Kansas Pension Withholding Form – There are a variety of reasons someone might choose to fill out a withholding form. These factors include the documents required, the exclusion of withholding as well as the withholding allowances. It is important to be aware of these factors regardless of why you choose to file a request form.

Exemptions from withholding

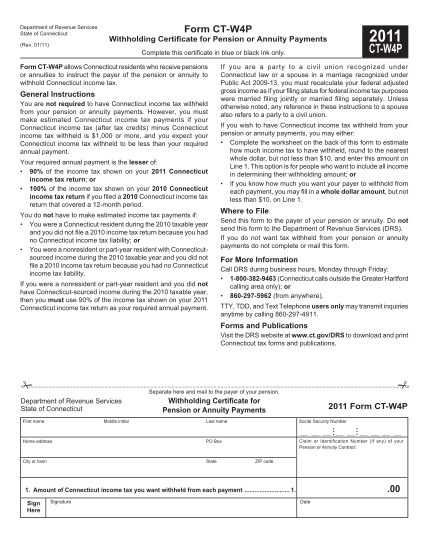

Non-resident aliens must submit Form 1040 NR once each year. If you meet the conditions, you could be eligible to receive an exemption from the withholding forms. The following page lists all exclusions.

The first step in submitting Form 1040 – NR is attaching the Form 1042 S. The form provides information about the withholding done by the withholding agency for federal tax reporting to be used for reporting purposes. When filling out the form, ensure that you provide the exact details. This information might not be disclosed and result in one individual being treated.

The rate of withholding for non-resident aliens is 30 percent. You could be eligible to get an exemption from withholding tax if your tax burden is higher than 30 percent. There are a variety of exemptions. Some of them apply to spouses or dependents like children.

In general, refunds are available for chapter 4 withholding. Refunds can be made under Sections 471 through 474. The refunds are made by the tax withholding agents, which is the person who is responsible for withholding taxes at source.

Status of the relationship

A proper marital status withholding will make it easier for you and your spouse to complete your tasks. You’ll be amazed at the amount you can deposit at the bank. Knowing which of the several options you’re likely to pick is the tough part. Certain aspects should be avoided. Making the wrong choice could cost you a lot. It’s not a problem If you simply follow the directions and be attentive. If you’re lucky you could even meet a few new pals on your travels. After all, today marks the date of your wedding anniversary. I’m hoping that they will reverse the tide to help you get the elusive engagement ring. If you want to get it right you’ll require the aid of a qualified accountant. A little amount can make a lifetime of wealth. You can get a ton of information online. TaxSlayer is a trusted tax preparation company.

