Iowa Department Of Revenue Withholding Tax Forms – There are many reasons why someone may choose to fill out forms for withholding. This is due to the requirement for documentation, exemptions from withholding and also the amount of required withholding allowances. There are certain points to be aware of regardless of the reason a person files the form.

Withholding exemptions

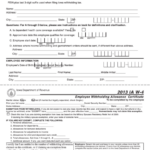

Non-resident aliens must submit Form 1040-NR at a minimum every year. You could be eligible to file an exemption form for withholding tax in the event that you meet all criteria. There are exemptions accessible to you on this page.

To submit Form 1040-NR, the first step is to attach Form 1042S. This form is used to report federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. When you fill out the form, make sure you fill in the correct information. One individual may be treated if this information is not entered.

The rate of withholding for non-resident aliens is 30 percent. You may be eligible to be exempted from withholding tax if your tax burden is greater than 30 percent. There are several different exclusions that are available. Some are specifically designed to be used by spouses, while some are designed to be used by dependents, such as children.

Generally, withholding under Chapter 4 entitles you for the right to a refund. Refunds are permitted under Sections 1471-1474. The refunds are made to the withholding agent the person who withholds the tax at the source.

Status of relationships

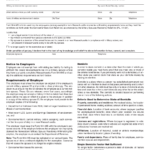

A marital withholding form is a good way to simplify your life and assist your spouse. You’ll be amazed at the amount you can deposit to the bank. It can be difficult to choose what option you’ll choose. There are certain that you shouldn’t do. Making the wrong decision will result in a significant cost. However, if you adhere to the directions and keep your eyes open to any possible pitfalls You won’t face any issues. If you’re lucky you might make new acquaintances on your trip. Today is the anniversary. I’m hoping that you can make use of it to get that elusive wedding ring. If you want to get it right, you will need the assistance of a certified accountant. A modest amount of money can create a lifetime of wealth. Online information is readily available. Tax preparation firms that are reputable, such as TaxSlayer are one of the most useful.

There are many withholding allowances being claimed

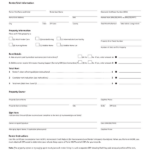

When submitting Form W-4, you must specify how many withholdings allowances you would like to claim. This is crucial since it will affect how much tax you receive from your paychecks.

There are a variety of factors that can affect the amount you are eligible for allowances. Additionally, you can claim additional allowances depending on how much you earn. If you have a higher income you may be eligible to receive more allowances.

It is possible to save money on a tax bill by deciding on the correct amount of tax deductions. If you submit your annual income tax return, you could even be eligible for a tax refund. But it is important to pick the right method.

Like every financial decision, you must do your research. Calculators can aid you in determining the amount of withholding allowances you can claim. An expert might be a viable option.

Filing requirements

If you are an employer, you have to collect and report withholding taxes from your employees. In the case of a small amount of these taxes, you may provide documentation to the IRS. There are additional forms you may require like a quarterly tax return or withholding reconciliation. Below are details about the different tax forms that you can use for withholding as well as the deadlines for each.

Tax withholding returns can be required to prove income like bonuses, salary, commissions and other income. If employees are paid punctually, you might be eligible to get tax refunds for withheld taxes. You should also remember that certain taxes may be county taxes. There are also special withholding methods which can be utilized under certain conditions.

As per IRS regulations, electronic filings of tax withholding forms are required. Your Federal Employer Identification Number should be listed when you submit to your national tax return. If you don’t, you risk facing consequences.

