Kentucky Withholding Form K 1 – There stand a digit of explanations why somebody could decide to fill out a tax form. These factors include documentation requirements as well as exemptions from withholding, as well as the amount of withholding allowances. It doesn’t matter what motive someone has to fill out the Form There are a few things to remember.

Withholding exemptions

Non-resident aliens must submit Form 1040 NR once each year. If you meet the criteria, you might be eligible to be exempt from withholding. There are exemptions that you can access on this page.

The attachment of Form 1042-S is the first step to file Form 1040-NR. This form details the withholdings made by the agency. When filling out the form, ensure that you provide the correct details. You could be required to treat a specific person for not providing this information.

The 30% non-resident alien tax withholding rate is 30. Your tax burden is not to exceed 30% in order to be eligible for exemption from withholding. There are many exemptions. Certain of them are applicable to spouses or dependents like children.

Generally, withholding under Chapter 4 entitles you for an amount of money back. As per Sections 1471 to 1474, refunds are given. The person who is the withholding agent or the person who is responsible for withholding the tax at source is responsible for the refunds.

Relationship status

The proper marital status and withholding forms can simplify the work of you and your spouse. Furthermore, the amount of money that you can deposit in the bank will pleasantly be awestruck. Knowing which of the several options you’re likely to choose is the challenge. You should be careful what you do. You will pay a lot in the event of a poor choice. But if you follow it and follow the instructions, you won’t have any issues. If you’re lucky, you could meet some new friends on your journey. Today marks the anniversary of your wedding. I’m hoping you’re capable of using this against them to obtain that wedding ring you’ve been looking for. In order to complete the job correctly it is necessary to obtain the assistance from a qualified tax professional. A small amount of money can create a lifetime of wealth. There are a myriad of websites that offer information. TaxSlayer and other reputable tax preparation firms are a few of the top.

The number of withholding allowances claimed

The W-4 form must be completed with the amount of withholding allowances you wish to claim. This is vital as it will impact the amount of tax you get from your wages.

You could be eligible to claim an exemption for your head of household when you’re married. Your income level can also affect the number of allowances available to you. You could be eligible to claim more allowances if earn a significant amount of money.

It could save you thousands of dollars by selecting the appropriate amount of tax deductions. If you file the annual tax return for income, you may even be entitled to a refund. But it is important to select the correct method.

Like any financial decision, you should do your research. Calculators can assist you in determining how much withholding allowances must be claimed. It is also possible to speak with an expert.

