Maricopa Superior Court Wage Withholding Form – There stand a digit of explanations why somebody could decide to fill out a tax form. The requirements for documentation, exemptions from withholding as well as the quantity of withholding allowances required are just a few of the factors. However, if the person decides to fill out an application, there are a few points to be aware of.

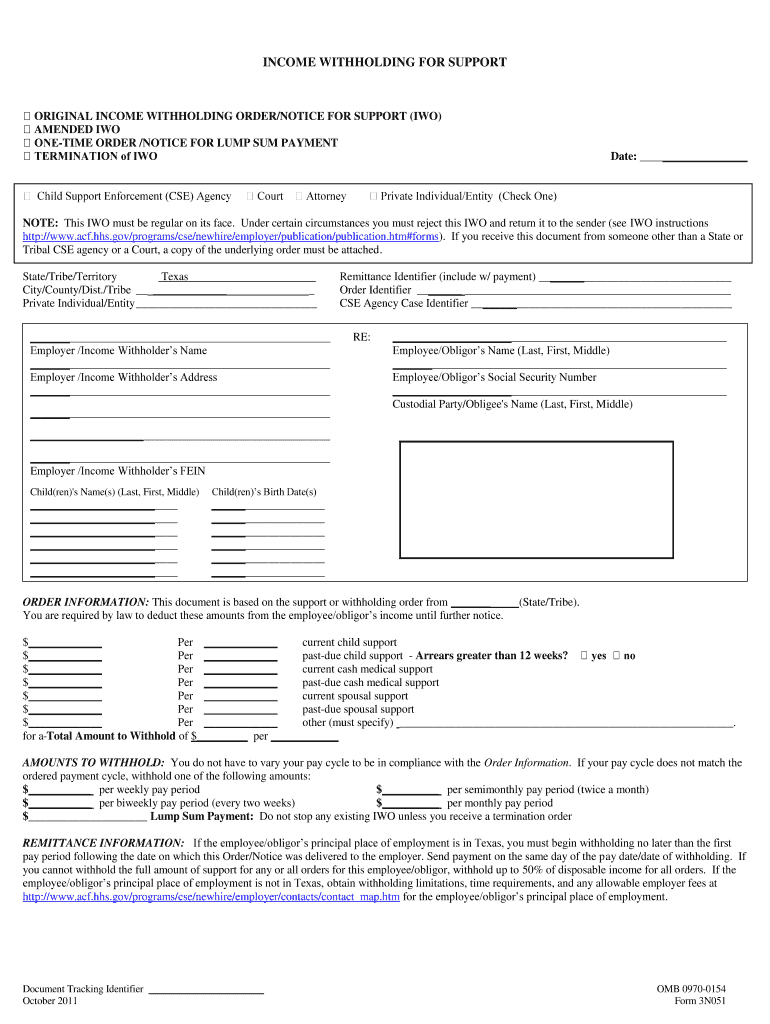

Withholding exemptions

Nonresident aliens are required to complete Form 1040-NR every year. If you meet the requirements you may be eligible for an exemption to withholding. The following page lists all exclusions.

To file Form 1040-NR the first step is attaching Form 1042S. This form provides details about the withholding that is performed by the agency responsible for withholding for federal income tax reporting purposes. When filling out the form, make sure you fill in the correct details. You could be required to treat a specific person if you don’t provide this information.

Nonresident aliens have a 30% withholding tax. If your tax burden is lower than 30 percent of your withholding, you may qualify to be exempt from withholding. There are many exemptions. Some are only for spouses or dependents like children.

Generally, withholding under Chapter 4 gives you the right to the right to a refund. Refunds are permitted under Sections 1471-1474. Refunds are given by the tax agent. The withholding agent is the individual responsible for withholding the tax at the point of origin.

Status of the relationship

The marital withholding form is a good way to simplify your life and aid your spouse. You’ll be surprised at how much money you can put in the bank. The challenge is picking the right bank out of the many options. There are some things you should not do. There will be a significant cost if you make a wrong choice. You won’t have any issues if you just follow the directions and pay attention. If you’re lucky, you may even meet new friends while you travel. Today is your birthday. I’m sure you’ll take advantage of it to locate that perfect ring. It’s a difficult job that requires the knowledge of a tax professional. A lifetime of wealth is worth the tiny amount. There is a wealth of details online. TaxSlayer is a well-known tax preparation business, is one of the most effective.

The number of withholding allowances claimed

When you fill out Form W-4, you need to specify how many withholding allowances you want to claim. This is essential as the tax withheld will impact how much is taken from your paychecks.

There are a variety of factors that affect the allowances requested.If you’re married for instance, you might be eligible to claim an exemption for the head of household. The amount you’re eligible to claim will depend on the income you earn. If you have high income it could be possible to receive higher amounts.

It can save you thousands of dollars by determining the right amount of tax deductions. In fact, if you file your annual income tax return, you could even be eligible for a tax refund. It is essential to choose the right approach.

Like any financial decision you make it is crucial to do your homework. To figure out the amount of withholding allowances to be claimed, you can use calculators. It is also possible to speak with a specialist.

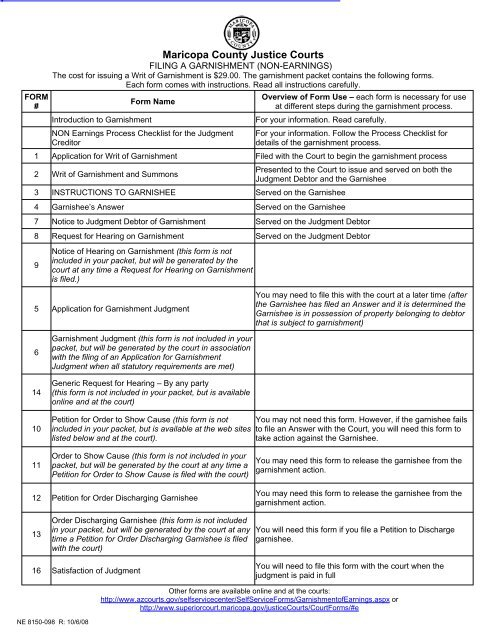

Specifications that must be filed

Employers must inform the IRS of any withholding taxes being collected from employees. A few of these taxes may be filed with the IRS through the submission of paperwork. Additional paperwork that you may be required to file include a withholding tax reconciliation and quarterly tax returns and an annual tax return. Here’s some details about the various tax forms and when they need to be filed.

In order to be qualified for reimbursement of withholding taxes on the salary, bonus, commissions or other income received from your employees it is possible to submit withholding tax return. It is also possible to be reimbursed for tax withholding if your employees received their wages in time. It is important to note that some of these taxes are also county taxes must also be noted. There are certain tax withholding strategies that could be suitable in certain situations.

You must electronically submit withholding forms according to IRS regulations. Your Federal Employer Identification number must be included when you submit your national tax return. If you don’t, you risk facing consequences.