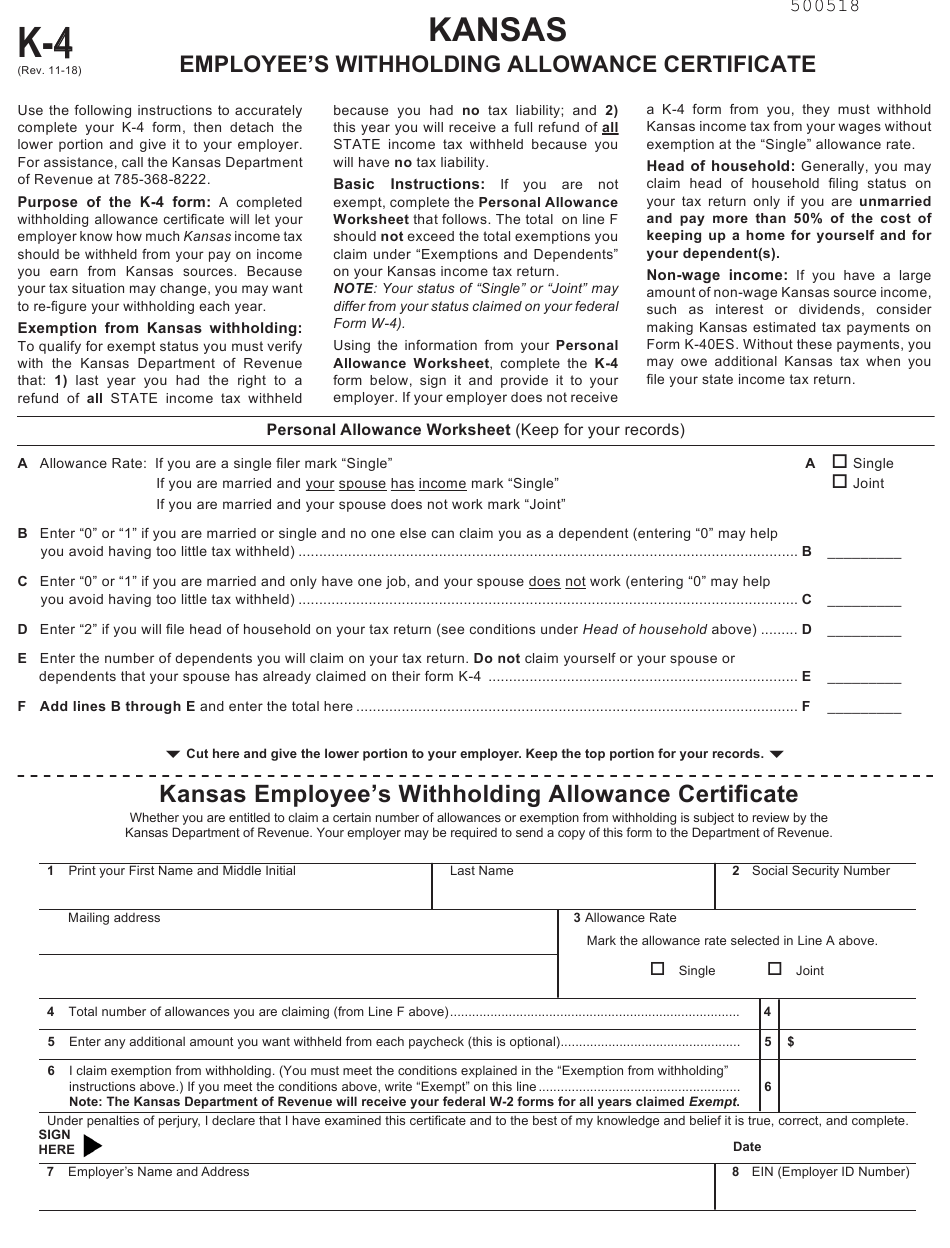

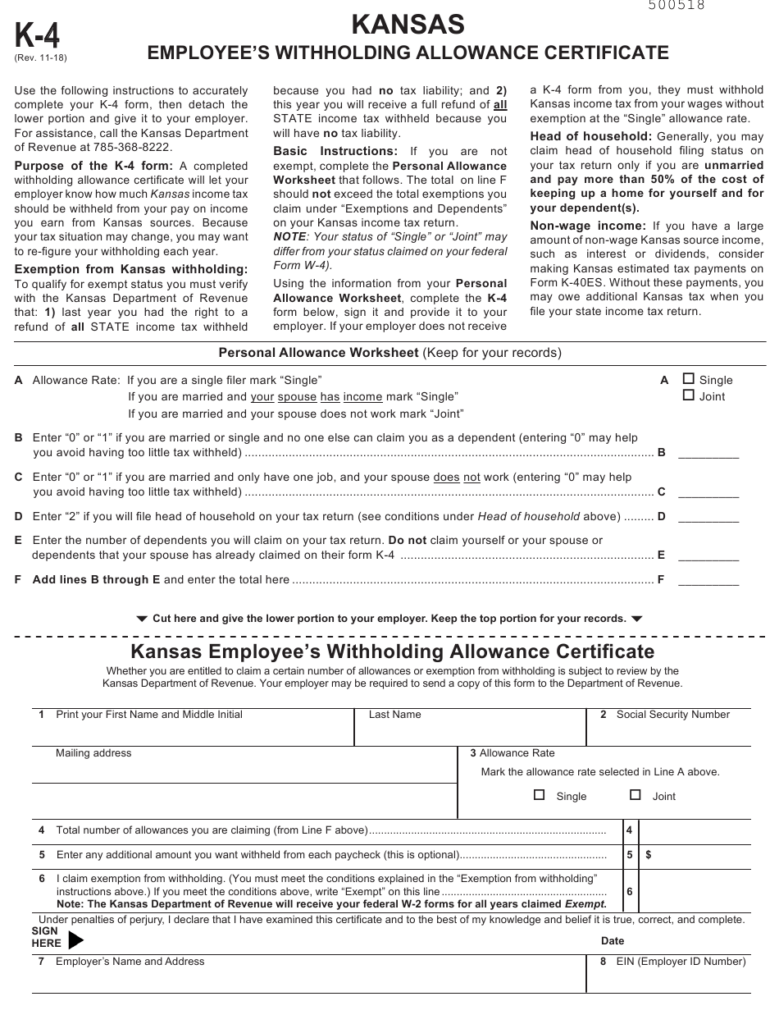

Number of claimed withholding allowances

The Form W-4 must be filled out with the number of withholding allowances that you want to claim. This is essential since the withholdings can have an effect on the amount of tax is deducted from your paychecks.

A number of factors can determine the amount that you can claim for allowances. The amount you earn will influence how many allowances your are entitled to. You may be eligible for a greater allowance if you earn a significant amount of money.

A proper amount of tax deductions will save you from a large tax charge. Refunds could be possible if you submit your income tax return for the current year. Be cautious regarding how you go about this.

Do your research, like you would with any other financial decision. Calculators are useful to determine how many allowances for withholding need to be claimed. Alternative options include speaking with a specialist.

Sending specifications

If you are an employer, you are required to be able to collect and report withholding taxes on your employees. The IRS can accept paperwork for certain taxes. Other documents you might require to submit includes an withholding tax reconciliation as well as quarterly tax returns and the annual tax return. Below are information on the different tax forms that you can use for withholding as well as the deadlines for each.

To be eligible to receive reimbursement for withholding tax on the compensation, bonuses, salary or other income received from your employees You may be required to file a tax return for withholding. Also, if employees are paid in time, you could be eligible for tax refunds for withheld taxes. Remember that these taxes may be considered to be local taxes. Additionally, you can find specific withholding procedures that can be used in specific situations.

The IRS regulations require you to electronically file withholding documents. The Federal Employer Identification Number should be listed when you submit to your national tax return. If you don’t, you risk facing consequences.