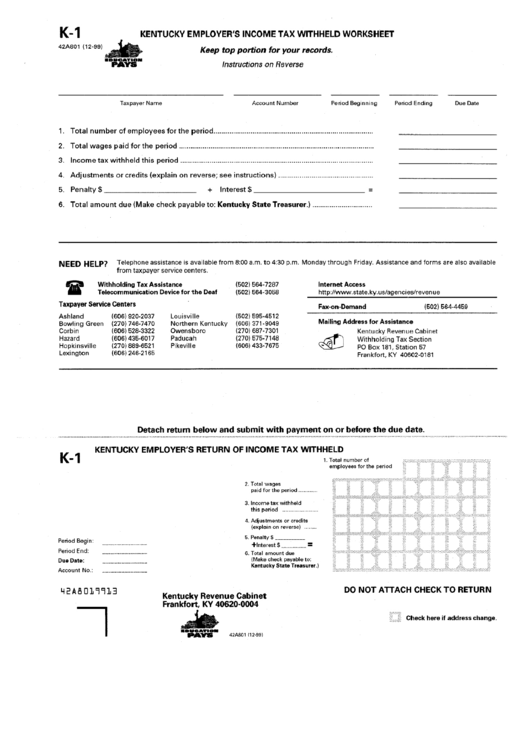

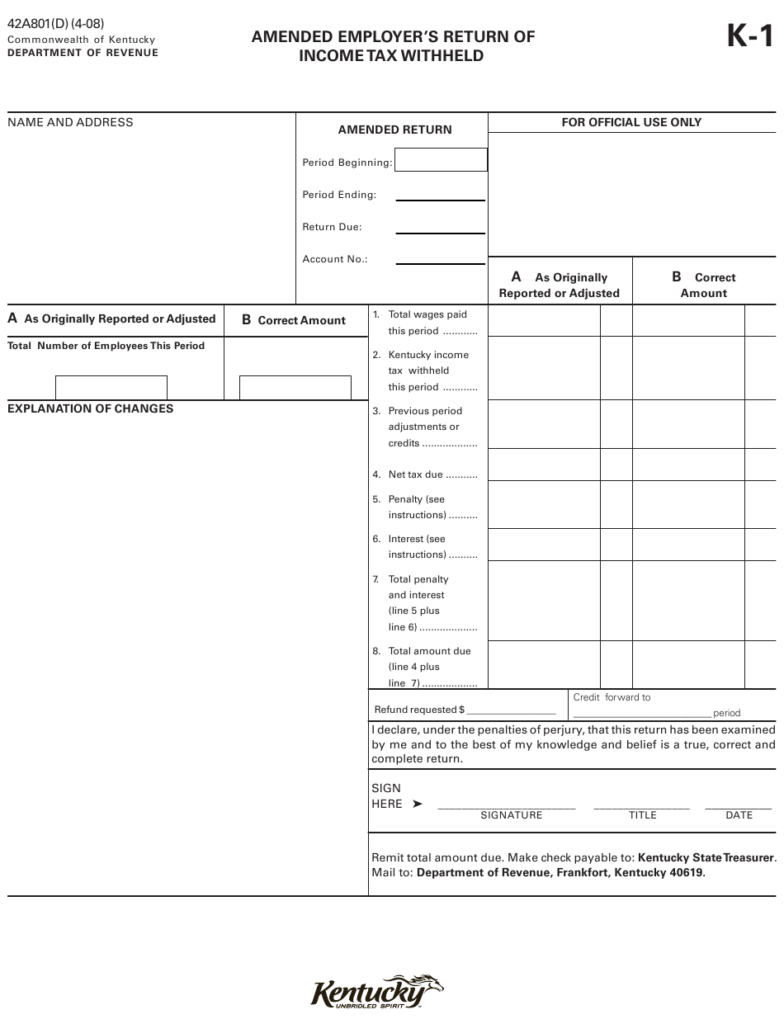

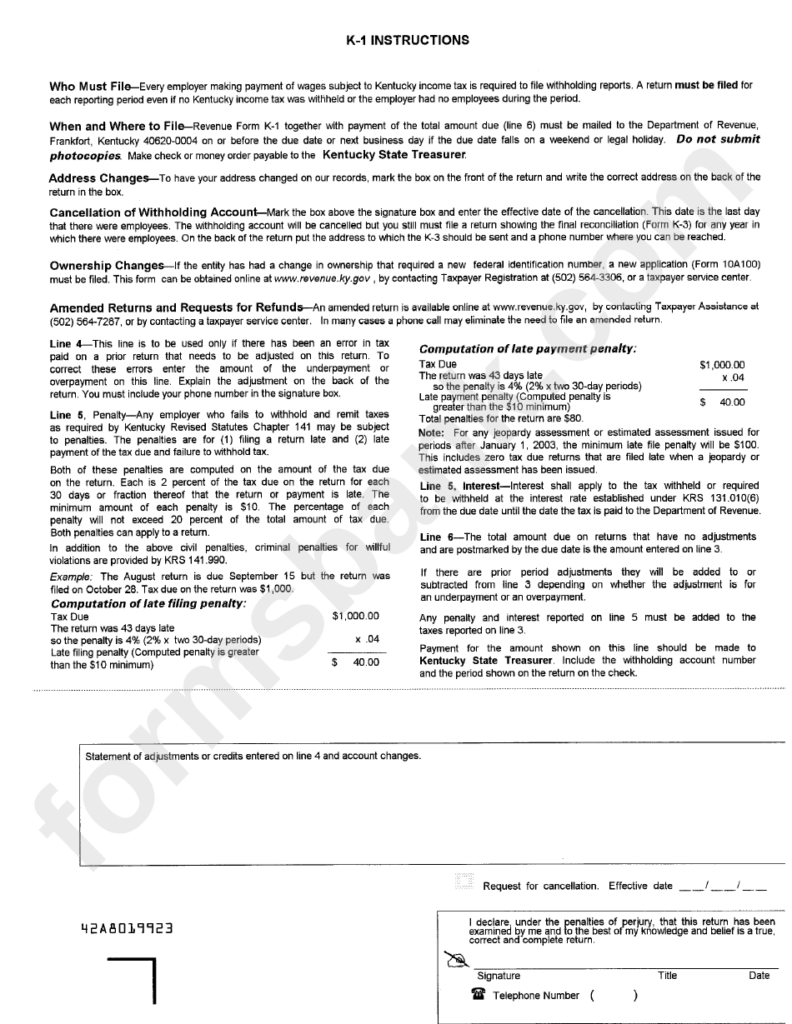

Specifications to be filed

Employers are required to report any withholding taxes that are being paid by employees. The IRS may accept forms for some of these taxes. A tax return for the year and quarterly tax returns, or tax withholding reconciliations are just a few kinds of documentation you may need. Below is information about the different forms of withholding taxes and the deadlines to file them.

It is possible that you will need to file withholding tax returns in order to report the income you get from your employees, like bonuses, commissions, or salary. It is also possible to get reimbursements for taxes withheld if your employees received their wages in time. The fact that certain taxes are county taxes ought to be taken into consideration. There are specific withholding strategies that may be applicable in specific situations.

The IRS regulations require you to electronically file withholding documents. The Federal Employer Identification number must be included when you submit at your national tax return. If you don’t, you risk facing consequences.