Louisiana Employee Withholding Form 2024 – There are many reasons for a person to decide to complete a withholding form. These factors include the requirements for documentation, withholding exemptions and also the amount of required withholding allowances. However, if one chooses to submit a form it is important to remember a few things to keep in mind.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040-NR at a minimum once a year. If your requirements are met, you may be eligible for an exemption from withholding. This page will provide the exclusions.

The first step for filling out Form 1040-NR is attaching the Form 1042 S. This form is a record of the withholdings made by the agency. Be sure to enter the right information when filling in this form. There is a possibility for one individual to be treated in a manner that is not correct if the information is not given.

The non-resident alien tax withholding rate is 30. Your tax burden should not exceed 30% in order to be eligible for exemption from withholding. There are many exemptions. Certain are only for spouses and dependents, such as children.

In general, refunds are offered for the chapter 4 withholding. As per Sections 1471 to 1474, refunds are granted. Refunds are provided by the agent who withholds tax. The withholding agent is the individual responsible for withholding the tax at the point of origin.

Relational status

The work of your spouse and you will be made easy with a valid marriage-related status withholding document. Additionally, the quantity of money you can put at the bank could surprise you. It can be difficult to decide which of the many options is most attractive. Undoubtedly, there are some items you must avoid. A bad decision can cost you dearly. You won’t have any issues when you adhere to the instructions and be attentive. If you’re lucky you might make new acquaintances on your journey. In the end, today is the anniversary of your wedding. I’m sure you’ll be able to make use of it to get that elusive wedding ring. It is best to seek the advice of a tax professional certified to finish it properly. It’s worth it to build wealth over the course of your life. You can get a ton of information online. TaxSlayer, a reputable tax preparation business is among the most effective.

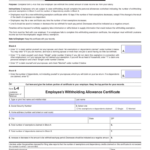

The amount of withholding allowances that are claimed

In submitting Form W-4 you must specify how many withholding allowances you wish to claim. This is crucial because your pay will be affected by the amount of tax that you pay.

There are many variables that affect the allowance amount you can request. If you’re married, you may be qualified for an exemption for head of household. The amount of allowances you are eligible for will be contingent on the income you earn. You could be eligible to claim a greater allowance if you have a large amount of income.

It is possible to save money on a tax bill by selecting the right amount of tax deductions. You could actually receive the amount you owe if you submit the annual tax return. But, you should be careful about how you approach the tax return.

Like any financial decision, it is important that you should conduct your homework. Calculators can help determine the number of withholdings that need to be demanded. Alternative options include speaking with a specialist.

Submission of specifications

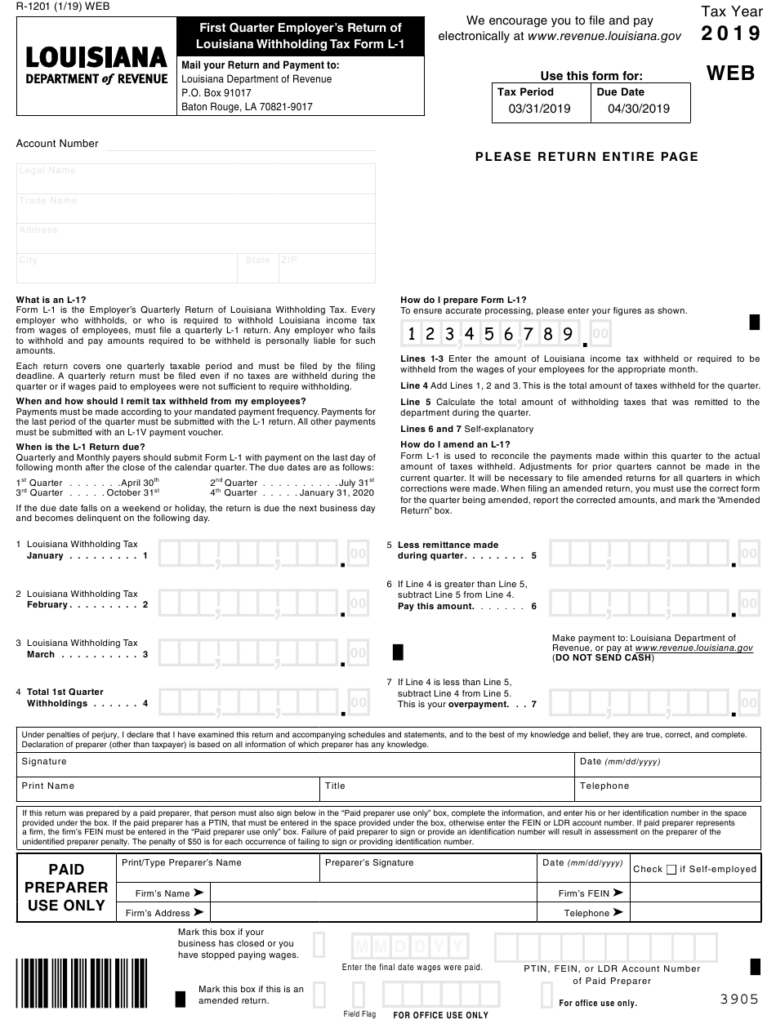

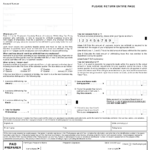

Employers must take withholding tax from their employees and then report it. If you are taxed on a specific amount you might need to submit documentation to IRS. You may also need additional forms that you might need for example, a quarterly tax return or withholding reconciliation. Here’s some information about the different tax forms and the time when they should be submitted.

It is possible that you will need to file tax returns withholding for the income you receive from your employees, including bonuses, commissions, or salary. If you make sure that your employees are paid on time, then you could be eligible for the refund of taxes that you withheld. You should also remember that some of these taxes could be considered to be local taxes. There are also unique withholding strategies which can be utilized in specific situations.

In accordance with IRS rules, you must electronically file withholding forms. Your Federal Employer Identification Number must be listed on your national revenue tax return. If you don’t, you risk facing consequences.