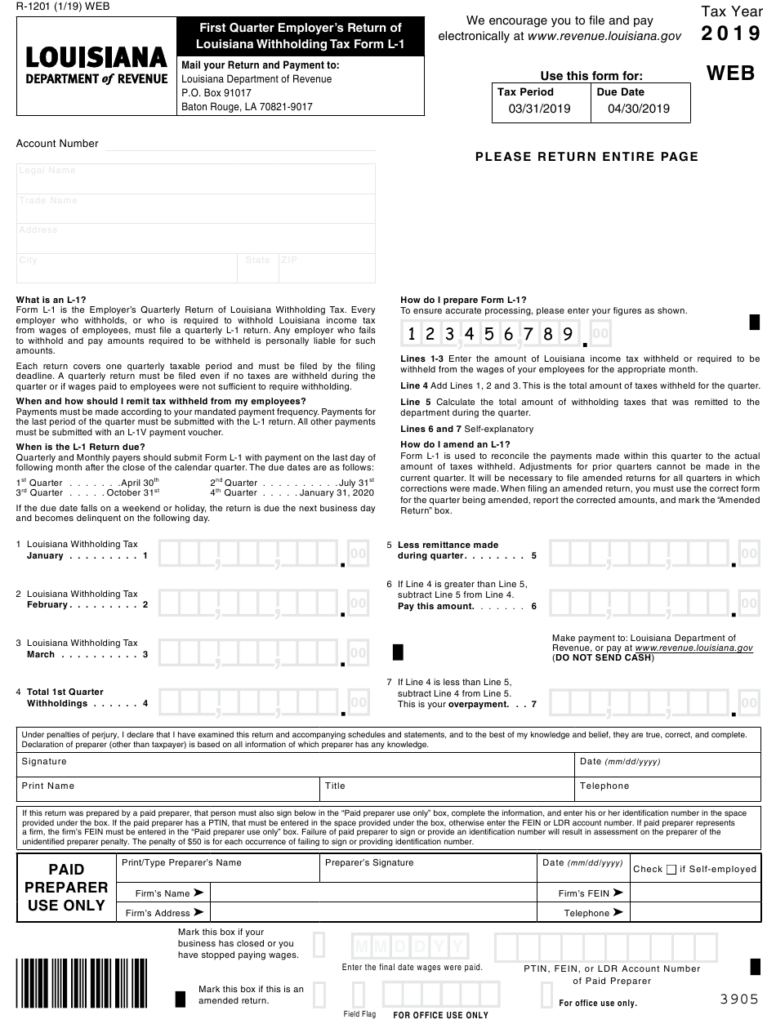

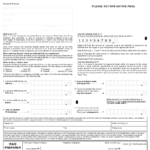

La Withholding Form – There stand a digit of reasons why someone might choose to complete a withholding form. These factors include the documents required, the exclusion of withholding, and the requested withholding allowances. There are some important things to keep in mind, regardless of the reason that a person has to fill out a form.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. It is possible to apply for an exemption from withholding when you meet the conditions. This page will list all exclusions.

The first step for submitting Form 1040 – NR is to attach Form 1042 S. This form lists the amount withheld by the withholding agencies for federal income tax reporting purposes. It is important to enter exact information when you fill out the form. There is a possibility for one person to be treated differently if the information is not given.

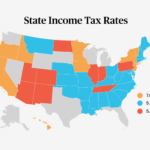

The rate of withholding for non-resident aliens is 30 percent. You may be eligible to receive an exemption from withholding if your tax burden exceeds 30%. There are numerous exemptions. Certain exclusions are only available to spouses or dependents like children.

You are entitled to refunds if you have violated the rules of chapter 4. As per Sections 1471 to 1474, refunds can be made. Refunds are given to the withholding agent the person who withholds the tax from the source.

Relational status

A valid marital status withholding will make it easier for both of you to complete your tasks. It will also surprise you how much you can make a deposit to the bank. Knowing which of the many options you’re likely to decide is the biggest challenge. Be cautious about when you make a decision. There are a lot of costs when you make a bad choice. But, if the directions are adhered to and you are attentive, you should not have any problems. You may make new acquaintances if lucky. Today is your birthday. I’m hoping they can reverse the tide to help you get the elusive engagement ring. You’ll want the assistance of a tax professional certified to ensure you’re doing it right. A lifetime of wealth is worth the small amount. Information on the internet is easily accessible. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

There are many withholding allowances that are being requested

On the W-4 form you fill out, you need to specify the amount of withholding allowances you asking for. This is essential as the tax withheld will impact how much is taken from your paycheck.

The amount of allowances you are entitled to will be determined by the various aspects. For example when you’re married, you might be entitled to an exemption for the head of household or for the household. Your income level can also impact how many allowances are accessible to you. If you earn a significant amount of income, you may be eligible for a larger allowance.

A tax deduction that is suitable for you can aid you in avoiding large tax payments. In addition, you could even receive a tax refund if the annual tax return is completed. It is important to be cautious regarding how you go about this.

As with any financial decision, you should conduct your own research. Calculators can aid you in determining the amount of withholding allowances are required to be claimed. You may also talk to a specialist.

Formulating specifications

Employers should report the employer who withholds tax from their employees. The IRS may accept forms for certain taxes. You may also need additional forms that you could require, such as a quarterly tax return or withholding reconciliation. Here are some specifics regarding the various forms of tax forms for withholding as well as the filing deadlines.

Employees may need the submission of withholding tax return forms to get their bonuses, salary and commissions. If you make sure that your employees are paid on time, then you could be eligible for the refund of taxes that you withheld. Be aware that these taxes can be considered as local taxes. There are special methods of withholding that are appropriate in particular situations.

The IRS regulations require you to electronically file withholding documents. The Federal Employer Identification Number must be listed when you submit your national revenue tax return. If you don’t, you risk facing consequences.