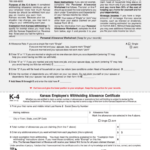

Kansas Withholding Tax Form – There are a variety of explanations why somebody could decide to fill out a tax form. Documentation requirements, withholding exemptions as well as the quantity of allowances for withholding requested are all factors. There are certain things you should remember, regardless of the reason that a person has to fill out the form.

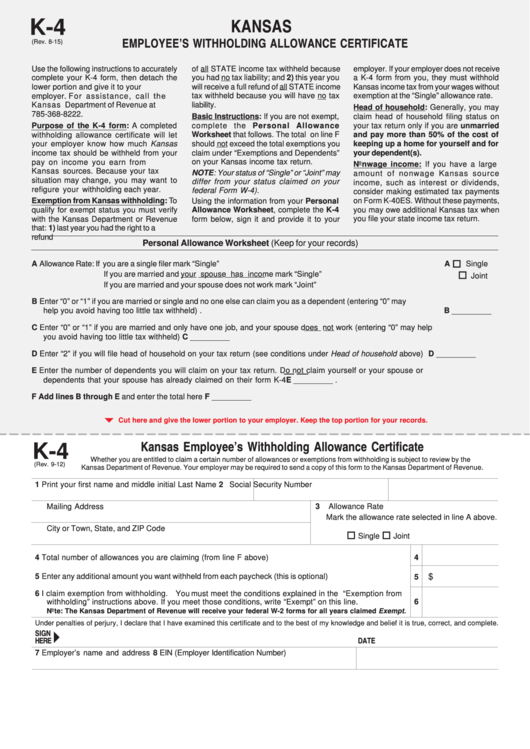

Exemptions from withholding

Non-resident aliens must submit Form 1040 NR once per year. It is possible to file an exemption form from withholding when you meet the conditions. On this page, you will find the exclusions available to you.

When submitting Form1040-NR, Attach Form 1042S. The form lists the amount withheld by the tax withholding authorities for federal tax reporting purposes. Make sure you fill out the form correctly. This information might not be disclosed and cause one person to be treated differently.

Nonresident aliens have 30 percent withholding tax. Non-resident aliens may be eligible for an exemption. This applies when your tax burden is less than 30%. There are numerous exemptions. Certain of them are applicable to spouses and dependents, such as children.

Generally, withholding under Chapter 4 gives you the right to the right to a refund. Refunds are permitted under Sections 1471-1474. These refunds are made by the agent who withholds tax (the person who is responsible for withholding tax at source).

