Louisiana State Tax Withholding Form 2024 – There are many reasons one might choose to fill out forms withholding. These factors include documentation requirements as well as exemptions from withholding, as well as the amount of withholding allowances. There are certain things you should remember, regardless of the reason a person files a form.

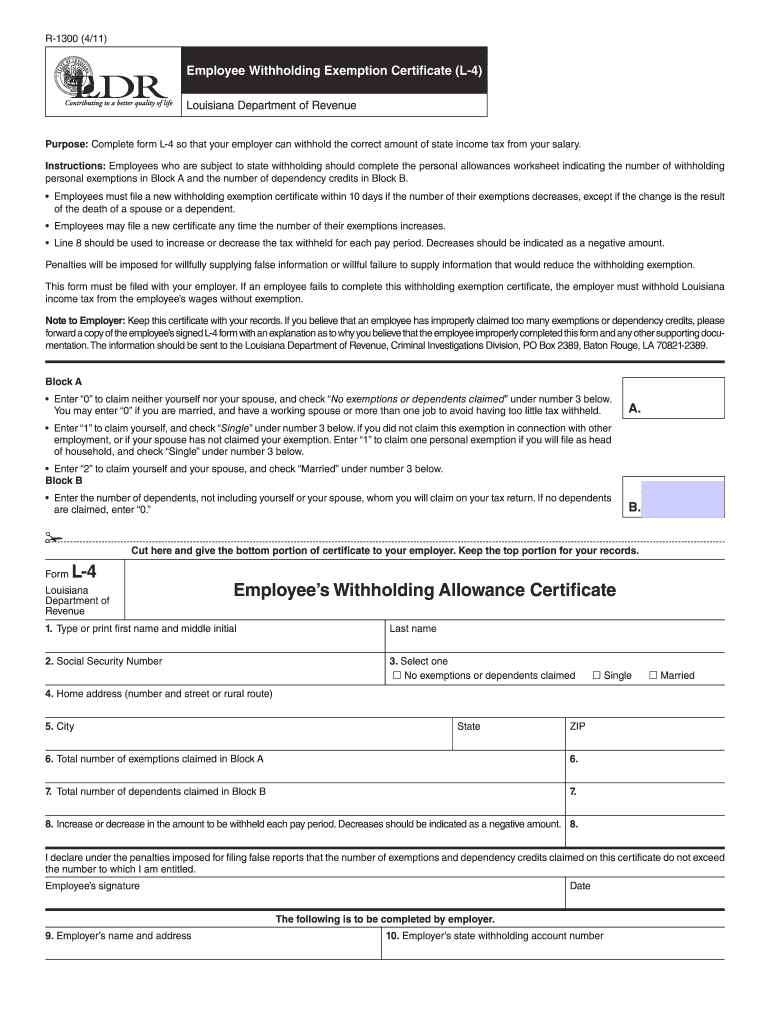

Withholding exemptions

Nonresident aliens need to submit Form 1040–NR every calendar year. It is possible to apply for an exemption for withholding tax in the event that you meet all conditions. This page you’ll find the exclusions for you to choose from.

Attaching Form 1042-S is the first step in submitting Form 1040-NR. The form is used to report the federal income tax. It outlines the amount of withholding that is imposed by the tax withholding agent. Complete the form in a timely manner. One person may be treated if this information is not supplied.

Nonresident aliens have 30 percent withholding tax. Your tax burden is not to exceed 30% to be exempt from withholding. There are numerous exemptions. Some of these exclusions are only for spouses or dependents like children.

In general, you’re eligible to receive a refund under chapter 4. Refunds are granted in accordance with Sections 1400 through 1474. These refunds must be made by the withholding agents that is, the person who collects taxes at source.

Status of relationships

A proper marital status withholding can make it simpler for both you and your spouse to do your work. Furthermore, the amount of money you can put at the bank can delight you. It isn’t easy to determine which of the many options you’ll pick. There are some things you should avoid doing. It’s costly to make a wrong choice. If you adhere to the rules and pay attention to instructions, you won’t encounter any issues. If you’re lucky you may even meet acquaintances while traveling. Today is your birthday. I’m hoping you can leverage it to find that perfect wedding ring. You’ll want the assistance of a tax professional certified to complete it correctly. It’s worthwhile to create wealth over the course of a lifetime. There is a wealth of information online. TaxSlayer, a reputable tax preparation firm, is one of the most useful.