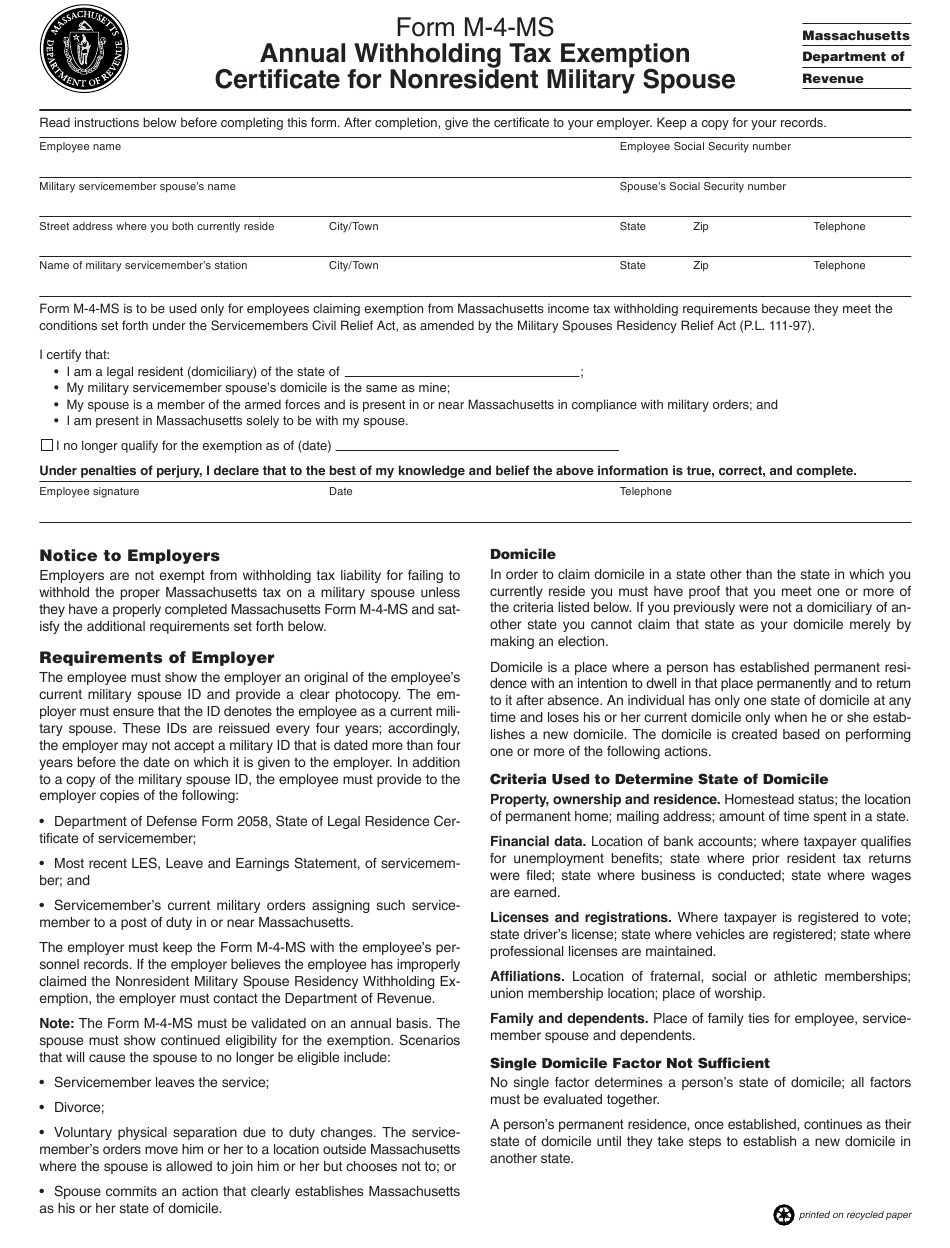

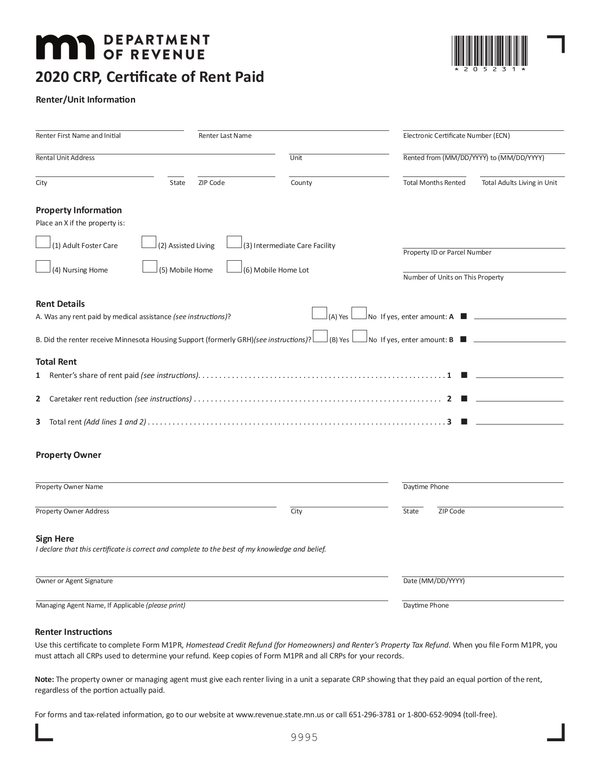

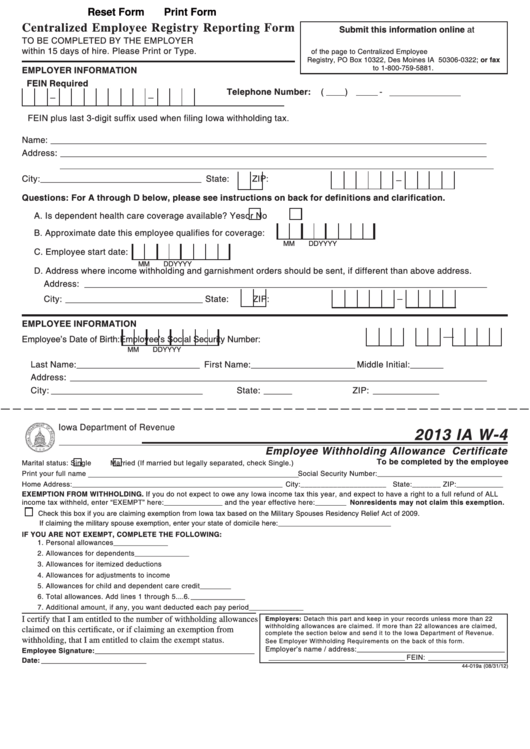

