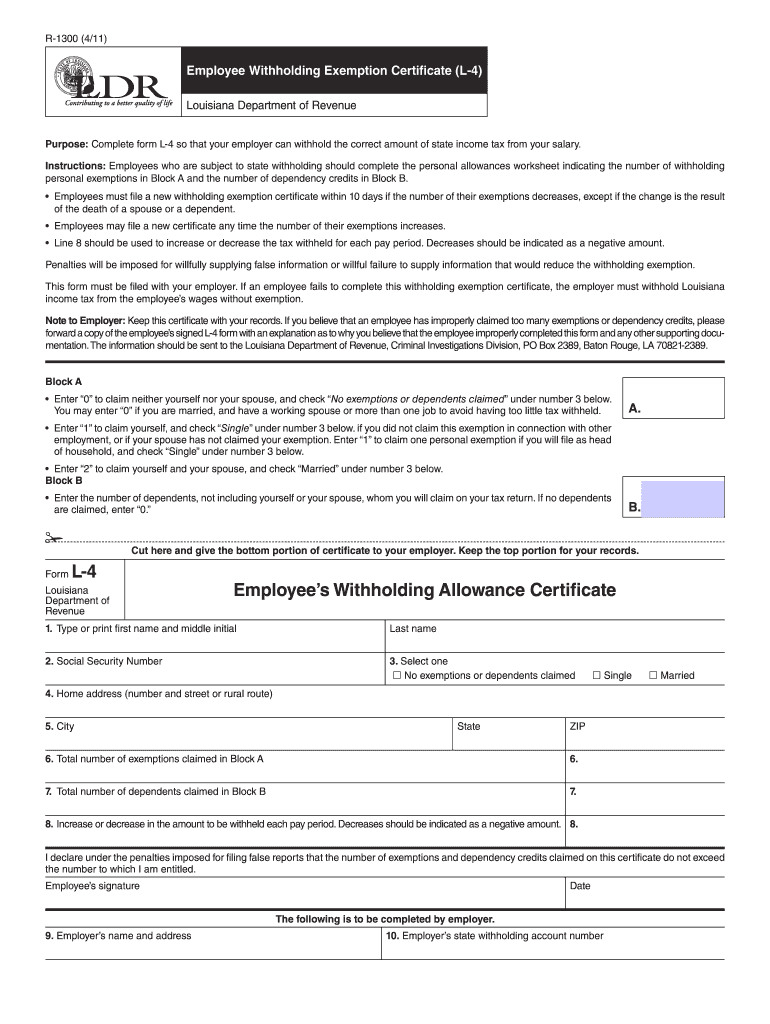

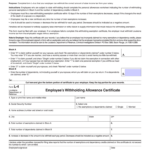

Louisiana Tax Withholding Form L-4 2024 – There are many reasons an individual might decide to fill out withholding forms. This includes documentation requirements, withholding exemptions, and the amount of requested withholding allowances. No matter the reason for an individual to file an application, there are certain things you must keep in mind.

Withholding exemptions

Non-resident aliens must submit Form 1040NR once every year. If you meet the requirements you could be qualified for exemption from withholding. The following page lists all exemptions.

For submitting Form 1040-NR attach Form 1042-S. This form is used to report the federal income tax. It outlines the withholding by the withholding agent. Fill out the form correctly. If the correct information isn’t supplied, one person may be diagnosed with a medical condition.

The non-resident alien tax withholding tax rate is 30 percent. A nonresident alien may be qualified for an exemption. This applies if your tax burden is less than 30 percent. There are many different exemptions. Some of them are intended to be used by spouses, while some are meant for use by dependents like children.

In general, chapter 4 withholding allows you to receive a refund. According to Sections 1471 through 1474, refunds can be made. These refunds are provided by the tax agent (the person who collects tax at source).

