Ma Tax Withholding Form – There are numerous reasons that a person may decide to submit an application for withholding. The requirements for documentation, exemptions from withholding and the amount of withholding allowances required are just a few of the factors. Whatever the reason behind a person to file a document, there are certain things you must keep in mind.

Withholding exemptions

Non-resident aliens are required to submit Form 1040NR once every year. You could be eligible to file an exemption form for withholding tax if you meet all the criteria. The exemptions listed on this page are yours.

The attachment of Form 1042-S is the first step to submit Form 1040-NR. The form provides information about the withholding that is performed by the tax agency that handles withholding to report federal income tax purposes. Be sure to enter the right information when filling out this form. If the information you provide is not given, a person could be diagnosed with a medical condition.

Non-resident aliens are subjected to 30 percent withholding. You could be eligible to receive an exemption from withholding if the tax burden is higher than 30%. There are many exemptions. Some are for spouses or dependents, for example, children.

Generally, a refund is accessible for Chapter 4 withholding. Refunds can be granted under Sections 471 through 474. Refunds are given to the tax agent withholding, the person who withholds taxes from the source.

Status of the relationship

A marital withholding form is a good way to simplify your life and assist your spouse. The bank may be surprised by the amount that you have to deposit. Knowing which of the several options you’re likely to decide is the biggest challenge. There are certain things you should be aware of. A bad decision could cause you to pay a steep price. It’s not a problem if you just follow the directions and be attentive. If you’re lucky, you might find some new acquaintances while driving. Today is the anniversary day of your wedding. I’m hoping they can turn it against you to help you get the perfect engagement ring. You’ll want the assistance of a certified tax expert to ensure you’re doing it right. It’s worthwhile to accumulate wealth over a lifetime. Online information is easily accessible. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

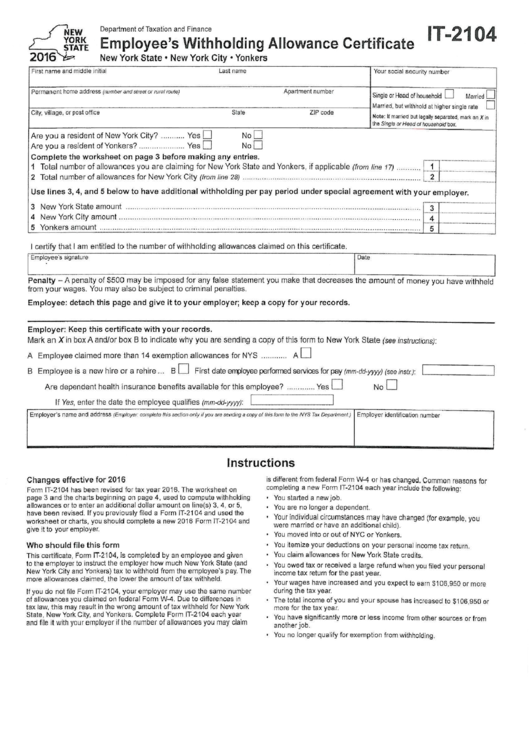

The number of withholding allowances that were claimed

When filling out the form W-4 you file, you should specify how many withholding allowances are you seeking. This is essential since the withholdings will have an impact on how much tax is taken from your paychecks.

A variety of factors influence the allowances requested.If you’re married, as an example, you may be eligible to claim an exemption for head of household. Your income also determines how many allowances you are qualified to receive. A higher allowance may be granted if you make an excessive amount.

A tax deduction that is suitable for you can help you avoid large tax bills. In fact, if you submit your annual income tax return, you may even be eligible for a tax refund. However, you must choose your strategy carefully.

Research like you would with any financial decision. Calculators can assist you in determining how much withholding allowances you can claim. A professional may be an alternative.

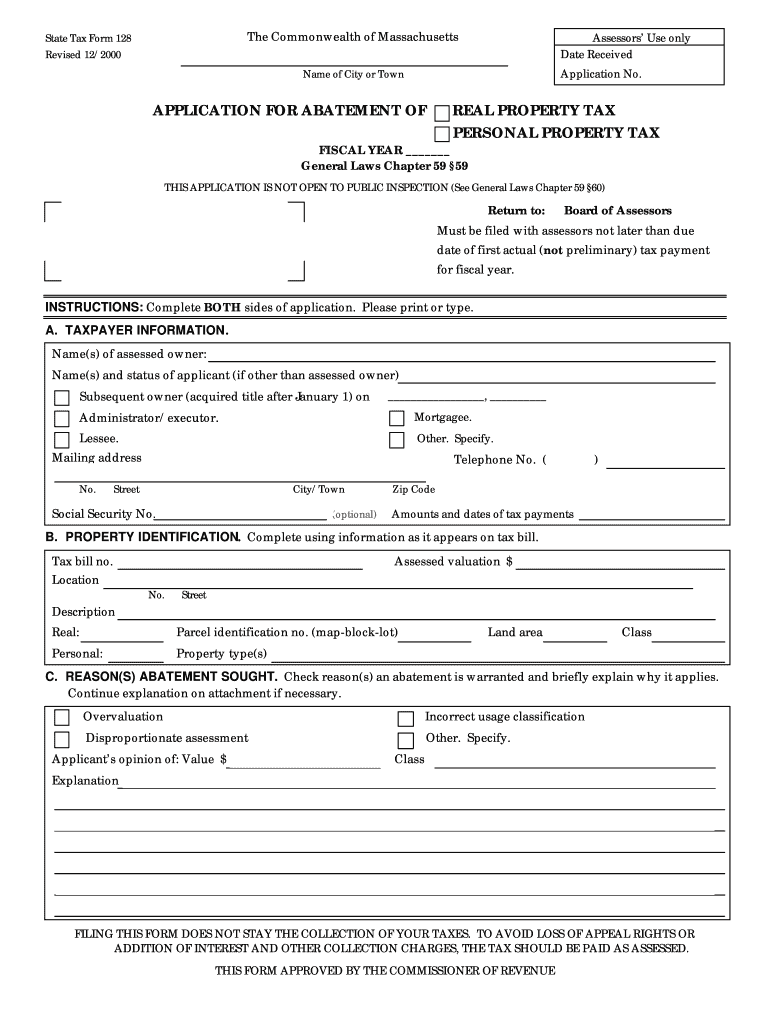

Filing specifications

Employers should report the employer who withholds tax from employees. You can submit paperwork to the IRS for a few of these taxes. A tax return that is annually filed, quarterly tax returns or tax withholding reconciliations are just a few types of documents you could require. Here’s a brief overview of the different tax forms, and when they need to be filed.

Tax withholding returns can be required for income like bonuses, salary or commissions as well as other earnings. Additionally, if your employees are paid in time, you could be eligible for tax refunds for withheld taxes. You should also remember that some of these taxes may be county taxes. There are also unique withholding methods that are utilized in certain circumstances.

The IRS regulations require that you electronically file withholding documents. It is mandatory to provide your Federal Employer Identification Number when you file your national income tax return. If you don’t, you risk facing consequences.