential to do your homework, just like you would for any financial option. Calculators are available to aid you in determining the amount of withholding allowances you can claim. Other options include talking to an expert.

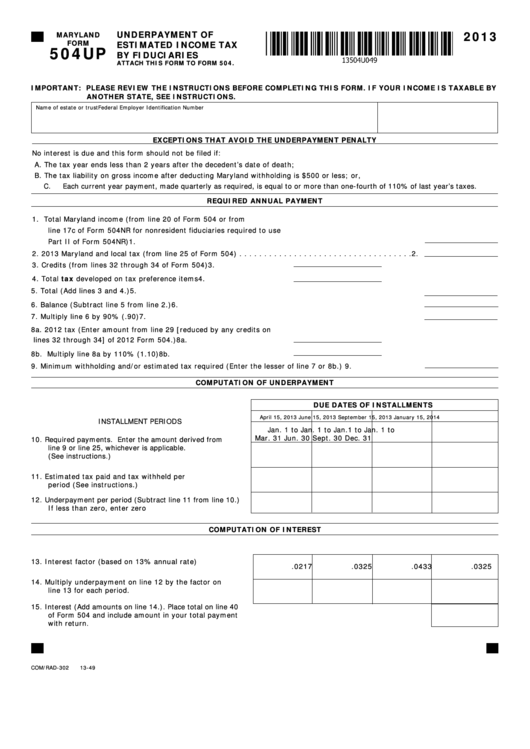

Specifications that must be filed

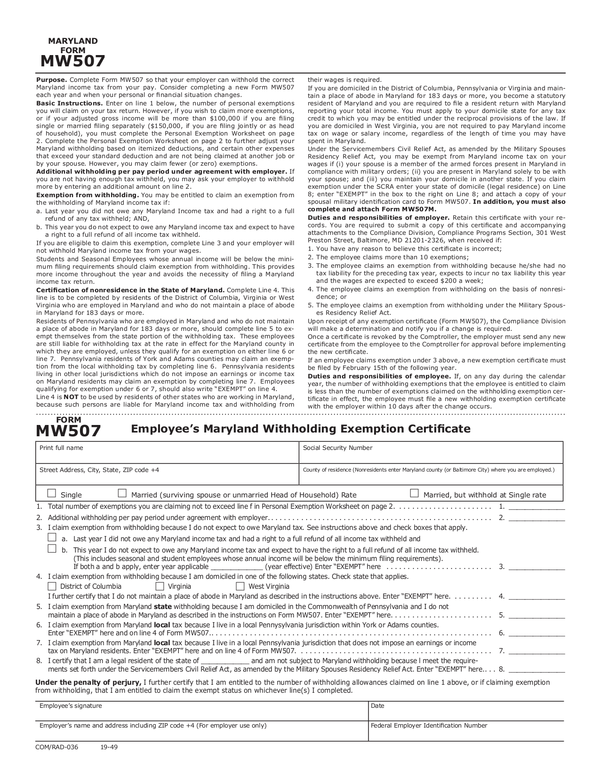

Employers are required to report any withholding tax that is being collected from employees. You can submit paperwork to the IRS to collect a portion of these taxation. A tax reconciliation for withholding and an annual tax return for quarterly filing, or an annual tax return are all examples of additional paperwork you might need to submit. Here are some information on the different types of tax forms for withholding as well as the filing deadlines.

You may have to file tax returns withholding in order to report the income you get from your employees, like bonuses, commissions, or salary. You could also be eligible to be reimbursed for taxes withheld if your employees were paid on time. Noting that certain of these taxes are county taxes, is also vital. Furthermore, there are special withholding practices that can be applied under particular situations.

According to IRS regulations, electronic filing of forms for withholding are required. Your Federal Employer Identification Number must be listed on your tax return for national revenue. If you don’t, you risk facing consequences.