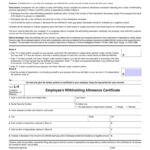

The amount of withholding allowances that were requested

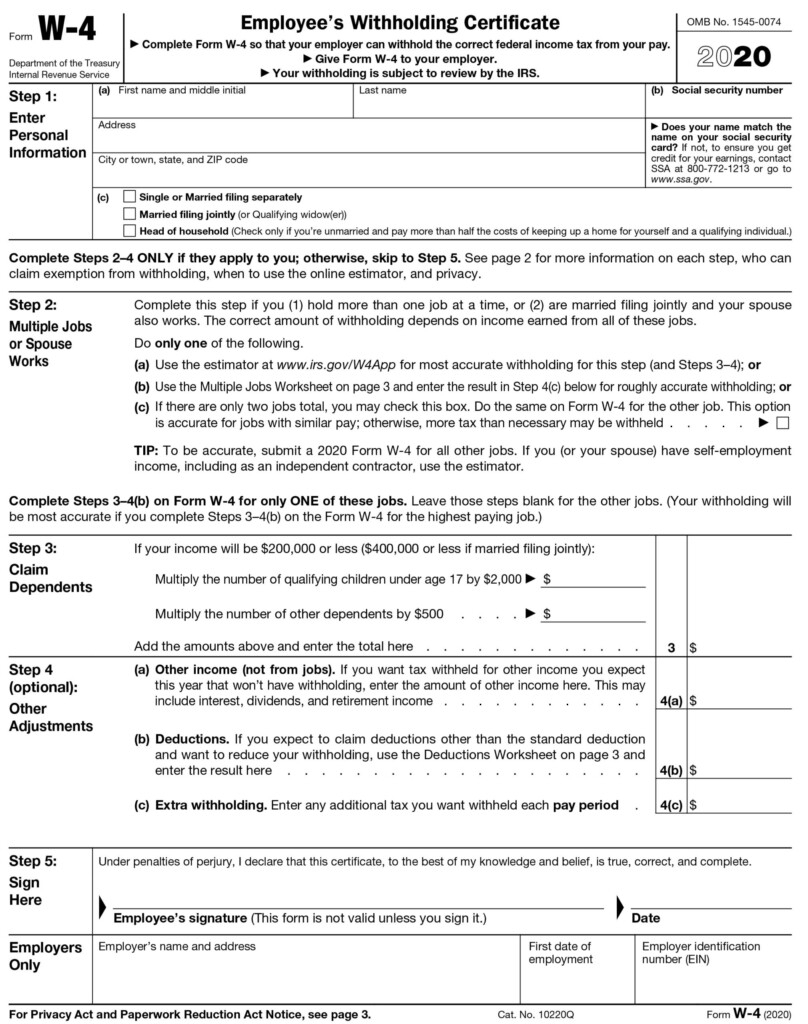

In submitting Form W-4 you need to specify how many withholding allowances you wish to claim. This is essential because the tax amount withdrawn from your paychecks will be affected by how you withhold.

You may be able to request an exemption for the head of your household when you’re married. Your income can impact how many allowances are offered to you. An additional allowance could be available if you earn a lot.

A tax deduction that is appropriate for your situation could allow you to avoid tax payments. Additionally, you may even receive a tax refund if your annual income tax return is filed. It is essential to select the correct method.

Similar to any financial decision, you should do your homework. Calculators are available to help you determine how much withholding allowances must be claimed. As an alternative contact a specialist.