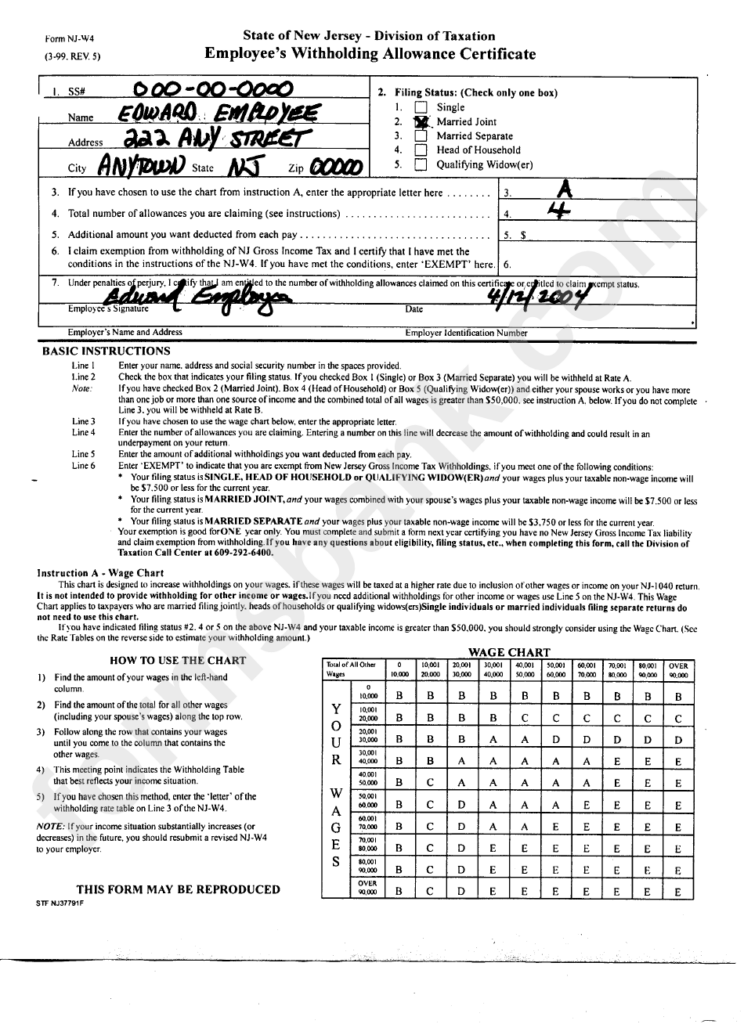

Status of relationships

A proper marital status withholding can help you and your spouse to complete your tasks. You’ll be amazed at the amount that you can deposit at the bank. The problem is deciding which of the numerous options to pick. Undoubtedly, there are some items you must avoid. Making a mistake can have costly consequences. If you stick to it and follow the instructions, you won’t run into any problems. If you’re lucky enough, you could be able to make new friends as you travel. Today is the day you celebrate your wedding. I’m hoping that they will reverse the tide in order to assist you in getting that elusive engagement ring. You’ll want the assistance from a certified tax expert to finish it properly. The accumulation of wealth over time is more than that modest payment. You can find tons of information on the internet. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

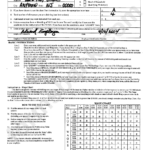

Amount of withholding allowances claimed

When you fill out Form W-4, you should specify the number of withholding allowances you wish to claim. This is crucial since the withholdings will effect on the amount of tax is deducted from your pay checks.

Many factors affect the allowances requested.If you’re married as an example, you may be able to apply for an exemption for head of household. Your income can determine the amount of allowances offered to you. A larger allowance might be granted if you make lots of money.

A proper amount of tax deductions can save you from a large tax charge. A refund could be feasible if you submit your income tax return for the current year. But, you should be cautious about your approach.

Do your research, just like you would for any financial option. Calculators will help you determine the amount of withholding that should be claimed. It is also possible to speak with a specialist.

