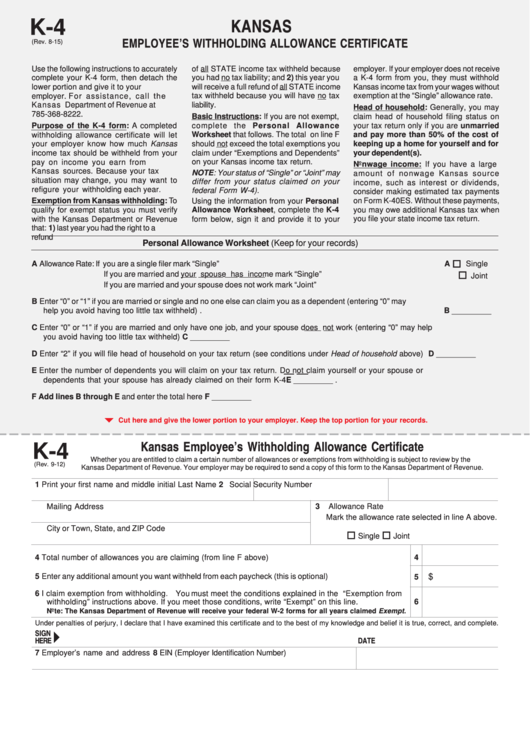

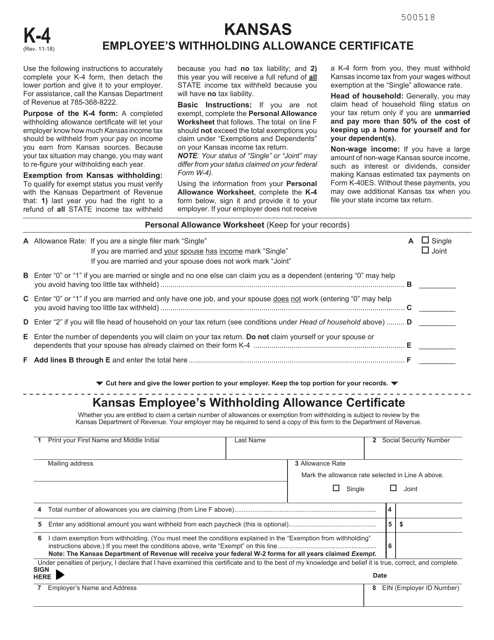

Kansas Withholding Form – There stand a digit of reasons why someone might choose to fill out a tax form. This includes the document requirements, exclusions from withholding, and the requested withholding allowances. There are a few important things to keep in mind, regardless of the reason that a person has to fill out the form.

Withholding exemptions

Non-resident aliens must submit Form 1040 NR at least once per year. If you satisfy these requirements, you may be eligible for an exemption from the withholding form. This page lists all exclusions.

To submit Form 1040-NR the first step is to attach Form 1042S. To report federal income tax purposes, this form provides the withholding process of the tax agency that handles withholding. When filling out the form ensure that you have provided the accurate information. It is possible for a person to be treated if the correct information is not provided.

The tax withholding rate for non-resident aliens is 30 percent. The tax burden of your business must not exceed 30% in order to be exempt from withholding. There are many exemptions offered. Some of them apply to spouses and dependents, such as children.

Generallyspeaking, withholding in Chapter 4 allows you to claim a return. Refunds are granted according to Sections 1471-1474. Refunds are to be given by the agents who withhold taxes who is the person who collects taxes at the source.

relational status

A valid marital status and withholding form will simplify the job of both you and your spouse. You’ll be amazed at the amount you can deposit at the bank. It can be difficult to choose which of the many options you’ll pick. There are certain actions you shouldn’t do. It’s costly to make the wrong choice. However, if the instructions are followed and you pay attention to the rules, you shouldn’t have any issues. It is possible to make new acquaintances if you’re fortunate. Today is the anniversary of your marriage. I’m hoping that they will make it work against you to help you get the perfect engagement ring. It is best to seek the advice of a tax professional certified to complete it correctly. It’s worthwhile to accumulate wealth over the course of a lifetime. You can get a lot of information on the internet. TaxSlayer, a reputable tax preparation company is one of the most useful.

The number of withholding allowances that were made

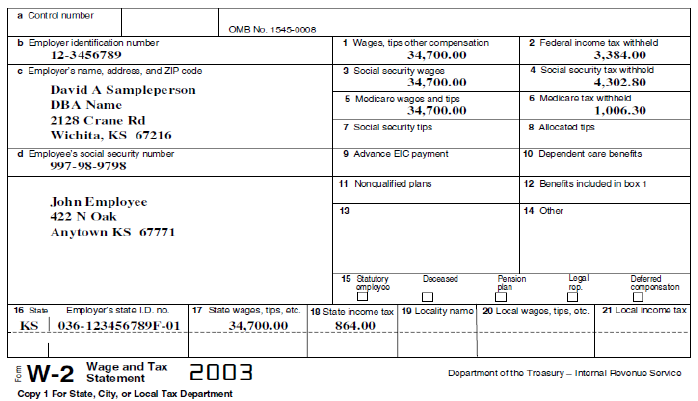

When filling out the form W-4 you file, you should declare the amount of withholding allowances you seeking. This is crucial as your paychecks may depend on the tax amount you pay.

You may be able to claim an exemption for the head of your household when you’re married. Your income can affect the number of allowances offered to you. You may be eligible for more allowances if make a lot of money.

A tax deduction that is suitable for you can help you avoid large tax payments. Even better, you might even get a refund if your tax return for income has been completed. You need to be careful when it comes to preparing this.

It is essential to do your homework the same way you would for any financial choice. Calculators can assist you in determining how many withholding amounts should be demanded. A specialist could be a good option.

Submission of specifications

Withholding tax from employees need to be collected and reported in the event that you’re an employer. A few of these taxes may be filed with the IRS by submitting forms. An annual tax return and quarterly tax returns, or tax withholding reconciliations are just a few examples of paperwork you might need. Here is more information on the different types of withholding tax and the deadlines for filing them.

In order to be qualified for reimbursement of tax withholding on pay, bonuses, commissions or any other earnings earned by your employees, you may need to file a tax return for withholding. If you make sure that your employees are paid on time, you may be eligible for the refund of taxes that you withheld. Be aware that certain taxes could be considered to be local taxes. In certain circumstances, withholding rules can also be different.

The IRS regulations require you to electronically submit your withholding documentation. Your Federal Employer Identification Number must be listed on to your national tax return. If you don’t, you risk facing consequences.