Kansas Withholding Tax Forms Kw-5 – There are a variety of reasons why someone could complete an application for withholding. These factors include documentation requirements and withholding exemptions. No matter why the person decides to fill out an application, there are a few points to be aware of.

Exemptions from withholding

Non-resident aliens must submit Form 1040 NR once every year. If the requirements meet, you may be eligible to request an exemption from withholding. There are exemptions that you can access on this page.

The first step for filling out Form 1040-NR is attaching the Form 1042 S. The form outlines the withholdings made by the agency. Make sure you fill out the form correctly. You may have to treat one person for not providing this information.

The non-resident alien tax withholding tax rate is 30. If your tax burden is less than 30% of your withholding, you may qualify for an exemption from withholding. There are many exclusions. Some are specifically for spouses, and dependents, such as children.

Generally, a refund is accessible for Chapter 4 withholding. Refunds can be made under Sections 1400 to 1474. These refunds must be made by the withholding agents, which is the person who is responsible for withholding taxes at the source.

Relational status

The marital withholding form can simplify your life and assist your spouse. You’ll be amazed by the amount of money you can deposit to the bank. The trick is to decide which one of the many options to choose. Certain issues should be avoided. There will be a significant cost if you make a wrong choice. If you stick to the instructions and watch out for any potential pitfalls and pitfalls, you’ll be fine. If you’re lucky, you could be able to make new friends during your trip. In the end, today is the date of your wedding anniversary. I hope you are capable of using this against them in order to acquire that elusive wedding ring. If you want to get it right, you will need the help of a certified accountant. The little amount is worthwhile for the lifetime of wealth. Information on the internet is readily available. Reputable tax preparation firms like TaxSlayer are one of the most useful.

There are numerous withholding allowances being made available

The form W-4 should be completed with the amount of withholding allowances you want to be able to claim. This is important because the tax withheld can affect the amount taken out of your paychecks.

The amount of allowances that you get will be contingent on the various aspects. For instance when you’re married, you may be entitled to a head or household exemption. The amount you earn can impact how many allowances are accessible to you. If you earn a high amount it could be possible to receive more allowances.

A proper amount of tax deductions will help you avoid a significant tax charge. You may even get an income tax refund when you file the annual tax return. But be sure to choose your approach carefully.

Research as you would with any financial decision. Calculators can assist you in determining the number of withholdings that need to be requested. You can also speak to an expert.

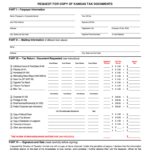

Sending specifications

Employers should report the employer who withholds tax from employees. For certain taxes you might need to submit documentation to the IRS. A withholding tax reconciliation or an annual tax return for quarterly filing, as well as the annual tax return are some examples of other paperwork you may be required to submit. Here are some specifics on the different types of withholding tax forms along with the deadlines for filing.

The salary, bonuses commissions, other income you get from employees might require you to file tax returns withholding. Additionally, if you pay your employees on-time it could be possible to qualify to receive reimbursement for taxes that were taken out of your paycheck. It is important to note that not all of these taxes are local taxes. You may also find unique withholding methods that are utilized in certain situations.

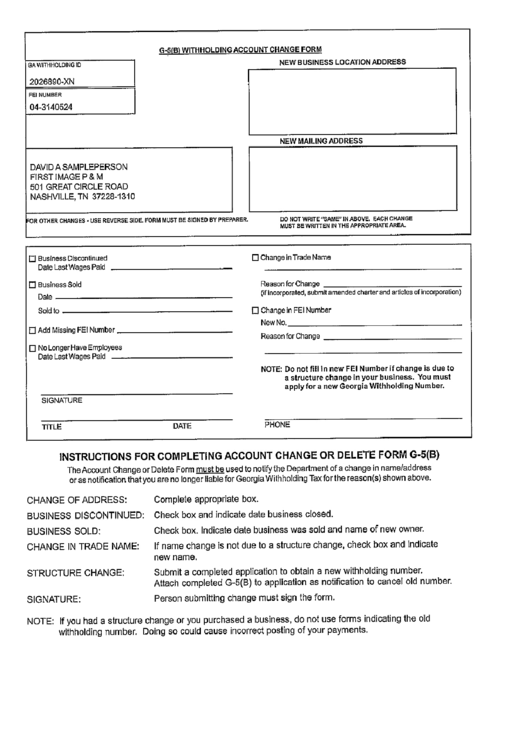

You are required to electronically submit tax withholding forms as per IRS regulations. The Federal Employer Identification Number should be listed when you submit to your national tax return. If you don’t, you risk facing consequences.