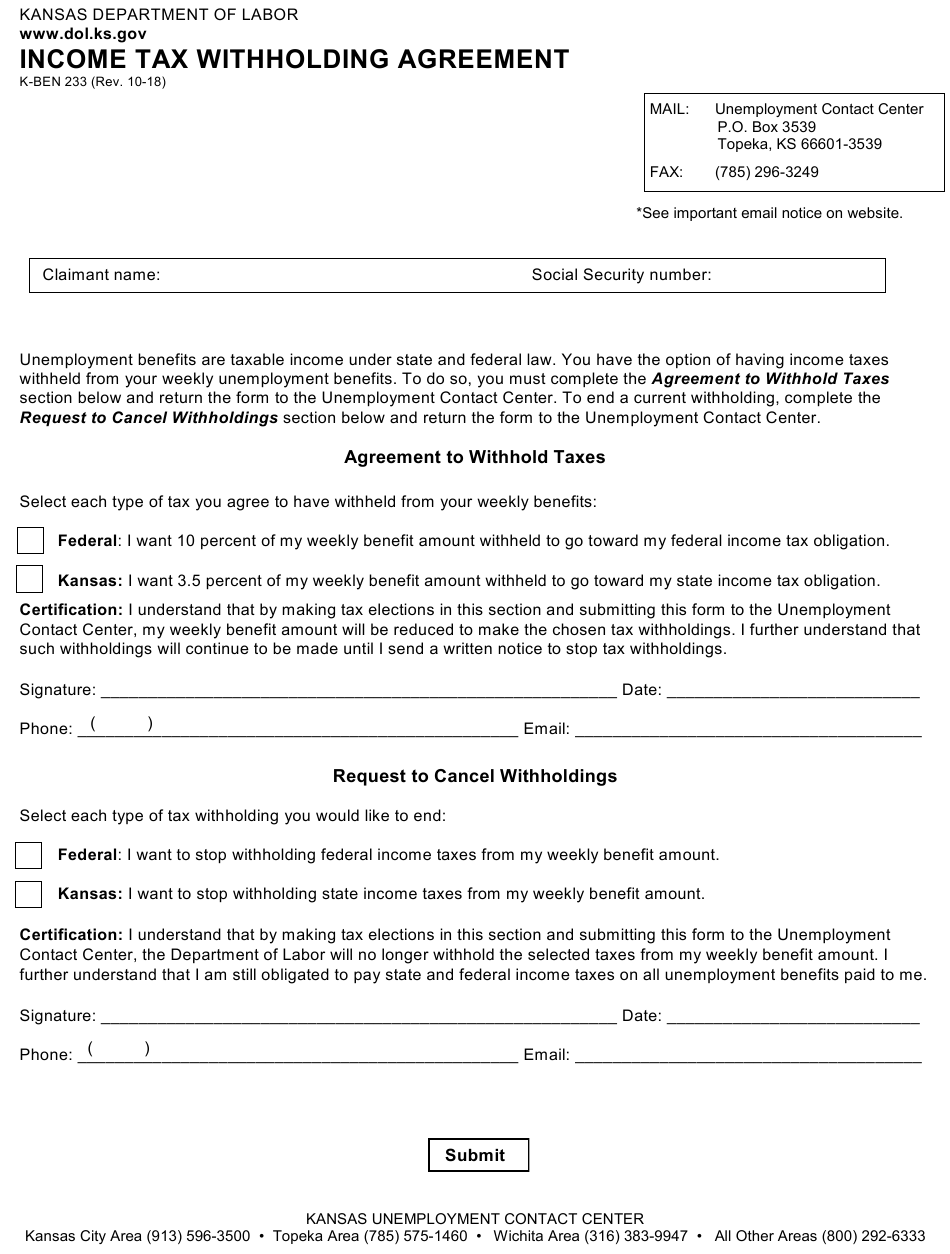

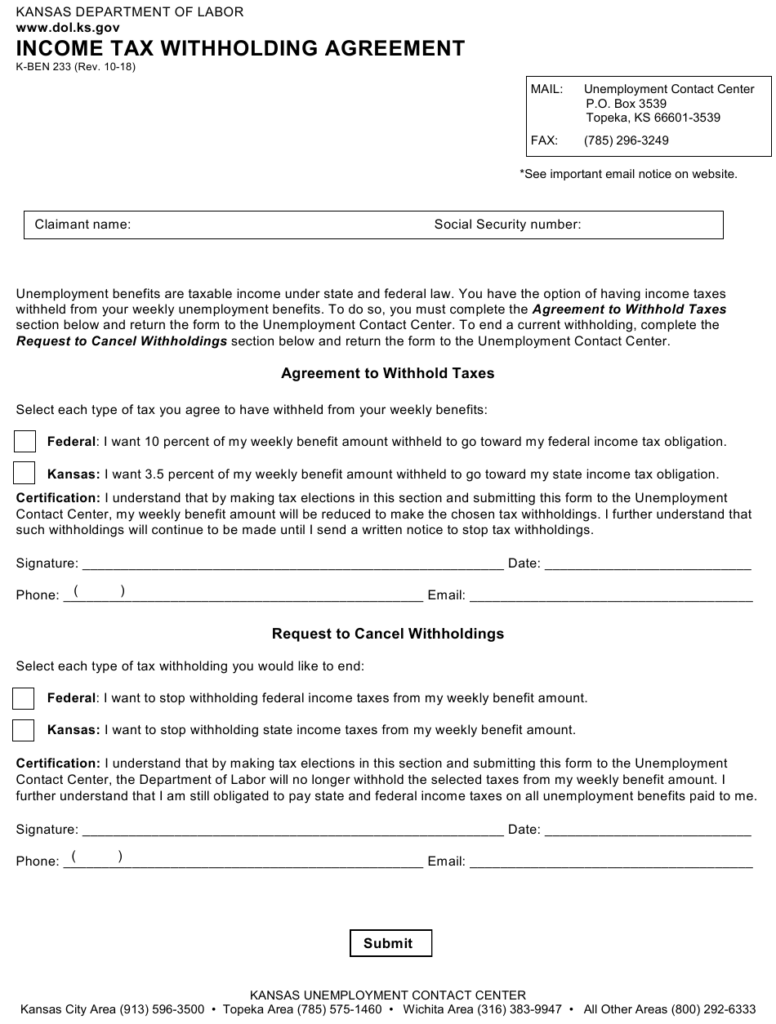

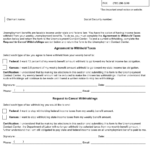

Sending specifications

If you’re an employer, you are required to be able to collect and report withholding taxes on your employees. Certain of these taxes may be filed with the IRS through the submission of paperwork. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly tax return. Here’s some details on the various withholding tax form categories and the deadlines for filing them.

Tax withholding returns can be required to prove income such as salary, bonuses and commissions, as well as other income. It is also possible to be reimbursed of taxes withheld if you’re employees received their wages on time. Be aware that certain taxes may be taxation by county is important. There are also unique withholding techniques that can be used in certain circumstances.

In accordance with IRS regulations, you have to electronically submit withholding forms. If you are submitting your tax return for national revenue be sure to provide the Federal Employer Identification number. If you don’t, you risk facing consequences.