Iowa State Withholding Tax Forms – There are many reasons someone might choose to complete a withholding form. These factors include the documentation requirements, withholding exclusions, and the requested withholding allowances. Whatever the motive someone has to fill out the Form there are some aspects to keep in mind.

Withholding exemptions

Nonresident aliens are required once each year to fill out Form1040-NR. If you meet the requirements, you may be eligible for an exemption from the withholding forms. There are exemptions that you can access on this page.

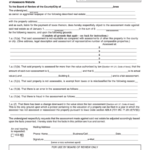

When you submit Form1040-NR, attach Form 1042S. This form is used to record the federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. It is essential to fill in exact information when you fill out the form. If the information you provide is not given, a person could be taken into custody.

The rate of withholding for non-resident aliens is 30%. It is possible to get an exemption from withholding if the tax burden exceeds 30%. There are many different exemptions. Some are specifically designed for spouses, while others are meant for use by dependents, such as children.

Generallyspeaking, withholding in Chapter 4 gives you the right to a return. Refunds are permitted under Sections 1471-1474. The refunds are made to the agent who withholds tax the person who withholds the tax at the source.

Relational status

An appropriate marital status that is withheld will make it easier for both you and your spouse to complete your tasks. You’ll also be surprised by how much you can make a deposit to the bank. The problem is selecting the best option out of the many choices. There are certain items you must avoid. It will be expensive to make the wrong decision. If you adhere to the directions and adhere to them, there won’t be any issues. If you’re lucky you may even meet acquaintances on your travels. Today is the anniversary of your marriage. I’m hoping that you can apply it against them in order to get that elusive diamond. You’ll want the assistance of a tax professional certified to complete it correctly. A small amount of money can create a lifetime of wealth. Information on the internet is easily accessible. TaxSlayer is one of the most trusted and respected tax preparation companies.

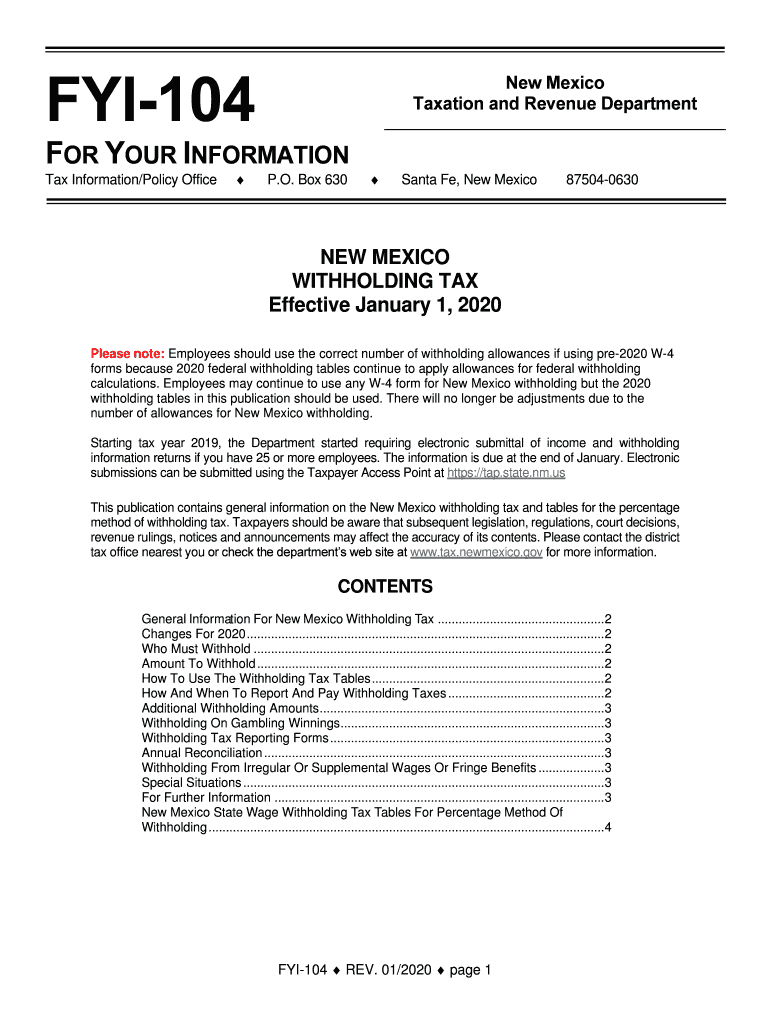

The number of withholding allowances that were requested

It is important to specify the amount of the withholding allowance you would like to claim on the form W-4. This is critical because your pay will be affected by the amount of tax you pay.

You may be able to apply for an exemption on behalf of your spouse in the event that you are married. Your income level can also impact how many allowances are offered to you. If you have a high income, you may be eligible for an increased allowance.

It is possible to save money on a tax bill by selecting the correct amount of tax deductions. You may even get the amount you owe if you submit your annual income tax return. But , you have to choose the right method.

You must do your homework the same way you would with any financial choice. To figure out the amount of tax withholding allowances to be claimed, you can use calculators. In addition to a consultation with a specialist.

Submitting specifications

Employers are required to report the company who withholds tax from employees. For a limited number of these taxes, you may provide documentation to the IRS. There are additional forms you could require, such as an annual tax return, or a withholding reconciliation. Below are details on the various forms of withholding taxes and the deadlines for filing them.

The compensation, bonuses commissions, other income you get from your employees may require you to submit tax returns withholding. If you make sure that your employees are paid on time, then you may be eligible to receive the refund of taxes that you withheld. It is important to note that certain taxes are county taxes ought to also be noted. You may also find unique withholding methods that are used in specific situations.

Electronic filing of withholding forms is required under IRS regulations. Your Federal Employer identification number should be noted when you file your national tax return. If you don’t, you risk facing consequences.