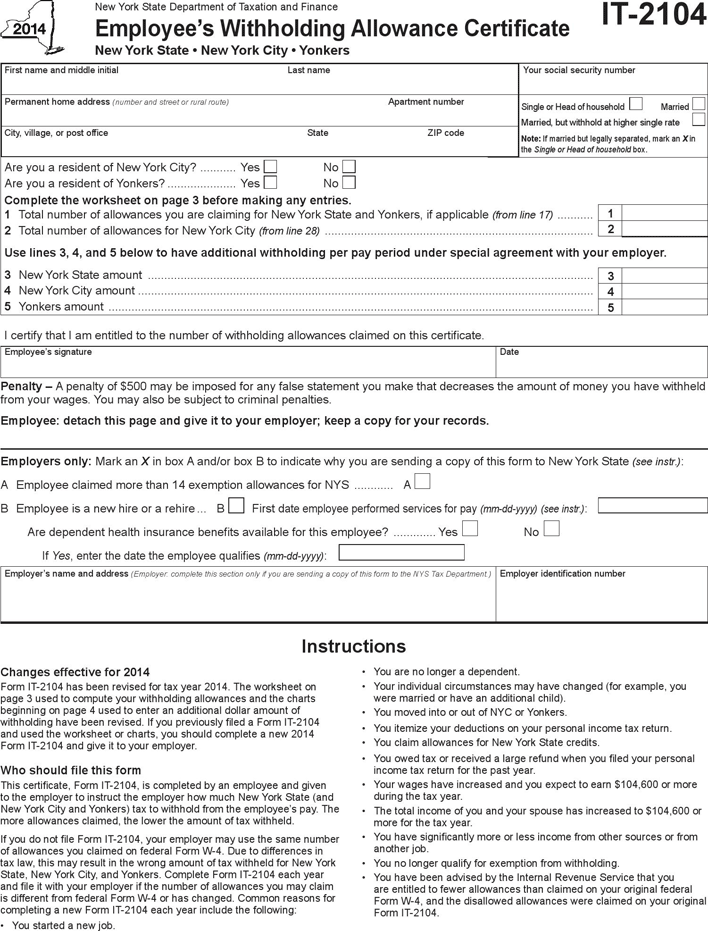

Status of the relationship

The proper marital status and withholding forms will ease the work of you and your spouse. The bank might be shocked by the amount that you have to deposit. The problem is deciding which one of the many options to choose. Be cautious about when you make a decision. It can be expensive to make the wrong decision. It’s not a problem when you follow the directions and pay attention. If you’re lucky you may even meet a few new pals when you travel. Today is the day you celebrate your wedding. I’m hoping you’ll be able to use it against them to search for that one-of-a-kind engagement ring. To complete the task correctly, you will need to get the help from a qualified tax professional. A lifetime of wealth is worth that modest payment. There is a wealth of information online. TaxSlayer, a reputable tax preparation company is among the most useful.

Number of claimed withholding allowances

It is essential to state the amount of the withholding allowance you would like to claim on the Form W-4. This is crucial since the tax withheld will affect how much is taken from your paycheck.

Many factors determine the amount that you can claim for allowances. The amount you earn will also impact how much allowances you’re eligible to claim. You could be eligible to claim more allowances if make a lot of money.

Selecting the appropriate amount of tax deductions might save you from a large tax bill. If you file your annual tax returns, you may even be eligible for a refund. However, you must choose the right method.

Like any other financial decision, you must do your research. Calculators can be utilized to determine how many allowances for withholding need to be requested. A professional might be a viable alternative.

Specifications to be filed

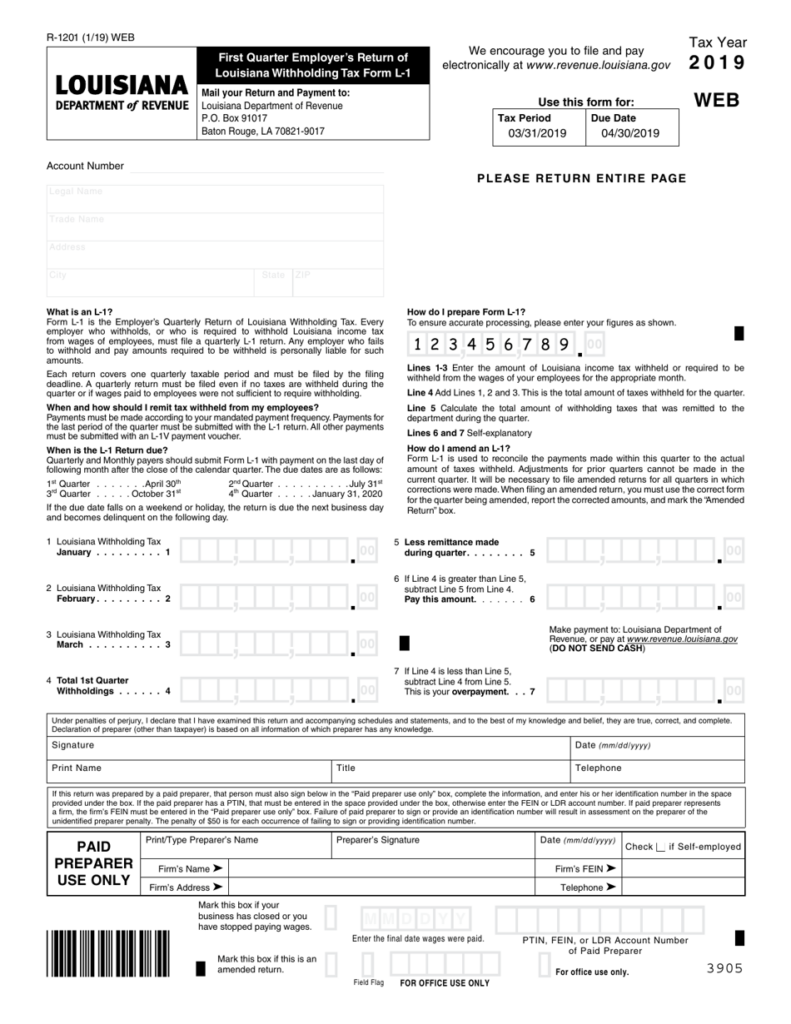

If you are an employer, you must collect and report withholding taxes from your employees. You can submit paperwork to the IRS to collect a portion of these taxes. A tax return for the year and quarterly tax returns as well as withholding tax reconciliation are all examples of paperwork you might need. Below are details on the various forms of withholding tax and the deadlines for filing them.

To be eligible to receive reimbursement for tax withholding on salary, bonus, commissions or other income received from your employees it is possible to submit a tax return withholding. Additionally, if your employees are paid in time, you could be eligible to get reimbursement of withheld taxes. The fact that certain taxes are also county taxes must be taken into consideration. There are also specific withholding techniques that can be used in certain circumstances.

You have to submit electronically tax withholding forms as per IRS regulations. If you are submitting your tax return for national revenue be sure to include your Federal Employer Identification number. If you don’t, you risk facing consequences.

Gallery of Louisiana Tax Withholding Form L-4 2024

Form L 1 R 1201 Download Fillable PDF Or Fill Online First Quarter