La Withholding Tax Form – There are many reasons that one could fill out an application for withholding. Withholding exemptions, documentation requirements and the amount of allowances for withholding required are just a few of the factors. You must be aware of these things regardless of the reason you decide to file a request form.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR every calendar year. You may be eligible to apply for an exemption from withholding when you meet the conditions. On this page, you will discover the exemptions for you to choose from.

The first step to filling out Form 1040-NR is to attach the Form 1042 S. The form outlines the withholdings that the agency makes. When filling out the form make sure you fill in the exact information. It is possible that you will have to treat a single person for not providing the correct information.

Non-resident aliens have to pay a 30% withholding rate. Exemption from withholding could be granted if you have a an income tax burden of lower than 30%. There are many exemptions that are available. Some are specifically for spouses, and dependents, such as children.

In general, withholding under Chapter 4 entitles you for a return. Refunds are granted according to Sections 1471-1474. The agent who withholds the tax or the person who collects the tax at source, is the one responsible for distributing these refunds.

Status of relationships

A form for a marital withholding is a good way to simplify your life and assist your spouse. You’ll be amazed at the amount you can deposit at the bank. It is difficult to decide which one of the options you’ll pick. You must be cautious in what you do. False decisions can lead to expensive negative consequences. However, if the instructions are adhered to and you are attentive to the rules, you shouldn’t have any issues. If you’re fortunate you may even meet acquaintances on your travels. After all, today marks the anniversary of your wedding. I’m hoping that you can utilize it in order to get that elusive diamond. You’ll want the assistance of a tax professional certified to complete it correctly. A lifetime of wealth is worth the modest payment. It is a good thing that you can access a ton of information online. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

Number of withholding allowances that are claimed

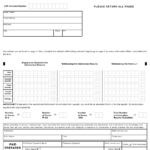

The W-4 form must be completed with the amount of withholding allowances that you would like to claim. This is crucial since the withholdings will effect on the amount of tax is taken from your pay checks.

There are many variables that influence the amount of allowances you are able to claim. If you’re married, you might be eligible for a head-of-household exemption. The amount of allowances you are eligible for will be contingent on the income you earn. An additional allowance could be available if you earn a lot.

It can save you lots of money by choosing the correct amount of tax deductions. It is possible to receive an income tax refund when you file your annual tax return. But be sure to choose your method carefully.

Like any other financial decision, you should conduct your homework. To figure out the amount of withholding allowances to be claimed, utilize calculators. Alternative options include speaking with an expert.

Formulating specifications

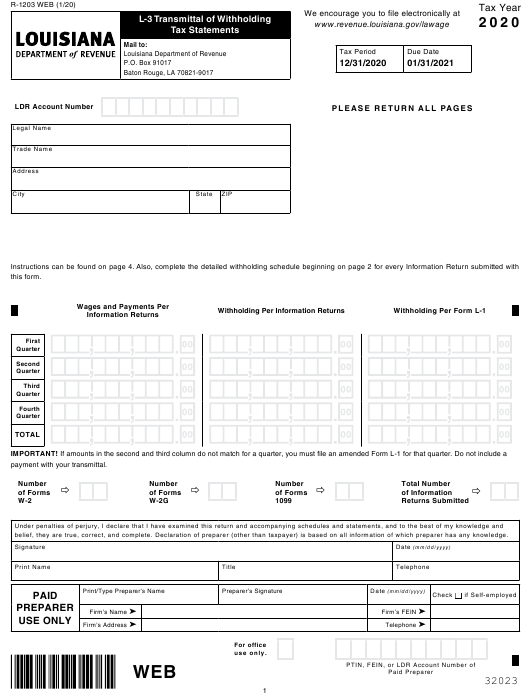

Employers must report any withholding tax that is being paid by employees. The IRS may accept forms for some of these taxes. You might also need additional documentation , like a withholding tax reconciliation or a quarterly return. Here’s a brief overview of the different tax forms and when they must be submitted.

Your employees might require the submission of withholding tax returns in order to receive their bonuses, salary and commissions. You may also be eligible to get reimbursements for tax withholding if your employees received their wages on time. It is important to note that certain taxes are county taxes should also be noted. In addition, there are specific withholding practices that can be implemented in specific circumstances.

The IRS regulations require you to electronically submit your withholding documentation. The Federal Employer Identification Number should be listed when you submit your national revenue tax return. If you don’t, you risk facing consequences.