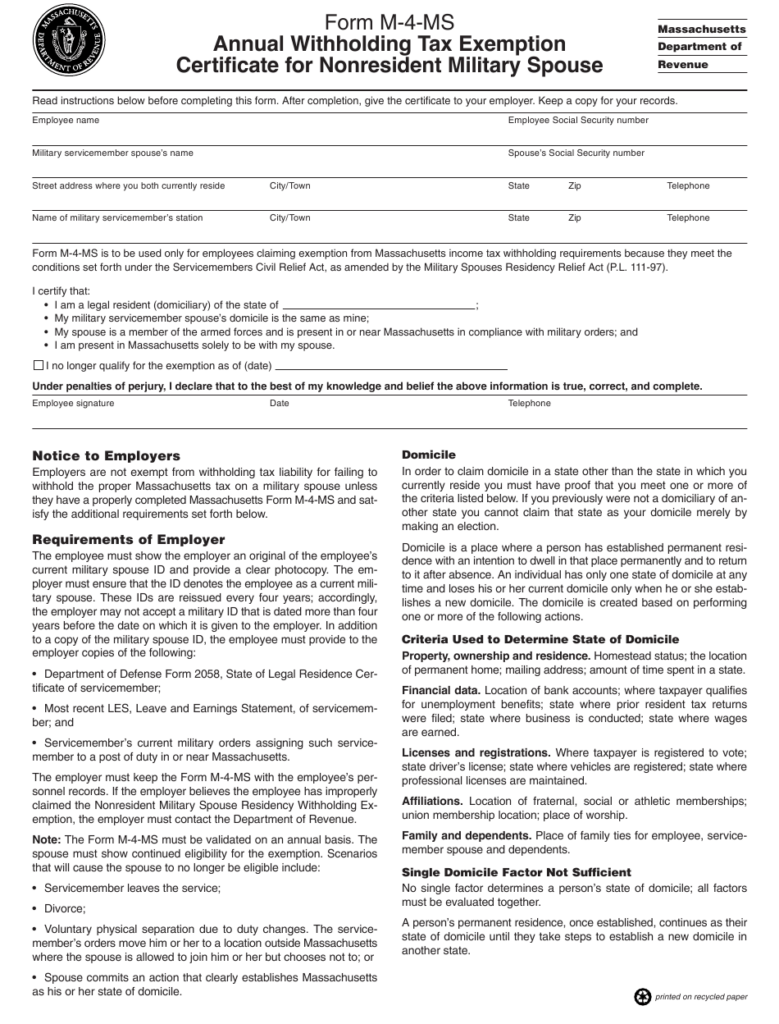

Gallery of Iowa Department Of Revenue Withholding Tax Forms

Iowa Department Of Revenue Withholding Tax Forms WithholdingForm