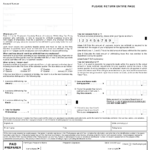

Formulating specifications

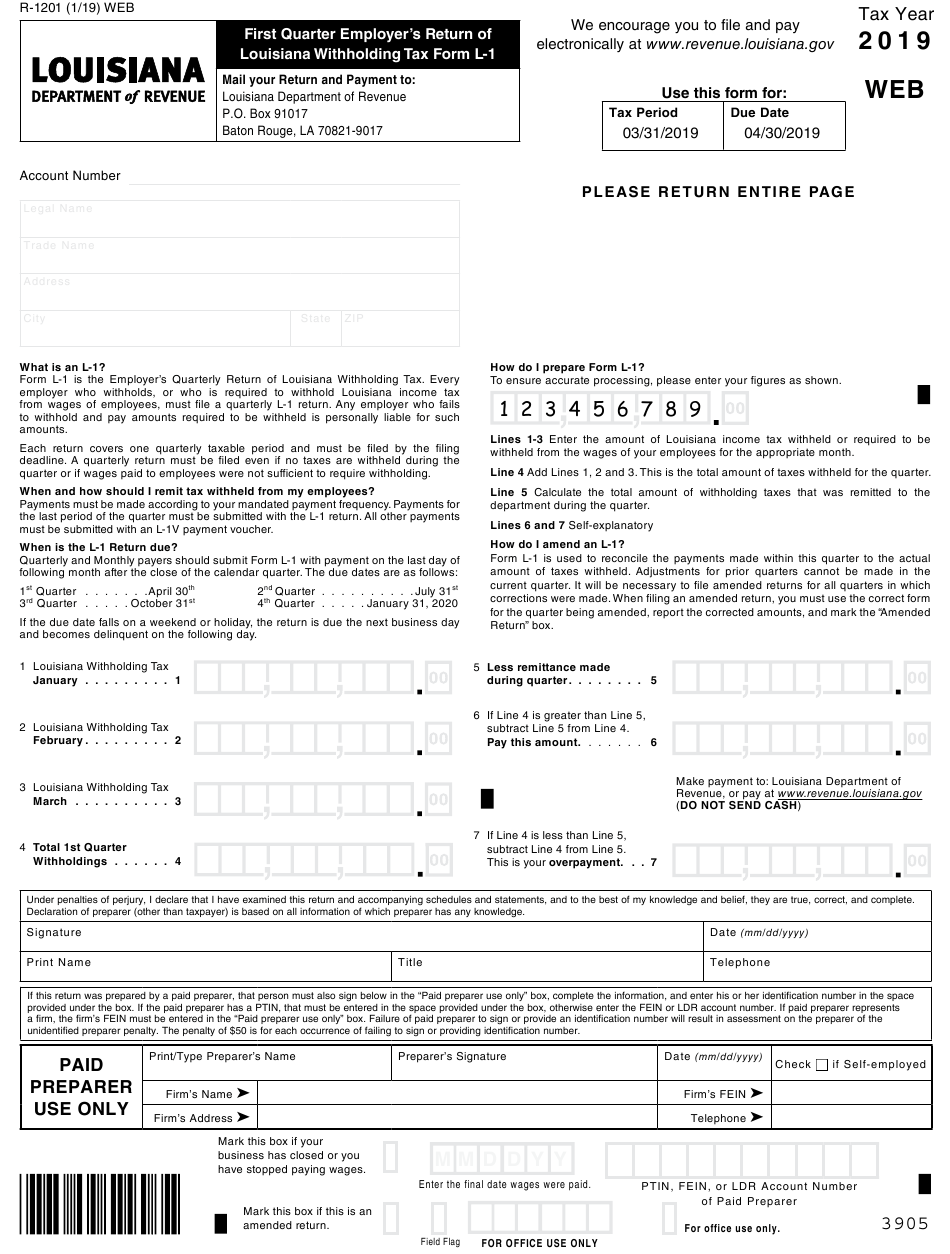

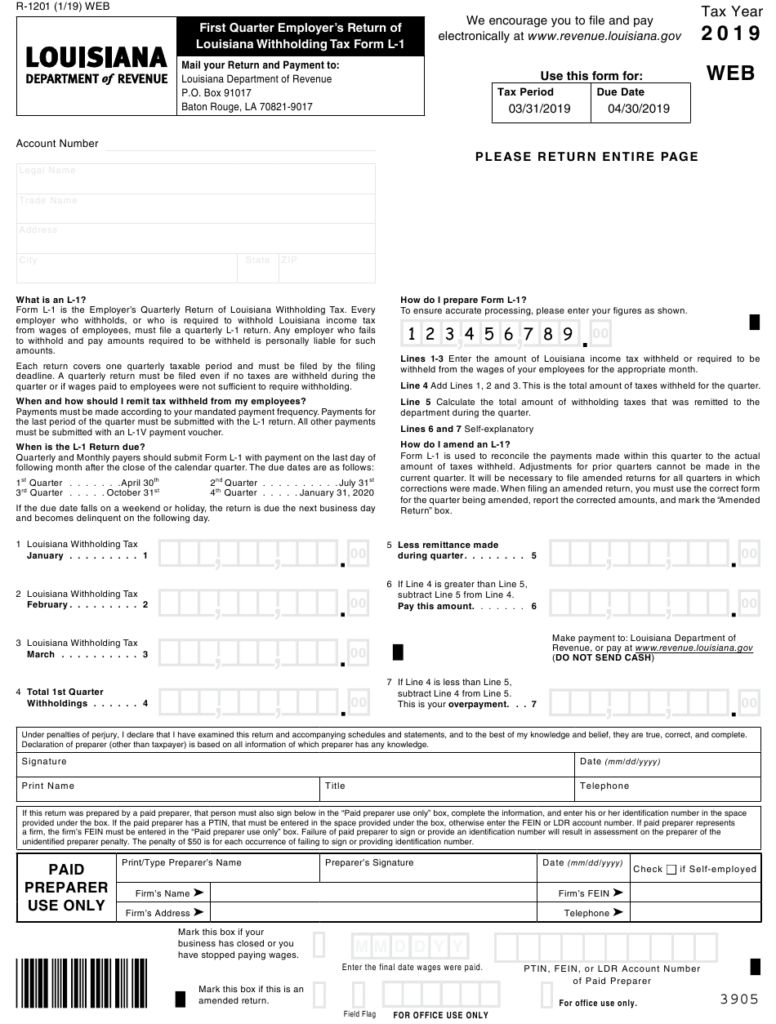

Withholding tax from your employees have to be reported and collected in the event that you’re an employer. If you are taxed on a specific amount you can submit paperwork to the IRS. A tax return that is annually filed and quarterly tax returns, or tax withholding reconciliations are just a few examples of paperwork you might require. Here’s some information about the various tax forms and when they need to be submitted.

Tax withholding returns can be required for certain incomes like bonuses, salary, commissions and other income. In addition, if you pay your employees on time you may be eligible to receive reimbursement for taxes not withheld. It is important to note that some of these taxes are taxation by county is vital. There are certain withholding strategies that may be appropriate in particular situations.

You have to submit electronically withholding forms in accordance with IRS regulations. You must include your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.